Avalon Life Review: Recruitment, mining & AVLX coins

![]() Avalon Life claim to be incorporated in Costa Rica as “Avalon Life AG”.

Avalon Life claim to be incorporated in Costa Rica as “Avalon Life AG”.

The company is headed up by Tom Koller (right), who serves as CEO and CTO.

The company is headed up by Tom Koller (right), who serves as CEO and CTO.

On his LinkedIn profile Koller lists his location as the Canton of Vaud, Switzerland, which is likely where Avalon Life is actually being operated from.

On a blog pitching “VIP Coaching”, Koller reveals he was formerly an affiliate with Monavie (circa 2011). Koller’s Twitter profile also ties him as an affiliate to FGXpress (2015).

Read on for a full review of the Avalon Life MLM business opportunity.

The Avalon Life Product Line

Avalon Life has no retailable products or services, with affiliates only able to market Avalon Life affiliate membership itself.

The Avalon Life Compensation Plan

The Avalon Life compensation plan primarily pays affiliates to recruit new affiliates.

ROIs are offered on mining package investment and AVLX coins issued when Avalon Life affiliate fees are paid.

Recruitment Commissions

Avalon Life affiliates are paid 50 EUR per affiliate recruited.

If an affiliate recruits ten or more affiliates in a single month, their recruitment commission is doubled for that month.

Residual Recruitment Commissions (unilevel)

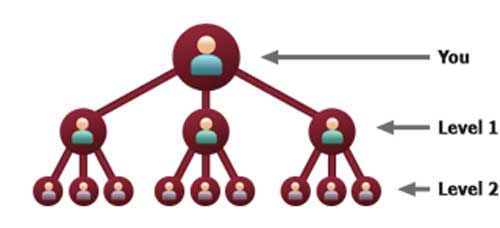

The first residual recruitment commission in Avalon Life is paid out via a unilevel compensation structure.

A unilevel compensation structure places an affiliate at the top of a unilevel team, with every personally recruited affiliate placed directly below them (level 1):

If any level 1 affiliates recruit new affiliates, they are placed on level 2 of the original affiliate’s unilevel team.

If any level 2 affiliates recruit new affiliates, they are placed on level 3 and so on and so forth down a theoretical infinite number of levels.

Commissions are paid out monthly via revenue raised from affiliate fees paid by recruited affiliates:

- level 1 (personally recruited affiliates) – 2 EUR per affiliate recruited

- level 2 – 4 EUR per affiliate recruited

- level 3 – 6 EUR per affiliate recruited

- levels 4 and 5 – 8 EUR per affiliate recruited

- level 6 – 12 EUR per affiliate recruited

Note that the above commissions are paid out 12 months for every affiliate recruited.

After 12 months if a recruited affiliate does not pay their 960 EUR affiliate fee, commissions on that particular unilevel position cease.

Residual Recruitment Commissions (matrix)

The second residual recruitment commission in Avalon Life is paid out via a 3×8 matrix.

A 3×8 matrix places an affiliate at the top of the matrix, with three positions directly under them:

These initial three positions form the first level of the matrix, with the second level generated by splitting each of the three first level positions into another three positions each.

In this manner subsequent levels of the matrix are generated as needed, with each level housing three times the positions of the previous level.

Positions in the matrix are filled via direct and indirect recruitment of Avalon Life affiliates, with commissions paid as a percentage of affiliate membership fees:

- level 1 (3 positions) – 2 EUR per affiliate recruited

- level 2 (9 positions) – 2.77 EUR per affiliate recruited

- level 3 (27 positions) – 2.81 EUR per affiliate recruited

- level 4 (81 positions) – 3.19 EUR per affiliate recruited

- level 5 (243 positions) – 3.20 EUR per affiliate recruited

- level 6 (729 positions) – 4 EUR per affiliate recruited

- level 7 (2187 positions) – 8 EUR per affiliate recruited

- level 8 (6561 positions) – 14 EUR per affiliate recruited

Note that the above commissions are paid out 12 months for every affiliate recruited.

After 12 months if a recruited affiliate does not pay their 960 EUR affiliate fee, commissions on that particular matrix position cease.

Mining ROIs

Avalon Life are officially coy about their mining package prices. Affiliates marketing Avalon Life however have quoted 2100 EUR, 2700 EUR and $2620 USD as the cost of the packages.

The idea is that Avalon Life invest in mining packages on the promise of a ROI paid out over a set period of time.

The length of an Avalon Life mining contract is not disclosed.

Referral commissions are available on Avalon Life mining contracts, paid out at what appears to be a few hundred EUR per contract invested in (no specifics available).

AVLX Coin ROIs

Everytime an Avalon Life affiliate pays 960 EUR in fees, the company gives them 1000 AVLX coins.

AVLX coins are supposed to be a cryptocurrency, the value of which has yet to be determined.

Each year Avalon Life award affiliates a 50% bonus of coins previously awarded, for a five consecutive years in total.

Joining Avalon Life

Affiliate membership with Avalon Life is 960 EUR a year.

Mining package investment will add a few thousand EUR to the cost of Avalon Life affiliate membership.

Conclusion

Avalon Life appears to be set up like your typical MLM cryptocurrency opportunity.

Affiliates will invest large sums of money and in exchange receive a relatively worthless cryptocurrency coin, no doubt touted to be bigger and better than bitcoin.

There’s little to no information available on Avalon Life’s AVLX coin at the moment. Expect it to be either an internal points cryptocurrency that’s worthless outside of Avalon Life, or a publicly traded coin that crashes on release (no demand for the coin outside of Avalon Life).

The rest of Avalon Life’s compensation plan is recruitment-based, making Avalon Life a pyramid scheme.

Affiliate fees are literally recycled to pay off top investors, with larger sums paid per affiliate recruited in both the unilevel and matrix teams.

This favors early adopters, Tom Koller and friends likely having created a bunch of preloaded positions at the top of the company-wide unilevel and matrix.

This ensures Avalon Life corporate receive the lion’s share of affiliate fee funds paid in, with everyone who doesn’t recruit enough people to cover their 960 EUR losing out.

As to the mining packages, they could be legitimate but given everything else about Avalon Life seemingly isn’t, I’m not willing to give the company the benefit of the doubt.

There’s a strong probability that invested affiliate funds will be used to pay out mining package ROIs, making Avalon Life a Ponzi scheme.

That said I haven’t seen any crazy ROI promises so perhaps affiliates will actually be paid mining profits. If that indeed is the case, don’t expect to recover your 2100 to 2700 EUR investment any time soon.

How transparent Avalon Life are with regard to their mining packages remains to be seen.

Of note is the math behind the Avalon Life compensation plan doesn’t add up. The full 960 EUR affiliate fee is split between the unilevel and matrix commissions for 12 months, with the direct recruitment commissions paid out on top of this.

I did see one Avalon Life presentation that claimed leased out mining contracts to third-parties would cover recruitment commissions, however this is far from a stable source of income.

I predict Avalon Life are going to pay the recruitment fees out of affiliate fees, throwing the scheme into deficit from day 1.

Outside revenue is hoped but not guaranteed, with a large-enough deficit triggering a collapse towards the end of the first twelve months after Avalon Life launches.

The incorporation of Avalon Life in Costa Rica is another red-flag, with there being absolutely no reason for someone in Switzerland to be running an MLM company incorporated half-way across the world.

This is likely done in the event of a collapse, which maximizes Tom Koller’s chances of making off with invested funds.

Regarding AVLX coin,

This coin is not listed on Coinmarketcap. If you can’t find it there then that is a flag it is not a legitimate crypto currency.

coinmarketcap.com

Legitimate crypto currencies are traded on at one of the many open markets.

What the fuck are u talking about?

AVL doesn´t want to be the next cryptocurrency bigger than Bitcoin!

AVL is NOT the next “join and get rich” – system.

AVLX isn´t even a typical cryptocurrency. It´s a DAO-Token like the one of slock.it and theDAO project…

The cryptinsider by itself is worth many thousands of euros per year… other companies take 3000-5000€ per year for informations that are already included in the license fee.

And the price for the miningpackages is a great deal. Far below 3000€ for 100 mh/s Ethereum mining… show me one other company that offers a lower price! Ah.. it´s not the price for a year, but lifetime. Following staking by X11 included.

I could write much more like that… oh my god… I thought, you are a serious company… who paid for that article?

Do your work before you write such a bullshit.

Blahblahblah, it’s another non-public Ponzi points system that hold no value outside of the MLM opportunity.

That’s why you can purchase it outside of the Avalon Life opportunity, right?

Cryptinsider is worth nothing, people are as usual investing in the points Avalon Life offer.

Funny what you can charge and get away with when you’re not actually accountable to your customers…

I guess it was inevitable that MLM schemers would discover Ethereum and DAO’s, in the Bullsh*t Baffles Brains arms race that is centered around crypto exploitation by the “Industry” at the moment.

Unfortunate timing by Avalon, what with the $60m recursive drama going on with “smart contacts” written with Solidity, plummeting ETH price and the DAO (DOA?) world in general crisis right now.

I don’t know if you’ve read this link re Avalon: spark.adobe.com/page/OwXOn/

Huge numbers, and huge numbers of ifs and buts.

I wouldn’t touch Avalon with the proverbial barge pole without the latest drama, never mind with it..

In other words, it’s even MORE worthless than cryptocurrency.

How DAO is supposed to work: DAO token is PURCHASED with cyptocurrency, and owning DAO token basically gets you a virtual vote in the DAO in making decisions. The DAO then engage contractors performing tasks that generate profits for the DAO itself, which is passed onto the token owners.

With AVLX all the presentation talk about is vague promises that makes little sense. What it does say is you’re not invested in mining directly, but rather, you’re buying into his DAO which runs the mining rigs in Costa Rica.

Except that’s not how DAO is supposed to work. DAO owners get rights/votes. All buying into AVLX is gets you a piece of that mining pool he’s supposedly running.

it’s also interesting that on the website Koller specifically talks about getting AWAY from the European regulations.

Any one remember what happened to the last guy that tried it? (Look up “Liberty Reserve”)

Also keep in mind that Costa Rica knows that it is a hotbed of money laundering. Its own estimates are more than 4 BILLION dollars are laundered through Costa Rica every year. (source: NOLINK://www.insightcrime.org/news-briefs/4-2-bn-laundered-in-costa-rica-every-year-official )

Then there’s the current Ethereum problem that someone has hijacked the system and took out MILLIONS of Ether… Check the news yourself.

Add it together, Avalon Life can be summarized as:\

It’s interesting that he claimed his farm of 7 rigs is under the domain name Avalon-sun. When I go to that, it displays a particular miner under Ethpool.org with about 700 MH/s, which generates… about 173 ether a month.

At current rate of $12 to 1 Ether, it’s about $2000 USD. He kept mumbling about it’s solar power but he never discussed what are the costs of running such a farm in Costa Rica, a pretty warm place. How much of that $2000 do you think he can spread around as mining “profit”? Hmmm?