Trage Tech securities fraud C&D & 500K fine from Georgia

Trage Tech, aka Trage Technologies, has received a securities fraud cease and desist from the Georgia Commissioner of Securities.

Trage Tech, aka Trage Technologies, has received a securities fraud cease and desist from the Georgia Commissioner of Securities.

The Commissioner’s order also cites Eric Ture Muhammad, a serial fraudster and Trage Tech promoter.

An investigation by the Georgia Commissioner revealed;

Trage began operating in early 2024 and is now offering investment in an automated cryptocurrency arbitrage trading program that purportedly pays lucrative profits on a daily basis.

Trage and its principals and promoters … are touting the legitimacy of Trage by claiming it is registered with the United States Securities and Exchange Commission.

In truth and fact, Trage is not registered with the United States Securities and Exchange Commission.

The Commissioner has found grounds to conclude that Respondents may have engaged in act or practices constituting violations of the Georgia Uniform Securities Act of 2008.

[Trage Tech’s] crypto arbitrage investments are securities as that term is defined in [the] Official Code of Georgia Annotated (OCGA).

Respondents are violating OCGA by offering securities for sale in Georgia at a time when the securities are not registered with or permitted by the Securities Commissioner.

Respondents are engaging in fraud in connection with the offer for the sale of securities in violation of OCGA.

Respondents named in the Commissioner’s December 16th order are:

- Trage Technologies

- Grame Gary Hearn

- Michael “Mike” Holoway” and

- Eric Ture Muhammad

The Commissioner’s order, as it applies to the above Respondents, is as follows:

It is hereby ordered:

- Trage Technologies immediately cease and desist all violations of the Georgia Uniform Securities Act of 2008

- Trage Technologies immediately cease and desist from offering for sale any security in Georgia until the security is registered with the Commissioner of Securities or is offered for sale pursuant to an exemption from registration under Georgia Uniform Securities Act, as amended

- Michael “Mike Holloway immediately cease and desist all violations of the Georgia Uniform Securities Act of 2008, as emended.

- Graeme Garry Hearn immediately cease and desist all violations of the Georgia Unfiform Securities Act of 2008, as amended

- Eric Ture Muhammad immediately cease and desist all violations of the Georgia Uniform Securities Act of 2008, as amended

Respondents Trage, Holloway and Hearn jointly and severally, pay a civil penalty in the amount of five hundred thousand dollars ($500,000).

Respondent Eric Ture Muhammad pay a civil penalty in the amount of five hundred thousand dollars ($500,000).

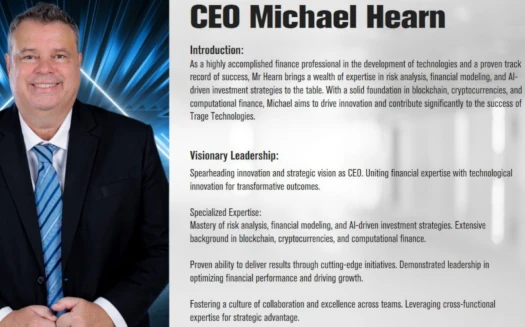

As researched and reported in BehindMLM’s TrageTech review, Michael Hearn is a fictional CEO played by Thailand-based UK expat Daniel Poole.

After BehindMLM’s review was published in August 2024 outing Poole, TrageTech rolled out “Michael Holloway”, an Australian expat also believed to be residing in Thailand.

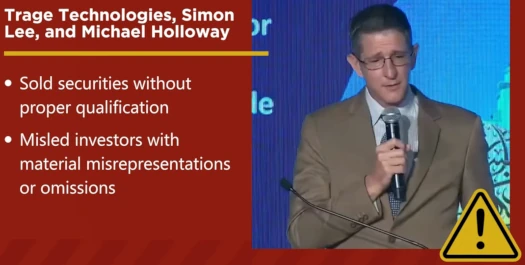

The above slide is from a separate Trage Tech securities fraud desist and refrain order, issued by California’s DFPI in November 2024.

Texas also issued a Trage Tech fraud enforcement order citing Eric Muhammad in October 2024.

Muhammad is not registered in any capacity with the Georgia Secretary of State and has never made filings with the Commissioner to offer or sell securities.

Muhammad is currently under an Emergency Cease and Desist Order issued by the Commissioner on January 22nd, 2024 and is barred from conducting broker-dealer agent activities.

The January 22, 2024 Order ordered Muhammad to pay a penalty of five hundred thousand dollars which is currently in default.

Muhammad currently is promoting Trage and its investments in digital asset trading, in violation of the January 22, 2024 Order.

The Division subsequently discovered that Muhammad is involved with several pyramid schemes and Ponzi schemes since the entrance of the January 22, 2024 Order.

On May 13, 2024, the Commissioner caused a subpoena to be issued to Muhammad.

The subpoena requested documents and records relating to Muhammad’s violations of the Georgia Securities Act, [and] requested Muhammad to appear to provide testimony under oath.

The deadline to respond to the subpoena was June 14, 2024.

On June 13, 2024, Muhammad stated in an email to Division enforcement staff, “I do not have any documents”.

On June 14, 2024, Muhammad appeared remotely to provide testimony under oath. Muhammad did not provide any documents requested in the subpoena.

When asked if he would supplement his testimony with documentation he stated, “If I felt the need, I’d take that under legal advisement.”

In testimony under oath, Muhammad was questioned about several financial deposits sent to him from investors.

Muhammad stated the Division would have to ask the individuals directly why they would send him funds.

In the course of the investigation, the Division discovered that investor funds were used to pay for Muhammad’s son’s school tuition.

When asked about this during testimony under oath, Muhammad told the Division he was “suspending” the testimony.

During the testimony under oath, Muhammad was asked if his financial statement were available for the Division to review.

Muhammad stated, “[N]othing available to you”. He went on say, “I just don’t have them to provide.”

The Division asked Muhammad about his Quickbook account.

Muhammad stated, “I might have. I don’t know.” However during the course of the investigation, the Division discovered that Muhammad had a Quickbook account bookmarked on his browser that he would share during his promotional activities.

During the testimony under oath, it was determined that Muhammad has actively promoting multiple investment schemes.

Muhammad exited the testimony under oath while still being questioned.

The Division attempted to reschedule Muhammad to resume his testimony but he failed to respond and failed to appear for additional testimony.

On September 9, 2024, Muhammad posted a video conference call and made several misrepresentations to investors participating in the video conference call.

Muhammad misrepresented the settlement terms of the January 22, 2024 Order and told investors that he had reached a settlement with state securities regulators.

However, Muhammad did not enter into a settlement with any state securities regulators. The January 22, 2024 Order issued on Muhammad is still active.

Attorneys for Muhammad’s co-Respondents in the January 22, 2024 Order confirmed that they did not represent Muhammad and that they were not negotiating that settlement on Muhammad’s behalf.

Muhammad stated in a video to investors and potential investors;

“Before this was settled I had to appear before the Secretary of State of Georgia by way of subpoena.

I told them very clearly. I asked them did they know anything about hell meaning the condition or the place that subscribe to it.

Folks, I said it’s always called hot, it’s always called full of fire. It’s talked about with unbearable heat and all that good stuff that’s hell, in closing comment before I turned my back on you, I am going to tell you it will be a good day in hell before you get anything out me so much as a dime or a little as a penn.

This fight you’re trying to fight a false fight that doesn’t belong to us, it belongs to god that backs us”.

While Muhammad appeared for testimony under oath remotely, per his request, he never made the above statement or any iteration of the above statement at any time to Division staff.

Several times during the course of the investigation, the Division urged Muhammad to seek the counsel of a qualified securities attorney to advise him on how his actions constitute violations of the Georgia Uniform Securities Act and his legal obligations under the subpoena.

Despite knowledge that his actions were in violation of Georgia law, Muhammad began promoting Trage.

After misrepresenting the settlement terms to investors on the September 9, 2024 video, Muhammad introduced investors to Respondent Trage.

Muhammad begins the introduction of Trage by listing the previous illegal schemes he promoted which had been, as he claims, “snuffed” by regulation.

Muhammad continues by reading a boiler-plate “trading disclaimer” which states that trading in financial instruments carries risk.

However, Muhammad proceeds to make guarantees about the investment stating that Trage has a monthly return on 36% on an investment of $10,000.

Muhammad tells investors on the September 9, 2024 video that “you might want to keep that same line of succession coming from GSB”.

GSB refers to Gold Standard Bank, the parent company of GSPartners.

GSPartners was a fraudulent investment scheme that Ture promoted.

GSB Owner Josip Heit is currently in the middle of a settlement with US authorities, through which he’s agreed to pay back GSPartners investors.

The Georgia Commissioner jointly fined Muhammad and several GSB Respondents $500,000 back in January. This is the “fine in default” previously referenced by the Commissioner above.

Muhammad further states to investors “when that money comes back,” referring to the GSB settlement, “it’s going to need a home to work for you.”

Trage Technologies collapsed again on December 12th. The company disabled its website and locked investors out of their accounts.

BehindMLM noted TrageTech originally collapsing in late October. This collapse also saw TrageTech pull down its website.

As of November 2024, SimilarWeb tracked ~293,000 visits to TrageTech’s website. This represents a 72% reduction month on month.

The US is/was the top source of traffic to Trage Tech’s website, representing 75% of all visitors for November 2024.

The Georgia Commissioner has pegged Trage Tech investor losses at “over $7 million”.

Eric Ture Muhammad continues to violate the Commissioner’s orders. In various December 2024 social media posts Muhammad can be seen promoting RideBNB through “Team Believe”:

Muhammad promotes RideBNB under the guise of “cryptocurrency training”. In actual fact RideBNB is an illegal MLM crypto gifting scheme.

Muhammad has until January 15th, 2025 to pay his new Trage Tech $500,000 fine.

It remains to be seen what action the Georgia Commissioner will take next if the fine, like Muhammad’s previous $500,000 GSPartners fine, also goes unpaid.