Blue Ocean Society Review: Secretive securities fraud

Blue Ocean Society fails to provide ownership or executive information on its website.

Blue Ocean Society fails to provide ownership or executive information on its website.

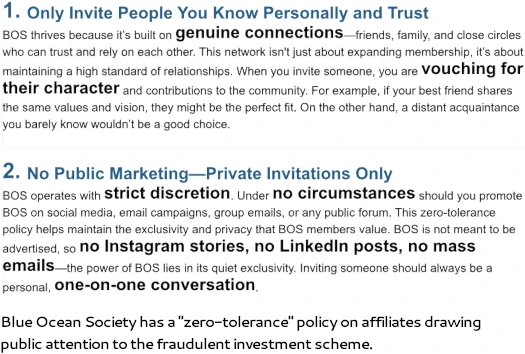

By its own admission, Blue Ocean Society intentionally withholds crucial due-diligence information from consumers:

Blue Ocean Society (BOS) is an exclusive, invitation-only private wealth club that brings together visionary individuals seeking extraordinary opportunities for growth and prosperity.

We curate access to blue-chip opportunities typically reserved for ultra-high-net-worth individuals and institutions, making them accessible through our collective approach.

Our society is built on the pillars of privacy, protection, and careful curation.

Membership is by invitation only. You must be invited by an existing member who knows, likes, and trusts you personally.

One name we can attach to Blue Ocean Society is “Kerianne”:

The above, from an official Blue Ocean Society investor email, cites Kerianne as a “Manager” of the company.

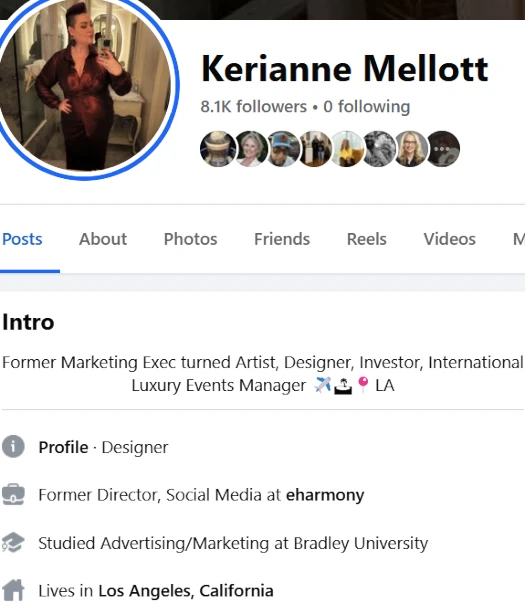

On social media Kerianne Mellott cites herself as a “Former Marketing Exec turned Artist, Designer, Investor, International Luxury Events Manager”.

Mellot is also a resident of California in the US.

Who Mellot works with to run Blue Ocean Society is unclear but they are most likely also based in the US.

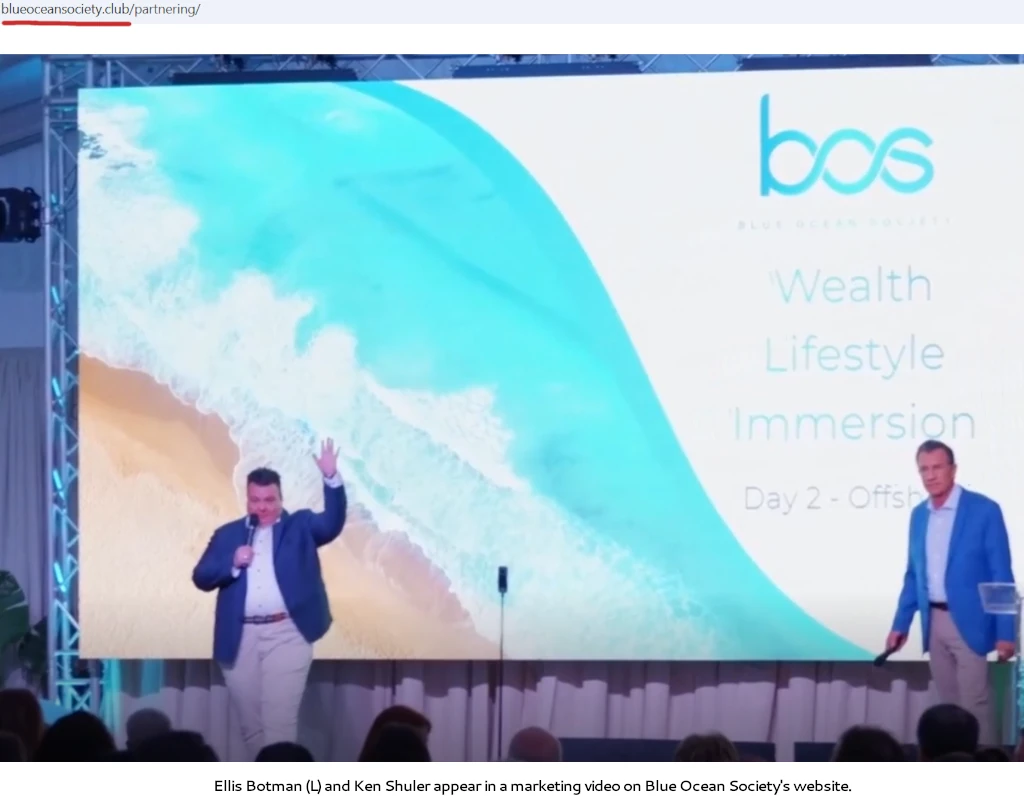

To that end two unconfirmed names who appear to be attached to Blue Ocean Society are Ellis Botman (aka Elisabeth Botman) and Ken Shuler (aka Doyle Shuler).

Shuler and Botman were cited in a Reddit thread discussing Blue Ocean Society in late 2024:

The thread has multiple Blue Ocean Society investors complaining about withdrawal delays, which we’ll further explore in the conclusion of this review.

Shuler and Botman also popped up in email communications I’ve had with Blue Ocean Society investors. I don’t have anything official tying either to Blue Ocean Society but this isn’t surprising given the secrecy of the scheme (again further explored in the conclusion below).

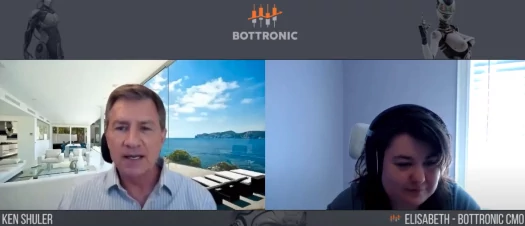

BehindMLM last came across Shuler and Botman working together in BotTronic, an fraudulent MLM crypto investment scheme launched in 2021.

(Sidenote: Elisabeth Botman appears to have transitioned to “Ellis” sometime after BotTronic.)

Update 27th January 2025 – This slipped my attention when I was doing my initial round of research; Ellis Botman and Ken Shuler both appear on a background marketing video on Blue Ocean Society’s website (click to enlarge):

From this it’s looking highly likely Botman and Shuler are behind Blue Ocean Society. /end update

Blue Ocean Society’s website domain (“blueoceansociety.club”), was first registered in August 2022. The private registration was last updated on August 12th, 2024.

Official Blue Ocean Society communication emails cite the shell company Blue Ocean Management LLC (registration unclear), tied to an undisclosed address in St Kitts & Nevis.

St Kitts & Nevis is a tax haven with little no known regulation of MLM related fraud.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money.

Blue Ocean Society’s Products

Blue Ocean Society has no retailable products or services.

Affiliates are only able to market Blue Ocean Society affiliate membership itself.

Blue Ocean Society’s Compensation Plan

Blue Ocean Society affiliates invest in various offered unregistered investment schemes.

Dignity Gold

Unregistered crypto investment scheme through which Blue Ocean Society pitches “huge ROI potential”.

Dignity Gold is purportedly tied to claimed gold assets in the US (no verifiable evidence provided). Built around collapsed DIGau tokens.

Raverus

Unregistered investment scheme promising 20% a year.

Fully Funded Synergy

Unregistered investment scheme pitching 16.67% a month. Purportedly run by “Bill and Nick”.

Stratagem

Claimed “private equity firm” investment opportunity pitching 500% annually, paid quarterly.

Tribe360i

“Fintech ecosystem” investment scheme through which Blue Ocean Society pitches “72% guaranteed annual interest”.

SuperCo

“300% to 500% in less than 8 months” passive returns investment scheme (specific details withheld by Blue Ocean Society).

PTI

Crypto investment schemes through which investment is solicited on a number of unverifiable marketing claims.

South One

“Using AI to scam Africans” unregistered crypto investment scheme pitching 8% a month.

VoiceLife

In-house investment scheme pitching “a potentially high ROI … that can provide passive income for years, if not decades”.

Legacy Trading

Unregistered trading investment opportunity pitching a “standard 18% monthly return”.

A “Legacy Trading – One Year” variant pitches 12% a month:

TAP Reset

An unregistered trading “investment opportunity … with projected returns of 300-500%” over six months.

Vicksburg Prospect (Gas) Opportunity

Purported Texas-based investment scheme run by Sung Kim. “Potential returns” purportedly derived through undisclosed “responsible drilling and production strategies”.

Power Pulse

“Passive income” pitched through a purported “strategic alliance with DME Energy”.

DME Energy holds itself out to be a “a modern day oil and gas company” based out of Texas.

365

Unregistered trading investment opportunity. $15 million in investment sought on the promise of “1% per day”.

Gold Harbor

Unregistered trading investment opportunity run by “Sean R.” 100% ROI pitched every “trading cycle” (duration not disclosed).

Santa Rally 2023

Unregistered trading investment opportunity pitching 100% (“double your deposit”) “at the end of the term” (duration not disclosed).

DAV Opportunity

Unregistered “dynamic algorithm venture” trading opportunity for “BOS Titans”. $10 million solicited on the promise of “a minimum monthly return of 11.5%”.

Rally 3

Unregistered trading investment opportunity “aiming to achieve 25% monthly profit”.

Rally 5

$5 million in investment asked for, no details provided.

Rally 7

Unregistered trading investment opportunity “aiming to achieve 25% monthly profit”.

Rally 10

Unregistered trading investment opportunity “aiming to achieve 25% monthly profit”.

Rally Hybrid

Unregistered trading investment opportunity “aiming to achieve 25% monthly profit”. Investment locked up for one year.

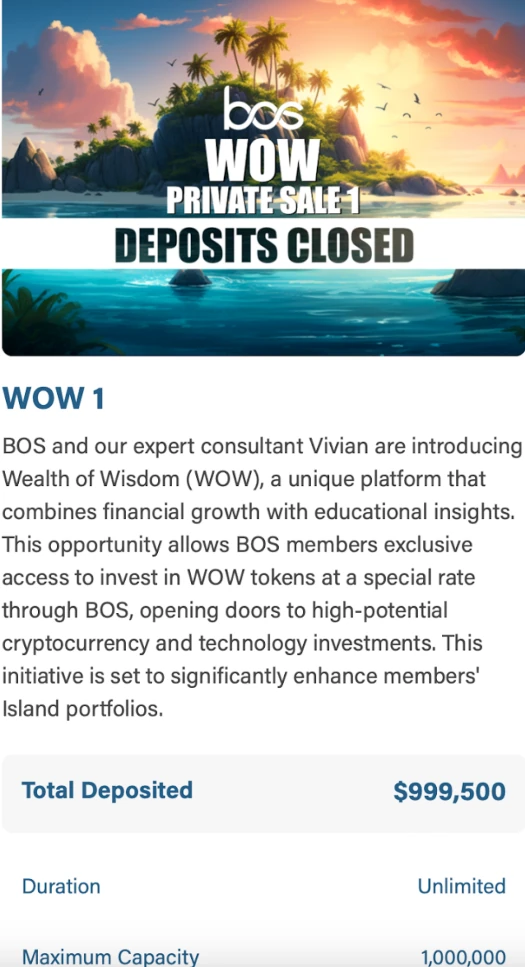

WOW 1

Wealth of Wisdom unregistered crypto investment scheme run through WOW tokens.

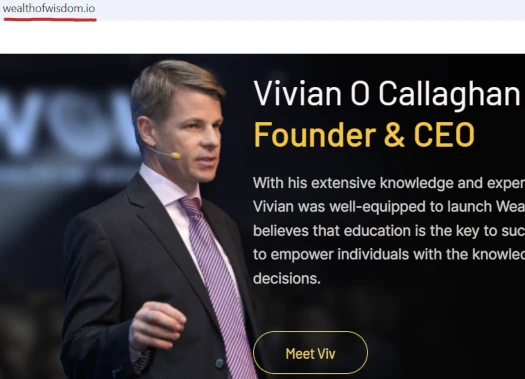

Wealth of Wisdom is run by Vivian O Callaghan.

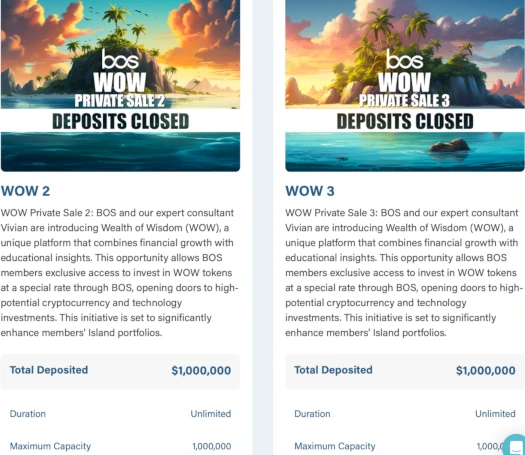

WOW 2 and WOW 3

Wealth of Wisdom unregistered crypto investment schemes run through WOW tokens.

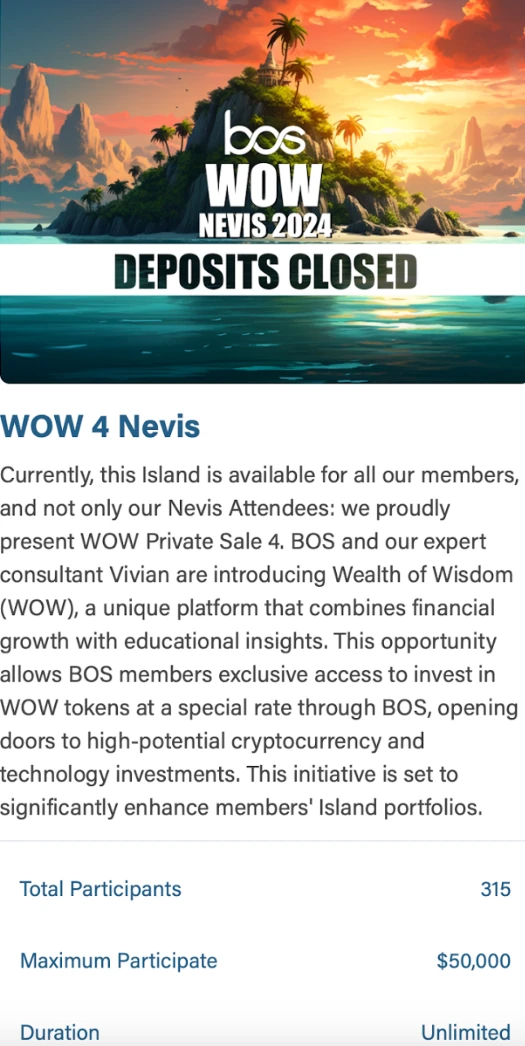

WOW 4 Nevis

“Private sale” crypto investment scheme run through WOW tokens as part of Blue Ocean Society’s ties to Wealth of Wisdom.

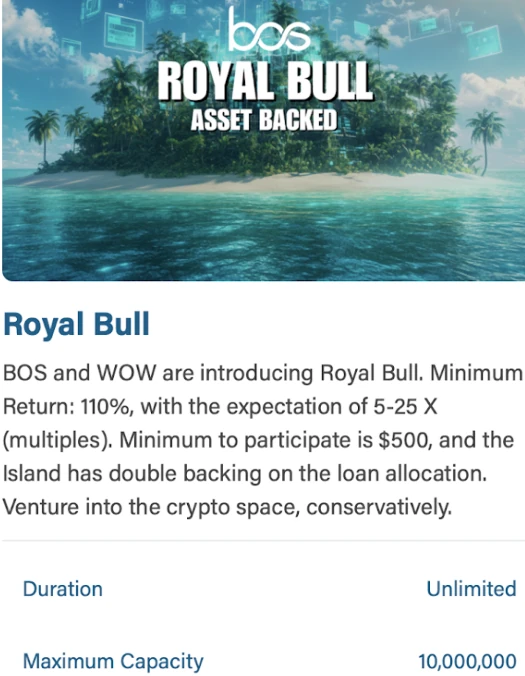

Royal Bull

Claimed crypto investment scheme partnership with “WOW” (Wealth of Wisdom”). “Minimum” 110% ROI pitched.

Mingo

Another partnership with “WOW”. Crypto pump and dump scheme built around MINGO tokens.

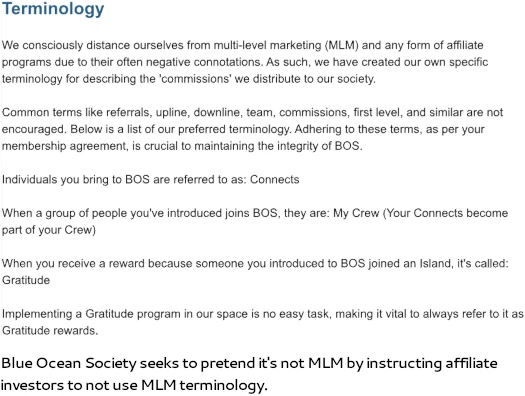

The MLM side of Blue Ocean Society pays on recruitment of affiliate investors.

Gratitude System

Blue Ocean Society pays commissions on downline investment activity and ROI payments. Blue Ocean Society refers to these commissions as “gratitude fees”.

Instead of having an open and transparent compensation plan, Blue Ocean Society manipulates commissions on downline investment.

This is done under the ruse of commissions being “made on a randomized basis”.

BOS Gratitude payouts are deliberately made on a randomized basis.

Accordingly, there will be moments when you are able to initiate transfers of Gratitude fees to your BOS Main Balance.

The timing of each of these Gratitude transfer windows will be determined by our Accounting Team and will not accord with any set or pre-determined schedule.

As BOS Gratuities are continually accumulating, we have established randomized windows during which these amounts can be transferred to your Main Balance.

Note that withdrawals of Blue Ocean Society are also only permitted on a randomized basis (to the “BOS Main Balance”). This appears designed to trap as much money in Blue Ocean Society for as long as possible.

Joining Blue Ocean Society

Blue Ocean Society affiliate membership costs are not disclosed on the company’s website.

Required investment amounts for each offered unregistered opportunity vary.

Blue Ocean Society Conclusion

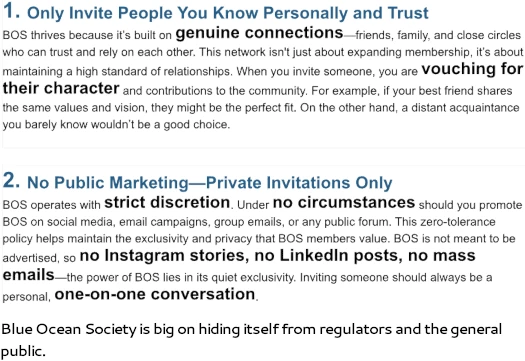

Blue Ocean Society appears to have been designed from the ground up with an emphasis on regulatory non-compliance and evading detection by regulators and authorities.

To that end we have Blue Ocean Society

- failing to disclose ownership and executive information on its website;

- failing to disclose investment details to consumers;

- failing to register any of its passive returns investment opportunity with the SEC and/or CFTC (trading schemes where applicable);

- misleading affiliate investors on the nature of the company’s MLM compensation plan; and

- instructing recruited investors to minimize the risk of public exposure by operating with “strict discretion”

In addition to verifiable securities and commodities fraud, disclosure fraud and deception goes hand in hand with Blue Ocean Society running a Ponzi scheme.

Supporting this is claims from investors of withdrawal delays. From the previously cited Reddit thread;

I believe these excuses are stalling methods to continue the scam as I know people who have been attempting to get their promised returns for over a year, but are unable to.

**

I am personally invested with six figures in Blue Ocean for two years. There have been delayed withdrawal payouts for their initial trading fund. That is expected to be resolved in October 2024.

**

I am part of the Blue Ocean Society Club. Unfortunately, I am in the same boat. I invested a high six figure and since December 2023 I requested withdrawal of a high six but was only offered $10,000, with the promise that the rest would come.

Sadly, like many other, I am still waiting. I am almost in recovery mode but they continue to stall with new promises.

While unverified testimonials should be taken with a grain of salt, there is further evidence to support Blue Ocean Society’s withdrawal problems.

From the same Reddit thread is this textbook example of Ponzi stalling;

Based on our meticulous preparations and expert consultations from the consulting group who is helping us with everything, here is the expected timeline for processing of the Government Bond Monetization (Plan A):

October 9th: Access to Gov Bond Liquidity

Updated October 9th: We have received news that access is forthcoming, but due to the substantial amount the monetization bank needs 4 more days. We expect access now on October 14th, but most likely October 15th.

Updated October 14th: We have moved into the access phase! This is a significant milestone in the process, as it allows us to begin coordinating with the bank for the next critical step.

At this stage, we will work closely with the bank to facilitate the transfer of liquidity from the monetization party to the designated destination account.

This marks an important progression, bringing us one more step closer to successfully completing the transaction.

The monetizer has notified us that on Thursday October 17th, a meeting is scheduled with coordinating parties on both sides, as well as the signing off on the transfer of the liquidity.

October 10th & 11th: Coordination with the bank to initiate the transfer from the Gov Bond Monetization process to our bank account

Updated October 9th: Due to the fact the bank needs more time, the coordination to initiate the transfer will move to October 16th & 17th.

Updated October 14th: We are still reasonably on track here, the coordination meeting is on October 17th, and might stretch to October 18th with the clearance of the transaction. Nonetheless, we are heading into the right direction. Step by Step.

The Gov Bond Monetization bank is located in Singapore, with our use of a bank in Switzerland. It will take approximately 5 – 7 business days for the funds to reach Switzerland.

Updated October 14th: We’ve been advised that it is highly likely that the actual transfer will start on the first business day after the weekend, which will be October 21st. This is of course pending the coordination meeting and signing off on October 17th and possibly stretches to October 18th.

Subsequently, we will transfer the funds from our Swiss bank to the exchange for conversion to USDT / USDC.

The converted funds will then be directed to the BOS Distribution Wallets, marking the beginning of processing the batches of withdrawals to the Main Balance of each member who is awaiting a withdrawal from the trading-related Islands.

Upon reaching the BOS Distribution wallets, we will process the transactions in batches. Our system can manage multiple batches daily and process unlimited amounts once it’s in place. We are well-prepared and ready to proceed!

That’s from October 2024 and strongly reminds me porky pies Michael Glaspie fed investors in his “Mike G Deal” scam.

Fast forward to January 23rd, 2025, and Blue Ocean Society is of course still trotting out excuses (note “trading islands” refers to Blue Ocean Society’s multiple unregistered investment schemes):

When we realized that our Island Partner—who was responsible for the Trading Islands—could no longer fulfill their obligations, we found ourselves in a difficult situation that, while completely out of BOS’s control, posed a serious risk to our members’ balances.

We understand how frustrating it can be to see sudden changes in your financial arrangements, and we empathize with any doubts or concerns you may have.

Earlier in 2024, we set out to secure external liquidity so that everyone’s withdrawal requests could be met while the Island Partner attempted to resolve things.

But as we arrived towards the end of the year, it became clear that the partner’s unprecedented challenges would drastically limit how much of the current Island Balances could actually be covered if we relied solely on that route.

We knew that wasn’t acceptable.

Leaving anyone empty-handed goes against everything BOS stands for. We made a decision to dissolve the relationship, and to move the reconciliation process with the Island Partner to the back-end so no member of BOS would be adversely affected by it.

The unnamed partner Blue Ocean Society refers to is Sean J Robertson (aka Sean James Robertson). Robertson has reportedly cashed out and disappeared.

Think about having your life savings in a bank that suddenly shuts down. If only a portion of deposits is insured, some people might get back only a fraction of their savings—while others could end up with nothing.

That’s unfair and goes against our mission of financial empowerment.

So rather than just hope for the best, we chose to replace the Trading Island Balances with a new asset on our own balance sheet—Dignity Gold security tokens.

These tokens are backed by physical gold and carry a corporate-guaranteed floor value of $2, meaning the structure we put in place makes you 25% up on top of what we were able to reconcile, at a bare minimum.

It’s not about “forcing” anyone into a new Island option; it’s about protecting the entire BOS community and ensuring no one is left behind. We realize change can be unsettling, but this transformation is aimed at giving you more security, not less.

Breaking down the above, Blue Ocean Society has rolled investor balances and promised returns into a new consolidated Dignity Gold investment scheme.

This forced migration has seen Blue Ocean Society slash pending ROI withdrawal liabilities.

Typically, when a financial meltdown occurs or a partnership dissolves, investors are lucky to get cents on the dollar—perhaps 20% or 30% of their original investment—if they get anything at all.

Recovering initial balances can be incredibly challenging, and collecting any accrued interest on top of that is even more difficult.

In many cases, a class action lawsuit or bankruptcy court process can drag on for years, with no guarantee of full compensation.

However, BOS approached this completely differently. We moved all recovery efforts to the back-end so that no member would be adversely affected or forced to wait out complicated proceedings that we as BOS have to go in, on behalf of the member.

Our legal teams will handle things with the former Island Partner.

By stepping in and replacing the Island Partner’s obligations, BOS has preserved not just the original balances but has multiplied them by two to four times their value.

Beyond that, by placing Dignity Gold security tokens behind your balances, there’s also the potential for future growth—these tokens can be leveraged and may be liquidated at much higher prices over time.

To summarize, Blue Ocean Society will be paying investor withdrawals with Dignity Gold security tokens, which are of course both printed on demand and worthless.

Want to cash out your worthless Dignity Gold security tokens? Not so fast.

If you wish to withdraw, we have worked on obtaining external liquidity that allow you to do so without hassle. The access to this liquidity is around the corner.

What is available now is Blue Ocean Society affiliate investors being able to “leverage [their] new holdings] into Tribe360i.

Tribe360i is yet another Ponzi launch, built on the “lending” ruse pioneered by BitConnect back in 2016.

If you choose to leverage your new holdings, you could potentially grow your wealth with minimal risk to your traditional finances or credit.

Tribe360i has a peer-to-peer lending platform that connects borrowers and lenders in a secure, low-risk environment. The loan specifically for the purpose of leveraging your asset can be for 24 months, and you can pay interest only.

After 24 months, you can pay off the loan by liquidating some of your tokens, or paying it off yourself; Your Choice.

For instance, using your car as collateral for a small loan might worry you if it’s your primary means of transportation. But what if you could leverage something separate—like a gold-backed token—where, in the worst case, only that token is at stake?

This blockchain-based lending model functions similarly, meaning a default would simply see the asset liquidated to repay the lender, without affecting your credit score, your home, or any of your other assets.

One of the most powerful ways to leverage this asset is by taking out a collateralized loan of up to 50% of your Current Token Balance—a percentage that will exceed your Final Island Balance. You can use the upcoming Tribe360i app to easily request and manage these loans.

As previously noted, Blue Ocean Society is pitching “72% guaranteed annual interest” returns through Tribe360i.

For Blue Ocean Society affiliate investors sick of being strung along with new schemes after previous ones have collapsed;

If you’re thinking long-term and don’t need to withdraw or leverage your position immediately, you can simply do nothing at all.

By holding onto your asset, you’ll allow it to appreciate naturally, with the ability to liquidate up to 60% of it in 24 months.

We believe that by then, each security token could potentially exceed $40, giving you a significant, life-changing benefit at that time.

Do nothing and we might let you withdraw in 24 months (if we find enough new suckers to fund your withdrawals). Maybe.

Like I said, the never-ending delays and excuses are very reminiscent of the Mike G Deal. Michael Glaspie was sentenced to six months in prison in October 2023. The outcome of parallel SEC civil fraud proceedings remains pending.

On that note, neither Blue Ocean Society, Ken Shuler, Ellis Botman, Sean J. Roberson, Wealth of Wisdom or Dignity Gold are registered with the SEC or CFTC.

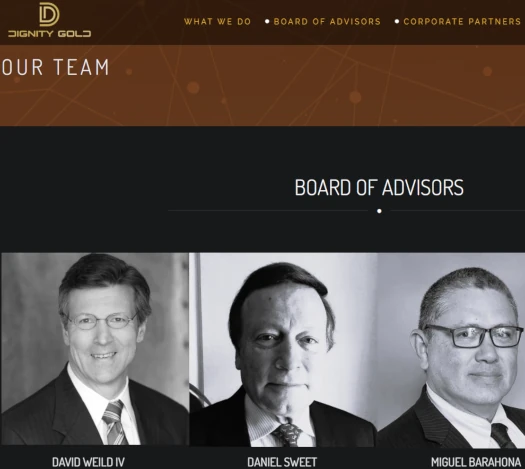

While Dignity Gold provides a list of “advisors” on its website, led by Chairman David Weild…

…executive details are withheld from the public.

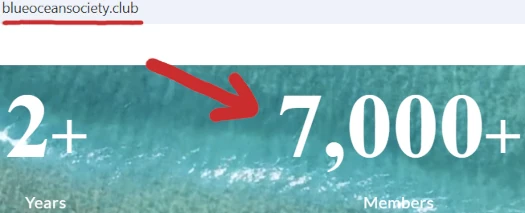

As of December 2024, SimilarWeb was tracking ~166,000 monthly visits to Blue Ocean Society’s website.

On its website Blue Ocean Society claims it has over 7000 members:

SimilarWeb tracked 53% of Blue Ocean Society’s December 2024 website traffic from the US, followed by 19% from Canada and 11% from France and the Netherlands respectively.

As with all MLM Ponzi schemes, once affiliate recruitment dries up so too will new investment.

This will starve Blue Ocean Society of ROI revenue, eventually resulting in a collapse. Communications from Blue Ocean Society indicate this has already happened, with investors now in an “prolonged exit-scam” phase.

The math behind Ponzi schemes guarantees that when they collapse, the majority of participants lose money.

Update 24th October 2025 – ASIC issued a Blue Ocean Society securities fraud warning on August 18th, 2025.

Sean Robertson also sued Ellis Botman and Kenneth Shuler for “Loss and Damage” on August 8th, 2025.

voicelife.io – looks to be legitimate

What’s legitimate about it?

If physics-defying portable free energy systems were a thing everybody on the planet would already have one. Notwithstanding any investment opportunity tied to VoiceLife isn’t registered with the SEC.

There is more to this story. Yes it is Ellis and Ken and Sean Robertson from Adelaide Australia.

Ellis has a longer history that you have documented here of ONLY EVER taking money in and NOT paying out and being at the top of multiple scams only to get commission referrals and leave everyone else bust!

BOS is the latest incarnation and has taken in 100s of MILLIONS! and have been making excuses for 2 years why they can’t pay out. all the while living the high life themselves and paying over 30 staff members that noone actually knows what they do.

Is it Robertson or Roberson? I wasn’t 100% sure and just went with my source material to be safe.

Sean James Robertson

I have been waiting since 2023 for my withdrawal.

Get your facts straight. There is not totally true and go get education on what is deemed to be a security for registration with bodies like the SEC.

BOS has been fully transparent about what happened to the trading islands and efforts they made to save folks investments as well as prevent a recurrence.

Don’t be all over the web spreading discord. I know it’s painful to wait for our funds and I believe it should be a matter of time soon when that will materialize.

As someone clearly uneducated on US securities law, I suggest you go read up on the Howey Test.

Blue Ocean Society’s many passive returns investment schemes clearly meet the definition of an investment contract.

What you believe is irrelevant. Go read up on the Mike G Deal, this is the exact same play from another old geezer spinning yarns.

You’ve been scammed. Sorry for your loss.

@Karma

Thanks, I’ll update the article.

History always repeats. When people have a history of fraud, then judge them by their actions in the present. Is history repeating?

@Andy How have they been transparent about the trading funds except they seem to have disappeared? No one knows what happened, even though we were told we would be.

Also They had to know as far back as early last year yet kept putting out a whole bunch of reasons and lies why hardly anyone could get a withdrawl.

They are doing it today with main balance withdrawls, told people back in Dec there was a banking ‘hiccup’ and still noone can even withdraw that money.

Hardly any of the islands are paying out and they lied about returns in an email about FFS and won’t correct it even though people are calling them out on it.

Same old story playing out over and over again.

Greed blinds people and blind people are happy to “invest” in anything that promises high returns. Scammers know it.

Wash, rinse, repeat.

I can confirm that BOS is 2 plus years behind in w/d’s and when they allowed w/d’s they have only given their members a very small percentage of the w/d request.

They make their members sign NDA’s in order to try to hide their scam but people are pissed.

Not only are they holding and refuse to give members their “profit” made but they change the rules of the “Islands” as they go to run in their favor. I would not recommend anyone to join this organization.

Oz BOS came in to life when few people started investing in to CROWN GLOBAL from Canada which collapsed about 2 years ago. I KNOW WHOS EXACTLY BEHIND IT And how this idea came about. 550 a slot BS. they copied the same model just like ED Zambardi with his advertising Ponzi scheme CryptoProgram.

All of these scammers were investing all collected money in to TRADERS DOMAIN.. and lied to 10000s of people by saying they are investing in to oil gold they are trading all the BS Under the son.

All if these scam started have issues when TD stopped their withdrawals.

The truth is not hard to decipher. A group of us hired some investigators and we found that BOS is in a big big hole.

They took investors money off the top, before sending it to the various islands partners. So, if an island partner promised them 40% per month like Sean Robertson did, they kept 10% of he deposits first, before sending the funds to him.

Investors were promised 30% of thereabouts, but in the end it came to naught as he could not deliver.

Unfortunately, all of the island partners, except one, also could not deliver. Matthew too failed with the bond timelines. That is why there are issues with the main balance as well, because whatever deposits were made for his islands, BOS already kept a % upfront.

It’s a house of cards about to fall. Sean is about to go rogue any time, and spill the beans, from what we heard.

He is being made a scapegoat for the entire failure of the Trading Island. That is why Ellis has shut any discussion of him.

There is also no legal team in BOS and its headed by a one lady show, who has hardly any courtroom experience.

One things is clear—BOS cannot sue anybody as the process of discovery will be self-devastating. Some staff are also about to just call it quits as the failed deadlines and promises are putting them in potential legal and criminal jeopardy, and they have families to take care of.

Others are just in it for the money they are paid.

BOS is definitely a scam and anyone with half a brain should be looking to exit or be prepared to become exit liquidity. Anyone know PTI Matthew’s real name?

Elis has a track record dating back to such Ponzi’s as hyoerverse where she was a super node, to traders domain, CGL , multiprenurs and 8 minutes trader and botronic to name but a few. kens also got a huge history from good scams to crypto.

as can be seen BOS takes in funds but never pays out ,it blames island partners but pats itself in the back for promising to make good on mistakes of its own making , but offers ever shifting timelines ,magic monopoly money schemes and fake securities ,not to mention manipulation or token value in certain venture.

they use coercion and shaming along with deletion exclusion and heavy censorship to control a cult like kabal.

they have not had a single island that made ROI in 2.5 years , they blame Sean Robertson,but he has previous form for such events in a prior scam called REXLA which BOS either were aware and failed to mention or did not make discovery of in spite of promising members due diligence and investagive measures had been taken to ensure the integrity of the island partners ability and history.

there other major oil and gas project also failed, they have made promises of loans to pay members which were swallowed by their so called treasury (read company balance sheet) they failed in promise of gold bars to members , failed to pay members back on cash backs in islands and for lavish events ,failed in education programs at 150k USD a pop , and have lied from day one to now.

anyone with any faith at this point is as deluded as their less than illustrious leader and her cohorts who trot out the lies on a daily basis ,for the wages of sin, well that and 1st class travel glove trotting ,high life penthouse living ,driving exotic Italian sports cars and doing four seasons courses it would seem looking at the manager in the articles Instagram.

returns for 2024 were guaranteed at 12% a month and ended up at 10% for the year paid in tokens you can’t own but bos will hold for you ,that don’t trade but somehow have a value of 3x the floor price.

this is clearly some surreptitious rouse to elevate the value of the token by preventing it being dumped at launch ,less than in the spirit of things at best and insider dealing or fraud at worst hmmm.

This week was do or die for BOS with a new banking app and final liquidity, all deadlines have come and gone chats closed all comments deleted on site ,no email update as promised for the past weekend nor the later promised one for Monday.

looks like that are busy booking flights burning hard drives and removing their damning online presence.

I know some BOS members know, because they posted in the BOS forums – so can anyone shed light on Matthew’s real identity?

The project was presented as fresh and exciting, but apparently some members had already been sitting around for years with this guy (outside of BOS) with nothing happening. I want to investigate this part of the scam in more detail.

OK, so how do we nail these guys? I’m up for reporting them to the authorities. All BOS members need to know the truth.

Securities in the US are regulated by the SEC. You can file a complaint with the SEC through their website.

im from the UK i joined BOS way back in Novemeber 2022 , all i get from them is false promises and nothing but excuses.

this situation has put my finacial future in serious jepardy , ive had to borrow £15,000 equivalent to $18,500 us dollars to keep up the mortgage repayment on my house.

Ive sent all of this to my legal team.

Some amount of uniformed crazies on here. (Ozedit: derail removed)

Get out of BOS immediately, you don’t deserve what you have. The SEC doesn’t have jurisdiction over BOS. How stupid can people be.

Gary,

You’re not from the UK.

You’re South African.

You have to wonder very often while reading this site that South Africans as victims or perps keep popping up

@Tim

The SEC regulates securities. With Blue Ocean Society we have a plethora of unregistered securities being offered by US residents to US residents.

When it comes to securities fraud and blatant Ponzi schemes, pretty fucking stupid.

@Tim if people could just “get out of BOS” the stampede would be deafening. But the smoke and mirrors game continues and seems some people need to wake up and see the reality of what’s going on before they fomo into the newest Shiney thing that’s always on offer but never delivers.

Ive just been sent the Reddit “is BOS a scam” link which took me here. All of a sudden a lot of inconsistencies and repeated failures make sense.

Im amazed I didn’t see through it and have continued to believe, the social engineering plus greed has worked very well. But the listed history of frauds by Ellis and Ken has opened my eyes.

Although, i have to maintain a healthy level of distrust for EVERYTHING i read from unconfirmed sources and without proof – here the same as everywhere else. The difference is i cannot see a valid objective here, whereas for BOS… they have my money…

Feel like I’m pointing out the obvious here but instead of performing the most basic of due-diligence (a 5 second search of the SEC’s public EDGAR database), you dumped money into Blue Ocean Society without question.

Selective distrust that disappears when greed comes into play is fine but at least be honest and own your bullshit.

So today 2/18 BOS made some payments finally to the main balance withdrawls, that were held up since Dec because of ‘banking issue’.

The reality is they paid out so far only 100k out of 400k today that was skimmed off deposits that were taken in for the new ‘Private Placement’ island. The blockchain doesn’t lie!

No payments yet to Trading Islands that have been waiting for years!

CGL Lawsuits and claw backs will be completed soon BOS is up next for the same plus.

The CFTC will chase them down just as ted safranko was but BOS with their vanity parties to fleece more people revealed where they can be found.

There may be an unofficial extradition where ever you are for El he/she and Kenny to move things along. Hope you thieves read this, sleep well.

One of the BOS staff had a conversation with me yesterday. We knew each other from before this debacle. It’s a text conversation and I will pull out the most important tidbits:

There you have it. What the administrators really think

As an insider, that person should be reaching out to the SEC and/or DOJ (FBI). A long drawn out “excuses” exit-scam isn’t going to magically return anyone’s money.

Sticking around to perpetuate Ponzi lies isn’t helping anyone, except the scammers who stole everyone’s money.

Desserting the ship? How about every month you get paid and we don’t you are colluding in a massive crime. If you are truly on the inside, do something about it!

I’ve been in BOS since November 2022 but the more I look into it the more and more I’m finding out how bad it’s looking.

Iv been removed from the hub for comments about withdrawal delays, I have received my tribe invite.

The only thing I’m not to sure about is this chris guy on the webinars who is saying he has overseen the bonds etc and it’s all accurate so iv no idea what to belive now.

Let me help you out here. Chris is lying to you. The bonds, etc. don’t exist except in Ellis’s mind; as well as all the other members of the admin team and promoters.

Every program is all smoke and mirrors and don’t exist. In short, they all are liars and criminals to boot as an added bonus. You all have been had and continue to be had. Report them to every legal jurisdiction in which they operate.

So I have been in communication with 2 support staff. They, and probably the rest, are just trusting Ellis blindly, but they are afraid for themselves and their families too in the event that law enforcement steps in.

Because of this, they do not wish to question Ellis too much and their defense, should anything happen, is that they just trusted him. I will leave it at that.

Our own intelligence efforts show that Matthew is a fake name and he is a failed businessman. Ellis probably know this and that the bonds story is all false.

It is very likely that should shit hit the fan, he will blame it on Matthew—the same way Sean is now being blamed for trading losses.

Chris has no track record and talks a big game. He is the one who tried to facilitate credit lines for BOS, all of which never materialized. Try mentioning to Ellis about the credit lines and their Plans B to F or whatever, and he will never respond.

The credit lines never materialized and Ellis started using deposits for operational expenses, trusting Matthew to deliver the bonds. Matthew has failed, and the Main Balance withdrawals have been paused for months on end, with the stupefying reason of banking upgrades. In essence, this is now a Ponzi scheme.

Chris has now pushed for a PPP program, that is deemed illegal in the USA.

Simple question for Chris: if this is real, you would be a multi-millionaire by now and would not need a party like BOS to promote it. Even if your reasons is that you never had the funding capacity for it, you would be a multi-millionaire on account of commissions.

Ellis is the mastermind of the Dignity Gold Asset Leveraging scheme, and that too is in limbo. The reason stated is that it is due to technical bugs.

The real reason? There are no lenders ready to accept a ridiculous and ludicrous proposition of lending hundreds of millions of dollars on the back of an unproven token.

This will stretch on and on and then Ellis will come up with the next great solution.

Ellis’ modus operandi is to offer hope with new ingenious solutions, but they never work. Every single timeline offered by Ellis, for even simple and basic things such as webinar or an email, is made on the go, and never comes to fruition.

It will be an ongoing story until something bring it to an end.

Bottom line: Ellis is a malignant narcissist, and nothing will change him.

The admins need to report what they know to the authorities and help stop these thieves before they run off with the cash. Claiming ignorance isn’t going to work.

I’ve heard that there are numerous lawsuits in play and people are filing complaints with the authorities so it’s just a matter of time.

Better to come clean then be charged as ‘an accessory after the fact’.

Case numbers or BS.

Spreading misinformation is never the play.

Thank you for this priceless information. I trusted Ellis and Ken, when they started. As a result, I loaned them a large sum of money and now I cannot get it back.

Does anyone know of a good attorney, who can get some results?

BehindMLM is not the place to solicit legal services. It’s not like lawyers are hard to find.

Matthew’s real name is Declan Barnett and has been allegedly associated with fraud before.

Anyone here who attended the Nevis event in 2024? This was so good organized with speakers, CEO’s the involved companies and even the president of st. Kitts and Nevis.

We had a bit more confidence. Now it all seems one big set-up. So many promisses and zero outcome. We should so something.

Where can we start? I am in.

Just received an opinion update from the BOS support staff on the sudden 30% drop in the price of the token:

Hey Tards, it’s crypto and goes up and down. Any long term projection shows it’s better than most. Try Google, it works!

A deep dive into the name above reveals a man eligible for saint hood compared to 99% of the people on this site.

If you are in BOS and airing your gripes here you are really a special kind of stupid.

A projection based on what? Blue Ocean Society is a fraudulent investment scheme tied to verifiable securities fraud.

MLM + securities fraud = Ponzi scheme. In light of that, the already stupid “number go up, number go down” crypto talking point is irrelevant.

Why is it always the stupid ones who come on here to defend MLM crypto Ponzis while calling everyone else stupid?

You’ve invested in Blue Ocean Society and come on here to defend fraud – you’ve already demonstrated you’re dumb as dog shit. At least the people “airing their gripes” are intelligent enough to have realized the scam.

I was referring to Digau.

Whatever you say OZ. Nobody thought they were at a Wall Street firm when they clicked send. I’m not defending anything but anybody helping to bring something they’re in down is not too bright in my book. Maybe yours, not mine.

You being OK with financial fraud is one thing. You can’t possibly speak for the entire Blue Ocean Society investor-base. Specifically what they were pitched on and how.

I’d be willing to bet at no point did Blue Ocean Society disclose to potential investors it was a Ponzi scheme prior to investment.

1. By all accounts Blue Ocean Society has already collapsed.

2. Investors discussing Blue Ocean Society didn’t cause it to collapse, basic math did.

3. Responsibility for Blue Ocean Society’s collapse rests solely with the admins running it.

You’re defending financial fraud. At least own your bullshit.

‘Belief’ and investments should not mix. Belief and cults do, for example Charlie Mansons deluded followers defended him, but didn’t make him right!

An investment is supposed to make you money and pay you when the initial agreement says it’s going to. Believing you are going to get paid after Nothing in BOS has performed as it was sold as, just means you are delusional.

Own a mirror?

Degen gamblers that can only make a buck by stealing from other people are not particularly “smart” as much as predatory shitnozzles.

Their so called “external consultant” Christopher Penfold is not just a consultant but is the person/entity behind the Private Placement Island.

If you look at his website refinedholdings.co you will see that the BOS island is pretty much a mirror image of his site. To me he seems like just another party in a complex scheme to get more new funds into BOS.

He claims to have taken a deep dive into BOS to confirm that they are legit, but I doubt Ellis will let anyone see all the bad things they are doing and will only show what makes BOS look positive to anyone from the outside.

The only way to ever really know exactly what is going on behind the scenes would be to get an insider with knowledge to give up that info or for a full forensic audit from a reputable source. Neither of which seem to be likely in the near future.

Okay, we have already confirmed a few things. The Main Balance amount is not there NOT because of a switch to banks.

The reality is that the funds were and are being sent to Matthew for the so-called bonds.

His story is that the banks have asked for more documents and revised insurance and reinsurance, and all these entail extra costs. Hence the Main Balance funds were used used by BOS for this.

Ellis is now caught, he calculated that the liquidity would have arrived at the end of last year, and the banking switch excuse will not be a big deal in terms of timing, as the funds from the bonds will quickly and easily cover the Main Balance hole.

As the bonds miserably fail, so does the Main Balance issue not get resolved. And the excuses no longer hold any water.

There is also a strong likelihood that the funds for the PPP are being used for the above and also operational purposes.

It is now a pyramid, where everything is collapsing because of the bond fiction story.

Ellis/Matthew/Chris could provide the CUSIP or ISIN number to show that there are valid bonds.

This would not jeopardize anything as this is public information if you have the numbers. It would go a long way to prove the validity of this bond waiting game. Also what rating are these bonds? AAA??

If insider info is true and there was no banking delay for MB withdrawals then there is definitely something at the least very strange and more than likely very nefarious going on there.

I would probably agree with you Forensicsplay that they used the money to cover something else anticipating the bond funds coming through.

My research says that selling/monetizing solid AAA bonds should only take a few days to a week. So therefore my assumption would be that these are not AAA bonds but are a much lesser quality bond which is harder to sell and which take much longer to liquidate and can often never be monetized due to their poor quality.

I guess only time will tell. I am very interested to hear the excuse Ellis gives about the MB withdrawal issues seeing as how insider info says it wasn’t banking issues.

Can someone put the link here to the telegram – chat? Is there a way we can do something together against BOS? There are thousands of investors involved who have been seriously duped. We are seriously cheated and justice is needed.

It hurts to see Ellis partying in the Caribbean and Australia, with booze and expensive cars, not giving shit about his investors.

(Ozedit: removed, see below)

I wish and hope that the responsible persons within BOS will be arrested as well as the crew members who must have been informed of all the shit by now! Let’s reunite!

Posting idiotic AI dubbed social media threat videos isn’t going to achieve anything.

Either file a complaint with regulators (SEC, ASIC) and/or the DOJ/FBI or stop moaning. Do nothing = nothing happens. And whining on social media is as good as doing nothing.

@Oz, are you the moderator here or what are you?

Bruh…

For those that don’t know where to report financial fraud to here is a list of authorities in the USA, Australia & Canada. These guys will be going down sooner then later so get your screen capturing done ASAP.

Report Financial Fraud To:

USA

FBI Crime Complaint Centre: ic3.gov/

FTC/Report Fraud : reportfraud.ftc.gov/

US Securities & Exchange Commission: sec.gov/

Commodity Futures Trading Commission (CFTC): cftc.gov/

Australia:

Australian Government Scam Watch: scamwatch.gov.au/

Australian Federal Police (AFP): afp.gov.au/

Canada:

Canadian Anti-Fraud Centre (CAFC): antifraudcentre-centreantifraude.ca/

Canadian Investment Regulatory Organization: ciro.ca/

Provincial Securities Commissions or Financial Regulatory Authorities

British Columbia: bcsc.bc.ca/

Alberta: asc.ca/

Saskatchewan: fcaa.gov.sk.ca/regulated-businesses-persons/businesses/securities-industry-participants/securities-laws

Manitoba: mbsecurities.ca/

Ontario: osc.ca/en

Quebec: quebecsec.ca/

Nova Scotia: nssc.novascotia.ca/

Prince Edward Island: princeedwardisland.ca/en/topic/securities

Newfoundland/Labrador: securities-administrators.ca/about/contact-us/newfoundland-and-labrador/

To all fellow BOS members waiting for the Tribe360 app, here is the hard truth: It will keep getting delayed because (whatever Ellis says) it is 100% dependent on the bonds coming through.

There are no lenders. Zero. Use your common sense.

Firstly, it defies logic for anyone to lend money with unproven tokens as collateral. Secondly, see the history of the timeline shift for the app launch and compare it to the timeline for the bonds being completed. They are running side by side. It is not just a coincidence.

Forget common sense if you want. We have proof of that that we cannot share.

Now, accept the fact that the bonds also will never happen. The story on the bonds is better than a novel: that the funds are already in the designated BOS account since end of 2024, but BOS cannot touch it!

At this stage, the creativity on BOS part assumes that the intelligence of the BOS members is very low.

If anyone has doubts about the reality as has been presented: check in every month here and see that nothing has moved and changed. There are so many things about Ellis that have been unearthed, but this is the most important: she or he is a malignant narcissist – definition of which is “a personality disorder characterized by a combination of narcissistic traits with antisocial, aggressive, and manipulative behaviors, often lacking empathy and remorse.”

More important than the definition is that such people see that they never do or are wrong, and –this is critical- will never or can never change, as they see things through the lens of what is best for themselves.

In essence, your situation will never improve in the next day, month or years when you deal with such an individual.

PS–I will be back here in every week just as a reminder that there will be no change in the situation.

Slowly, most of you will come to terms that this is nothing but an elaborate scam that ran out of legs more than a year ago, and is now just a showcase of creativity in stupefying everyone.

What do we do at this point?

See comment #54.

Condescension. Definition: “people who practice condescension treat others like inferior idiots”

It has now come to a stage that Eliis is so cut off from reality that he assumes BOS members are still stupidly ignorant.

I wanted to take a break from coming in here but had to do it after the last email update, which is so outrageous in assuming that people will buy the BOS narrative.

Having already been forced to go silent on the Main Balance issue because the story of the banking upgrade became a laughingly ridiculous reason after 6 months, Ellis tried her luck again with some things even more ludicrous in the email update.

1. That onboarding for Tribe had already started. Really? When? Surely, you have announced this, and for days nobody on the chats or hub said that they had been invited in the face of so much criticism about the missed deadline.

2. Oh wait. It gets better: that those who got onboarded have been told not to share it with anyone. This is the most crazy thing ever. No reason given for them having to be asked to remain silent. If anything, you would want them to say that they were indeed onboarded so that it will reassure the rest of the society that the process had indeed started.

3. Another glitch at the last minute? Anybody buys this reasoning? As I said many times before , everything, Tribe and Main Balance are contingent on liquidity from the bonds. Which will never materialize by the way, butis another story from the novels for another day. But to keep insisting that they are all independent and then to see continuous delays proves the lies.

4. Onboarding expected to start on Monday at the earliest. Look at the choice of words—at the earliest. There is no firm date, and even if it ever starts, I am willing to bet the onboarding will be super slow (just like the aerrr-ridden manual KYC) , and the those with the smallest balances will get a first go. And then there will be tech problems again.

If this whole thing is real, and transparent, and if BOS is even remotely professional, it would state target onboarding batches by days and state exactly when it hopes to complete the entire exercise. It wont. It took 2 months for a manual KYC process riddled with issues and still ongoing, and this will follow this will follow the same pattern.

It’s the same thing from year ago—keep giving hope and drag this until…even I cant answer what is the end game. Because there is no way out now, Ellis. And I know you are reading this. Don’t assume members are naïve and stupid as think they are.

I cried when I read the update, it made me physically ill. I was a believer, but after reading everything here I can see how blind I was.

To read the hub and see the messages or questions from members constantly deleted is now making sense.

To those in the hub who daily say be patient, be grateful and are full of ra ra for BOS I wish you could feel the pain of others.

I pray to god the moderators have a sense of humanity and empathy and stand up to the truth and not be scared to tell the members what is really happening.

I wish all those who have lost out physically, mentally and emotionally all the best. I also pray that this is all a massive misunderstanding and Ellis is a good person.

As an action man, words mean nothing….time to look after my family another way. God bless you all xx

The reality of BOS inactions continues to sink in. Why is it difficult to create and secure an APP?

Day in day out there is always a delay of some sort or glitch or “The bank HAS the money BUT WE DO NOT HAVE THE CONTROL ON….”.

I remember in 2023 when they kept saying “Sean will release the percentage allocation after xmas, then after the new year then he was to spend time with family”.

This whole thing has always been about DELAY, DENAIL & SUSPENSE. They kept coming up with emails like they were doing us all a favour. I remember the contract being about LOANING the money to BOS.

From traveling to Australia “to be close to what is happening” to Michael traveling to Dubai it all just does not make sense.

I would prefer to get over the bad news and move on. Enough of the unsettling suspense. BOS is BAD NEWS.

Strange there are no updates in the comments, since there are new developments regarding the Tribe app.

Some users state they can obtain a loan related to the number of tokens they have and think this is a way to get momey out of BOS.

Can anyone confirm this, and mails from Ellis?

So, Ellis still operates from an unknown place anywhere in the world, and is not impressed at all from people hunting him.

At a rudimentary level the premise of getting a loan to withdraw money from a collapsed Ponzi scheme makes no sense.

Nobody is handing out loans willy nilly – someone is going to owe that debt. And it’s probably not going to be Ponzi scammers.

He operates from Australië. By the way, who is hunting them?

So, the Tribe app is launched, but anyone see the shift from previous commitments:

1. Once you are onboarded, the lenders will be ready to lend funds. Reality; they are not at all even onboarded themselves

2. They have more than enough fund s to lend everybody and more. Reality: totally untrue

3. These are traditional lenders, they do expect anything from 10-12% a month. Reality: Ellis is now saying she has no control and 2% may be acceptable to lenders.

4. Yu can prepay your loan off before the term without penalty: Reality: not true.

And many other contradictions. Main Balance withdrawals are not available at all, and Matthew its almost 6 months from when BOS was told by the banks that it will be able to access funds from the bonds.

Oh Ellis, you are not only a liar, you are a failure. I wanted to come in every week from my last post to see if anyone is in a better position from then. It is a month later and nothing has changed.

I am willing to bet my last dollar that nothing will change in the next 6 months. By that time, it will be the end of BOS.

So there have been a few Tribe DG or Treasury backed loans that have been funded. They range only in the few thousands of dollars.

I believe that this is just BOS (Ellis) funding a few small loans to quiet down the uproar about no one getting loans funded as they stated people would as soon as the app was launched.

I believe this is just another stalling tactic while BOS tries to secure the bonds. If they secure the bonds you will see all the loans start being funded and they will claim this is from “lenders” but will really just be BOS funding the loans from the bond proceeds.

@BOSBigOleScam what makes you think that they actually do have a bond?

It’s all typical Ponzi bullshit unless audited financial reports are filed with regulators as is legally required.

Before he was finally arrested, Mike G strung his mostly elderly investors along for years with “just around the corner” fiction. Ellis is doing the same.

I don’t know either way, this is just my theory IF they do have the bonds and they do get the funds.

I am working on trying to track down this bond transaction through creditable sources and hopefully over the next few weeks I will have some info.

I still believe the only loans being funded right now are BOS(Ellis) just trying to manipulate people into thinking lenders are really in there giving out loans. I highly doubt that any lender has deposited $400 million into Tribe but then just doesn’t put it to work and just lets it sit there.

A handful of loans, for less than $5000 each a week after launch, is a slap on the face of the investors.

Yes, it is Ellis’ way of making things look as if they are moving along, and just to buy more time and silence. The lenders were supposed to be onboarded and ready to disburse $400m and more.

Look at the narrative now: the lenders are observing, and more meetings have been planned. Not one thing Ellis says ever is what was originally presented. Zero.

She lies as she breathes, and people just get convinced and start praising her. Its like a cult.

There are no loans or lenders, the Govt bonds and “Matthew”/Declan are BS, Plan B and Plan C are for the birds.

The penny won’t drop just yet for most of the membership, who are still celebrating the launch of the Tribe website, but give it a few more weeks.

A year ago, it was unthinkable that Sean Robertson’s failure to meet the April deadline would mean a delay of more than a few months. And yet, it is now more than a year and nobody has been paid. Now, with Tribe, many are clinging on to hope that they will get the loans within days and finally have relief.

A year from now seems unthinkable and unbearable. Yet, I dare say, in a year’s time, everyone will still be waiting around, as Ellis’ genius solutions in the form of Tribe and the bonds would still be waiting to come to fruition, and a couple of other genius solutions will be being put in place. It’s a never ending cycle.

Ellis’ theory about lenders not knowing about BOS and just lending because of the Dignity Gold Asset is ridiculous. Forget about the actual real value of the unproven asset. How does Ellis show the lenders who owns the asset for their verification? It is BOS.

Remember the partial withdrawals of a year ago. Almost no one got them but Ellis kept saying people were not reporting that they have received them. Well, the Tribe funding lottery is the same.

About 5 people have received loan offers of not more than 2k, and Ellis insists that there are many more and people are not reporting them, and in some cases, they are near 6 figures.

In fact, Ellis and BOS have technically washed their hands from honouring the balances of investors. Like the good ol’ scams where failed Ponzis turned to creating and issuing worthless coins as a solution, this is no different. You are left to keep waiting for a lender to lend you the money, end of story.

If indeed there is north of $400 million in lending capacity, BOS would have negotiated a standard lending rate for every member and not have the chaos of 4000 members auctioning for thousands upon thousands of loans to be funded on a platform that took months to launch and in actuality, is error-ridden.

The chaos is undeniably deliberate to drag this on for as long as possible. Ellis now saying that she has to be neutral between the lenders and BOS members gives away the fact that she is washing her hands off the lending mess.

Ellis gets excited about the value of the Tribe Coin. It means nothing until people get their full loans and are able to withdraw.

As for Matthew, well, well, well. A month ago, he was waiting for key people to join him in Dubai and then they would be off to other continent to finally close the deal.

Alas, the last update states he is still in Dubai. The lies are insane at this stage. It takes some type of creativity to make people forget what the last thing was said.

And then there is Chris. He authoritatively proclaimed that if he was the one monetizing the bonds, he would have give a buffer of 2 extra months to allow for any unforseen delays. Well, it is coming to month number 3. Oh, by the way, with buffers applied, PPP payments are still not there.

I don’t think there will be any money returned. Smartest thing to do now is report everyone involved.

Want confirmation of how bad things are at BOS? Chris, the external consultant, who is supposed to be independent and has vetted the new islands and their owners coming into BOS, has gone eerily quiet.

It coincides with the failure of the first Private Placement Program island to pay investors their first returns on time. And BOS has quickly closed the most recent open PPP island and not opened another ,which was the plan.

Chris is the man who claims to have connections and networks in the higher echelons and sometimes-secretive deal making world of finance, and promoted the Private Placement Program that offers 20% monthly interest (and probably more after taking into account BOS’ share).

He claimed such deals are not open to anyone and are exclusive invitation-only offers. It never made sense why such an offer would land on the plate of a man in the street, when the Warren Buffets of the world, who struggle hard to make 5% to 8% a year return on their funds, were never given an opportunity.

Yet, someone in the eastern belt of Australia, sitting in the comfort of his badly lit bedroom and a poster of Spiderman on the wall, was chosen to be given such a life-changing opportunity.

The story of PPPs has been debunked many times. It doesn’t exist and US authorities had proclaimed them to be a fraud offering more than a decade ago.

It would be interesting to see how BOS wriggles its way out of this. Its first explanation for the failure to dish out the returns is the same as the initial explanations for all other withdrawal delays- be it Trading, Main Balance, or the PTI cashbacks—compliance verification.

At some point, you must wonder what charm Ellis has on members that they seem to fall for his fairy tales. He must be laughing and thinking that he is luckier than the cat with nine lives.

At this point basically every island and the main balance are all in default. You can only put money into the system and you will never get it back out. Their newest PPP islands are not even paying out! It’s just a matter of time till they shut the lights off and ride off into the sunset with all our money.

OZ, do private placements in a foreign jurisdiction need to be registered with the SEC? How can it be private and registered with the SEC? Just curious as I find that contradictory.

If you’re soliciting investment from US residents on the promise of passive returns, you need to be registered with the SEC. Refer to the Howey Test.

Outside of the US every country with a regulated financial market has similar securities laws. This includes Australia.

Any bullshit terminology scammers come up with to pretend they’re exempt from securities law is irrelevant.

Yes. “Private” has nothing to do with regulatory registration.

You finding obviously unrelated things contradictory sounds suspect.

Has anybody noticed how quiet it is around Ken? That man is keeping to the background, only to quietly and inconspicuously disappear.

I’m going to report the BOS employees involved (I know a few) to the authorities in our country. I hope everyone else will do the same.

Ken, staying in the US, distances himself form any thing related to finance. He is well aware of the risks of being charged for securities fraud, as he is living in the US, unless Ellis, who has abandoned Canada for Australia.

Ken will be happy to be involved in webinars where he only asks technical questions, and avoids anything pertaining to profits and returns or any money issue.

In fact, the BOS staff are careful too. They just pass on info from Ellis, and make it a point to say it comes from him. They know they are at risk too. (This is directly from BOS staff to me, btw). Yes, we already have details of almost all BOS staff. It is useful to have material witnesses.

If Ellis resides in Canada and is currently in Australia on a tourist visa, he remains subject to Canadian law. If there are suspicions of his involvement in securities fraud or other financial misconduct, these can be reported to the appropriate Canadian authorities.

It might be the US authorities are looking into him as part of the BOS scam so he may be trying to lay low.

So.. since the Tribe Loans scheme, that investors were desperately pinning their hopes on, turned out to be a total flop.. and the ‘Declan/Matthew’ fake Government Bonds project continues to stagger on with nothing to show – what now?

The BOS hub is now on total lockdown every weekend to prevent any members from saying hurty words behind admin’s back. I reckon this only has 2 or 3 more months of uptime before it gets shut down or they call it a day.

Yeah the wheels are falling off this bus at a rapid rate. I think it only has a few more months left before they shut it all down and disappear off into the sunset with all our funds.

I think the only hope is that the law catches up with them and puts them in prison for a long time but I feel that is unlikely as well unfortunately.

It’s funny that they will not tell you anything about the bonds because they are trash bonds that are next to impossible to sell/liquidate.

That’s why they keep talking about reinsurance, because no one insurance company wants to shoulder the cost all by itself when the bonds ultimately can not be redeemed, so they want another insurer to help shoulder the cost when the bonds are unable to be redeemed and they holder calls on the insurance policy. This is common in the trash bond world.

Well, it looks like another rug pull scam after years of lies from Elisabeth (Ellis) or whatever its name is, and Doyle “Ken” along with their entire staff. So many lives destroyed by these human parasites. Prison is too kind for these people.

Report them! Ellis has a Dutch pasport so we can report him to the Dutch authorities.

The value of the trading islands is (Ozedit: snip, see #70)

nothing. The value of anything in a Ponzi scheme is nothing.

If you want to make financial representations about Blue Ocean Society, provide audited financial reports filed with regulators or spambin.

Well It’s time to call this game over. Declan Barnett aka ‘Matthew’ has a post on his old Twitter account from 2023 promising the imminent launch of his token based on his Brazilian bonds that were just about to be monetized to but bullion to back the token.

YES 2023! And he also had a loan coming from land in India. Other sources say this scam has been running for a long time. Looks like Ellis got conned AGAIN, with our money, or is in on it.

Only thing Ellis has proved to be good at is getting scammed by bigger cons than her or teaming up with them. But any one holding out hope after lie after lie after lie after lie FOR YEARS is fooling themselves !

There is nothing to loose at this point, sue and report!

Is this fraud collection company legit? They claim to have success collecting for BOS victims. (Ozedit: recovery scam link removed)

Recovery scammers. Anyone pitching you fraud recovery that isn’t a government authority/regulator is trying to scam you.

They ask for a fee, you pay and then nothing happens.

To clarify my prior comment, the liability owed was rather small compared to the inflow of new money being deposited for the new islands.

It seems even a ponzi pyramid should have been able to cover the spread. What you are making me realize is the new money coming in was also hyped and non existent though posted in the millions.

At any given time, the only verifiable source of revenue entering a Ponzi scheme is new investment. Everything else is bullshit.

Ellis deserves a special place in hell and lengthy prison time for this ongoing long winded scam that is leaving a wake of destruction in peoples lives.

So lets see who the this new co-conspirator is that’s defrauding members: Steven L Braverman Founder and serial criminal of Dignity Gold

brokercheck.finra.org/individual/summary/1731936

I filed my complaint with the SEC and it took just about 1/2 hour. Would encourage others to do the same if affected and will help draw attention to the issue.

BOS did make claims that what “Matthew” was working on was SEC and FINRA regulated. So it is a matter of jurisdiction for the SEC.

Further, other partners (S. Braverman) are also under SEC indictment so they have an open file already that may dovetail into BOS.

With everything failed, every promise broken, and payouts stalled for over 6 months now it looks like Ellis is just going to keep on abusing the membership by launching even more islands.

The latest one is 10% a month, you would have to be completely batshit crazy to keep pumping money into this scam.

I am sadly an investor brought in by a friend. Trusted early but quickly realized things did not feel right but at that point, I could not get my money out. I tried several times to just pull out and there was no option for it and no method.

I was not trying to get rich quick, just tired of traditional FP’s and ETF’s. I am not in finance and thought well, this makes sense to try something different.

Sadly, invested in 2022 and in 2025 have nothing to show for it despite trying for the last 2 years.

I am happy to join the cause to stop this and keep them from hurting others. I am resolved that I will not see a $ back, working more to make it up but want to see Ellis and Ken in Jail for their actions. I will look at the SEC and how to file.

Its over. If anyone believes Ellis is missing because she is finding “solutions”, you need an appointment with your shrink. The reality is that Ellis is inundated with legal challenges from multiple fronts.

This is going to end like any other scam online programs, with the lights gradually going off one by one, until everything grows dark.

If you look at it, the seeds have been laid for some time: Ken gong AWOL, now Ellis, reduced chat hours, limiting hub open times, Ellis no longer recording live sessions for fear that they may used as evidence, etc.

I don’t even wish to continue to highlight facts, because the facts speak for themselves. Which are: no bonds, no lenders, nada.

Stop making yourselves believe that Ellis is behind the scenes working hard for you. NO, he is isn’t, and you don’t have any proof and your mind is making you WANT to believe this.

Chris has called it quits BTW, eating humble pie as an “expert consultant” he obviously is not. The chickens always come home to roost, and here the time has arrived.

I was a bit heartened by the presentation that Ellis did in Q4 2024 with all the plans for BOS – Plan A,B,C,D, Tribe loans, Dignity Gold and a benevolent cycle of funds being generated for the good of all members.

Now of course I see it was all BS. I can’t decide whether Ellis was just scamming/stalling for time, or if he believed it all and was just naive and pulled down multiple dead ends by scammy island partners and consultants. He’s certainly lying about “banking restructure” being the reason for withdrawals not being honoured.

@forensicsplay – do you have any further information or sources you can share about Chris quitting and the multiple lawsuits? I’ve not heard anything about legal action and I keep my ear fairly close to the ground.

@Tell It To The Bear, it is really simple. Ellis, and everyone involved in this, have been lying since day one. None of these projects are real They are all Ponzi’s. Every excuse was nothing more than buying time to keep the members from going to the authorities.

Everything they did and said followed the Ponzi Playbook to a T. All you have to do is go back and look at everything they said, promised never came true. It was always one more excuse, or “outside” circumstances that cropped up at the last moment stopping the promise to be fulfilled.

Chris the “External Consultant” is back on webinars this week so is far from out.

How are they still pushing new islands. Putting two islands together calling it new. Crazy work.

Doesn’t mean he knows anything about what he is doing.

Nothing that he has said would happen has and the PPP that was his venture is tits up now, just waiting for the official announcement after they are done peddling the new DG scam to get a little more money in the door before it all collapses.

If a scheme isn’t paying out it has collapsed. Holding marketing webinars in the hope of a reboot shouldn’t mean anything to the original victims.

The things I am hearing from behind the scenes are beyond criminal. They are treating people that work for them, or they want to work for them with cult like control, manipulation born from desperation.

What started with one trader gone bad has become a side show circus with so many lies and deception to cover up each scam, it’s beyond absurd!

When you are running a scam from the start you must keep control of all information otherwise the scam will be exposed. She (Ellis) knew from the beginning that Sean the “Unicorn Trader” was a fraud and scammer as she was involved in a prior scheme with him called RELAXA where everyone lost their money.

So it wasn’t “one trader gone bad” it was built on lies and deceit from the very start.

Cherie, we would love to hear more about what control measures are being used and what criminal things you are hearing about. Get any and all proof that you can for future use.

Their new recruit Glen, from Crawford Coaching seems like a just another puppet to spew the things Ellis wants the members to hear and has little to no experience in what he is supposedly doing. Just another stalling method to keep people actively holding on for a little while longer.

Blaming the collapse of PPP on the members is just low. If BOS could prove to the “institution” that they are not a Ponzi Scheme or some other type scam then the negative press and all wouldn’t matter.

Claiming member wallets were also part of the problem is highly suspicious as well, I would figure the way BOS transacts is more than likely the case and not the members themselves.

And it is always funny how each time she says something is about to happen there is always something that pops up at the last minute that BOS needs to provide more info/documents that pushes that thing out further.

Again I believe this is all just stalling tactics to string members along till the eventual collapse of this giant scheme.

I’d like to share a positive story that has come out of this BOS “Big Ol’ Scam.”

Until last year, I participated in a cult in Bali. Our cult leader (a German national who I later discovered to be an abusive narcissistic sociopath) forced/manipulated all of us to invest all our savings into BOS as a means of ensuring future financial abundance for our ‘community.’ He also invested six figures of his own savings into BOS.

Like everyone else, he lost all of his money and was unable to repay his creditors. I believe one of his creditors made sure that he was permanently deported from Indonesia and now he is unable to return to the ‘sanctuary’ he created and funded by abusing vulnerable people and demanding their money.

So him losing all his money in BOS has resulted in his ejection from Bali and he is no longer preying on vulnerable people there. And somehow it seems fitting that a cult leader would get duped by a Ponzi scheme.

The way he talked about BOS and Ellis was like he had been totally brainwashed. Now that is karma at work.

@ Cult

That should be a movie!

There is an argument to be made that all MLMs are cults of course but this is next level

Vivian from WoW (World Of Wealth) seems to give very informative crypto news/macro updates, that I would have liked to trust. But I can’t.

Anybody who’s been so involved with BOS islands (repeatedly) cannot be trusted ever again. And the WoW project/token seems to have a very convoluted system, like BOS, which I now see as a warning sign in any crypto project.

Being financially ruined has opened my eyes, but its a hard lesson of greed and FOMO. Thanks for explaining it all and making it public Oz/BMLM.

Trouble in Paradise.

Relations between Ellis and “Matthew” (Declan) appear to be strained as PTI has failed to deliver anything at all but has the begging bowl out for another 0.5m, which was refused.

Nothing else in BOS is working or paying out. Not sure how much longer they can continue for.

Regarding the narcissistic sociopath cult leader… like attracts like. BOS is a cult built around Ellis own narcissistic, sociopathic need for more, more, MORE!

Trying to fill some gaping hole in her soul! And all she has been able to do is find others like her, to take, take , TAKE!

It’s time to take down this ponzi!

How long will they keep dragging this out?

They can’t credibly take in any more money as no-one will invest as they haven’t paid out for nearly a year. Members are choosing to owe their membership fees in their back office rather than pay up.

Somehow the whole excruciating debacle drags on month after month.

I invested the minimum amount in Oct 2022 of $5k for a 12 month period. This grew by about $900 per month for 18 months as the pay out period kept getting extended.

By mid 2024 it was advised that our investment was being reassessed and that interest would stop being paid.

By 2025 it was advised that all amount were being adjusted as payout would be easier- amount were recalculated to about 60% of their value. Since then we have been promised payout from a Bond that has never eventuated.

Many members are understandably angry but many still believe the manipulation from Ellis. Every day we receive new investment promotions with promise of large return rates.

We are also being persuaded to move our balances to other non BOS entities that offer similar unbelievable offers.

Are Chris and Steve still pushing the Dignity Gold island or have they moved on?

The new dramatic BOS Email update!!! The Silence ends here (but assuredly not the lies)

“What Really Happened with Sean Robertson — And What BOS Has Endured”. (Another long winded email from the thieves at BOS)

Obviously another deflection by Ellis/Elizabeth (aka Pat) the sociopath to keep the lawyers from their door is throwing their partner (by their own admission) under the bus.

Sean has no money because more than likely he lost it, compensation nor justice will come to the members. Sounds like a plan where BOS can walk away from liability and Sean will be rewarded by BOS for taking the fall.

I have talked to someone who has much more knowledge about SR than anyone else in the world probably and I’m told that Ellis (Elizabeth) is not telling the whole story and that there is much more going on than what she tells everyone.

She claims to have lost $14 mil to SR personally but I doubt much if any of that money was actually her personal money, probably just some of BOS members money she is claiming as her own.

The reason for the $6mil in legal fees is because BOS is registered in Nevis so that is where most of the legal costs are coming from.