Analysis of USI-Tech’s ethereum mining pool (external ROI revenue?)

With a large percentage of the MLM underbelly on board, in order to survive the next few months USI-Tech needs to convince regular investors to get on board.

With a large percentage of the MLM underbelly on board, in order to survive the next few months USI-Tech needs to convince regular investors to get on board.

This has seen the company forced to try to address the question of where its ROI revenue comes from.

Since May USI-Tech has been promising proof of external ROI revenue, yet in the secret “thou shalt not record” affiliate meetings the company holds around the world, all affiliates have gotten is promises of this and that.

First it was forex trading, then it was bitcoin trading, then it was bitcoin mining, then it was magical energy devices and now, out of nowhere, an ethereum mining pool named “USITech” has surfaced.

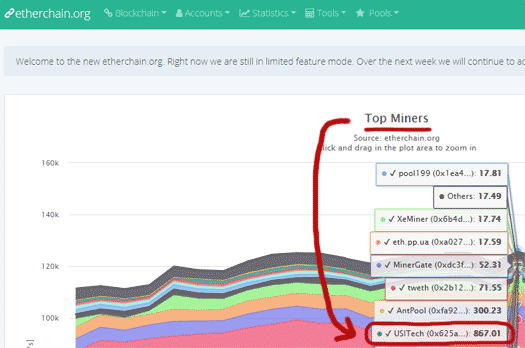

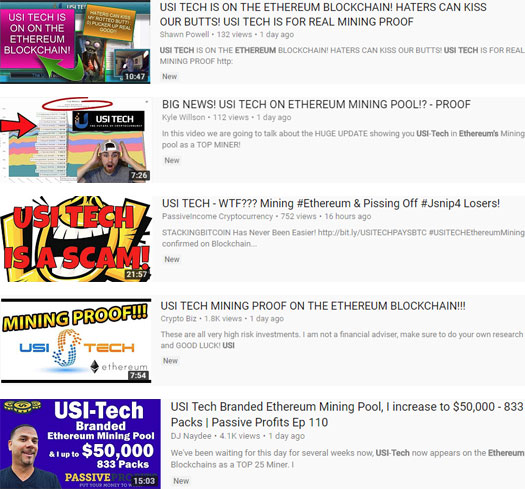

A few days ago USI-Tech affiliates began spamming EtherChain’s top Ethereum miner charts all over the internet.

As above the charts show a mining pool named “USITech”, corresponding to the account “0x625a083Bee9E6F0FD756e79880b26B955826702c”.

Putting aside the fact that anyone can create or buy a mining pool and call it whatever they want, let’s take the USITech named pool at face value and accept it is actually owned by USI Tech.

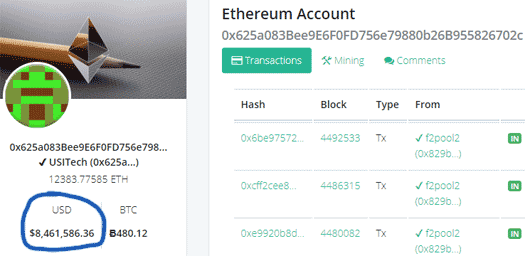

According to Etherchain, the USITech mining account was first seen on May 1st, 2017.

Word on the grapevine is the USITech account is just an existing Chinese ethereum mining farm the company recently purchased, however I was unable to independently verify these claims.

The USITech account has, as at the time of publication, been mining for 221 days and accounts for approximately 0.59% of the global ethereum hash rate (mining power).

Those are the facts pertaining to the USITech ethereum mining account (which may or may not be owned by USI-Tech). Now lets dig deeper into the financial numbers.

As you can see in the screenshot above (blue circle), to date the USITech account has mined $8,461,586.36.

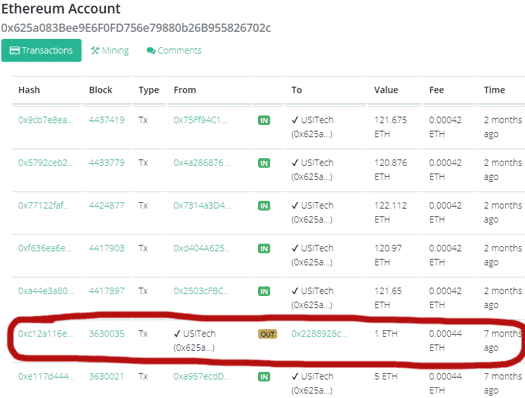

In the screenshot below, you can see the sole outgoing transaction linked to the account was made seven months ago for 1 ETH (about $90 USD at the time):

Before we go any further, let me break down what that means.

The theory behind all these EtherChain mining chart spam is that it’s proof that USI-Tech is generating external revenue (we’ll address why that’s not the same as audited accounting later).

In order for this to be so, USI-Tech would need to be transferring ETH out of the USITech mining account in order to pay affiliates.

As the transaction history for the USITech account shows, no ethereum has left the account since 1 ETH was transferred out seven months ago.

Ergo even if we play along and accept USI-Tech owns the USITech mining account, they have not been using mined ethereum to pay affiliates a 1% daily ROI.

Even without the transaction history though, this should be already blatantly obvious.

The USITech account to date has only mined $8.4 million worth of ethereum.

Current USI-Tech affiliate investment numbers are unknown, but in late September co-founder Horst Jicha claimed the company had taken in around €350 million EUR.

Let’s be conservative and reduce that to $300 million.

USI-Tech’s business model sees the company promise a 140% ROI on €50 EUR investments.

€300 million in investment from their affiliates equates to a €420 million EUR liability. And remember, we’re using a conservative investment amount and totally ignoring referral commissions.

If USI-Tech completely drained their $8.4 million ethereum mining pool (€7.14 million EUR), that leaves €412.8 million EUR in ROI revenue unaccounted for.

And that also requires the assumption that USI-Tech used the ethereum mining profit to pay affiliates with, of which there is absolutely no evidence of.

Regardless of whether you’re a realist and see an ethereum mining pool as meaningless without audited accounting showing generated profits are being used to pay affiliates, or you’re part of the Ponzi gullible and take everything at face value, the assertion that ethereum mining is being used to fund USI-Tech affiliate ROI payments is impossible.

So with respect to the USITech mining pool account, where to from here?

Over the last few days the USITech account has mined 146.7, 74.47 and 178.1569 ETH.

That comes out to an average of 133.1 ETH a day, which at the current exchange rate is €79,814.96 EUR.

A €420 million EUR ROI liability backdated to September would take 5262 days to pay off.

A far cry from USI-Tech’s “140% in 140 days” marketing pitch.

And bear in mind that’s only if you froze new investment into USI-Tech and the value of ETH itself, neither of which has happened.

Time to face facts: The USITech mining pool is nothing more than the latest attempt in a long list of failures by USI-Tech management to feign legitimacy.

USI-Tech is not generating external ROI revenue through stock trading, bitcoin trading, bitcoin mining, a partnership with Genesis Mining, a $70 million dollar BitFury mining contract, magical free electricity devices, ethereum mining or anything else they come up with.

The only verifiable source of revenue entering USI-Tech is new affiliate investment, the use of which to pay existing affiliates a 140% ROI makes it a Ponzi scheme.

I had to go a bit deeper into the blockchain stuff than I’m comfortable with for this one.

Appreciate anyone more familiar with crypto letting me know if I misinterpreted any of the data.

This is good proof of the ponziness of this scam. Oz, I hope you pass this information along to the authorities. Good work!

here’s a board outside a usi tech meeting room saying no recording allowed :

facebook.com/photo.php?fbid=1912601349067473&set=p.1912601349067473&type=3&theater

when you’re going to feed affiliates a bunch of nonsense about millions of dollars mining contracts and free energy machines and crap at these meetings, it makes sense to ban the recording of any proof!

And what’s to stop someone from pointing a camera at the screen? What utter nonsense.

after a continual sharp rise in recruitment from around march 2017, usi tech shows a decline from around mid november:

alexa.com/siteinfo/usi-tech.info

the exposure of USI tech’s continuous lies [promises to release trading account details, fake bitfury contract, fake mining video, BTC packs missing, etc] on social media and critical articles online, may have helped slow recruitment.

this recent ‘proof’ of ethereum mining is therefore a well timed trick to give affiliates some weaponry for recruitment – usi tech really mines. look!

a layperson in the world of crypto can be easily seduced by such mining proof because they know frigall about crypto in the first place, and cant figure the numbers game either. i think oz has explained this stuff simply enough in this article for crypto/ponzi newbies to understand.

this bit of conversation on FB from a few hours ago gives a glimpse into the mindset of usi tech affiliates, who just need a clutch to help them recruit, no matter if the clutch is made of psuedo legitimacy.

this conversation pertains to usi tech buying a mining pool containing insufficient funds and no proof of paying out any ROI from it:

^^ it’s all right for usi tech affiliates if the ‘mining proof’ doesn’t add up at all, just as long as the company gave them ‘something’ to hang their faith/recruitment pitch on.

They redirected their .info site to the .com sometime in the past week or so.

oops.

alexa shows they’re climbing higher. guess there’s no shortage of idiot investors after all.

alexa.com/siteinfo/usitech-int.com

And the above figures do not include the $10 million a month USI is paying to a shadowy “we shall not be named” mob.

Probably the same mob Ralf Gold claimed in the Scoville USI Tech video that were trading crypto on USI’s behalf. The Phantom lives.

Can someone in the USA explain why the SEC aren’t shutting this down asap.

USI-Tech has US investors but is being operated out of Europe. They’re also scamming through bitcoin.

The SEC and securities regulators globally have yet to catch up on MLM bitcoin scam regulation. They’re only just now getting stuck into pump and dump altcoin launches.

@anjali web activity will also include those withdrawing. Many are on a daily basis

the larger the usi tech ponzi grows, so does it’s liabilities, and this is controlled by making people reinvest their ROI earnings into new bitcoin packs, so that withdrawals are limited to a manageable pace.

with christmas approaching and withdrawal requests increasing, usi tech must be feeling the pressure, because obviously they don’t have enough money in their pot.

so, they’ve now created an excuse about a ‘blockchain slowdown’ as reported by the FB page – ‘Usi tech scam page’ – a few minutes ago:

facebook.com/303785166766536/photos/pcb.326662534478799/326662514478801/?type=3&theater

facebook.com/303785166766536/photos/pcb.326662534478799/326662511145468/?type=3&theater

first bitcoin packages of many affiliates went missing due to ‘technical glitches’, now the blockchain has ‘slowed down’ – next we only need to wait for ralf gold or one of his founder buddies to get their ass rammed by a dumpster truck [a la pablo munoz of onecoin] and we’ll know usi tech is cooked!

let the ‘run out of money’ stories begin!

and BTW which blockchain slowdown is usi tech gabbling about?

the ether blockchain they’re on is not even used for ROI payment!

liar liar pants on fire!

The blockchain is slow

blockchain.info/charts/mempool-count

110,000 transaction waiting to be processed and the minners are charging 20% or more to move your bitcoins.

This is something that usitech doesn’t take into consideration.

even so, a delay of over a week in payment is not explainable:

coincentral.com/how-long-do-bitcoin-transfers-take/

usi tech is delaying payments because it’s a ponzi scheme and running out of money to pay earlier investors.

Excellent and well constructed article which sticks to the facts and again proves beyond doubt that USI-TECH is an MLM ponzi scheme which needs shutting down before too many other people buy into the scam.

Some payments from the 13th November still haven’t been cleared.

One high up person in the UK is helping people by buying packages for them from her own USI balance and getting them to send her the money through paypal or payza, thus bypassing the USI withdrawal. A few more are also doing this. Hundreds of packs seem to be involved with this method.

Not sure how widespread this is as i’m only seeing what happens in one group, but it seems to currently be the only surefire way to get money out of the scheme.

Everything is getting blamed on the blockchain, USI is remaining blameless in everything.

I’ve just read down the page a bit and there is actually someone who has started a post saying they will do this method to help people out and to help them avoid fees. They paypal him the money for the packs and he transfers the packs to their account from his. He gets real money, they get packs.

@Alice

Sadly this happens in every major MLM Ponzi scheme.

Unfortunately for their victims it creates a nightmare scenario when they try to file victim claims. Either they cannot prove any of their money was invested into USI-Tech (because it isn’t if they transferred it directly to the scammer), or the scammer files a claim overlapping theirs.

At the end of the day a Receiver can only work with money that went in and out of USI-Tech itself. Money sent to scammers is treated as external revenue and is not claimable.

I’m open to sit down with Oz (if that’s really his “Real” name) and do a livestream face off. (Ozedit: Snip, see below.)

The fuck do we need to do a “livestream face off” for?

You have no evidence of USI-Tech using external revenue, same as the rest of the USI-Tech Ponzi schmucks.

If you want to be the next Ken Labine, have at it. But please don’t waste my time with bravado in attempt to shift discussion away from USI-Tech’s glaring due-diligence issues.

If you truly want to have a “livestream face off”, do it with USI-Tech management and corner them into either providing a third-party audited report of the source of affiliate ROI revenue, or admit they’re just recycling newly invested funds.

Don’t be surprised if they respond by terminating your investor account though. Such is Ponzi life if you rock the boat.

Hans Mohr – in the video with fellow scammer Charles Scoville, Ralf Gold says evidence of crypto trading will be coming soon. That was in April 2017.

Could you ask Ralf how the blank piece of paper is shaping up?

this usually happens towards the end of a ponzi scheme, like in onecoin when top affiliates starting selling humongous amounts of their own coins to their downlines and making a quick buck.

so how is this usi tech top UK affiliate [sharon james?] going to pay these investors their ROI, since she’s bypassed the company and sold them her own packs/balance? how does this work, does anyone know?

She doesn’t She transfers 50 EUR worth of USI-Tech monopoly money from her backoffice to a newly created account for her victims. Not sure how the referral commissions work.

It’s not Sharon James, it’s someone else, I believe this may be her first Ponzi. She’s not at Sharon James type level, I am wrong, she isn’t in the UK, she is in Utah.

The group I am in has a lot of UK people, i’m guessing a lot of her victims are from the UK, although there are plenty all over the world in the group.

She is definitely quite high up though and when it collapses will be a net winner.

She has stated that if you do it that way and transfer the packs you still get referral commissions.

A USI webinar apparently said that wasn’t allowed, but i’ve read some more and it seems a lot of people are bypassing USI withdrawal to get cash and transferring packs to others.

They obviously won’t want that happening as it’s just moving funds sideways instead of new cash flowing into the scheme which will make it collapse quicker.

As far as I can work out she buys the packs with her USI balance, she then transfers them into the other persons account and they will get their ROI on the packs that she has bought for them and she apparently gets commission for it all.

I did look further into it and they set it up so you can buy a pack to get someone else started in USI and buy it with your balance straight into their account. This seems to have been set up to entice people to join.

This seems to be what they are using to get around the withdrawal process, instead of gifting the packages they are exchanging them outside of USI for cash via paypal or payza.

Someone was asking a few days ago how to go about transferring £100k into bitcoins to buy into USI, which is a horrible thing, and rather stupid.

Not a lot on Sharon James, she is right near the top, scamming lots of money from those she has conned into the scheme, back in June she posted something which indicates she is withdrawing a substantial amount of her earnings to keep it out of the scheme.

She posted how many packs she had and at the bottom it showed the amount she had withdrawn from USI. It was in bitcoin, if she still has those bitcoins they are worth over half a million GBP.

That was back in June, so I dread to think how much she has scammed from others since then.

There is someone else as well who will come out of this a huge net winner, he appears to have been in Traffic Monsoon as well, not sure if i’m allowed to name names here.

I know Sharon James is okay as she’s been mentioned a few times already, but not sure about others. This guy is obnoxious, flaunting the amount of sign ups he has and how many packs he has.

My fear with the net winners, including Sharon James, is that if they try and clawback the money it may end up only being a small amount of what they have made from the scheme due to bitcoin.

If they have held onto the bitcoin when they have withdrawn their money from the scheme it will now be worth substantially more than the day they withdrew it.

Obviously this won’t be so much of a problem if they still have a lot left in there and withdraw huge amounts just before it collapses when bitcoin is as high as it is now.

who pays the ROI on these packs?

the USI balance in her backoffice is just numbers on the screen and not hard cash.

i don’t see how or why usi tech will pay an ROI when they haven’t received any cash themselves?

i think usi tech is turning a bind eye to this behavior because it lets them off the hook from paying out to this top affiliate whoever she is. meanwhile, she gets to encash her balance via selling packs to newly recruited schmucks under her.

if this is widespread then it is a sure sign of usi tech collapsing.

I *think* ref commissions and the ROI is generated when backoffice funds are reinvested under the new account. That has to be it.

As part of the package to which only “insiders” have access, it happens with every “next-big-thing” scheme.

Insiders are warned of the imminent collapse, giving them time to offload their (non existent) packs in exchange for real currency.

They most likely haven’t invested any of their own money, instead having “earned” their packs via whatever scheme is in operation, so, it’s all cream.

I have friends putting in alot to this crap. Its not going to end good. But I guess everyone has to learn the hard way somehow.

Yes, this is what everyone who got in early has done, their packs are growing through rebuys and they just withdraw their commission and ROI.

You can set the back office to automatic rebuys, so as soon as you get paid your ROI you automatically get more packs. Even those who got in later and only have a modest amount of packs or a very small amount of packs seem to be growing them by rebuys instead of investing more cash.

Commission is the big earner from what I can tell. Someone who has put their stats up has over 50,000 team mates and he will be earning commission from them.

He has over 5000 direct referrals and I believe each direct referral gets you 120 Euros, although i’m not certain on the amount, that was just a figure I saw to do with referrals so can’t say if it’s correct or not.

The tokens sold has gone past 72 million. Free tokens are given with every pack bought and with every rebuy. 50 tokens cost 50 Euros.

The more you buy the cheaper each token is and you can get bonuses from them. With higher amounts you are entitled to bonus coins. A gold pack costs 2500 Euros and you get 5000 tokens and a further 10,000 tokens when the first bonus happens. The first bonus will happen when USI have sold 125 million tokens.

No idea as to when the tokens will be turned into Techcoins.

It also doesn’t seem as though people are buying them with cash, most of them seem to have been free with packs or rebuys. I’m not seeing them talked about or anyone investing in them for the future.

As far as I can see you cannot resell the tokens, you need to wait until they are turned into techcoins, which will never happen. I don’t think it has been the cash injection USI hoped it would be.

You cannot buy tokens with your USI balance, you need to withdraw it and then buy them.

Nobody is talking about the tokens or investing in them that I can see. Some must have for them to have sold 72 million, although information from USI cannot be relied upon as truthful.

Nobody seems that interested in them and are more interested in the packs and the long term investment.

Just one last thing i’ve noticed. The daily ROI is meant to be between 0.75% and 1.25%, your pack will run until it hits 140%, this used to work out to about 140 days.

The daily ROI has dropped so that it is at the lower end most days. This means a pack is tied up for at least 150 days rather than the 140 days, so USI get to keep it longer before you can withdraw it.

The daily average ROI is now about 0.85% and dropping. It is very clever the small little things they are doing to keep hold of money just a little bit longer to try and prevent the inevitable collapse.

I’m finding it fascinating to see a Ponzi in action, and see peoples reaction to obvious signs that things aren’t right and how they dismiss them.

Also seeing the little things USI are doing to make the scheme last longer. I feel terribly sad for the victims though, although there is plenty of talk about rumours it’s a scam and the reasons why it absolutely isn’t a scam.

woah, bitcoin has been ranging higher and higher through most of this year and particularly over the last two months, and usi tech’s ‘secret mining contract worth 70 million dollars’ is getting lower and lower returns?

With such an ‘industrial level’ of mining and the rising prices of bitcoin, one would think usi tech would increase the ROI to it’s investors?

no wonder horst jicha wants to set up his own mining farm, god knows when in 2018 and god knows where! cant trust anyone else to do your mining for you these days! pfft.

I have a girlfriend whom is so wrapped up with USI to the point of obsessiveness and wants me to do the same.

People will not listen to reason when they want to hear what to want to hear, perception is reality!

I can only say this, be very cautious with this or any company that makes promises on ROI that they clearly can’t prove or won’t prove that it’s coming from source’s other than new money through the front door!

Don’t drink the KOOL AID, Bless all their family member’s!

ASPCQ

ASPCQ – what about your other girlfriends? 😉 Hope you can get her out of USI, it really is a disease. Have you shown her all the latest fraud alerts?

I have pretty much lost a friend over USI-Tech – he was convinced it was the real thing.

Me too. He tried to get my other friends involved and I got quite.. well, vocal about it. But I got lots of support from other friends. It’s tough but you have the moral high ground.

I just read that the Texas securities board issued an emergency cease and desist on USI tech and some of their affiliates.

Got any more info? First I’m hearing of it.

Too many domestic duties will addle your brain,Oz.

behindmlm.com/companies/usi-tech/usi-tech-securities-fraud-emergency-cease-and-desist-issued-in-texas/

Sarcasm fail, I’ll see myself out 🙁

hahahahaha 😀 u guys have no idea what you’re talking about and the author of this article probably never watched a single interview with the owner.

is he did, he would know exactly that non of the profits for users come from mining, that’s why they don’t need SEC approval. and he would know why it is not possible to show trading results officially 🙂 but carry on 🙂 enjoy your day.

As far as securities regulation goes, how a return is generated is irrelevant.

Wire fraud does however come into play if newly invested funds are being used to pay off existing investors.

The only reason an MLM company would hide trading results is if they didn’t exist.

Stop watching Ponzi scammer YouTube videos.

What a lot of you do not understand is USI trades through arbitrage. When they show up on the blockchain charts you guys will see.

You know what would clear up this whole mess? Somebody buy 1 package and let it run its course until it hits 140% then cash out their bitcoin. If that happened would you believe it?

See what? USI-Tech launched BTC Packages back in July, why haven’t they “showed up on the blockchain” already?

Proof of stealing money from people who join after you isn’t a substitute for third-party audited ROI revenue accounting.

That would prove nothing. Ponzi schemes ALWAYS pay out at first, that’s how they convince their victims that it’s legit.

FYI, Bernie Madoff’s ponzi scheme lasted for almost 9 years before it imploded, and 50% of his investors never lost a dime. But it was still a ponzi.

Very easy… back a month ago Etherium was worth about $448.00 today it is up around $1200.

^^ I nuked the original question because he posted it under two articles, see here – https://behindmlm.com/companies/usi-tech/usi-tech-suspend-withdrawals-18-mill-eth-mining-pool-cleaned-out/#comment-392920

ah ok…