Win On Wealth founders indicted, sued by SEC

Trong Hoang Luu and Linh Thuy Le, Win On Wealth’s husband-and-wife co-founders, have been indicted.

Trong Hoang Luu and Linh Thuy Le, Win On Wealth’s husband-and-wife co-founders, have been indicted.

The pair, who are based out of California, have also been sued by the SEC on civil fraud charges.

Win On Wealth, or “WoW”, was an MLM Ponzi scheme launched in 2022. Le was Win On Wealth’s CEO and husband Luu was CFO.

Win On Wealth, or “WoW”, was an MLM Ponzi scheme launched in 2022. Le was Win On Wealth’s CEO and husband Luu was CFO.

Win On Wealth was part of Inventis Ventures, through which Luu and Le targeted Vietnamese and Latino communities across the US.

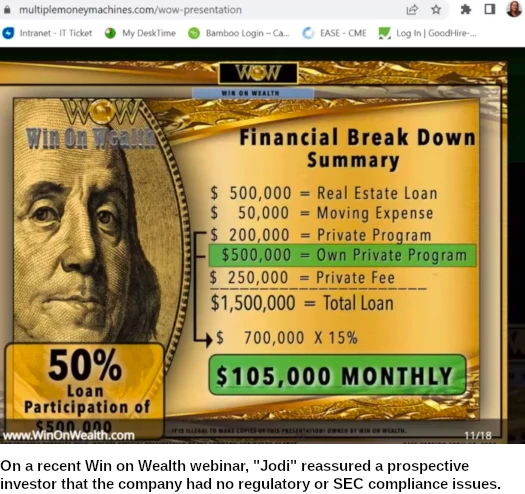

Through fraudulently obtained business loans, which Win On Wealth helped investors obtain, consumers were pitched on 15% a month.

After drawing in “at least 1400” investors, Win On Wealth stopped paying out in September 2023. BehindMLM called Win On Wealth’s collapse in December 2023.

The SEC has pegged victim losses at “at least $26.5 million”.

$16.5 million was paid out as Ponzi returns and $1.5 million funded Win On Wealth’s MLM compensation plan. Luu and Le misappropriated the rest.

Luu and Le were indicted by a Grand Jury on September 17th, 2025. The pair have been charged with sixteen counts of wire fraud and two counts of money laundering.

The SEC filed suit on October 15th, additionally charging Luu and Le with securities fraud.

The ruse behind Win On Wealth’s 15% a month return was investment in “emerging projects”. Specifically, Win On Wealth was a marketing funnel feeding Inventis (the investment side of the scam).

From the SEC’s Complaint, Le gave

different investors inconsistent descriptions of the use of funds and source of returns, varying from “real estate” and “health insurance investments” to claims that she had access to an unnamed bank that provided 40% returns.

She falsely told many investors that the investments were “guaranteed,” “safe,” or “insured.”

Rather than use investor money to engage in legitimate business activity, Le and Luu misappropriated the funds, spending investor monies for their personal benefit, paying referral fees, and making Ponzi-like distribution payments to earlier investors in an attempt to keep their scheme going.

On the money side of things;

Individual investments generally ranged from $5,000 to $300,000.

Many investors were later solicited to make additional investments or to rollover their purported earnings from prior investments into new investments.

On or around November 27, 2023, Investor C met with Le in the Tustin office. During the meeting, Le told Investor C that if Investor C invested … Inventis would use their funds in health insurance investments with the government.

She also told Investor C that she received 25% returns from these investments, which enabled her to pay the 15% returns. She told Investor C, “Trust me”, “all will be okay,” and “this is not a scam.”

Being a Ponzi scheme, Win On Wealth was of course a scam – one that primarily benefited its creators.

With respect to investor funds being used for Le and Luu’s personal benefit, bank records show that Luu transferred approximately $4.7 million to entities controlled by Le and Luu, approximately $1 million net to their personal accounts, and more than $880,000 net to purchase real estate and pay mortgages.

Employees also reported that, during the period when the Inventis scheme was underway, Le catered monthly parties at restaurants and described travel to Dubai with Luu where she posted photos of limousines, luxury meals, and paintings that she had purchased, which she claimed were worth more than $20,000.

Le spent $12,000 on “tour fares” in October 2023.

In the months leading up to Win On Wealth’s late 2023 collapse, Le and Luu escalated their pillaging of investor funds.

On October 20, 2023, a wire transfer was made that moved $679,913.28 from an Inventis account to an account Le and Luu controlled in the name of TBD Miracles Production (“TBD”).

On November 16, 2023, another $350,000 moved from Inventis to TBD.

Over the course of December 2023 and January 2024, over $1,000,000 of these funds were moved to other accounts controlled by Le and Luu, including to Wow Construction ($500,000) and the Luu Le Family Trust (approximately $300,000).

The DOJ calims Le and Luu misappropriated “approximately $7.4 million”.

Forfeiture of ill-gotten gains is part of Le’s and Luu’s indictment. Similarly, the SEC is seeking a disgorgement order.

Worse still, Le and Luu shamelessly continued to sign up new investors are Win On Wealth’s collapse.

Even though Inventis was no longer making regular distributions, Le and Luu directed employees to continue to sign investors up to new contracts.

For example, Le met with an investor in her home on or about November 1, 2023, where she promised the investor monthly returns and encouraged him to invest $200,000.

According to bank records, Inventis received over 130 additional investments from September 2023 to November 2023, raising almost $4.4 million.

Le and Inventis employees, at Le’s direction, made false and misleading statements to investors and engaged in other deceptive acts to lull investors into thinking they would recoup their funds.

For example, Le and Inventis employees, at Le’s direction, told investors that “bank audits” and “banking compliance issues” caused Inventis to cease payments and restructure, and that with additional time Inventis would resume the program and pay people back.

Eventually Le and Luu began funelling Win On Wealth victims into other scams.

First, beginning in or around November 2023, Le directed investors to open and fund an account at Apex Bank, a purported “sovereign bank,” to recover their funds.

The Georgia Department of Banking and Finance had already issued an order in September 2023 mandating that Apex Bank cease and desist conducting business as a bank because it had never been registered as a bank.

Next, when a group of investors met Le and Luu at their home, both Le and Luu told those investors that, in order for them to receive the funds they were promised under the Inventis scheme, those investors had to open and fund accounts with Trage Technologies, Ltd. (“Trage”), a digital asset scheme.

Luu told an investor that the investor would only receive the promised Inventis payments to the Trage account if the investor did not withdraw funds from that account.

TrageTech was an MLM crypto Ponzi fronted by UK national Daniel Poole. Following fraud warnings from regulators in Texas, California and Georgia, TrageTech collapsed in late 2024.

At another point, Inventis advertised a different digital asset scheme involving “USDT,” a stable coin, that would purportedly provide 36% returns.

Le also told employees that she was immune from prosecution, and threatened that if investors pursued legal action or complained to law enforcement they would not receive their money back.

It’s unclear why Le was running around telling people she had prosecution immunity.

One investor asked why the investment was described in the agreements as a loan, and Le told him that it was “illegal to pay 15% returns.”

Having established Win On Wealth’s passive returns investment scheme was an investment contract, the SEC confirmed neither Win On Wealth, Inventis, Le or Luu were registered to offer securities in the US.

The offering of Inventis securities was not registered with the SEC and did not qualify for any exemption from registration.

Le and Inventis offered and sold the securities through interstate commerce to investors in multiple states.

Inventis did not provide, and investors had no access to, audited financial statements or other information that registration would have required.

The SEC’s case is active as of October 31st but I’m not sure in what capacity given the current US government shutdown. I expect at some point the DOJ will move for a stay, pending the outcome of Le’s and Luu’s criminal proceedings.

Following their indictment, Le and Luu were arrested and released on bond pending trial – currently scheduled for December 9th, 2025.

Stay tuned for updates as BehindMLM continues to track both the Win On Wealth criminal and civil fraud proceedings.

Update 12th December 2025 – Following filing of a December 2nd stipulation, the Win On Wealth criminal trial has been continued to May 19th, 2026.

Stated reasons for the continuance include appointment of a new defense attorney and voluminous discovery from the DOJ.