The Financial Commission distances itself from Anna Becker

![]() The Financial Commission is feeling the heat, prompting the independent organization to distance itself from Daisy AI’s Anna Becker.

The Financial Commission is feeling the heat, prompting the independent organization to distance itself from Daisy AI’s Anna Becker.

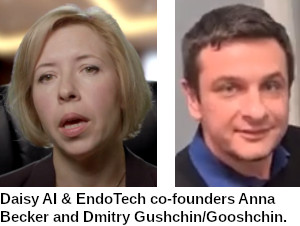

Daisy AI is an MLM crypto trading bot Ponzi launched a few weeks ago. The scam is run by co-founders Anna Becker and Dmitry Gushchin.

Daisy AI is an MLM crypto trading bot Ponzi launched a few weeks ago. The scam is run by co-founders Anna Becker and Dmitry Gushchin.

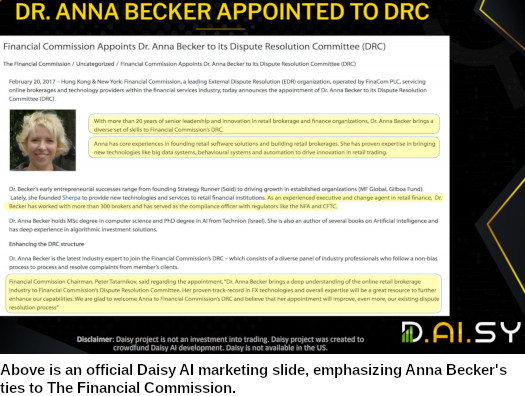

Before she got into launching Ponzi schemes, Becker was a member of The Financial Commission’s dispute resolution committee.

Despite the official sounding name, The Financial Commission is

an independent self-regulatory organization and external dispute resolution (EDR) body, that is dedicated specifically to Forex.

In other words for the purposes of due-diligence into Daisy AI, Becker’s ties to The Financial Commission are meaningless.

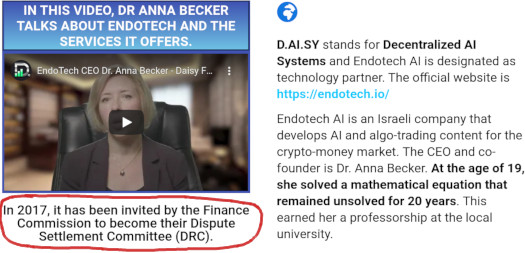

This however hasn’t stopped desperate Daisy AI promoters using The Financial Commission in their marketing.

The implication being that Becker’s ties to The Financial Commission mean she couldn’t possibly be running a Ponzi scheme.

Daisy AI themselves encourage this nonsensical narrative in their official marketing materials:

Here on BehindMLM it took about a week for someone to use The Financial Commission to imply Daisy AI’s legitimacy.

Perhaps weary of having their name associated with the MLM crypto Ponzi space, The Financial Commission has put out a statement clarifying their relationship with Becker:

In response to numerous inquiries regarding Dr. Anna Becker’s affiliation with the Financial Commission, the Financial Commission hereby confirms that from 2017 until 2019 Dr. Anna Becker served as a member of the Financial Commission’s Dispute Resolution Committee.

In March 2019 Dr. Becker resigned from this position and is no longer affiliated with the Financial Commission.

The Financial Commission cannot evaluate or recommend any investments or offers made by any projects purporting to involve Anna Becker or any other former or current member of the Dispute Resolution Committee.

The use of The Financial Commission It goes hand in hand with people mistaking The Financial Commission for a regulatory body, and I imagine asking them whether Daisy AI is a legitimate investment opportunity.

That evidently falls outside of what The Financial Commission does, which is provide a non-legally binding dispute resolution service for member trading firms.

The Financial Commission does provide a “warning list” on its website. This however is just a list of trading companies they’ve received complaints about who haven’t paid them membership fees.

That said, here’s how The Financial Commission identifies companies it places onto its warning list:

- Ponzi scheme, Pyramid Scheme, or a High-Yield Investment Program

- Theft or misappropriation of funds

- Fraudulent or unlicensed offering

- False or misleading statements about a company

- Other fraudulent conduct

That criteria fits Daisy AI to a T.

I know if I was running a supposedly reputable organization that was capable of identifying high-yield investment programs, aka Ponzi schemes, I’d be quick to issue a warning.

Even quicker if said company was using my organization to market a fraudulent investment opportunity and I was fully aware of it – which appears to be the case with Daisy AI and The Financial Commission.

What makes you think you know all of this? How can you even say all of this? Where did you get your info? Also I noticed your promoting trading strategies as well?

What proof do you have this is a scam??

Know all of of what? I’ve linked to every source referenced in this article.

No.

Daisy AI’s own business model. Recycling invested funds to pay ROI withdrawals = Ponzi scheme. Then there’s securities fraud on top of that.

Whether “all MLM are scams” is neither here nor there with respect to Daisy AI due-diligence.

You Are Saying what you don’t know. Go to YouTube and watch proofs of live ongoing trading shown by Dr Anna Becker on Binance and We also See it on our Dashboard.

Bloggers with Fake news seeking attention. Lol.

YouTube is proof of fuck all.

Social media is not a substitute for legally required registration with financial regulators and periodically filed audited financial reports.

MLM + securities fraud = Ponzi scheme. Sorry for your loss.

Ah, records in the dashboard (backoffice) and youtube as “proof” of a real trading!

How many times we saw these proofs … which turned out to be bogus?

Will it be the same case here? I think so.

Come’n braindead and slimy Ponzi promoters and “coaches” (thieves)!

(Even if this wasn’t a scam) Yeah Youtube and Webpages have totally never ever been faked.

You must be new to being an adult and being allowed to use a computer.

What proof of scam are you talking about?

There is no real daisy AI. If there is they should have paid 600% to all the investors up to this day April 26.

They keep on asking for more people to join and invest but no small investor had payout any piece of money from this project only those promoter and recruiter…

Its A SCAM.

I invested $100 in Feb 2020.not had a penny back. there is nothing on the dashboard that you can interact with.

it tells you you have x amount of dollars ready for withdrawal but no way of doing it..

beginning to think big SCAM GLAD I WAS ONLY STUPID ENOUGH TO LOSE $100.

Not that this implies a legitimacy towards the companies connected to Dr. Becker, but it seems to me quite specious that the Financial Commission provides a warning list of companies that it relegates to the various categories reported, only after these companies no longer pay the membership fee.

If they were scams the Financial Commission knew even before, as well when these companies was paying their dues.

Its no-more-fees-revenue-awakening, sounds a little dumb, IMHO.

So, I would not define the Financial Commission as an honest source from which to obtain impartial judgments.

What do you think?

I think none of that has to do with The Financial Commission not wanting itself to be associated with Ponzi schemes.

If you have a problem with The Financial Commissions fee structure take it up somewhere else.

I DGAS about Financial commission or Daisy or Endotech. (Ozedit: cool, bye.)

I myself invested $12700 in January 2021 and so far it has felt like a complete scam, before I joined they make as if you are going to make such a huge ROI, but so far the AI trading has been a complete joke.

They have no customer support incase of any issues and for 90% of the time the withdraw button to withdraw your profits is not working or not even visible.

I hope these people get their karma! COMPLETE SCAM!!!! It truly feels as if it is just a matter of time till they disappear with all the investors money.

This review was done on Jan. 26, 2021. It is now Aug 22, 2021.

I would say it is a little old. Plus I looked up Behind MLM and you don’t have great reviews either

1. This isn’t a review. What happened happened, regardless of how long after the fact you’re reading about it.

2. BehindMLM reviews = meaningless. We’re not an MLM opportunity.

3. Daisy AI is still a Ponzi scheme. Sorry for your loss.

Thank you for your contribution. Here’s a cookie.

So, anyone have any updates on the DAISY model? Have people been able to withdraw profits? Has customer service improved? How has KYC crackdowns affected anything?

I’m being “persuaded” to sign up and shown 110% returns historically, but any REAL stories to share?

Thanks

Latest update: Daisy AI is the same Ponzi scheme it was when it launched.

Bagholders trying to rope you in with numbers on a screen they can’t cash out unless you give them money.

hello I can’t say for sure that is not a Ponzi but a good friend of mine invested in 2021 about 13000 usd and already successfully withdrawn about 11000 usd.

Regardless of how much your friend has stolen through EndoTech/Daisy AI/Daisy Forex, it’s still a Ponzi scheme.

Yeah,

I know a guy who put in a lot and has made 200k in the last year and a bit.

Cool. Regardless of how much your guy has stolen, Daisy AI and EndoTech are still running a Ponzi scheme.

To date: (5/9/2023)

D.AI.SY has paid out $139,655,126.47 in rewards to the members who have provided funds for continued testing of AI capabilities in the ForEx trading arena.

Additionally, D.AI.SY is being audited by Ernst & Young, one of the big 4 in accounting / auditing / consulting / tax services.

1. If you want to make financial claims about DAISY’s Ponzi scheme please provided audited financial reports filed with regulators.

2. Ernst & Young has most definitely not audited DAISY’s Ponzi scheme. Feel free to prove me wrong with Ernst & Young audits filed with financial regulators.

Try harder scammers.

Hahahahaha

Hahahahaha

Hahahahaha

No

Daisy is a scam. One of the first players at the Top is Angel Lee, he has already been IN JAIL for financial fraud.

After the very beginning you don’t see him anymore, he has a british guy who is his front man, but he is behind the scenes.