Steve Chen not opposing USFIA preliminary injunction

The strongest indication that Steve Chen has not fled the US yet, comes today via two SEC filings.

The strongest indication that Steve Chen has not fled the US yet, comes today via two SEC filings.

Following the granting of a TRO against USFIA and Chen last month, at some point in the future a preliminary injunction hearing would need to take place.

If granted, a preliminary injunction would make permanent the closure of USFIA and prevention of Chen from conducting further securities fraud.

It would also pave the way for recovery efforts to secure funds Chen and top investors and insiders stole from USFIA victims.

In a filing by the SEC dated October 5th, pertaining to consent by USFIA, the following paragraph appears:

WHEREAS, Chen consents to the entry of a preliminary injunction and to the appointment of Thomas Seaman as permanent receiver with full power over the Entity Defendants, during the pendency of this action;

WHEREAS, the Entity Defendants, by and through the court-appointed receiver, consent to the entry of a preliminary injunction and appointment of a permanent receiver over the Entity Defendants;

A second filing also dated October 5th, pertaining specifically to Steve Chen, contains similar verbiage but goes further:

WHEREAS, Chen consents to the entry of a preliminary injunction and appointment of a permanent receiver over the Entity Defendants;

IT IS HEREBY CONSENTED, STIPULATED AND AGREED by the SEC and Chen:

1. Chen waives service of process under Federal Rule of Civil Procedure 4(d)(3) as to the summons and Complaint in this action and admits the Court’s jurisdiction over him and over the subject matter of this action (with respect to the instant Complaint only).

2. Chen acknowledges that he was properly served with a copy of the Complaint, the TRO and all papers submitted by the SEC in support thereof.

3. Chen does not contest the entry of a preliminary injunction and appointment of a permanent receiver over the Entity Defendants.

4. Without admitting or denying any allegations of the Complaint (except as to personal and subject matter jurisdiction under the instant Complaint, which Chen admits), Chen consents and stipulates to the entry of a preliminary injunction.

5. Chen waives the entry of findings of fact and conclusions of law pursuant to Fed. R. Civ. P. 65.

6. Chen enters into this Consent and Stipulation voluntarily and he represents that no threats, offers, promises, or inducements of any kind have been made by the SEC or any member, officer, employee, agent, or representative of the SEC to induce him to enter into this Consent and Stipulation.

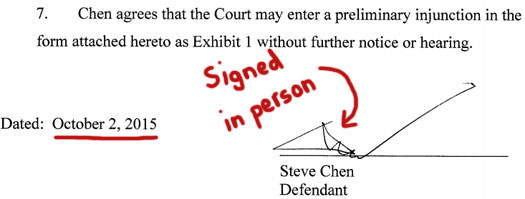

7. Chen agrees that the Court may enter a preliminary injunction in the form attached hereto as Exhibit 1 without further notice or hearing.

The second document bears Chen’s signature, dated October 2nd, 2015:

The only reason I can think of that explain why Chen consented to his effective losing of the SEC case against him, is that he was arrested by the FBI. Otherwise Chen’s consent makes no sense.

It was only a few weeks ago Chen had his attorney, Andrew Beal of Crowley Corporate Attorneys, declare ‘claims by Gemcoin critics are unfounded‘.

Why drop the facade now?

My gut is telling me Chen is likely facing far more serious charges brought about by the FBI, with the SEC complaint thus seen as being of secondary importance.

Civil penalties he can live with, but this is probably now more about fending off a lengthy jail sentence.

As of yet though, there has been no word from the FBI about Chen’s arrest. Nor the current status of their criminal investigation.

Stay tuned as the situation develops…

a criminal investigation/case can be kept under wraps, but can an arrest be kept under wraps?

also, the FBI has been investigating chen/usfia for almost a year now, and the matter was serious enough for the SEC to take a back seat.

i wonder if chen’s ‘guns’ have anything to do with the FBI investigation!

The FBI think Chen is a flight risk. He obviously knows about both the FBI and SEC investigations now, so wouldn’t they be worried about him fleeing if they didn’t have him in custody by now?

Otherwise why halt the SEC investigation, only for them to later file for an emergency TRO and not swoop down and nab Chen at the same time?

That said I don’t know if you can seal an arrest warrant, we’re pushing the limits of what I know here.

And what, Chen just rocked up to the SEC offices to sign a preliminary injunction consent?

This is the guy who dressed as the sheriff of Ponzi-land and surrounded himself with armed goons at fort GemCoin. I’m not buying he’s going out without so much as a whimper.

The only thing I’ve been able to turn up are two arrests in Temple City, California.

Temple City is next door to Arcadia.

The man arrested was Steve Chen, DOB 9/23/61 (53 years of age). Hair color: Black, Eye color brown, Races: C & O (Chinese and Oriental?)

First arrest was $20,000 bail with Chen arrested and released on the 29th of July.

Second arrest was $30,000 bail with Chen arrested on the 3rd of September and released on the 8th. The second arrest lists a felony charge as the reason for arrest.

I haven’t been able to find anything further to confirm this is USFIA’s Steve Chen… but other than “wtf they arrested him in July?”, the personal details seem to fit. That and the bail amounts seem pretty low but I don’t know what the specific charges for (might not be USFIA related).

How many 50 something year old Steve Chens were arrested in the city next to Arcadia this past month?

Go here app4.lasd.org/iic/ajis_search.cfm and put “Chen” as last name and “Steve” as first. Last two bookings.

This is not confirmed to be USFIA’s Steve Chen!

Those are too low to be for serious crimes, but about right if they are for DUI. (drunk driving)

Is drunk-driving a felony?

Depends on how serious it is. If there’s no damage and no injury, misdemeanor. But a second DUI is a felony.

Any injury in DUI automatically makes it a felony.

Correction, if one had 3 misdeamnor DUIs, the 4th one, even if misdemeanor DUI, is considered a felony due to repeat offender status.

And if one has a felony DUI, then subsequent misdeameanor DUI are also considered felony.

The “repeat” cut off period is “ten years”. i.e. don’t reoffend in 10 years and the timer resets.

Class action lawsuit filed?

news.uschinapress.com/2015/1005/1039202.shtml

Yep: BC596792 is the supposedly file/case number. Asking for… 100 million.

And he’s suing everybody. Solomon Yang, Steve Chen, UCCA, USFIA, Anmkey, John Wuo, Quen Jiang, et al.

So uh, SEC (Receiver?) intervention in 3…2…1…

ChinaPress has a different article that links Steve Chen to the old “US Mining” scam in China. No surprise there.

this^^ gent sounds awfully close to steve chen of gemcoins.

but, steve chen may be a common name though. i found a steve chen in temple city who won the Civic Recognition Award for acts of kindness and compassion!

seems there are ‘all types’ of steve chen’s available in and around arcadia!

Don’t think the man arrested in Arcadia was the same Steve Chen.

USFIA’s Chen is probably 57 or 58, according to this SEC filing from a company called Aspac Communications which says he was 43 years old in 2001.

sec.gov/Archives/edgar/data/840399/000101968701000038/0001019687-01-000038.txt

The Aspac guy sounds very similar to our Gemcoin king: same middle initial, same trumped-up biography.

nope, ASPAC is a genuine company which is still in operation.

bloomberg.com/research/stocks/private/people.asp?privcapId=528253

the truth is, there are too many ‘steve chens’ hanging around in california.

I don’t think ASPAC exists anymore. they haven’t filed anything at the SEC since 2002, and according to the CA Secretary of State they surrendered their business license.

This very informative report http://amlmskeptic.blogspot.fr/2015/09/usfia-update-continued.html

identifies USFIA’s Steve Chen as formerly affiliated with Aspac which it describes as “long closed.”

So I think it’s the same guy, who is age 57 or 58.

After looking over that report by Peter Del Greco of the SEC, I’m wondering if the Arcadia police made a mistake by calling Chen in for questioning. Right after they talked to him he went to the bank and wired about $3 million out of the country. Doubtful that USFIA investors can recover any of that money.

Fun Fact:

Los Angeles County felony offenses with a bail of $30,000

PC 245(a)(1) – Assault with deadly weapon (other than firearm)

PC 245(a)(4) – Assault with likely Great Bodily Injury

VC 23110(b) – Throwing item at vehicle W/ likely GBI

HS 11352 – Furnish/Transport substance under 1 kilogram

HS 11360(a) – Furnish/Transport Marijuana (over 10 lbs)

HS 11366.5(a) – Operate or allow a drug house (simplified)

HS 11378 – Possess controlled substance for sale (under 1 kg)

HS 11379 – Sales of Controlled substances/Possess for sale

HS 11379.5 – Sale of PCP

I’m not sure if LA County “Stacks” bail or if they just go by the highest single charge.

If they stack, it’s near impossible to tell from the bail amount what the charge is/may have been. A judge can also issue a warrant and place any amount he/she feels fit.

Fun Fact #2:

All felony DUI bails are $100,000 ($30 seemed awfully low to me so I checked).

That’d be me and my blog. 😀

As they both mention China Unicom, it had to this the USFIA Steve Chen. The “L” would be “Li”, which was his Chinese name.

Nice digging up the EDGAR report. Forgot about that completely.

I looked up ASPAC and it’s listed as closed on Yelp. Address now belongs to various other businesses, so it is long closed.

Good thing I don’t drink at all. 😀

If there was no injury (i.e. misdemeanor DUI) do you still go to jail and sober up? Do you still need to be bailed out? Or it is “self-recognizance” thing?

Depends on the policy of the local jurisdiction. Most can and will be released after sobering or to an immediate family member who will take responsibility

There are now TWO class-action suits against Chen and USFIA. The one earlier reported (Superior Ct of LA, case #BC596792) was filed on Oct 5 by the Liu law firm on behalf of a “John Doe” plaintiff.

On the same day, the Scandura law firm also filed suit in Superior Ct of LA (case #BC596569) for an investor named Wei Geng who said she lost $32k in USFIA.

See here: lacourt.org/casesummary/ui/casesummary.aspx?

Scandura appears to know a lot about Chen’s modus operandi, as he handled a 2006 lawsuit against Chen and his MLM company Amkey. That case seems to have settled in 2007. (citation is U.S. District Court, Central District of CA, civil docket CV06-4731 AHM).

The new Wei Geng lawsuit explains how USFIA evolved from Amkey. It seems Chen looted Amkey by cheating its distributors out of their commissions.

Every time a distributor would set up a successful downline network, Chen would reassign the network to himself or his cronies, so they would earn the commissions and the original distributors got nothing.

Finally Amkey was a hollow carcass and then Chen changed his strategy, instead of using one single company, he set up more than 20 different companies to diffuse his assets and make it harder to trace them.

One of these, surprise, surprise, was USFIA. The poor old Amkey distributors who were still owed money, were told the debt had been converted to “units,” i.e. Gemcoins, which they would be able to cash in. Well, we know how THAT turned out.

Scandura also goes into details on some of Chen’s other holdings like that real estate company Ahome to launder his ill-gotten gains.

No wonder the FBI is interested in Chen, don’t need a crystal ball to see there maybe a RICO case in his future.

The allegations thrown to the Chinese press by victims said that Steve Chen had conned FOUR times… Amkey, NGNTalk, AFG, AND USFIA.

Amkey — nutriceuticals

NGN Talk — VOIP equipment

AFG — backed by real estate / REITs

USFIA — “backed by amber”

Amkey started in 2003, so this is has been around for a long time.

Amkey in China was total mess, according to old reports I dug up, promised the sun and the moon, with the stars thrown in for free, and it all crashed when Amkey never got the direct sales license… and lied about it all the way through the legislation and licensing process claiming they’ll be first to get it.

Not much details on the NGN talk, practically zero on the AFG stuff.

Wait, the Scandura case has a smaller case number. That would mean it was filed FIRST, right? 🙂 So Attorney Liu wasn’t *quite* right that he’s the first to file the suit? 😉

Yes, I believe you’re right, Scandera was first.

Direct link didn’t work, so here’s an alternative method.

lacourt.org/

→ Access your case

→ Case number

“View document images” required login and payment.

If anyone’s wondering why I’m not covering the USFIA class-action lawsuits, here’s why:

That’s from a filing today from the TelexFree Trustee.

I expect something similar will be filed against the USFIA class-action suits by the Receiver at some point in the future (obviously outside of a bankruptcy context).

Anyone, we have wechat groups which these people still use for continuing defrauding (over thousands).

If you want to join to check what’s going on, please let me know

Per filing with US District Court on Nov. 5, Steve Chen has taken the 5th Amendment and refusing to provide the SEC with details on his assets.

If he’s pleading the fifth, that all but confirms criminal charges are pending.

Guess we’ll be reading about it through the DOJ when the time comes.

The receiver filed his first report to the court on November 13. VERY interesting reading.

The receiver has recovered almost $20.5 million mostly from seized bank accounts. Also has taken control of real estate controlled by Chen and his cronies, including a hotel, a warehouse, that mansion where they held the champagne party, and that golf course property.

So, if the SEC was correct about Chen & USFIA stealing $32 million from investors, it seems like they might be able to recover quite a bit of that money.

Also the receiver’s report states:

Also there is a fascinating account of the raid on USFIA headquarters:

It seems Chen and his family are NOT happy about all of this, as the report states:

Think old Steve’s gambling days are over, they don’t have casinos in federal prison so far as I know.

Thanks for the heads up Fred, much appreciated.

There have been fews update from singapore USFIA here. Kindly share and i reckon these are fake. youtube.com/watch?v=ebmdI4QwSGk

^^ That’s just some dumbass in Singapore clinging desperately to hope.

Remember all the jackasses with “real news” after TelexFree was shut down? Same shit.

I’ll have a look into where USFIA litigation is actually currently at later this week. Will post an update.

AFAIK there is nothing to update. Receive filed a report last year, a new one may be due soon. It’s once every 3 months, right?

I was just browsing stuff when I am finding all sorts of **** left over by Gemcoin promoters… lots of abandoned websites… Pathetic, funny, and sad all at the same time.