Lawyers Barnett & Linn ok’ed WCM777 profit points?

On their website legal firm Barnett & Linn list one of their practice areas as ‘SEC Compliance‘.

William Barnett and Roger Linn have each been representing business clients for over 30 years. Together they bring a wealth of experience and extensive knowledge to achieve efficient and practical solutions to their clients.

Barnett & Linn specialising in SEC compliance and the fact that they are based out of California, are likely the primary reasons WCM777 founder Xu Ming approached the firm for legal consultation.

Turns out Ming himself wasn’t sure if WCM777’s “Profit Points” compensation plan component would be seen as an unregistered security by the SEC.

In addition to offering affiliates a 100 day passive ROI on investments of up to $1999 and recruit commissions for bringing new investors into the scheme, WCM777 also offered affiliates what they called “Profit Points”.

Taken from the BehindMLM WCM777 review:

Profit Points are issued with each membership position purchase, with WCM777 claiming that the points ‘will be turned into stock when WCM goes public on NASDAQ‘.

In addition to points generated on the purchase of membership positions, 20% of all WCM777 affiliate’s earnings are held by the company “to purchase profit points” with.

Despite appearing to have “unregistered security” written all over it (points awarded on the expectation of future profit via the company going public), when approached for legal advice Barnett & Linn thought otherwise.

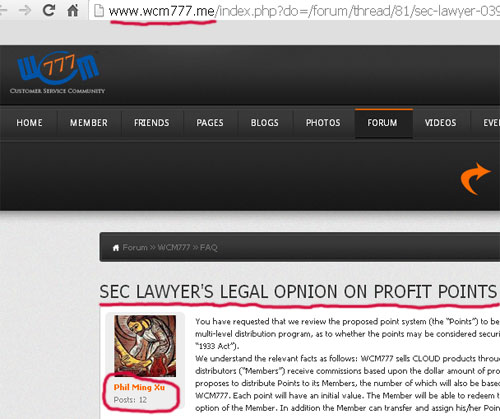

The website WCM777.me was launched in mid 2013 and is registered to Xu Ming of World Capital Market, operating out of an address in Pasadena, California.

The primary function of the WCM777.me website appears to be that of a communication portal, with which affiliates and WCM777 executive management can exchange information amongst themselves.

On the 1st of October an account using the name “Phil Ming Xu” created a new thread on the forum in an attempt to justify WCM777’s compensation plan. Titled ‘SEC LAWYER’S LEGAL OPNION ON PROFIT POINTS’, Ming published what appears to be a letter from Barnett & Linn advising the company that their profit points “do not appear” to ‘fall under the category of a “security”‘, unregistered or otherwise.

Barnett & Linn’s letter opens with their explanation of WCM777’s profit points component of their compensation plan:

You have requested that we review the proposed point system (the “Points”) to be initiated by WCM777 (“WCM777”) in regard to its multi-level distribution program, as to whether the points may be considered securities under the Securities Act of 1933, as amended (the “1933 Act”).

We understand the relevant facts as follows: WCM777 sells CLOUD products through a multi-level distribution network. Its member-distributors (“Members”) receive commissions based upon the dollar amount of products purchased from WCM777.

WCM777 also proposes to distribute Points to its Members, the number of which will also be based upon the dollar amount of products purchased from WCM777. Each point will have an initial value. The Member will be able to redeem the Points for cash or additional products, at the option of the Member.

In addition the Member can transfer and assign his/her Points to another Member.

For the most part this seems accurate. Although WCM777 don’t sell cloud-services, so much as bundle access to them with participation in the company’s 100 day passive investment scheme. The more money an affiliate invests, the more profit points they are allocated (both on the initial deposit and subsequent 20% mandatory ROI conversion into profit points).

Based on the proposed use and distribution of the Points as set forth above, it does not appear that the Points would fall under the category of a “security” as normally defined under the 1933 Act. We then reviewed the attributes of the Points in relationship to an “investment contract”.

An investment contract is defined under the “common enterprise test” under the 1933 Act and in subsequent court cases as (a) an investment of money due to the (b) expectation of profits arising from (c) a common enterprise (d) which depends solely on the efforts of others.

Although the characteristics of “an investment of value” and “a common enterprise” may exist in this situation, the other two prongs of the four prong test are missing and have not been met.

It is unclear how or why these Points, when distributed to the Members, would ever increase in value above their initial value nor is it clear as to whose efforts would cause such an increase in value, if any.

Applying the “common enterprise test” to WCM777’s offering, as presented by Barnett & Linn, would be as follows:

(a) an investment of money

Affiliates invest money with WCM777, with the company accepting dollar amounts ranging from $399 to $1999.

due to the (b) expectation of profits

The notion that affiliates invest in WCM777 with the expectation of profits should be obvious enough. The 100 day passive ROI the company itself advertises is the primary marketing point used by WCM777 affiliates to market the scheme to new investors.

from (c) a common enterprise

As per WCM777’s business model and compensation plan, “common enterprise” as it exists by definition would be the investing and re-investing of money by the company’s affiliates.

(d) which depends solely on the efforts of others.

All investments are made by affiliates, with an affiliate’s own involvement in their ROIs and subsequent profit point shares not extending beyond their initial and ongoing financial contribution to the scheme.

Without additional affiliate investment (from “others”), a WCM777 affiliate cannot be paid a ROI, 20% of which is converted into profit points.

Given this, I’m at a loss to explain Barnett & Linn’s claim that ‘the other two prongs of the four prong test (3 and 4) are missing and have not been met‘.

As for

It is unclear how or why these Points, when distributed to the Members, would ever increase in value above their initial value nor is it clear as to whose efforts would cause such an increase in value, if any.

That much should again be obvious. WCM777 needs a constant influx of newly invested affiliate money to sustain itself. The more new money being injected into the scheme, the higher the perceived value of the company’s profit points.

Given the virtual nature of the points, with all real monies being held by WCM777 in the interim, whether or not the points are pegged to real dollars is irrelevant. Affiliates will most definitely perceive value in the points, based directly on the perception of how healthy the scheme is, which is in turn directly tied into how much newly invested affiliate money is being pumped into the scheme.

Underscoring this is WCM777’s inclusion of the profit points in the company’s compensation plan. An MLM compensation plan is used to explain to affiliates how they generate commissions (income) via participation in the company. This alone attributes an expectation of profit (perceived or otherwise) to WCM777’s profit points. This holds true irrespective of whether or not Barnett & Linn took the time to go over the rest of WCM777’s compensation plan.

In USA, courts have also applied a “risk capital” approach whereby a security can exist if (i) funds are being raised for a business venture (ii) where the funds are raised from the public (iii) in which the investor will have little or no participation in the enterprise and (iv) the investor’s money is substantially at risk because it is inadequately secured.

In this approach it does not appear that any of the factors would be satisfied other than the fact that the Points would be inadequately secured.

None of the above factors would be satisfied bar one? What crack are these guys smoking?

(i) funds are being raised for a business venture

You’re going to argue WCM777 and any subsequent front company they set up as an IPO is not a business venture?

What???

(ii) where the funds are raised from the public

WCM777’s affiliate investors are not from the public?

What???

(iii) in which the investor will have little or no participation in the enterprise

Affiliates invest in WCM777, sit back and do nothing. That’s not “little or no participation”?

What???

The fourth point (which is the only once Barnett & Linn concede applies) is obvious enough. Ponzi ROIs and “profit points” purchased out of Ponzi ROI funds are naturally “substantially at risk because” because they are “inadequately secured”.

Duh.

On what basis Barnett & Linn dismiss the other three points though I have no idea. The firm’s letter to Xu Ming concludes with;

The Points, when issued to a Member, become the sole property of the Member and therefore he/she can do anything with such property that he/she can do with any other property that he/she owns.

This would include assigning and transferring the Points to other Members in return for consideration, if any, agreed to between the selling and buying Members.

We have limited our review to issues of federal securities law and California law only; no review has been made as to the effect of the foregoing proposed transactions on the laws of any other jurisdiction.

This letter is being provided solely for your use and may not be relied on by any other party other than WCM777 for any reason, whatsoever, without our express consent in writing.

Sincerely,BARNETT & LINN

William B. Barnett

The assertion that the points themselves belong to WCM777’s affiliates I have nothing against, other than pointing out that given the entire company is a Ponzi scheme and the money invested is “inadequately secured”, comparing WCM777’s profit points to tangible personal property seems silly.

If WCM777 collapsed or was shut down, whether members can buy, sell or transfer the points becomes a moot point (no pun intended).

Again, whether or not Barnett & Linn took a look at the wider WCM777 compensation plan and business model is unclear, however at best the analysis they provided Xu Ming is paper-thin.

Whether or not Barnett & Linn’s analysis was intended to hold up in court I have no idea but I suspect that if the matter did wind up in court, that the SEC would abolish any arguments made with little to no effort.

Ultimately this is reflected in Ming Xu’s own actions following the publication of Barnett & Linn’s “you’re not selling unregistered securities” letter. Two weeks after Ming published the letter on the WCM777.me website, the company abandoned their US operations.

No official reason has surfaced as to why WCM777 fled the US, however they did state a company policy to “abide by local laws” in the countries they operate in. Ponzi schemes and the selling of unregistered securities are of course illegal in the US.

Despite WCM777 pulling out of the US just over two weeks ago now, it was only today that an affiliate investor of the company attempted to publish Barnett & Linn’s above letter to Ming as supposed proof the company was not operating a global Ponzi scheme.

Whether or not WCM777 can stop its affiliates running around the internet publishing misinformation in defence of the company remains to be seen. They did however issue the following directive to WCM777 affiliates sometime in the last twenty-four hours:

Reorganize Internet Marketing

Posted on October 28, 2013.

WCM777 global legitimacy is to implement new policies and procedures and regulations in accordance with laws of the target countries. WCM777 is headquartered in Hong Kong.

In the transitional period, WCM777 would like to ask affiliates for their cooperation and support on reorganizing Internet marketing:

1. Please remove all WCM777 related videos on all online platforms. As WCM777 is relocating to Hong Kong, some information in the early videos may not accurately reflect WCM777 operations.

The company will create an official video presentation that affiliates can utilize.

2. All promotional websites must follow the company policies and procedures. Content used with WCM777’s logo and trademark may not be used without written consent.

Please take down all unauthorized websites currently up. To protect the legitimacy and long-term development of the company, WCM777 reserves the right to apply penalties to and/or freeze accounts of distributors violating company policies and procedures. Thank you for your cooperation.

Kind of amusing when you consider that WCM777’s own official marketing presentations clearly presented the opportunity as that of a passive investment scheme:

Good luck stuffing that cat back into the bag.

securities fraud ?

pyramid scheme fraud ?

selling unregistered securities ?

common or garden variety fraud ?

wire fraud ?

money laundering ?

Who cares, the end result is the same for the victim/s

ONE legal opinion on ONE aspect of a shady business means nothing to the prudent investor.

I was reading you all for quiet time and this “100% ROI” is not excatly correct. 50% STAYS for the REPURCHASE in the future. and there are some certain rules for repurchase, which includes shopping from 1and300.com

and you were saying wrong things about 100% payback. because some (or many) Leaders misleaded you with wrong information about this plan. it is not an investment, and Points CAN BE USED to buy some shares of the Company. but nobody have to do so, its up to Partners.

There are still plenty of people calling Oriflame, Avon, Herballife and ect. “a pyramide”. If you focus on brown, you see only brown. try to see some other colors here.

Regardless of what they force affiliates to re-invest to trap money in the scheme, investments are made with WCM777 on the premise of an implied >100% ROI.

No. By design most people who invest in Ponzi schemes lose money. Those early investor ROIs have to come from somewhere.

Not an investment but pays out a daily ROI? Riiiiiiiiight…

Not according to WCM777’s own compensation plan material. Regardless, the choice to do so does not make it any less of a Ponzi scheme with an additional dubious virtual share system slapped on top of it.

Cool story bro.

Best case: the company is doing a very poor job of teaching the “leaders”.

Worst case: It’s a scam

Why would you want to join in EITHER case?

Did you check out the Vantone scam in China in 2012? “required shopping to get shares in company”. Vantone US is headed by… Zhi Liu. See a pattern?

If you focus on brown and see other colors, i suggest having your eyes checked.

Guys, it is pointless to continue a dialog with you. Really. Have a good day

Trying to convince the world at large that obvious Ponzi schemes aren’t obvious Ponzi schemes is always going to be pointless.

You’re better off saving your efforts for the gullible investors you’re trying to recruit.

That’s because you have nothing useful to add.

At least you didn’t start making s*** up. Thank you for that.

Since these points appear to be redeemable for cash and transferable member-to-member , I wonder if WCM777 has sought an opinion on whether it is a Money Services Business.

Or, more specifically, a “money transmitter.”

http://www.fincen.gov/financial_institutions/msb/amimsb.html

Beyond that, the ability to transfer money member-to-member sets the stage for all kinds of internal abuses, such as downline stacking and using the company’s in-house system to engage in money-laundering.

For example, Member X actually could be a consortium of any number of unknown members. When Member X gets paid, he or she could be secretly paying the secret members of the consortium. If Member X is using a stolen identity or is a ghost on another sort, it would mean a phantom is paying other phantoms

Little wonder Colombia now is interested in WCM777 — and its interest could go beyond whether WCM777 is a pyramid scheme.

A purported enterprise that provides the ability for members to transfer money or money-equivalents in house with a Member X in the thicket raises serious concerns about money-laundering and whether a new outlet for the Black Market Peso Exchange has been created.

In theory, Member X could be a narcotics trafficker or a money mule, with the downline group being fellow money mules or people involved in the drug-trafficking business.

This became a problem in the David Murcia DMG pyramid scheme, with charges brought both in Colombia and the United States. A Murcia associate helped create “hundreds of subsidiary and affiliated companies linked to DMG in countries including Colombia, Panama, and the United States,” according to the U.S. Feds.

Meanwhile, Robert Hodgins, a tangential figure in the ASD Ponzi-scheme story (as a reputed supplier of debit cards), was indicted in Connecticut amid allegations he set the stage for Colombian narcotics traffickers to launder proceeds at ATMs in Medellin. Hodgins also was keen on laundering money in the Dominican Republic, according to the Feds.

The commonality in any number of these ROI schemes is the ability to transfer money or money-equivalents in-house. Beyond that, there also is an element of the circuitous flow of money.

Look at TelexFree: Some sponsors effectively are advertising that they can gather money from recruits, rather than the recruits sending it directly to TelexFree. It very likely could be a way to game the U.S. banking system while hiding or covering the tracks within the internal systems of TelexFree.

ASDers did the same thing. There is no doubt that members of AdViewGlobal, the ASD reload scam, did the same thing.

In fact, it’s probable that some members got screwed out of remissions because they could not demonstrate they paid any money to ASD. Instead, they paid their upline, who may never have sent the money to ASD, relying instead on ASD’s internal system to transfer a corresponding number of “ad packs.”

PPBlog

can someone from wcm777 explain this is on 1and300.com:

@Thomas

I believe they’re trying to stop affiliates selling their Ponzi ROI money on 1and300. This is likely due to money laundering issues.

eCash, oh dear. Is this going to be a repeat of Liberty Reserve yet? 😉

I dunno what Ming Xu’s thinking. He’s posting crap on Twitter like “join us and be blessed, go against us and be cursed” or something like that.

What’s really funny is he can’t spell Colombia either. 😀

Hey K. Chang will you respond the invitation of a meeting face to face on Nov 2 made by Dr. Phil?

He has always exhibited a rather apocalyptic view of things.

Must have read “Rich Dad Prophecy” by Kiyosaki. ;P

Believe it or not, his Twitter sounds a lot like the prosperity movement — which is surprisingly common amongst some Christians, and, since the mainstream movement of “The Secret”, seems to be getting more traction.

The basic idea is that certain people are entitled to get everything their little heart desires because God has given them the opportunity, and it’s just up to them to seize it. In a ponzi, it’s spun so that regulators (and skeptics who write blogs like this one) are standing in the way of God’s will.

It’s all about faith — which is why you get so many apologists resorting to the argument that you just have to “take a risk”.

Yes, that. The last twist I encountered relied on predestination. I was predestined to success or some such rubbish. Faith was a prerequisite to believing the pitch of course.

PPBlog has joined the coverage of WCM777 where it apparently is entrancing smaller Latino communities, such as Rialto California

http://www.patrickpretty.com/2013/10/30/churches-may-be-at-risk-from-wcm777-program-congregants-in-rialto-calif-may-have-been-swept-into-bizarre-cross-border-scheme-youtube-pitchman-says-venture-will-go-into-selling-shares-pre-i/comment-page-1/#comment-71252

Ming Xu Tweeted 1/4 of a page, containing two names: Goldpoint Holdings, and Siemens China, and claimed it’s an agreement between Siemens and WCM. There’s no date and no title on the page. It’s also a smartphone photo of something displayed on a computer monitor.

Goldpoint Holdings is a shell company lead by… Zhi Liu, CEO of WCM777. It’s in a part of Rosemead that’s NOT known for office buildings (on top of a Vietnamese restaurant).

Goldpoint Holdings address is same as old address of Vantone Intl, that scam busted in China in 2012. That Ming Xu admits involvement in (though he claimed to have withdrawn).

Given that Siemens China has 72 subsidiaries, why isn’t WCM dealing with one of them, but the parent company?

And why can’t the deal be between WCM777 and Siemens, instead of through Goldpoint?

And if Ming Xu claimed that he wasn’t involved in Vantone, why is Vantone stock STILL LISTED TODAY on OTC, with value of $0.01? Who did they got listed with if not through WCM? (Okay, this part is a little iffy, so this needs a bit more research)

http://amlmskeptic.blogspot.com/2013/10/wcm-head-ming-xu-posts-paper-with-name.html

What was the point of that? As it stands there’s still no proof of WCM777 having entered into any contract with Siemens.

Siements called Xu out as a liar and publishing photos of other companies agreements doesn’t change that. If WCM777 themselves never entered into a contractual agreement with Siemens Xu should have never claimed otherwise.

Why don’t ask Ming Xu himself and end of the story??

Do you really think asking Ming Xu would be the “end of the story”?

Although, I think it’d be awesome to have Scott Pelley ask him and START the story.

Isn’t he just trying to keep the recruits coming in? Seems like it’s all just a show to keep the faithful placated in the face of mounting evidence that he’s a massive fraud.

I have to work that day.

Besides, facts are supposed to be from trusted THIRD-PARTY and VERIFIABLE. Interview of the perp is not an interrogation and thus worthless to find the truth.

Well at least he was open to a conversation, may be K. Chang could end up buying a unit or two.

What’s there to discuss?

‘By merit of it’s business model and compensation plan, WCM777 is a Ponzi scheme.’

‘BUT I’M JESUS!’

‘uh… yes but, why do you take investments from new investors and use it to pay out existing investors?’

‘FLYY WITH MEEEE ALL THE WAY UP THE SEVEN MOUNTAINS! INVEST WITH ME AND YOU INVEST WITH GOD! WITHDRAW FROM ME AND YOU WITHDRAW FROM YOURSELF!’

‘…’

There are surely more productive uses of one’s time.

“Take no part in the unfruitful works of darkness, but instead expose them.” — Ephesians 5:11, The Christian Bible

Just tossed a dozen Bible quotes back in Ming Xu’s face on Twitter. Many of them bilingual (Chinese and English) We’ll see who’s a better Bible quote researcher. 😉

we agree that boys are ponzi schemes, however, while you continue to look for that are scams, pyramid schemes, ponzi schemes, many people have found an easy way to get rich, get early in these scams, recruit people, earn and see so what happens then.

These online predators are depopulating the world and the authorities are completely absent, and do not take any legal procedure against the promoters, so in the end who are the fools?

Those who criticize and remain with 1 penny in his hand, or those at risk and change their lives? states also have their ponzi, pensions are not a ponzi? co’sè right, what is wrong? morality? afraid of the risk? fear of becoming rich? loss aversion?

Those who participate in Ponzi schemes. Stop making excuses for your scams.

It is understandable that an ignorant unschooled person is attracted to such things.

If they manage to profit, they do at the expense of everybody else at risk. There’s blood on their hands. Do NOT deny the truth.

is that a few months study how these things are becoming the reality although they are not in good standing, you are still open them all for years, telexfree , bb, uinvest. the game is the same, a company born with promising earnings, and then by word of mouth begins entering beginning to become popular, who enters immediately is likely to prejudice the investigation improrvvise least in theory,

the players know they are going, at least most, so you do not speculate on the skin of others, is a game of chance that can pay a lot, how to be catastrophic.

if the authorities were more present these things do not exist and no one would think + the problem here do not do anything, telexfree is still to promote in the world and a lot of people it enters, since it does not stop then people start to think that they are in good standing and everyway comes in.

what is the address? is that it is right to denounce these schemes and point the finger at various CEO or on the various scams, but does not do anything until the competent bodies do not really care about something in order to eradicate this world of chance.

if they do not move then the authorities under each has the right to make bets and bet on these things, I also think that criticizing these systems is also an alibi for those who have the courage not to do it.

are the ponzi like wildfire and grow quickly by word of mouth, those who do not part remains outside and create an alibi to say it is a scam, then others will lose money, do not feel like investing so much money.

I’m afraid to lose them, I’m afraid to gain so easily, I do not believe ect ect, there’s people instead of these things is making a fortune rischiandoci above, that’s all.I am one of those who remain with 1 penny in hand, but I envy those who succeed in these things.

What an incredibly strange conclusion to make regarding the motive/s of people who choose to follow the road less travelled and take a stand against these criminals.

Fraudulent income opportunities will pop up over and over again. You can’t do much about that. As long as people are willing to join them and make them become profitable for the organizers, there’s simply too much incentives and too little risk (for the organizers).

* Fraudulent income opportunities WILL pop up.

* People WILL join some of them.

* It will all be repeated over and over again, with new ideas and new people coming in to replace some of the old ones. The market itself will be relatively stable, i.e. it isn’t like that Ponzi schemes suddenly will become “popular” or “trendy” among people in general.

That’s a realistic description of the world “out there”.

It will most likely have some predictable “patterns” for growth and failures, e.g. people in one market will become “immune” for several years when a big Ponzi scheme collapses.

If you want to make money in the long term, focus on the VALUE you can deliver into a market. I’m talking about the type of value people can be willing to PAY FOR, e.g. as a product, service or paid work.

We have other types of value too, e.g. your friends can see you as a “valuable friend” because you’re easy to talk to and share some similar ideas as they do. I’m not talking about those types of value now.

If you look at rich people, you will very often find that they’re focused on value rather than money. They have become rich because other people have been willing to pay them for something directly or indirectly.

They have typically DUPLICATED and MULTIPLIED their own creation of value, e.g. by hiring other people to participate in the production of value.

Most income opportunity seekers are typically focused on money rather than value. They are typically attracted to opportunities that can offer them potentially high monetary rewards for little value.

I don’t find that idea very “successful” in the long term, it’s only an ILLUSION. And the illusion will only work when they’re surrounded by other people believing in the same illusion.

Ponzi and pyramid schemes are about “perceived value” = people’s OWN ideas about something. They can work for a short period of time when they reflect what people WANT to believe in (e.g. the idea of high monetary rewards for little value). But the realities will soon catch up with them.

Ponzi and pyramid schemes are not really successful in reality, they’re just other types of failures. Whether you win or lose as a participant isn’t really important, it will be a failure anyway. It will first become a success if people are able to generate any value from it, e.g. use the experienc and knowledge in other areas.

The idea of “success is about value, not about money” will also work inside Ponzi and pyramid schemes. You will typically be rewarded if you produce something of value, something people can be willing to reward you for. People will typically throw stones at you if you focus on how much money you have made personally.

We all desire success. Don’t underestimate your own.