How Visalus & Vincent Owens screwed people out of millions

MLM affiliates receiving giant oversized commission checks means different things to different people.

MLM affiliates receiving giant oversized commission checks means different things to different people.

Prospective affiliates might see a window of opportunity, a chance to better themselves financially.

Existing affiliates might take it as a kick up the butt and commit to their business with newfound focus and enthusiasm.

A regulator might see income claims used to market the company and decide to investigate further.

Personally I’ve come to wonder at the stories behind the checks. Who are the people that made it possible? Were they customers? Were they affiliates?

Behind every dollar written on one of those checks is a story. But unfortunately more often than not those stories go untold.

Through a class-action lawsuit filed a few days ago against Visalus however, rare insight into how one such check receiver built their business is revealed.

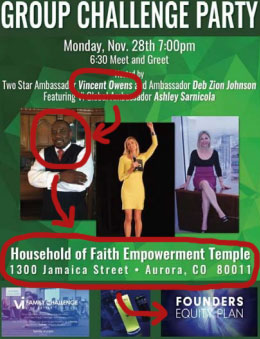

Vincent Owens joined Visalus back in 2006 and is a Two Star Ambassador. At or around the time Visalus launched, Owens was personally recruited by Visalus co-founder, Nick Sarnicola.

Vincent Owens joined Visalus back in 2006 and is a Two Star Ambassador. At or around the time Visalus launched, Owens was personally recruited by Visalus co-founder, Nick Sarnicola.

On LinkedIn Owens describes himself as a “transformational speaker, life coach (and) business consultant”.

As alleged in a class-action lawsuit filed on August 10th by three of Owens’ Visalus downline, Owens’ role as Pastor at a local church plays a big part in his Visalus business.

Owens is Pastor of Household of Faith Empowerment Temple, a church is Aurora, Colorado.

In the church basement, two times a week Owens pitches Visalus to members of his congregation.

It was at one of these meetings that Owens convinced Caprece Byrd’s fourteen year old son Cory to sign up as a Visalus affiliate.

It was at one of these meetings that Owens convinced Caprece Byrd’s fourteen year old son Cory to sign up as a Visalus affiliate.

Owens promoted the ViSalus “business opportunity” through Faith Empowerment by making pitches to the congregation

and their invitees in regular Saturday morning, and later Thursday night meetings.In 2015, Owens encouraged 14 year old Cory to attend his Saturday morning meetings at the church so that he too could learn how to make a “six-figure income.”

Cory began attending the Saturday morning meetings regularly in August 2015.

In these meetings Owens pitched him (and others) the ViSalus “business opportunity,” and told Cory that he could own a part of ViSalus by becoming an “equity shareholder” and in return receive huge payouts for the rest of his life.

Cory was persuaded that Owens, his pastor, had his best interest at heart, and wanted to become a ViSalus distributor so he too could get rich like Owens told him he would.

But since Cory was only 14 years old at the time, he needed the money from Caprece to purchase the ViSalus “business opportunity” to become as rich as Owens.

Cory repeated Owens’s words to Caprece about the business

opportunity and explained to her that he could choose to be one of four people: selfemployed, an employee, a business owner, or an investor.Caprece called Owens to discuss the ViSalus “business opportunity” for Cory.

Owens encouraged Caprece to attend a Saturday morning meeting at Faith Empowerment to learn about the opportunity.

Caprece attended the meeting with Cory, which lasted approximately from 10:00am to 1:00pm in the church basement, and learned from Owens that Cory could own a business and be a successful entrepreneur “just like Owens” for $499 or $999.

Owens showed the crowd of 40-50 people in the basement meeting who attended along with Caprece PowerPoint slides about ViSalus and the money available to those who wanted to participate with him.

He told Caprece that if Cory was “serious” about being successful with his business she needed to purchase the $999 kit to give him the best opportunity.

Caprece gave Owens her credit card information and purchased the $999 kit for Cory’s business – she did not read or sign anything nor was she asked to read or sign anything.

Neither she nor Cory were then aware that ViSalus ostensibly prohibited anyone from being a distributor unless they certified they were 18 years old.

Owens processed Cory’s “application” to become a ViSalus distributor, using Caprece’s credit card for the distributor kit, Cory’s real social security number, but a fake birthdate since he was not yet 18.

Caprece was told that ViSalus would set up Cory’s “business” under Caprece’s business name, Frame of Mind, but Cory’s name is associated with his promoter number.

Cory received his ViSalus kit a few days later and was assigned (a) promoter number.

After signing up the minor Cory and selling her the $999 “business,” Owens, together with his business partner, ViSalus promoter Deb Johnson, started calling Caprece to encourage her to attend the ViSalus meetings at the church.

Caprece only wanted to support Cory’s business, so she did not attend, but dropped him off at the required meetings each Saturday morning and Thursday evening at the church.

At each of these meetings, Owens would bring Cory up to the front of the room, praise Cory for being so focused on being an entrepreneur, and tell the audience that Cory was going to be the youngest shareholder of ViSalus.

Owens conveyed the same message to the audience at every meeting: “you too can be successful and make lots of money.

All you have to do is follow the system and find three business partners to join you, and then they find three business partners to join them, and so on.”

Owens repeated statements that directly related to the equity Plan: that ViSalus was a multi-billion dollar company, and that an investment would make everyone rich for generations; and that a “payout” would happen on April 17, 2017.

In October 2015, Caprece learned from Owens that Cory “needed” to attend a business event for ViSalus in Kansas City, Missouri.

Caprece drove Cory to Kansas City so he could attend ViSalus’s Vitality event.

Caprece purchased tickets to the Vitality event for Cory, herself, and John Owens, Owens’s brother.

Vitality is one of ViSalus’s largest events. It is held annually in various cities throughout the United States and features ViSalus’s new products, “Vi success stories,” and ViSalus’s top promoters parading their large cardboard bonus checks around the event.

The Kansas City Vitality event that Caprece attended with Cory was a 3-day event with approximately 7,500 people in attendance.

This particular event featured hundreds of people dubbed as new “shareholders” who had earned equity in the Plan.

Caprece witnessed all of the new “shareholders” receiving their shareholder certificates on stage at the Vitality event, including Owens’s business partner, Deb Johnson.

She also witnessed Owens receiving two large cardboard checks on stage at the event – a $250,000 check and a $750,000 check.

At that point she assumed that Owens was a ViSalus millionaire and was telling the truth about the opportunity, else why would ViSalus give him a million dollars worth of checks?

After the Kansas City Vitality event, Deb Johnson told Caprece that Cory only had two more days to achieve “Rising Star” – a requirement if he, a 14 year old without a driver’s license, was going to unlock the possibility of receiving a BMW automobile and a chance at receiving “equity” in ViSalus.

Not wanting Cory to miss the opportunity to become a ViSalus shareholder, at Owens’s urging, Caprece purchased three more $999 distributor kits so Cory could achieve the Rank of Rising Star: two for Owens’s brothers and one for Owens’s cousin.

Again she was not given anything to read or sign. ViSalus readily processed these orders.

Later that year, Caprece and Cory attended a second large ViSalus event in Omaha, Nebraska.

Cory was attracting a lot of attention at the event from the other promoters because he was wearing a Regional Director armband at the event, yet by then he was (and looked) 15 years old.

Owens told Cory to stay quiet about his age and told him not be bragging about his business at the event.

When Caprece questioned Owens about Cory’s age, he told her not to worry about it.

Caprece later heard top ViSalus promoter Anthony Lucero mention to a crowd at the event that promoters do just about anything when they are trying to achieve rank, including enrolling their cats and dogs as promoters, so it put her at ease.

After seeing certificates that purported to show ViSalus stock being handed out to the “shareholders” on stage at the events and hearing Defendants Mallen, N. Sarnicola, and Owens all talk about the financial benefits the ViSalus “shareholders” in the “March to Equity” were going to receive, Caprece decided that she too wanted to be one of the 2,000 families to obtain the limited “equity” that she was hearing about.

Owens told Caprece that in order to become a ViSalus shareholder she needed to become a ViSalus distributor, reach Rising Star within 30 days, and invest $40,000 into her ViSalus business.

In December 2015, Caprece once again provided her credit card

information to Owens to purchase a $999 kit so that she could become a ViSalus distributor (although her start date in the ViSalus system indicates July 2015).Deb Johnson, Owens’s business partner, placed Caprece above Cory’s business in the ViSalus compensation system.

Caprece reached Rising Star within 30 days by, among other things, purchasing ViSalus kits for three distributors so she could unlock her opportunity to earn equity in ViSalus.

Caprece applied for a home equity line of credit in order to fund her ViSalus business and get equity in the Plan.

She qualified for her BMW on December 24, 2015 and focused her “run for equity” as Owens called it, between December 24 and December 31, 2015.

The $40,000 “investment” was spent at Owens’s and Johnson’s direction to essentially pay for new recruits and their product along with Caprece’s product.

Caprece also paid to run both Cory and Owens’s brother, John, to the rank of Regional Director so they could each qualify for a BMW.

Cory qualified for the ViSalus Bimmer Bonus Program in the Vi Incentives Plan, yet he was not old enough to legally drive a car.

Before she decided to run, Owens encouraged Caprece to visit ViSalus websites.

He explained that by becoming an equity shareholder in ViSalus, Caprece would receive a large payout on April 17, 2017, and dividends for years after, sufficient to support her family.

Owens encouraged Caprece to find the $40,000 required to become a National Director and earn 3% equity in ViSalus available through December 2015 “by any means possible” so that she could secure her future financially.

Owens explained that the $40,000 would “fund” her business by enrolling enough individuals as ViSalus promoters in one calendar month to allow her to achieve the rank of National Director.

Caprece believed Owens and saw nothing on the website, nor nothing in the presentations she witnessed that suggested anything else.

As directed by Owens, Caprece paid to enroll promoters in her business to hit the rank of National Director.

She enrolled Owens’s family members, her own family members, and anyone else she could find.

She even paid a homeless man, Mr. Moody, $5.00 to fill out the promoter application and use his social security number (Caprece still gives Mr. Moody the leftover ViSalus products).

Caprece enrolled the individuals through the ViSalus website and used the PayNearMe cash payment method available at the 7-Eleven near her house—a method encouraged by ViSalus for people to pay for their ViSalus purchases.

Caprece reached the rank of National Director on December 31, 2015 and believed she became a ViSalus shareholder.

As she had been repeatedly told, and as the web pages she visited seemed to confirm, she had obtained “equity” in ViSalus and was waiting for her first of many dividend checks to come, the first supposedly in April.

She even received a “Certificate of Qualification” signed by the Founders.

In April 2016, Caprece attended a ViSalus National Success Training event in Orlando, Florida and was again officially recognized as a ViSalus “shareholder” in front of hundreds of other distributors.

At this conference, Defendants N. Sarnicola and Mallen again discussed the Plan.

The pitch was essentially identical as the 2015 Plan pitch except that the “buy in” was $25,000 rather than $40,000.

The new “shareholders” were paraded as examples in front of the other distributors.

The audience was even shown a slide with the names of all of the

“new” ViSalus shareholders who had earned equity in ViSalus, including Caprece’s name.She also received an “I Own It” hat, a special ViSalus “shareholder” lanyard that identified her as a shareholder, and a certificate with her name on it that she understood to be a symbol of her equity.

She was also invited to attend the special shareholder meeting at the event held separately from regular distributors.

All this and the certificate led Caprece to believe that she was indeed a part-owner of the company, and, as she herself heard Nick and Blake say or imply, would receive payouts for her $40,000 investment for years and generations to come.

Caprece was never given any kind of prospectus, any financial statements (beyond hearing repeatedly that ViSalus was a multi-billion dollar company and had reached several billion dollars in sales and that Sarnicola, Mallen and Blair paid $143 million to buy the stock, that is how valuable it was), or any written disclosure of any kind about ViSalus’s financial condition.

She was never told, and there was no literature ever published by the Defendants, how many shares of common stock there were.

The only information provided to her about these subjects came from Owens and the oral statements she heard at the meetings.

In none of these did she hear any suggestion that ViSalus was losing money.

In November 2016, with the promised April 17, 2017 payout date approaching, and fearful that space in the 2016 program would run out, Caprece decided that she wanted another portion of the 3% of ViSalus equity.

She was impressed by the Owens material and wanted a “portion of the 6% of 2.2 Billion projected to be over $10 Billion in 2020.”

To take part in this new $25,000 “investment” Caprece intended to “run” her son, Cory’s account.

But Owens convinced Caprece to “run” his brother, John Owens, to equity instead since the equity would result in too much money and be overwhelming to a younger person such as Cory.

And, he said, since John Owens was in Caprece’s downline, she would also receive shares herself from the investment.

Listening to and trusting Owens, Caprece invested another $25,000 in November 2016.

She scraped together the funds to earn additional equity, but she was not concerned because Owens assured her and the rest of the Denver team that they would receive their first large check on April 17, 2017, only a few months away.

As with the first $40,000 “investment,” Caprece, at Owens’s direction, set up an account and paid for required purchases, this time through John, so that the total “investment” in ViSalus product totaled $25,000 in a limited period of time.

In this way again, Caprece believed that she now had another portion of the 3% equity set aside for 2016.

After obtaining her first certificate of qualification, Caprece got another certificate, but this one was a little different.

The “contingent on” and “Participation Agreement” language, and the “vesting requirements” language were something never previously disclosed to her, and certainly not before she decided to “run for equity.”

In March 2017, Caprece attended the ViSalus National Success Training event in Atlanta, Georgia.

The schedule was similar to every other ViSalus event, but the number in attendance was much smaller than in earlier events she attended.

Caprece noticed a different atmosphere with the top promoters showing less enthusiasm at the event.

But Caprece was excited to attend the shareholderportion of the event because the event was so close to the April 17, 2017 payout date she had been told about, and she wanted to hear about the details.

After two years of marketing hype and over $65,000 sunk into Visalus, Blake Mallen delivered crushing news to Caprece and other assembled shareholders.

But (Blake) Mallen gave the shareholders different news – instead of talking about the big first payout in April like they had been led to expect, or presenting the perks of being a shareholder like he had done at all the past events, he told the shareholders in the room that “equity is for the long haul” and that similar to their houses, equity is realized when there is a sale, but ViSalus was not ready to sell.

Mallen did not offer time for the Q & A session as he normally did at the shareholder meetings to answer any of the questions raised by all of the shareholders about the April payout.

Instead, he told the entire audience something brand new: that a shareholder “Participation Agreement” was being reviewed by ViSalus’s legal department and would be provided to them soon via email.

This was the first that Caprece explicitly heard about having to sign another agreement before she would get “equity,” or that she would not get a payout the next month.

Mallen transitioned quickly to the “training” part of the event and opened the doors for the general promoters to enter the meeting room – effectively closing the doors to any discussion about equity because shareholders were not to discuss any of the information given to them in their meetings with the general promoters.

At the meeting Caprece talked with other “shareholder” distributors, including many not connected to the Denver Church Plaintiffs group.

Several other distributors told her they too had believed and been told there was supposed to be an April, 2017 payout.

While they were still recovering from the shock of the Mallen statements, Ashley Sarnicola met with Caprece and the other members of the Denver team for a quick Q & A and to try and calm down a few of the members that were upset after not hearing any mention of the April payout for equity.

But when confronted with the statements about an April 17, 2017 equity payout that Owens, in front of her and Nick, had talked of, she told Caprece and the other shareholders words to the effect she had no idea what they were talking about, and “we never said that.”

When Caprece continued to ask questions about the payout, Ashley Sarnicola asked Caprece to “keep it down” and then moved on to meet with another group.

Having nothing to do with Visalus whatsoever or Caprece, I nonetheless feel compelled to point out that in putting this article together, it was here that my blood began to boil.

Allegedly lying to people for two years, stealing what must be millions of dollars and then telling people who start asking questions to “keep it down”?

…I have no words.

Owens’s entire Denver team was upset because Mallen and Sarnicola contradicted what Deb Johnson, Owens, Ashley’s own husband and Mallen had said in the videos and in the church meetings.

On April 13, 2017, Caprece emailed Jody Doll, the ViSalus Sales Support Manager to inquire about the “Participation Agreement.”

Jody Doll responded to Caprece and the other Denver team shareholders that the agreements would be going out “this month” but provided no detail on what they may contain.

Over time, it became evident that through her investment, Caprece had become trapped in the cycle of handing over money to Visalus.

When she invested in 2015 and 2016, Caprece did not expect that she would have to continue to work as a distributor for ViSalus in perpetuity in order to get her “generational wealth.”

She had no interest in selling ViSalus shakes, nor did she think that there was much of a market for doing so in the Denver area in 2016 or 2017.

But she was now being told by Owens and Deb Johnson and others that in order to “qualify” further for the equity she believed she had purchased, she needed to continue to buy ViSalus shakes every month and continue to recruit and continue to have others buy the shakes or buy them for her recruits.

And, a few months ago, she was told about a new ViSalus venture, LIV, a travel concierge program but in a network marketing format, that she would need to spend $150 a month to support in order to get her equity.

Jonson pressured her to get into LIV.

Caprece has lost money as a result of investing in the Founders Equity Incentive Plan, the costs associated with attending the ViSalus events and shareholder meetings, and the amounts required to stay “Active” in order to, as she now understands, be eligible to receive an equity payout.

Bryan Watts is Caprece Byrd’s brother.

Bryant heard about ViSalus from his sister, Caprece Byrd.

He “invested” in the Plan via the “March to Equity” in December 2016 after attending the ViSalus meeting at Faith Empowerment hosted by Vincent Owens and his partner Deb Johnson.

At the meeting, Owens introduced Blake Mallen, who

gave a talk about the ViSalus prosperity that would come if everyone there—about 20 people—signed up as distributors and joined the equity Plan.But Bryant was only interested in earning equity in the Plan – he did not want to be a distributor or sell any ViSalus product.

He had heard about the April, 2017 equity payout at the December meeting at the church.

In the meeting, Mallen hyped-up the opportunity to earn equity in ViSalus.

He explained that ViSalus equity “would change lives” and that they would receive an equity check every year and “the more equity, the higher the checks.”

The presentation on the screen while Mallen spoke to the audience showed pictures of yachts, RVs, and luxury vacations.

It also showed slides depicting sales for ViSalus at $3.5 billion dollars and percentage breakdowns indicating that since the opportunity was limited to 2,000 families, the first payout check to each of the shareholders would be over $4 million dollars.

That presentation sold Bryant and he decided to invest, although he was concerned that the “opportunity” to invest would be over by the end of December and he would lose his chance to get a part of the 3% that he heard about.

Good news came, however, when Owens told Bryant that ViSalus extended the deadline to qualify for equity from December 31, 2016 to the end of February 2017 to promoters who enrolled in December and achieved Rising Star by enrolling three additional promoters.

Because of the equity extension and the income opportunity shown to him at the Faith Empowerment event, Bryant enrolled as a ViSalus distributor shortly thereafter.

Caprece Byrd loaned him the money required to enroll as a distributor.

Bryant paid to enroll three additional distributors on December 30, 2016 in order to achieve Rising Star and “unlock” his opportunity to become a ViSalus shareholder.

He was not given any disclosure, prospectus, or other financial information, he was not shown any “Participation Agreement” or a copy of the Plan, and was not asked to sign anything other than whatever Owens told him was needed to enroll as a distributor, a simple application.

Bryant initially tried to sell product and enroll distributors by the scripts he received in his ViSalus kit to achieve rank of National Director and receive equity, but he struggled to find anyone that wanted to buy the product or enroll.

Despite being unable to generate revenue by legitimately working a Visalus business, Owens pressured Bryant to come up with the money to secure his equity share.

Owens told Bryant to get to equity any way possible: “beg, borrow, steal, but get the money!”

Bryant found someone to fund his run to equity on the promise that Bryant would repay the loan when he received the April 17, 2017 payout and give a percentage of his equity checks.

The funder was hesitant to loan the money so Bryant arranged for him to participate in a call with Owens.

Owens reassured the funder that the first equity payout would occur on April 17, 2017 and that the money would be substantial.

As a result, Bryant was able to get a loan from his funder so that he could receive equity in ViSalus.

On February 27, 2017, Bryant was told he “achieved” the rank of National Director and equity in ViSalus.

He did so by paying to enroll and purchase product for 20 promoters—with Owens’s full knowledge.

Bryant cashed the check from his funder and used the 7-Eleven PayNearMe feature to become a National Director before the end of February.

Deb Johnson assisted Caprece with enrolling the promoters online and structuring Bryant’s business through his Back Office

account.Bryant attended the ViSalus National Success Training event in March 2017 in Atlanta, Georgia.

Bryant walked across the stage at the event with the other National Directors, and ViSalus recognized him as a shareholder.

As a result of the qualification certificate and his official recognition, Bryant believed that he too had purchased a portion of the 2016 3% equity and that he too would be eligible for “generational wealth” from the multi-billion dollar year company he was told about.

He did not know that he would be asked to continue to buy the product and continue to try to recruit people into the weight loss system.

He could not afford to spend $1500 a year to buy the shakes or Neon drink that he could not sell to anyone just to maintain his “share” of the promised equity.

Bryant became concerned about his investment at the event shareholder meeting when Mallen refused to discuss the April 17, 2017 equity payout and the shareholder meeting turned into a “training.”

Bryant attempted to ask Ashley Sarnicola about the equity payout, but she would not answer any questions about the equity.

Owens has also refused to answer Bryant’s questions about equity.

Bryant has lost money as a result of investing in the ViSalus Founders Equity Incentive Plan, the costs associated with attending the ViSalus events and shareholder meetings, and the amounts required to stay “Active” in order to, as he now believes, be eligible to receive an equity payout.

Renae White wasn’t recruited by Vincent Owens. She became a Visalus affiliate through Frank McWhorter, who nonetheless collaborated with Owens to build their Visalus business.

White met McWhorter through a non-profit counselling service clinic he ran. White was volunteering at the clinic.

Renae, a former nurse, has been diagnosed with rheumatoid arthritis, so she was interested in the ViSalus products because she was looking for a healthy eating routine.

Renae viewed a video on ViSalus equity and participated in a call with Deb Johnson and Dr. Frank before enrolling as a promoter.

Dr. Frank paid for Renae’s enrollment as a ViSalus distributor.

At his invitation, Renae attended Owens’s meetings at Faith Empowerment every Thursday and Saturday, as well as participated in the weekly ViSalus calls and Zoom calls.

Renae heard about the (equity) Plan from Dr. Frank and Mr. Owens during the meetings at Faith Empowerment.

She attended the meetings at Faith Empowerment and in the Denver area, which featured Defendants Blake Mallen, N. Sarnicola, and A. Sarnicola.

Her knowledge and understanding of the Plan and the “March to Equity” programs come primarily from these meetings and the materials and slides she was shown there.

Like the other Plaintiffs, she was never asked to sign any agreement beyond enrolling as a distributor, nor shown a copy of a “Participation Agreement.”

The statements she heard from the Defendants prior to investing were substantially similar or identical to those heard by the other Caprece and Bryant.

The message about the (equity) Plan and the 6% equity opportunity at 3% per year that Renae understood from the ViSalus events was: equity was really valuable, the Founders paid a lot, it was only going to be offered to 2,000 families, and that ViSalus was going to pay out a percentage of the $3.2 billion in sales to the equity shareholders starting on April 17, 2017.

Renae did not imagine these things.

At one of the events held at Faith Empowerment in 2015, before she invested in the equity, Owens said the following in statements Renae videotaped and later circulated on Facebook to other prospective investors:

Let’s just say we get 300 more shareholders in, let’s just say that happens, between now and the end of December which, we’re gonna do it, I know it’s gonna happen.

But here’s what I’m saying to you, take 1,000 people and if we say we’re at, let’s just say we’re at $3.1 billion because of what they’re getting ready to drop, ok, if you take 10% of $3.1 billion, that’s $300 million every year to be split up between 1,000 folks.

Do you understand that?

Every 365 days if we just stayed at $3 billion, another $300 million is coming every April to help those 1,000 families. And then another 365 days here comes another $300 million to help those 1,000 families.

And say it goes to $5 billion, then it turns to $500 million, that’s coming to help those families.

I’m just doing the math to keep it real simple so you can understand what’s happening.

If you knew what I knew, there’s nothing short of breathing that will keep you out of this equity pool.

I would call a family meeting if I was you and I would tell everybody in my family that has a 401K, ya’ll need to have ya’ll’s behind if they have a 403B, or a SEP, or SAR SEP or contractual, whatever they got, you need to get your butt over to that church over there on 13th & Jamaica on the 28th and you need to see the founder’s wife who is going to be here talking to you about the propensity of equity and what it does for families.

They are building foundations. Do you understand what I’m saying?

After repeatedly hearing about the equity opportunity, and the payout in April, Renae finally decided to “run for equity” in November 2016.

Like Caprece and Bryant, White was told to come up with the required investment funds via “any way possible”.

Renae cashed out her 401(k) retirement fund and sold her vehicle to invest in ViSalus and receive equity.

Renae sponsored (paid for) three promoters to hit the rank of Rising Star to be eligible for equity.

Renae believed that she had invested, and that she was an owner of a portion of the 6% equity she was told about when she achieved the rank of National Director.

She did so by paying to enroll and purchase product for a number of promoters by using the 7-Eleven PayByMe cash feature and her Back Office account.

Later Renae attended ViSalus events in Chicago, and Orlando.

Each of these events ran the same way: success stores, cardboard check parade for the bonus earners, and shareholder recognition.

After she believed that she had successfully obtained her equity, Renae attended the March 2017 ViSalus National Success Training event in Atlanta, Georgia.

She was unable to attend the entire event, including Defendant Mallen’s shareholder meeting, because her rheumatoid arthritis did not allow her to leave her hotel room.

She became concerned when she learned from other shareholders that did attend the shareholder meeting that there would not be an equity payout on April 17, 2017.

Sometime this year Renae learned that ViSalus planned to launch a new product, a travel concierge multi-level marketed recruiting program.

She was told that she needed to pay a monthly minimum charge of approximately $150 to participate in LIV if she wanted to keep her equity.

She does not understand why she needed to do this and has no interest in the program.

Renae has lost money as a result of investing in the ViSalus Founders Equity Incentive Plan, the costs associated with attending the ViSalus events and shareholder meetings, the amounts required to stay “Active” in order to be eligible

to receive an equity payout, and the amounts she has paid to participate in LIV.

Three separate affiliates (among over a thousand who invested), common links in Visalus and Owens, hyped to the balls marketing promises, a pay-day that failed to deliver and tens of thousands of dollars in losses.

That’s ultimately all Visalus’ Founders Equity Incentive Plan has delivered to Caprece Byrd, Bryant Watts and Renae White.

With an estimated collective investment of over fifteen million dollars made by Visalus’ shareholder affiliate, the burning question is: Where did the money go?

After the April meeting in which Mallen and Ashley Sarnicola denied there would be a payout, (Visalus) went silent on the question of what exactly the Plaintiffs had obtained as a result of their investment.

Instead, through Owens and his business partner Deb Johnson, Plaintiffs continued to be pressured to keep working as distributors, and join and pay for LIV, the “new” venture.

All of a sudden Visalus’ equity plan is starting to sound like a hostage situation.

Continue to pay up each month, or else.

Not happy with this outcome at all, Caprece Byrd confronted Owens about his earlier claims.

In response, Owens

attacked her character for even asking questions about the equity payout.

Owens physically threatened another “shareholder” (there are at least four other known Denver-area “shareholders” who “ran” to equity like the Plaintiffs, but who are intimidated and afraid they will lose their “investment” if they complain) and publicly blamed Byrd for “stirring up dissention” by asking questions.

Owens did tell Byrd that he would “ask” the Sarnicolas and Mallen to find out what “happened.”

To the best of Plaintiffs’ knowledge no such meeting has taken place, and no one has responded to the question.

In exchange for investing $65,000 and spending however much more on maintaining equity qualification, Caprece Byrd received public shaming and a corporate wall of silence regarding the status of her investment.

One of the obvious questions raised in yesterday’s coverage of the Visalus securities class-action lawsuit, was where the regulators were in all of this.

Visalus and its top earners appear to have been engaged in major securities and wire fraud violations (on top of pyramid fraud) since 2015.

Where the hell was the FTC and SEC? And why, to date, haven’t they taken any action?

According to the class-action filing, after Owens brushed her off, Caprece filed a complaint with the Colorado Department of Regulatory Affairs.

(Byrd was) were informed approximately two weeks ago that the department has issued subpoenas to ViSalus and Owens with

respect to the complaint.

Seemingly in response to the subpoenas and possibly in an attempt to persuade other Visalus shareholders from taking action, Nick Sarnicola and Blake Mallen hastily put together a shareholder conference call.

During the conference, these Sarnicola and Mallen announced that there had been an “error” in how units had been calculated, that “everyone” on the call was a “shareholder,” and that Plaintiffs and others would get “new” certificates.

But, Mallen and Sarnicola repeated, they would need to sign new legal documents to get their equities, and there would be no dividends or payouts for at least 24 months.

Sign some new documents and sit tight for at least another two years. Oh and keep quiet and don’t ask any questions, lest Owens and his downline goon squad turn on you.

The current status of regulatory investigation(s) into Visalus are unknown, but I can’t see them getting away with this. It’s just too much.

Through their Founders Equity Incentive Plan, Visalus appears to have signed up a bunch of people with no interest in the MLM business. And by that I mean selling Visalus products to retail customers.

Had Visalus been run with a compliant compensation plan and business model, this should never have been allowed to happen.

And remember, this is just an accounting of three affiliates who invested.

Visalus’ target was for two thousand families to invest. Pending discovery, the exact number of equity shareholders is unclear.

Stay tuned…

Update 18th September 2022 – Class Plaintiffs and the Visalus Defendants reached a cash settlement in 2019.

This sound so much like the scams in China I’m starting to have flashbacks.

Read the story on Vantone scam in China (which was handled partly by Phil Ming Xu and Tiger Li of WCM777) and see if you feel any deja vu

amlmskeptic.blogspot.com/2013/10/breaking-news-wcm777-ceo-zhi-liu-linked.html#more

I had to stop reading that about a quarter of the way through because I found it too upsetting.

How can somebody be so heartless as to use a child to promote this dreadful scheme and to put his mother into so much debt?

Now I’m not a Christian but surely using a church to advertise this scam is about as unethical as it gets.

Well, the obvious question here is: Why haven’t the FTC or SEC acted sooner?

They sure acted quickly with Vemma, and this Visalus scam is a whole lot worse. Of course we all know that the Vemma deal was a witch hunt and never should have gone that far.

Again, the government ruined a very good business opportunity when they attacked Vemma.

Visalia is not even a good opportunity. It was a planned scam from the start. Let’s hope

Pastor Owens burns in hell, and the Visalus founders do prison time.

Another greed ridden pastor using his flock for personal gains!

@Walt

Vemma was a pyramid scheme, that is a fact.

The lack of regulatory action against Visalus does not justify Vemma operating as a pyramid scheme.

My understanding is that Vemma was no different than Xango, Herbalife, etc.

The big difference (I believe) is that the Visalus founders planned this as a scam, unlike Xango, Herbalife, etc.

Be it Herbalife, Vemma or Valentus, you don’t accidentally have no retail and close to 100% revenue generated via affiliate recruitment.

I believe that most of the companies you mentioned above #6 started of as a valid opportunity. What happened along the road is distributors out of greed manipulating their own company system to drag out more money and of course that’s not with building consumers.

In Vemma you had the YPG and PHN groups of Morton and Alkazin, who by the way are now doing exactly the same in other companies being it Zija or his own venture.

In Herbalife you had the “Work from home” cassette tape systems that were pure racketeering and pyramid, and this was the start of going the wrong way.

Xango had greedy founders who closed their eyes for what trustees were doing with MB30 and other scam set-ups.

Bottom line it mainly starts with the founder’s vision and the leaders ethics. If nobody in those companies had an ostrich politics for money it wouldn’t have gone that far at all. But they did !

Visalus was a machine build to crash from the start on the other hand and the best proof was their Car plan. Short term thinking putting 90% of all people that got one in trouble financially.

The new deal seems to run with the same people: facebook.com/photo.php?fbid=10155558609282520&set=a.10150223810767520.341300.516477519&type=3&theater

LIV lives on with Pastor Owens using his Pay checks of Visalus to now attract people in the new deal as we speak and even with a court case on hand. If governments don’t stop these scammers who abuse their religion and religious people or followers, nothing changes.

wow.

And company shares the blame for creating such a system and allowing such manipulation to continue unabated. Blaming only the minions is NOT the answer.

Let’s simplify this. You want to start an MLM. Do you:

A) Want one distributor who buys, and recruits other distributors who buy, who recruits other distributors who buy?

B) Want one distributor who buys and finds one customer who buys keeping in mind the chain stops dead with the customer?

I would point out that, to the founder, a distributor and a customer are exactly the same regarding the sale of a product. In fact, someone who thinks they have a vested interest (the recruiter) might actually buy more.

Me thinks the founder wants A’s!!!

All MLMs are the same, pyramid schemes, and that is why you see so much “creativity” going on.

I am curious. Nothing is stated about the Owners/CEO’s/Founders of the company.

Nothing is said about their project of “The Power of PROJECT 10 Kids”

No, I am not in this company in any way. I am disturbed by what this Owen guy has allegedly done, but am looking for the whole story, the rest of the story.

I googled Visalus and could not find any mention of this story or of China cracking down.

I’ve googled companies where I know the whole story and only found the negative – the half truths. So what is the rest of the story for Visalus? Are they another Vemmus? etc.

I also didn’t mention North Korea, the 1920 olympics or price of fish in Gibraltar.

If you came looking for offtopic marketing spiels, you’ve come to the wrong place.

This article was put together straight from the filed complaint. The China story has a link to the official government announcement.

Don’t really care. As far as the MLM business opportunity goes it’s looking pretty rotten.

A pastor taking a 14 year old into a church basement, brainwashing them with a load of religious nonsense and convincing them to give them money in exchange for unlimited rewards in the future?

Cory Byrd is lucky he only got financially screwed.

All the charity work done by these hustlers is just a bunch of self licensing.

I doubt that any of the numbers they put out about how many people they helped and how much money they gave are all hot air.

Plus, giving money to charity is a write off, and a good way to make illegal money legal.

Seems to be a recurring theme with these MLMs using professionals like Doctors and Pastors who use their clients as pitching posts. Despicable.

Using religion to feed the greed however is quite possibly the lowest method a salesman can employ and speaks volumes about their ethics.

Preying on peoples vulnerabilities is low considering these people are relying on you for guidance.

It is no surprise that MLM found its best home in Utah… the Mormon style of “sharing” evangelism was perfect for MLM.

How are ViSalus and Liv. Intl. connected? Or are they?

This was hard to read at times. The levels of deception involved is disgraceful,wish you had sharing buttons. These MLM companies need to be exposed for what they are.

I don’t see how people didn’t check out this organization. Billion dollar businesses have a track record.

I see everyone wanted to increase their income in a easy way. No paperwork no integrity and no ethics no sale. For the size of the investment there has to be some form of validity.

The first broken spot in the conversation is a 14 year old boy could continue in the program.

The young person lied about his age and the company accepted him against their own policies. It seemed like greed was the motivation in this transaction by both parties.

With no mone comming back after the first kits were sold then that is a red light too… Integrity and ethics are a must in any transaction.

Take the low road till you see some results from what you have invested even if that is very small.

^^ Cool. Doesn’t explain or justify alleged wire fraud on Visalus’ part though.

I still get my equity?? Right guys? I have a plaque, I am the owner of a billion dollar company. Where is my million dollar pay??

In response to Vanduvall,

You misread the article – the pastor approached the 14 year old about he business – not the mother. The mother was only wanting to help her son have a business – there was no deception there other than the pastor enrolling the boy and falsifying his age – the pastor was deceptive. The boy did not lie about his age nor did the mother.

The point of the whole article is that Visalus, Vincent Owens, and Deb for that matter, were, have been, and still are being deceptive. They have used the church, the word of God to lure and prey on people for their own personal greed.

Caprece Byrd is a liar. This whole lawsuit is malicious attack against John Owens Vincent Owens brother.

Caprece was in an intimate relationship with him and he left her so in an attempt to get back at him she thinks making accusations against his brother Vincent the pastor would do something.

Caprece and her son Corey and her brother Bryant all made large sums of money earned BMWs paid for by Visalus. Visalus change the date of the equity payout and at that time her and John relationship was going through turmoil.

John end up leaving her and then she start making malicious accusations it’s crazy for her to bring her son into it she’s a sad soul.

Facts aren’t a “malicious attack”.

If Visalus and Owens screwed millions out of Visalus affiliates on false promises, that has nothing to do with Byrd’s personal life.

Looks like this story was covered by a news station in Denver. It’s all on video now. Just Google “visalus lawsuit” and check out the “Aurora Pastor…etc” Headline to watch the video.

You’ll have to wade through a page or two of of OTHER lawsuits that Visalus is facing, however. 😀

Update on the story of things left out; Caprice Bird who was dating Owens brother John Owens she left that part out she was actively apart of all meetings on her own recognizance she wanted to have her son Corey involved as a mentorship from Vincent Owens.

Lawsuit has been thrown out of court Caprice bird has lost.

Not so much an update as an attempted strawman. None of that changes the fact that Visalus and Vincent Owens in particular screwed a bunch of people out of millions of dollars.

And the case is still very much open as I write this.

You Have 48 hrs to remove this article, and post a public apology or legal action will follow this comment

Sincerely

Vincent Owens

This was dismissed April 2018

District Court Of Michigan

Honorable Mathew Leitman

Oh, in addition to emailing me this you’ve also left a comment.

Well, as emailed to you Vince and in the interests of transparency, here’s my quoted response as emailed back to you:

I did cover the settlement in a separate article. I’ll add that as an update to the original publication.