A sick joke? Robert Craddock publishes Zeek Rewards book.

Out of all the people on the planet who might pen a book about Zeek Rewards, arguable none would be less qualified to do so than Robert Craddock.

Out of all the people on the planet who might pen a book about Zeek Rewards, arguable none would be less qualified to do so than Robert Craddock.

Craddock, an investor in the Zeek Rewards, was hired by Gregory Caldwell to assist him with silencing Zeek Rewards’ critics compliance.

After the SEC shut down Zeek Rewards and revealed it to be an $850 million Ponzi scheme, Craddock was one of the most outspoken critics of the regulatory agency.

Craddock pushed all sorts of conspiracy theories in the immediate aftermath of Zeek through ZTeamBiz, a network of investors he set up.

Wishing to pursue legal action against the SEC, Craddock (right) convinced investors of Zeek to send him thousands of dollars.

Through ZTeamBiz, Craddock (right) promised to put the money towards defending investors against future regulatory action.

Through ZTeamBiz, Craddock (right) promised to put the money towards defending investors against future regulatory action.

The money ZTeamBiz fleeced from affiliates who donated was originally gathered to be used to defend all Zeek Rewards affiliates who donated against impending SEC litigation.

Shortly after the bulk of the money that would be donated was donated however, this changed to the offering of a cookie-cutter attorney letter, provided at an additional cost.

Where did the rest of the money go?

It is widely believed that the bulk of it went towards financing the legal defences of the Zeek Rewards net winners that formed ZTeamBiz.

In the months following the SEC shutdown, a number of legal initiatives were launched by ZTeamBiz affiliates to try to thwart attempts to recover funds they stole from their fellow affiliates.

To date, every single one of these actions has failed.

After that farce, Craddock’s name continued to pop up in connection with a number of shady schemes. It wasn’t until late 2013 that regulators and/or the Zeek Receivership shut him down.

After a series of Ponzi points business pushed by Craddock flopped, his newest role appears to be that of publisher.

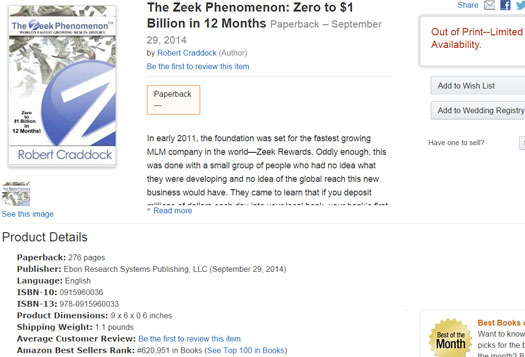

Titled “The Zeek Phenomenon: Zero to $1 Billion in 12 Months”, I don’t really know how else to describe Craddock’s latest move other than that of a sick joke.

Published by Ebon Research Systems Publishing, Craddock’s 276 page book was listed on Amazon on September 29th:

Whether or not the book is actually available is unclear, with it being listed as “out of print – limited liability” barely a week out from launch. As such, no ticket price is provided either.

Here’s what the supplied blurb says:

In early 2011, the foundation was set for the fastest growing MLM company in the world — Zeek Rewards.

Oddly enough, this was done with a small group of people who had no idea what they were developing and no idea of the global reach this new business would have.

They came to learn that if you deposit millions of dollars each day into your local bank, your bank’s first impression is that you must be doing something wrong. With this unsubstantiated impression, the bank will close your account and ask you to leave.

The founders of Zeek Rewards soon overcame this challenge and built a billion dollar enterprise. This was just the beginning of what Paul Burks, the owner of Rex Venture Group and the promoter of Zeek Rewards and the Zeekler Penny Auction site, was up against.

This sounds like fiction, but in fact, it was the blueprint in 2012 that caused more than 2 million people in many countries to unite and question the motives of the US Government.

Little did anyone know that the people who came together were lawyers, doctors, lawmakers (Federal, local and state), teachers, and everyday people just looking for a way to earn their way into the American Dream.

In 2012, if the present Administration wanted to build a successful stimulus program, it should have used Zeek Rewards as a guide. This pioneering venture went from zero to one billion dollars in just 12 months, paid over 400 million dollars to more than 20,000 people earning an average of $20,000, created 10 people who made over one million dollars, and caused several thousand people to earn incomes in excess of one hundred thousand dollars.

This unparalleled example would have been a phenomenal feat for our US Government during a period when our very financial existence was threatened.

When the US Government closed Zeek Rewards, the Company had over 600 million dollars in the bank ready to pay out to the people who helped the Program grow!

The following question is addressed in this book: Why would the US Government want to shut down the American spirit, innovation, self- reliance and global trade? We will discuss in depth this question and more.

The Zeek Phenomenon is a must read book for all entrepreneurs, attorneys, ordinary people, government officials and those who seek the American Dream!!!

Speechless. I am left absolutely speechless.

When the SEC shut down Zeek Rewards, it was revealed that during the course of its operation (2011 to 2012), the company did indeed take in around 600 million.

This is not however the amount Zeek had in the bank when they were shut down.

Upon being shutdown, the SEC revealed that Zeek held

approximately $225 million in investor funds in approximately 15 foreign and domestic financial institutions, and those funds are at risk of imminent dissipation and depletion.

Around $3 billion in monopoly money points had been accumulated by Zeek Rewards affiliates. At a value of $1 being equal to 1 point, it was thus calculated that Zeek would have had to pay out $45 million a day to meet its obligations.

With $225 million in the bank, without Ponzi points monopoly money re-investment, Zeek would have gone bust in around 5 days. Well short of the required 90 day ROI maturity period.

By July 2012, a month before Zeek was shut down, the company was bringing in $5 million a day. The balance it owed to affiliate investors however continued to increase at an alarming rate.

ZeekRewards’ current investor payouts are approaching, and may soon exceed, total incoming revenue. In July 2012, total revenue for ZeekRewards was approximately $162 million, while total investor cash pay-outs were approximately $160 million.

Had the SEC not have moved to shut down the company, in a few months Zeek would have collapsed under the weight of its financial obligations in any event.

But what’s more important than all of that is the fact that Zeek Rewards was a Ponzi scheme.

Owner Paul Burks sat in a room and each day decided how much newly invested funds he was going to pay out to existing investors.

Burks himself hasn’t been charged yet, but his right-hand woman Dawn Wright-Olivares plead guilty to fraud late last year.

The two counts Wright-Olivares plead guilty to (securities and wire and tax fraud conspiracy), come with $250,000 fines and up to five years imprisonment respectively.

And in addition to that, both Burks and Wright-Olivares only a few months ago consented to a judgement of $600 million to be paid to the Zeek Rewards Receivership.

This money will eventually be used to pay out Zeek Rewards’ investor victims. The first batch of checks were sent out to Zeek Rewards victims just a week ago.

This is the reality and facts behind the shutdown of one of the biggest MLM Ponzi schemes of all time currently playing out in US courts.

And then of course there’s Robert Craddock’s alternative “American Dream” take on it all.

Good grief.

It’s like the scriptwriters for the X-Files met with the writers of the Twilight Zone and together they came up with the concept for The Zeek Phenomenon.

Wow..

Think I will wait for the Bantam paperback edition.

Ebon Research Publishing? Wasn’t that the firm that ACTUALLY holds the Zeek trademark? That PPBlog said they replied “we don’t know who’s RVG”?

Something’s fishy. Either there’s a real link between Ebon and RVG/Burks besides a licensed trademark, or Craddock’s much deeper than a mere consultant.

BUT , why is craddock selling on amazon ?

he could have started a new ‘book MLM’ .

then he could write ANOTHER book about the highest ever selling book –zero to 1 billion sales in one year !

Must have been skipping his meds and/or smoking that real good stuff.

It he had named it: “The Bleak Phenomenon: The Great Big Money Shuffle That Failed”… I’d take him a bit more seriously.

This is more money than even the government says passed through Zeek. Government estimates in December 2013 put the sum between $850 million and $897 million. (The Bill of Information against Wright-Olivares and Olivares filed Dec. 20, 2013, suggests that $897 million could have passed through Zeek.)

If Craddock is correct Zeek gathered $1 billion, there could be a discrepancy of at least $103 million between what Craddock says and what the government says. That’s no small discrepancy and conceivably could prompt agents to do some checking.

SEC filings, meanwhile, say Zeek operated from “approximately January 2011” to August 2012. That’s not 12 months.

If Zeek operated between Jan. 1, 2011, and Aug. 17, 2012, that’s about 595 days — or one year, 7 months and 17 days.

So, nearly 20 months — not the 20 Craddock cites.

NOLINK://http://www.timeanddate.com/date/durationresult.html?m1=01&d1=01&y1=2011&m2=08&d2=17&y2=2012&ti=on

If a discrepancy of $103 million exists, that’s almost as much as the $119 million AdSurfDaily, another “revenue-sharing” scheme, took in. It’s also roughly in the same ballpark as the alleged hauls of Zhunrize ($105 million) and eAdGear ($129 million).

It would be interesting to know the basis on Craddock’s claim that Zeek took in $1 billion in 12 months.

Because this is MLM La-La Land, maybe it’s just marketing theatrics for the book — or, as the MLMers might say, “mere puffery.”

PPBlog

The trademark was held by Ebon Research Systems LLC.

Actually, the PP Blog reported that Ebon Research Systems said it “certainly” knew of Zeek, but had “no knowledge” of any trademark or copyright complaint filed at HubPages against you.

See PP Blog story July 28, 2012.

Craddock, on July 22, 2012, appears to have implied Rex Venture Group (Zeek) gave him the authority to bring the “Copyright, Trademark infringement” complaint against you at HubPages on behalf of Rex Venture/Zeek.

I don’t happen to believe you engaged in either copyright or trademark infringement. The bigger question, though, is why Ebon Research wasn’t identified in the complaint to Hubpages as the owner of the trademarks and how Craddock somehow acquired the authority to complain on behalf of Zeek when the trademark was held by Ebon Research.

And although Craddock identified himself as a Rex “consultant” in his communications to you, Zeek submitted a roster of such individuals to the court on Sept. 17, 2012. Craddock’s name was not on it.

From the files website of the ASD Updates Blog:

https://docs.google.com/viewer?a=v&pid=sites&srcid=YXNkdXBkYXRlcy5jb218ZmlsZXMtd2Vic2l0ZXxneDo0NGU4N2EyZjU1OTcyNDZh

You’ll recall, of course, that both you and I picked up a stalker with an IP from the region of Columbus, Ohio, after the SEC brought the Zeek action. During that same period, I was also being menaced by someone backing the JSSTripler/JustBeenPaid “program,” which had promoters in common with Zeek.

Intimidation tactics. Wild conspiracy theories. Antigovernment screeds. They’re all part of efforts to chill reporting on scams and therefore to chill speech. The truly amazing thing is that some of these folks purport to be great supporters of the Constitution.

Oz has experienced it. You have experienced it. I have experienced it. Eagle Research has experienced it. Individual posters at the PP Blog who have been stalked have experienced it.

PPBlog

LOL, just when you think you’ve seen it all.

Maybe Craddock is trying to position himself as an Alex Jones type.

From the claim on Amazon.com:

This is just horseshit. This is no evidence at all that 2 million people “united.” It may be possible that there were 2 million user IDs at Zeek, no doubt because a large number of Zeekers had more than one user ID.

Eary reports did suggest that Zeek affected 2 million people. But that’s because it was still early and the SEC and receiver weren’t yet fully acquainted with the internal mechanics.

Zeek appears to have had on the order of 1 million participants, possibly fewer. But even those folks didn’t “unite” en masse.

A relatively small group “united” around the ZTeamBiz crew, but it became clear quickly that not all members of the group had equivalent interests. Some victims could have ended up funding what in effect were precursor pleadings designed to derail the receiver’s plan to file clawback actions.

So, the victims might have funded an effort to insulate some of the key pitchmen. This had the stench of AdSurfDaily all over it, given the fact that Andy Bowdoin had solicited his victims to fund his criminal defense and given the fact that some of the leading Zeek winners also had been associated with ASD.

PPBlog

Our shady friend Craddock is now pimping another questionable MLM called Changes Worldwide that sells investments in something called a Business Promo Pack under the “shady tree” of selling vitamins and weight loss supplements.

Their website went dark last week.

As they always do.

this SEC form D ‘Notice of Exempt Offering of Securities’ was filed 4 months back on 19-05-2014, by changes worldwide LLC .

it names timothy baggett as the owner and craddock as executive officer

sec.gov/Archives/edgar/data/1606118/000160611814000002/xslFormDX01/primary_doc.xml

about form D of the SEC:

can anyone familiar with the system make sense of this ? whats changes worldwide upto?

4 months ago they’re filing form D ‘s and now kaput?

This book is a perfect example of rolling a turd in sugar and selling it as a doughnut.

The SEC filing is great but Changes Worldwide is/was not selling stock. They are/were promoting a Business Promo Pack (BPP) that was claimed by the owner Tim Baggett to be tied to sales of products like travel and nutritional supplements (can you scream REV SHARE).

Changes was promising returns of 15-18% PER MONTH from sales of these products, but the products were junk and i don’t believe most people ever got paid anything.

I personally know a person who “invested” nearly $50,000 in this arrangement but after four months, has never been paid a dime. Also, Baggett has boasted of many trips to China in recent months by himself and key leaders.. there are tons of Facebook pics of these trips on the Changes FB page and “Master agent” Rob Skinners FB page.

Arent MLM companies illegal in China?

Thanks, PPBlog.

My question mainly was like “wait, RVG’s dead. Burks is in hiding. So why’s Ebon still involved in this mess? How is Craddock waving around Ebon’s name, since he’s not supposed to be a stakeholder”?

Oz, PPBlog, Eagle, and I should co-write a book on “Zeek hunt: How Google search and resolute amateurs busted the most popular Ponzi in US history”

From the claim on Amazon.com:

The ASDers said the same thing in 2008, when George W. Bush was still in office. ASD’s Andy Bowdoin and some of his minions still were saying it in 2011, when he was pitching OneX, which used an image of a bomb in its logo.

I’m wondering if Craddock even can bear to mention Barack Obama’s name, given that he’s described as “the present Administration.”

The U.S. government did not seek to shut down “the American spirit.” Nor did it seek to shut down “innovation, self- reliance and global trade.”

This is the same sort of pandering in which TelexFree figure Carlos Costa engaged in Brazil.

On a side note, money from both Zeek and ASD appears to have been infused in the political process in the form of campaign donations.

The disconnect is stunning. It’s also sad, scary and dangerous.

PPBlog

I got a feeling that this book was written by Craddock as a part of the Caldwell PR blitz hoping to head off investigations and such back in 2012. After Zeek was pit-roasted, he tried to “pivot” the book to push his other enterprises.

A “book” like this and lot of what these folks say and do would be hilarious if it wasn’t for the damage their activities cause to others.

I’ve noticed that the waste of skin types pushing these schemes often seem to target … or are part of … the folks who are suspicious of “big gubmint” and who hold a variety of pseudo-libertarian beliefs … who of course are also the folks most likely to buy a nonsensical “it’s gubmint’s fault (the scheme) collapsed”, yadda, yadda, yadda, malarkey line.

And of course the religious folks whose ability to have faith in the unseen can sometimes be manipulated to have “faith” in the scheme promoter and/or “God wants you to be rich” line long after other folks might have called it quits … or never become involved in the first place.

The book I’d like to see about Zeek … or these schemes in general … would be by someone who has interviewed a number of participants concerning their general beliefs and identified any common themes amongst these that ethically impaired scheme promoters can exploit.

And the percentage of participants who are well aware that they’re getting involved in a phony doomed to collapse scheme and are simply hoping to make some cash before the collapse and not caring who, other than themselves, is hurt in the process.

The one thing I still wonder about with folks like Craddock is whether some actually buy their own line of BS, as opposed to just using the BS because they know it plays well with their target group of suckers.

“American Dream”, lol.

When did “American Dream” become something to be achieved by defrauding others and feeling okay about it?

Funny you should mention that. Have I ever shown you UFO-MLM, i.e. the MLM for conspiracy-theorists?

NOLINK://www.youtube.com/watch?v=q5ej1BbQX_0

You’ll be ROFL

doublethink: To tell deliberate lies while genuinely believing in them, to forget any fact that has become inconvenient, and then when it becomes necessary again, to draw it back from oblivion for just so long as it is needed. — George Orwell, 1984

Changes Worldwide is now Changestrading.com and they say they are not going to honer any BPP investments unless you have been active and on autoship and recruited 2 in the last 60 days with an autoship.

They’ll probably try some chapter 11 shenanigans like others we know to get out of paying their returns as stated.

IF the SEC is not looking at these crooks now they should.

And let’s not forget that Robert Craddock tried to trademark the word “Scam”.

Of course, they told him to go pound sand….

The original price was $24.99

lookupbyisbn.com/Lookup/Book/0915960036/978-0915960033/1

They told him to hire a professional copyright lawyer next time, after they had vasted several hours trying to correct his copyright application. I actually read most of those corrections when it was posted on PPblog (the link to the copyright application with corrections).

See this screen shot from court filings:

http://patrickpretty.com/wp-content/uploads/2014/06/FaithSloanCheck.jpg

Craddock is the purported copyright agent for Changes Worldwide. The SEC alleged in June 2014 that Sloan sent nearly $15,000 to Changes Worldwide after her assets were frozen in the TelexFree case.

It later developed that BehindMLM.com got a DMCA takedown notice from Sloan that used the email address of a “program” known as “Diamond Holiday Feeder” that appears to have collapsed in 2010.

PPBlog

oh if Faith Slone bought into Changes World wide it must be legit!

The sick joke is the attacks this website makes on Robert Craddock. He is a strong fighter for the victims of Zeek Rewards. He has every right to write a book about it.

Stop attacking Craddock and start attacking Bell about how he is spending our zeek money for this receivership he is making a profit for.

Thank you, I needed a good laugh this morning.

I would just like to say thank you to the folks who run this website and to those who contribute on a regular basis. Zeek was my first time getting into a scam and my last. I ignored a lot of red flags in Zeek because of the easy money.

I have a couple of questions. Is is possible that the receiver or someone else could go after some of these affiliates personally? I have seen a handful of Zeek affiliates who are holding out paying back any money go from scam to scam drawing more people in along the way.

While they may eventually have to pay back some from what they made in Zeek, some of them have already moved on to 2,3,4 other scams. It seems to me that some of these folks need to be stopped personally in addition to the scam being shut down.

Another question I got on the legal front is can the receiver place a lien on the assets of affiliates who owe? I get that some of these people are settling, but it seems to me that they should be placing liens on assets or maybe freezing accounts.

I don’t know if the receiver has the legal authority to do any of these things or if they plan to later on down the road.

The last thing I wonder about is if you guys have done anything on Matt Lloyd’s My Online Business Empire (MOBE). And no I am not getting into it at all. But I was speaking with one of their affiliates or what they are called and for a long time I could for the life of me figure out what he was peddling.

Then when I started figuring it out, I started asking him questions to which he told me I had it all wrong and blocked me from his Facebook page. This seems like a clear scam to me but wondered if you guys have done anything on it.

Thanks again. Keep up the good work. Keep exposing these scams. I know there are too many to keep up with. More people need to know about your website.

Jeff Steawrt says:

While he has the legal right to publish books here in the USA, Craddock and his supporters have no right to whine when others point out the falsehoods me makes.

This “Strong Fighter” also tried to use the DMCA to silence critics.

Hypocrisy much ?

Jeff continues-

Well, if Craddock can manage to stick to the basic facts, then the hard critical comments would be greatly reduced, or stop altogether.

Don’t cry too much of Craddock’s troubles- he invested much time and energy and other’s people’s money into making them.

In the passing, it is good that his assertion that a Ponzi scheme / Fraud would be a good template for running a nation’s economy is held up to the light of day and exposed as the terrible notion that it is.

You mean he’s a strong believer of taking your money, spend a little on hiring a lawyer to sit in on some meetings, and allegedly spent the rest fixing up his private airplane.

Jeff:

So let me get this straight. Robert was fighting for the members of Zeek, right? So please list all the legal filings he made on behalf of the Zeek members against the evil SEC closing down Zeek Rewards.

You know the money he collected from the Zeek members to do exactly that. You can list them, right?

While you are at it, please list all the accomplishments of Robert on behalf of the Zeek members that he worked so hard for, according to you. I mean you can name them, right?

While you are at it you might want to ask Robert about his “chat” with the SEC and how that went for him. I’m sure the SEC was impressed with his being able to prove that Zeek was a real business.

Oh wait, he came back with his tail between his legs praying they wouldn’t sue the pants off him.

I’m sure looking forward to your listing all the legal filings and accomplishments for the Zeek members Robert performed.

If Robert’s numbers are correct, then he was an “insider” and more involved with Zeek than he has let on to the members.

Only someone who was an “insider” would know the real numbers of Zeek. So much for Robert claiming he was just a consultant to shut up people exposing Zeek as a Ponzi.

He was indirectly fighting for the top net winners, e.g. the Fun Club USA filings against the subpoenas. But that was all, the rest was just empty talk.

If he was part of a group, e.g. along with “Kettner, Kettner, Sorrells” and “Gilmond, King”, they may have agreed to use different strategies to fill a wider range of strategies.

* one focusing primarily on the subpoenas

* one focusing primarily on “dissolvment of receivership”

* one focusing primarily on “unfreeze frozen e-wallets”

Fun Club USA at the bottom of the page:

NOLINK://sites.google.com/a/asdupdates.com/files-website/zeek-rewards-sec-case

changes worldwide has now shifted to; changestrading.com

apparently they will be trading futures in the commodity market using ‘robotic traders’ in true sci-fi manner 🙂

naturally , it will be a pure investment ponzi scheme,nevertheless braggert and craddock , are trying to give it legitimacy [SEC filing in post #12].

Wait a minute… Where is the information published that Changes Worldwide is becoming a public company? I would love to know who made the decision to do that one… have any of the “leaders” at Changes Worldwide like Tim Bagget, Robert Craddock and the rest of the cronies ever heard of Sarbanes–Oxley?

i cant wait to see their financial disclosures..

lets see….. highly questionable rev share, YEP, we got that. promises of returns that are unsustainable, yep we got those those. Chinese cash we cant provide accounting for.. uh uh that too.

Lets just have Craddock call the SEC… it will all be fine. by the way, does this orange jumpsuit make me look fat?

it was too irresistible to not go searching for this public offering from Changes Worldwide.

here is a link to the sie where they are peddling their “stock”.. i sure hope your followers are smart enough to smell them “rolling a turd in sugar and selling it as a doughnut”.

changeshangout.com/stock/purchase.php

and it appears that Craddock was the author of their disclosure statement see below

Wait a minute… Where is the information published that Changes Worldwide is becoming a public company? —im guru

on the changestrading facebook page :

facebook.com/ChangesTradingSystem

@anjali

if you go to Changes Worldwide facebook page, look at the September 16 postings, where they state that the company is debt free and “fiscally prudent”, and are hawking their stock

then barely two weeks later, they are no longer paying their reps!

how in the world can the CEO of the company make what appear to be completely false and misleading statements about the financial health of the company, and then turn around and state they are becoming a publicly traded company?

there are some major challenges with a company doing that, and im certain that CEO Baggett will face some pretty uncomfortable questions if and when they do go public.. stay tuned, he did name the company Changes for a reason.

sec.gov/Archives/edgar/data/1606118/000160611814000002/xslFormDX01/primary_doc.xml

above is a link to Changes Worldwide SEC filing and guess whose names are on it? Robert Craddock and Tim Baggett.. does anyone see a pattern here?

Now that this company is circling the toilet faster than one of those sugar covered turds they are hawking, i wonder if Craddock has started his new book:

“How Changes Worldwide made off with all of the reps commissions, but it was actually a government conspiracy…”

A best seller for sure.

i’m not a finance expert , but raising money through an IPO may be a smart way to collect funds and run .

1]from wiki : . A company selling shares is never required to repay the capital to its public investors. After the IPO, when shares trade freely in the open market, money passes between public investors.

2]from craddock’s disclosure : All of the shares in the proposed offering are to be sold by Changes Worldwide Inc.[ gnerally shares are sold to institutional investors who in turn sell to the public. in this case , its obvious NO institutional investor will buy changesworldwide shares]

3]from craddocks disclosure : Changes Worldwide Inc. is a MLM company focusing on the sale and distribution of futures trading software design to help and assist the novice in engaging in the futures trading market. [this ‘software’ is being sold at 2995$ a pop —- i have a feeling buyers may receive some ‘shares’ of changesworldwide along with the ‘software’]

i wonder WHO is underwrting this IPO . chase bank is the tie up for making payments against share purchases. i wonder if they are the underwriters.

ChaseBank:

BankAddress: 4136 US, Hwy 98 N, Lakeland Florida 33809

The ChaseBank local account for assistance if needed is:

(863) 853-9484

changeshangout.com/CWW-Wire-Instructions.pdf

What happen to the guaranteed monthly return rev share??? I was pitched this as a new improved legal Zeek

Why are they changing names and domains??? It is like I2G casino deal changing to G1E

Can these money games be stopped?!?!?

I don’t think that will be legal. Shares are financial products (regulated by laws), and software is a commercial product. They can’t bundle those two product types together as an MLM “product package”.

It’s de riguer in the world of HYIP ponzi fraud and pyramid/endless chain recruiting schemes to announce it / they intend to become a listed company.

It never happens, but it sure as hell impresses those unfamiliar with what it takes to actually become a listed company

I mean, what’s another lie or two among friends when it was nothing but smoke and mirrors from its’ inception ??

to hold an IPO changes worldwide will have to go thru the following process:

1 required registration of the sale of the shares in an IPO;

2 mandatory disclosure of business and financial information in a prospectus;

3 SEC review of such disclosure;

4 prohibitions on misrepresentations and fraud; and

5 civil liability and SEC enforcement for violations

from post#37 we can surmise that step 1 and 2 has already been initiated by changes worldwide.

step 3 , is where it shall all come unglued !

thanks for letting us watch , changes worldwide or changes trading or just changing .

on second thoughts is it really too difficult to get listed and stay listed ? how can DUBLI be explained? maybe the SEC outsources some due diligence 🙂

Welcome to the blog, Captain Obvious

Not really. PeopleString, one of those paid social networks that was going to make Facebook irrelevant, traded on the OTCBB just like Dubli does.

Unlike behemoths such as Herbalife which actually had the clout to get listed on a real exchange like the NYSE, little scams like PeopleString and anything that Craddock might be doing will most likely shoot for an OTCBB listing.

Companies there still have to file certain documents with the SEC, but the vetting is nowhere near as rigorous to get listed.

SEC filings create a paper trail “for the record,” for enforcement purposes, but the SEC doesn’t really vet for investment quality or suitability. That determination must be made by the investor himself.

Once a security is “registered” it can legally be sold/traded but Dubli is a penny, pink sheet over the counter stock which assuredly is ineligible for listing on the NYSE.

That Changes Worldwide Inc. claims to be shooting for NYSE listing is a testament to major cow pasture activity or an absurdly high expectation of product success.

There are like 500 exchanges worldwide so if a company is willing to pay a listing fee then they can almost certainly be “listed” somewhere.

@ chris, hoss

well, that explains EVERYTHING. thanks.

changes worldwide has filed SEC form D ‘Notice of Exempt Offering of Securities’ . this further means:

1. Any company that wants to offer or sell securities to the public must either 1] register with the SEC, OR , 2] meet an exemption

2. Some smaller companies offer and sell securities WITHOUT registering the transaction, under an exemption known as Regulation D [form D]

3. Form D is a brief notice that includes the names and addresses of owners and stock promoters, but ‘little other information about the company’.

5.Unless they otherwise file reports with the SEC, companies that are exempt from registration under Reg D, DO NOT have to file reports with the SEC.

this is beautiful , if you have a name and address, you could float your own little IPO !

well , i hope its become obvious to you captain blockhead, that companies CAN get listed real easy peasy.

and why not ? SEC and FINRA are standing by to HELP them !

With respect to Forms D: They’ve been used in MLM/direct-sales style pyramid schemes.

See SEC v. Fleet Mutual Wealth, announced as an emergency enforcement action on March 5, 2014:

http://www.sec.gov/News/PressRelease/Detail/PressRelease/1370540883619#.VDamFBawRWw

With respect to “reverse mergers”: See this for some background on microcap fraud and how reverse mergers and shell companies may be used in such schemes:

http://www.sec.gov/News/PressRelease/Detail/PressRelease/1365171489086#.VDanbBawRWw

PPBlog

I want hear five good reason’s why people should not trust Robert Craddock?

anjali: this is beautiful , if you have a name and address, you could float your own little IPO !

Sure you can. Keep in mind though that this exemption is permitted in part because the securities can only be sold to “accredited” and “sophisticated” investors.

Its not much of an impediment really but the law is on the books and that might partly explain why Craddock said the stock would be pedaled to “institutional investors” for starters, and of course any affiliate who is willing to buy a Trading Program must consider themselves “sophisticated” in some sense. In any event it appears they are playing the angles.

Seemingly there is no law against an MLM affiliate buying a trading program, urging others to do likewise and in a separate transaction, purchasing stock in a company they think has a bright future.

You’re doing it backwards. You should have started from a neutral position (neither trust or distrust). THEN you ask why should you trust Craddock.

If you want us to tell you why you should NOT trust Craddock, you are starting from a biased position. Are you sure you want to hear the truth? Or are you just going to filter them out as gossip?

Perhaps you can do some of your own research. Here’s some suggested topics.

* What was Craddock doing before Zeek?

* How did Craddock get involved with Zeek? In what role?

* What is ZTeamBiz and its relationship to Craddock?

* What claims did Craddock make right after Zeek got shut down?

* How much money did Craddock raise for his alleged attempt to “defend” other Zeek “victims”?

* How many lawfirms/lawyers turned him down for that?

* How much of the money raised did Craddock really spend? Did he produce any results? Where may the rest of it went?

* Is Craddock a net winner or a net loser from Zeek?

* How many other ventures did Craddock went onto join (or recruited for) since Zeek? Did he recruit any Zeek victims for those?

* And did he really tried to trademark the word scam… and why?

How about 120,000 of them.

How about 1 good reason, If you spend 30 seconds talking to him that reason enough. With his slimy little smile that is covering the teeth he is lying thru. Its a total tell.

1,

Zeek Rewards was an obvious ponzi scheme. It’s been proven by looking at the business model and by examining the records. The insiders have even admitted to fraud.

While Zeek was active, Robert Craddock threatened anyone who was critical of Zeek and even got a critics blog taken down temporarily, while claiming that anyone else who pointed out Zeek being a fraud might be sued.

2,

After the government moved in and seized everything, he solicited money from Zeek investors claiming that he could help protect them and save Zeek. He talked a lot of talk and wasted money in court costs for no effect. MONTHS LATER, nothing has happened. Zeek was never coming back and he knew this the whole time.

3,

Every dollar he solicited from people who already lost a ton of money went right into his pocket, and rumor has it, to fixing up his personal airplane. He robbed people who had already been robbed and NEVER PAID ANYONE BACK.

4,

He has never issued a public apology to anyone he’s threatened or stolen money from. He’s constantly criticized the receivership (the people who can actually help Zeek victims) the entire time while trying in anyway he could to make money off any of the Zeek victims who would still listen to him. He only shut up after the receivership made him.

5,

He wrote a book that completely ignores what a catastrophic failure and fraud Zeek was. He claims that the government decided to pick on Zeek and shut it down just because they’re a bunch of big meanies and they don’t want anyone to have fun. Completely ignoring the fact that if the government didn’t step in, there wouldn’t be any money left to pay out to victims at all.

That’s five reasons, but you only really needed one. Just think of how you’d feel in your gut if you did any of these things to people. Then you’ll know if you should trust someone who’s actually done all of these things.

1. Is it TRUE what he writes, or is it mostly UNTRUE?

That’s the only reason you will need. I’m not talking about details, e.g. some exaggerations. I’m talking about the heart of the story.

I believe most of the insiders have settled the civil claims from the Receiver. Paul Burks, Dawn Wright-Olivares, Dawn’s stepson, Darryle Douglas, Roger Plyler’s Estate, etc. (I don’t remember all the names).

I’m talking about the book here. I have no idea about whether you can trust him in other areas.

Jeff: I thought you would have been back here providing the lists that I asked you to produce in a heartbeat, but yet silence from you. You can provide the lists I asked you do provide, right? So why the silence?

You see if you can’t provide the lists, your silly give me 5 reasons why people should not trust Robert is your answer.

But here are two freebies for you: He is a liar and a crook. There is no need for three more.

For intelligent people…

ONE good reason not to trust someone is enough!

Guys, guys, let Jeff think for himself for a moment.

If you keep slamming Craddock you may give Jeff the backfire effect. (No telling how deep is Jeff in already though)

Jeff, you said that Craddock really fought the the Zeek victims. I ask you these three questions. Not as an “opponent”, but as an observer:

What had Craddock REALLY done? (with the money raised) and did it do ANYTHING the receiver had not done?

Why did Craddock make various announcement post Zeek shutdown claiming SEC malfeasance / mistake / cover-up and so on? Was he lying? Blowing smoke? Smoked something really good? What?

What was his gameplan since Zeek closure? What had he done? How did his various “ventures” fared?

Answer these questions for yourself by doing your own research, not by asking Craddock or his associates, but not by looking at the critics either.

I think you will see a pattern… as for what that pattern means, I leave it up to you. I’m not going to prejudice you on what you “should” see.

forewarning to craddock : troubles ahead , troubles gonna find you :

craddock needs to be smarter than mutual wealth, if he wants jeff stewart to write him a new check.

Looks like there’s a new Zeek: It’s called “BIDCASH”.

They took advantage of taking an existing (but on the downfall) company called “Mukirana” (a penni auction), and made a Ponzi Scheme claiming to be using “Mukirana” services.

Affiliates will get ROI no matter if they make sales or not.

Mukirana is based in Brazil, but the MLM (Ponzi), “Bidcash”, side of the company will be run in Uruguai, to avoid governament suspensions.

I know the Compensation plan is in Portuguese, maybe it’ll be hard to make an article about it…

If it’s a Ponzi points model and only available in Portuguese I’ll avoid reviewing it for now.

Did you all see the post on PP blog?

“Zeek Rewards figure Robert Craddock has been accused in a private lawsuit filed in Nevada federal court of trademark infringement and using a “shell corporation” to engage in a “shake-down” bid against affiliates of at least three MLM networks: Zeek, OfferHubb and BTG180.”

Slime factor increase…

I’m in the process of putting an article together which will be up shortly. In order to avoid confusion hold off commenting till then.

And we’re live – https://behindmlm.com/companies/robert-craddocks-sordid-post-zeek-rewards-conduct/