Malaysian Prime Minister’s son linked to uFun, untouchable?

I have to give full credit to my readers for this one, as without their research there would be no story.

I have to give full credit to my readers for this one, as without their research there would be no story.

Two weeks ago now we saw the arrest of several individuals involved with uFun Club’s Thai operations.

Afterwards it was quickly established that uFun Club’s owners and upper management had fled to or were already in Malaysia.

From there they released statements professing their innocence, seeking to mislead uFun Club investors while they squirreled away invested funds to who knows where.

Those of us following the case has found it increasingly odd to observe a complete lack of regulatory action on Malaysia’s part.

Contrast this with Thailand’s authorities, who have done everything they can to seize millions of dollars uFun Club stole from investors.

Now it can be revealed that one possible reason Malaysian regulators are doing nothing, is because the son of the current Prime Minister appears to be involved.

The current Prime Minister of Malaysia is Mohammad Najib Abdul Razak. His son Mohd Nazifuddin has now emerged as a key player in the $1.7 billion dollar Ponzi scheme. operations.

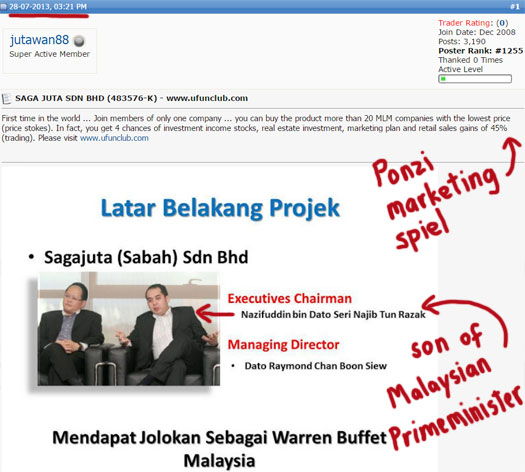

Nazifuddin’s name appears as a selling point in multiple Malaysian uFun Club presentations:

The links go as far back as mid-2013, when uFun Club was just starting. The scheme was initially sold as a real-estate investment opportunity, through the company Sagajuta (Sabah) Sdn Bhd.

A uFun Club marketing spiel from May 2014 reads:

UFUN Group Ltd is a company which triggered the idea of some Taikunproperty States Saga Million Shd.Bhd.

Together Dato ‘Dr Warren (Money Master) has been working with the company owners Sagajuta Sdn. Bhd Managing Director Datuk Raymond Tan Boon Siew and Executive Chairman Dato’ Nazifuddin bin Dato ‘Seri Najib bin Tun Razak in which they have a multi millionare One Borneo Sabah building, One Embroidery, One GateWay, Tuaran huge project and projek2 ago and has been completed.

UFUN Group Ltd in its early stages is as real estate agent only where he has worked at the company Saga Juta Sdn. Bhd act with promoting and selling property owned Sagajuta Sdn Bhd.

Sabah Borneo One such project, Knit One, One Likas, GateWay Tuaran to outside investors from China, Taiwan and Hong Kong, and received good response.

Another from August 2014 states:

COMPANY BACKGROUND

UFUN Group Ltd is a company that triggered his idea by Property tycoon ie a total of 6 people and founded by Dato ‘Dr Warren (Money Master).

They are multi millionare and has collaborated with the company owner Sagajuta Sdn. Bhd namely Dato ‘Raymond Tan Boon Siew and Cairman Dato’ Nazifuddin bin Dato ‘Seri Najib bin Tun Razak who built One Borneo Sabah, One Embroidery, One getway Tuaran and large projects.

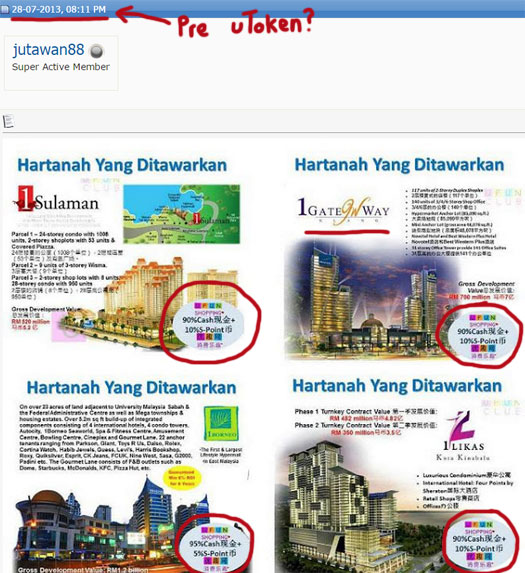

Prior to uToken, uFun Club and Sagajuta (Sabah) Sdn Bhd had their investors invest in “e-shares”:

UFUN CLUB cooperate with companies Sagajuta Sdn Bhd to create a business that uses e-share system recently launched on May 27, 2013.

The owner of the company Dato Raymond Chan Boon Siew and Chairman Nazifudin Bin Dato Seri Najib Tun Razak.

“E-shares” obviously sounded too Ponzi’esque, hence the uToken facade was brought into the picture.

As per the image above, Mohd Nazifuddin is credited as the Executive Chairman of Sagajuta (Sabah) Sdn Bhd.

Sagajuta (Sabah) Sdn Bhd are a property developer, with several projects currently in the works.

And, if they weren’t already, here’s where things get murky.

Back in 2013, uFun Club investors were openly advertising investment in uFun Club being tied to 1Gateway Plaza.

This development should be instantly recognizable to uFun Club investors and those following the case, as there’s a purported agreement set to be signed this Sunday.

The agreement is to establish a partnership, which is supposed to facilitate the investment of million of dollars of uFun affiliate funds into the development.

Published less than 24 hours ago on a major uFun Club Facebook page:

Over 2000 Utoken members from around the world will be attending the Gateway Klang Signing Ceremony starting today in Kuala Lumpur, Malaysia.

And so what started as a property-development based Ponzi scheme, at some point morphed into the uToken pseudo-cryptocurrency $1.17 billion dollar scam uFun Club is today.

So with all of this taking place right under the noses of Malaysian regulators, why has nothing been done?

The answer to that question brings us back to Mohd Nazifuddin, the Malaysian Prime Minister’s son.

uFun Club has clearly laundered money through Sagajuta (Sabah) Sdn Bhd dating back as far as 2013. How many millions in stolen Ponzi funds have flowed between these two companies? Who knows.

That’s something Malaysian regulators should be investigating, yet still, even with uFun Club on the Central Bank of Malaysia’s blacklist, the lack of inaction sticks out like a sore thumb.

As per a Thai news report that aired yesterday,

It’s a very sensitive issue.

(excruciatingly awkward pause)

Well we hope that um, the police will take the appropriate actions.

Hope indeed.

I mean really, if a bunch of BehindMLM readers and this author, who can’t string a sentence together in Malaysian, are able to put all of this together, what’s the bet that Mohd Nazifuddin’s involvement in uFun Club is an open secret among Malaysian police?

And sons of Prime Minister’s tend to have powerful connected friends. How far does the integration of uFun Club with the Malaysian construction industry go? Who are they key players? What’s really at stake here?

And where the hell are the Malaysian media in all of this?

One BehindMLM reader provides a possible answer:

There have been cases of Malaysian newspapers beens (sic) sued into bankruptcy (suing newspapers/news portal is quite common in Malaysia) by notable public figures (currently in an unrelated case the PM is demanding an apology with retraction from another news portal and are going to sue if the demand isn’t met) before.

As a result the news media here are quite reluctant to publish stories that might insinuate anything without more solid backing.

Until the authorities actually do anything they will only do cursory stories based on republished sources. Only after confirmed LE action the media attention to the level in Thailand may actually begin.

Is investigative journalism really that dead in Malaysia?

At the time of publication the only news articles I’ve seen published by the Malaysian media do nothing but regurgitate what has been reported in Thailand.

There has been no breaking news on uFun Club out of Malaysia to speak of.

We of course can only dig so far, with Malaysian regulators and/or the media having to lead the charge at some point. Thai media appears to have kickstarted the conversation, with a thorough investigation into the flow of money between uFun Club and Sagajuta (Sabah) Sdn Bhd needed urgently.

Who are the main profiters? Who is pulling the strings behind puppets like Daniel Tay and General Athiwat Soonpan? Are other Malaysian “untouchables” involved???

Sadly the end-result of inaction by Malaysian police and regulators is that some of the culprits known (those unknown to us have already likely fled), have now purportedly fled Malaysia.

Assistant national police chief Lt-General Suwira Songmetta said police were trying to track down Malaysians Tay Kim Leng, 40, Lee Kuan Ming, 38, and Won Sing Hua, 42, who were facing arrest warrants for their role in UFUN’s alleged public fraud.

“We have heard that Lee and Won have already fled Malaysia,” Suwira said.

Bear in mind that this is news being reported in Thailand, with zero coverage from the Malaysian media.

uFun Club was added to the Central Bank of Malaysia’s black list back in July of 2014, with regulators likely first aware of the scheme around that time.

With $1.17 billion dollars in stolen investor funds on the line, still they’ve done nothing.

Sounds to me like Malaysian regulators are hoping all of the uFun Club culprits flee, so they can then wash their hands of the scheme and claim they had no idea what was going on.

A Thai woman in her 40s said her friends introduced her to UFUN and she ended up investing Bt1.2 million.

“I was told that I would be able to earn returns of between Bt50,000 and Bt60,000 a month. But after I made the investment in December, the return rate was much different,” she said.

She said when she tried to take back the investment, the firm told her she could not get the cash back but promised to give her gold or a car instead.

“I agreed to such conditions but the firm still has not provided me with the gold or a car,” she claimed.

Another woman, identified only as Sam-ang, said she invested Bt100,000 in UFUN about five months ago.

“Since I made the investment, I’ve never got any returns.

“When I called the [UFUN] agent, she turned off her cell phone,” Sam-ang said.

I said it yesterday and I’ll say it again today: What a disgrace.

Footnote: Sensitive issue or not, readers are encouraged to do their own research on the contents of this article.

Useful search terms include “Sagajuta (Sabah) Sdn Bhd” “ufun” “1gateway klang” “Nazifuddin” and “Mohd Nazifuddin”. Various combinations of the terms should provide you with all the information you need to verify what has been published here.

Any additional information from Malaysian readers concerning this matter would be appreciated. It hasn’t been easy to put together due to the language-barrier, but I’m pretty confident everything above is accurate.

it’s extremely stupid of ufun to have a gateway klang MOA signing with sagajuta on sunday the 26th.

they will just confirm to the world, that PM najib’s son of sagajuta is their friend and partner.

getting 2000 people and the media, to witness the signing, is hardly a way to sweep matters under the carpet.

maybe the program will be cancelled tomorrow at the end moment citing uh, ‘concerns of malayasian authorities’?

does the malaysian govt have an opposition party, in parliament?

if the press and police are running scared, this is such a fine opportunity for the opposition to question PM najib in the media, and earn brownie points!

recently we heard from ufun affiliates, that utokens would be converted to unit trusts/mutual funds.

in relation to this, another bigshot name that has emerged from malaysia, is Dato Haji Ahmad Kamal, who is being credited as the CEO of utoken.

in jan 2015, kamal presided over the UToken Global Prestige Seminar held at Chengdu, China.

kamal is the director of integrated rubber corporation Bhd, which is a listed company on the kuala lumpur stock exchange.

in.reuters.com/finance/stocks/officerProfile?symbol=IRUB.KL&officerId=454437

facebook.com/UtokenLatestNews/photos/a.1540449979504751.1073741828.1540421409507608/1600915846791497/

Dato Haji Ahmad Kamal is the director of Amanah Raya Capital Sdn. Bhd. this a private company which offers financial products.

so, it should come as no surprise, that ahmad kamal has offered his services as CEO of utoken, and gets to convert investor funds into mutual funds/unit trusts, or whatever they are upto in this latest reincarnation of the ufun business.

I think that is not Ufun Ahmad Kamal. The real Ahmad Kamal can be viewed here: facebook.com/BlockBuzzPowerTeam#!/BlockBuzzPowerTeam

the ahmad kamal you have linked to seems to be an ordinary ufun affiliate. ‘ahmad kamal’ is not a unique name.

see this link of a program in china in jan 2015 :

facebook.com/UtokenLatestNews/photos/a.1540449979504751.1073741828.1540421409507608/1600915846791497/?_rdr

the full name of this gentleman is “Dato‘ Haji Ahmad Kamal bin Abdullah Al-Yafii’

surprisingly amanah rayah capital is a subsidiary of amanah rayah berhad, which appears to be a malaysian govt owned ‘trust’.

with the prime ministers son, being behind the curtain in ufun, it is not surprising that he has the wherewithal to drag govt entities into the scam. this is getting murkier and could really blow up in PM najibs face.

fully or semi owned govt trust’s and their subsidiaries, planning on converting ponzi money to financial products, that too over a billion dollars worth, is a political disaster waiting to happen!

can someone do a double check of dato ahmad kamal and the amanah raya capital and utoken connection, to ensure i have not misunderstood anything?

Then your info is correct.

According to Chinese paper in Malaysia Nangyang, kpdnkk just launched its investigation into the UFUN subsidiaries in Malaysia. However, they’re being pretty low-key, even specified that they at the moment have no plan to seal the compan(ies).

Another interesting note: there’s apparently UFUN folks are now denying that they EVER called a press conference in Malaysia and claimed Tay will be there.

They claim it was called by someone as a hoax, and the press conference had always been planned for Thailand. I got this tidbit at the end of a Chinese report.

There are multiple sources in Chinese that claimed it’s none other than Zhang Jian that’s the missing “Thai” suspect, but they seem to be copying each other.

Apparently the couple had somehow got out of their jail in Phuket and disappeared. However, there’s no confirmation of that.

BTW, Oz, “August 2015”? Really? 😀

Argh damnit I thought I had everything right!

Told you I was tired. Been a hell of a week. Looking forward to some downtime tomorrow.

PS. I saw that Chinese report too. Translation made no sense so I left it.

Sounds like they’re reluctantly investigating some side-companies. Nevermind the $1.17 global Ponzi scheme staring the right in the face.

the ufun philippines FB page is reporting that ufun’s thailand ‘problem’ is almost over.

yeah considering binapuri has handed over all the units of the marina resort to the police, and the thai police are reporting progress with their investigation, and the arrestees are still in jail, i guess one could read that as ‘problems getting over’.

these sneaky affiliates are just not letting out whether Anyone From Management is at the event. i guess it’s not important.

as far as i can see, the event is in an enclosed space, and i’m not counting 2500 people there.

boss, your leave application for sunday stands cancelled.

tomorrow is the klang signing event. you have to report on who signs the documents, and take pictures of the malaysian police smiling.

Ah yeah that gateway klang thing going down isn’t it.

Maybe they’ll be kind and cancel it overnight.

If that’s the event with the banquet tables, there was a few hundred tops.

Those tables sit 8-10 a piece and half the chairs were empty.

integrated rubber corp also had till 2013 a director on it’s board named Dato’ Daniel Tay Kwan Hui. this is a documented semifamous person who may be around 60 years of age.

i don’t know how malaysian names and honorifics work, but i do know that ‘dato’ can be inherited.

it seems too much of a coincidence that dato haji ahmad kamal has worked closely in integrated rubber with a dato daniel tay kwan hui, and now dato haji ahmad kamal is associated with ufun, which has dato daniel tay associated with it.

is the name ‘dato daniel tay’ fairly common in malaysia? could there be some ‘familial relation’ between dato daniel tay kwan hui and dato daniel tay of ufun?

someone who understands how ‘names’ in malaysia work, could please explain?

chinese christian malaysians usually adopt a western name along with their chinese name. so ‘dato daniel tay kwan hui’ would translate to:

dato = honorific

daniel = western name

tay = family name

kwan hui = personal name

dato daniel tay of ufun, has the real name ‘tay kim leng’, so he shares the western name and family name, of dato daniel tay kwan hui, of integrated rubber.

there is Something Here! Help!

daniel tay and eddy tan, are out in the open in malaysia, kuala lumpur.

today evening they arrived at the ufun event being held at a hotel in kuala lumpur.

so, now we know that ufun has the blessings of malaysian govt and regulators and police.

thai police just got slapped in their face by malaysia. don’t be expecting any cooperation from malaysia moving forward.

this is unbelievable. it is more than a disgrace, it is a whole country protecting a ponzi scheme, due to political pressure. how can this Happen in this day and age?

facebook.com/UtokenForum/videos/952375721469770/

Shame.

So the face of a $1.17 billion dollar Ponzi scheme is just waltzing around in public, signing agreements that will see stolen funds laundered through Malaysian construction firms.

And he has a warrant out for his arrest too.

Hang your heads in shame Malaysian authorities. This is a disgrace!

ufun has gone from selling e-shares to utokens and now onto some financial products. they barely have any investments or revenue coming from any projects. it’s as clear as day that all revenue is generated by member investment. in which language is it NOT a ponzi?

malaysia has to remember that they have taken their ponzi international. yes, this is a ponzi coming directly from the current govt of malaysia. if it grows now, it will implode sooner or later.

we have seen how massive schemes like telexfree or zeek grew fast and furious, but were out of funds within an year or so.

i’m already worried about how malaysia will look the world in the eye, when this national ponzi scheme of theirs collapses.

I’m surprised Malaysian police didn’t offer Tay an escort.

One officer on each arm is all that parade needed.

On the funds side of things, and assuming Malaysian regulators continue their current trajectory of inaction, we’ll probably see a collapse before the year is out.

All the plebs madly reinvesting at the moment will start cashing out in the 2nd half of 2015. Only then will they realize the well has run dry.

God help the department charged with cleaning up that mess.

well, tay does have some security around him in that video. maybe the police came in casuals instead of uniform , to save themselves some embarrassment 🙂

we already have reports of people not getting their ROI’s and FB comments about things slowing down.

as if ponzi schemes ever last! even the malaysian PM’s son cannot will a ponzi to last forever.

Sinchew website: news.sinchew.com.my/node/420593?tid=73

what’s wrong with this iskandar fellow?

which recognized virtual currency in this world, can evolve from internal buying and selling?

as a deputy director does he not does owe it to people to Educate Himself?

normal citizens, often do not know, and can get carried away by the whole ponzi/money/love, amusement park ride, but if deputy directors of the Trade and Consumer Department [malaysia], gets stupid himself, who’s going to protect people from their own silliness?

malaysia is not ‘truly asia’, as they bang about in tourism videos. malaysia is a third world country which has no independent institutions of governance in place. malaysia is a banana republic:

yeah.

2nd Chinese report is repeating mostly the same:

kwongwah.com.my/news/2015/04/24/11.html

These guys are hot on UFUNS tail. I have been reliably told that they were responsible for initiating the latest police investigation and raid on UFUNs HQ in BKK.

facebook.com/JusticeAlwaysLate

I cannot read Mandarin so I have to sift through using google translate but the guys there occasionally translate things when asked, which is great.

The western sounding name probably is a nickname or a “business name”. I don’t think it’s related to religion.

Dato’ Daniel Tay = Tay Kim Leng

Tay / Tae = family name

Kim Leng = personal name

Daniel / Taniel / Danial = “business name”

Update: According to this Chinese news report, filed 11pm on April 25th, they weren’t able to get in contact with Mohd Nazifuddin.

Will probably know more tomorrow as news of the Prime Minister son’s involvement spreads.

ch.therakyatpost.com/%E5%9B%BD%E5%86%85%E7%84%A6%E7%82%B9/2015/04/25/%E6%B3%B0%E8%AD%A6%EF%BC%9Aufun-%E4%BA%8C%E9%AB%98%E5%B1%82%E9%80%83%E7%A6%BB%E5%A4%A7%E9%A9%AC/

The Rakyat Post do have an English website, but unfortunately there’s no English reports on uFun Club.

Interesting, are they citing local news? They are claiming that Thai DSI has handed over a list of 26 names to Thai Police, basically a “most wanted” list. It may not be online yet.

I was looking through their earlier stuff, and they basically said that Thai police is barking up the wrong tree about Zhangjian.

Apparently the missing wanted man, Arthit, tried to obtain a quote for large qty of some sort of juice in Bangkok at a certain distribute, quote only, a while back.

Then UFUN suddenly started claiming to be a distributor of that juice, but no orders were ever placed. And this Arthit speaks Thai, and Zhangjian does NOT speak Thai.

But here’s the real elephant in the room… According to Thai police, they notified Malaysian Police back on 16-APR

facebook.com/JusticeAlwaysLate/photos/a.419929838185892.1073741828.419828431529366/428906090621600/?type=1

Kasey stop finding me stories to cover! I’ve only just started looking into the World Ventures stuff. Give me a minute!