Sports Trading BTC collapses, Global Credits Network reboot

Less than two months out from launch, Sports Trading BTC has collapsed.

Less than two months out from launch, Sports Trading BTC has collapsed.

Owner James Ward has announced a Global Credits Network reboot.

Sports Trading BTC was a simple enough Ponzi scheme.

Investors invested bitcoin on the promise of 0.25% to 2% daily returns, which Ward claimed were generated via sports trading.

Had that been the case, Sports Trading BTC wouldn’t have collapsed. Yet here we are.

In a December 1st webinar titled “The Future of STB”, Ward (right) attempted to explain why Sports Trading BTC collapsed.

In a December 1st webinar titled “The Future of STB”, Ward (right) attempted to explain why Sports Trading BTC collapsed.

[4:33] A lot of people are like, “Why are you changing the company so… you just launched on October 1st. You know, why didn’t you make any of these decisions beforehand?”

Well, the truth of it is this … we had no idea that we were gonna get tossed into every single category that every other company that accepts crypto falls in.

[5:44] With the new branding, with the new company, with the new direction, the one thing that we wanted to do is separate ourselves from any of that stuff that is out there.

Although Ward doesn’t address securities head on until later in the webinar, the “stuff” he’s referring to is securities fraud.

It is currently not illegal to offer a passive trading investment opportunity in the US, provided you do it legally by registering with the SEC.

A big part of that is having to disclose audited accounting that proves to the SEC, investors and the public that an MLM company is actually doing what it claims it is.

In the case of Sports Trading BTC, that would be paying returns with actual trading revenue.

Instead of proving that though, Ward opted to pull the plug. Keeping in mind recycling newly invested funds constitutes a Ponzi scheme, make of that what you will.

[7:12] If you allow someone to earn a commission of any type without having any activity whatsoever, it classifies you as a security.

We’re not trying to be a security. We’re not a security, we’re not an investment.

If I can just interject here, Sports Trading BTC’s passive investment scheme was very much a security.

Not continuing to commit securities fraud however, is a large part of why Sports Trading BTC collapsed.

[7:24] So from our perspective, we thought that we … needed to make a change as soon as possible.

Now that change that we made, it happened almost overnight. It effected many people out there and we didn’t communicate it as properly as we should of.

That change? Scrapping passive returns that Sports Trading BTC was literally built around.

[8:35] Since when did network marketing become that you just sit there and earn?

Oh I dunno… probably around the same time people like James Ward started marketing opportunities that promised exactly that?

[8:42] I don’t ever remember that until just a couple of years ago when this started happening and people thought that they could just earn for nothing.

I’m not bashing on any companies out there, I’m not bashing on you personally if that’s your philosophy; I’m just simply telling you that where we’re coming from as a company is one that we care about our people, we care about the direction that we’re going in as a company, and we want to be here to serve you, right?

We want to be here to be able to protect you. We don’t want to sit here and three months from now be shut down, when something that we can control is as simple as making a simple change to our comp plan.

Ward downplays the changes made under Global Credits Network as “minute”.

Kinda sounds anything but if you ask me;

[12:00] We have to stop marketing this as a passive opportunity.

If you are using the word passive, if you are using the word investment, investor, um rate of return – any of that stuff, you may as well just go to another company because the reality is you’re gonna get us into serious trouble. And you might even get yourself into serious trouble.

Under Global Credits Network’s business model, all affiliates will be required to sell 0.01 (BTC?) in volume to a recruited affiliate or retail customer.

This requirement however is waived for existing Sports Trading BTC affiliates… until December 2020.

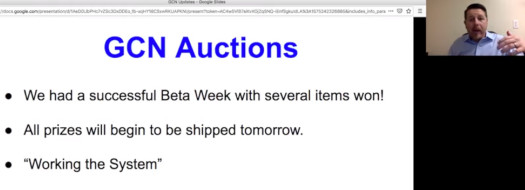

Global Credits Network’s credits appear to have something to do with penny auctions. The sports trading investment opportunity is gone.

Penny auctions are terrible for consumers. For each item sold only one bidder receives the item. Everyone else loses money.

Penny auction companies and owners however profit handsomely.

Legalities aside, Sports Trading BTC affiliates were undoubtedly sold on a passive investment opportunity.

The Global Credits Network is a penny auction reboot. Chalk and cheese.

From a regulatory perspective, again securities fraud aside, Ward should be refunding every Sports Trading BTC investors whatever they invested.

After that and assuming a regulator doesn’t go after him for running a Ponzi scheme (even if it was only for a few months), he’s free to launch whatever he wants.

That doesn’t seem to be what’s happening though, and that’s a problem.

As of December 1st, Ward is planning to host a December 14th Global Credits Network launch event at Tropicana in Las Vegas.

Global Credits Network isn’t ready for the public yet. Ward states that a new company website is “coming very soon”.

It looks like the big leaders are gary wood, joe reid, tim turbyville? They seem to be pushing this on everybody.

Do you know anything about these people?

If they’re pushing Ponzi schemes, what else do you need to know?

When the FBI and Interpol will arrest these guys?? It is unacceptable because it is the most coward plan to do robbery from innocent people! When those kinds of people will be stoped?? My God!!

This is a great example of badly researched FAKE NEWS. The site has not collapsed! What nonsense…

I am in the site and it pays every day directly to my wallet. I think he is doing the right thing to rebrand for the reasons he stated but so far it works as he says. They are trading as I saw the Sports Betting slips forwarded to me while I was researching them.

However as far as the auctions – they are outrageous and horrible for the consumer. If you don’t win something at an Ebay auction you would never pay but in this case each bid cost $7.50 or one credit.

Hundreds of bids are happening and then its announced someone got an iphone for $11.12 . Nonsense – that would be 11.12 costs but it is times 1112 bids of $7.50 70k…

I am sure as people catch on that will go away.

So its legitimate but not well run. Website has bugs and this dwayne golden seems to not be very knowledgeable.

But its running and paying.

Well there’s nothing illegal about using betting revenue to pay returns… provided a company registers with the SEC and proves it’s actually using external revenue to pay investors.

What’s more probable; James Ward was recycling newly invested funds (Ponzi) or he scrapped a legitimate business to launch a new one – with a product that’s “outrageous and horrible for the consumer”?

Gary wood is a serial scammer. He should have been put in prison a long time ago.

They started a new one, it is called Lion’s Share.

Now they are plan to make a new plan in that. It same as this. get fund from network and trading, hahaha.

Lion’s Share itself isn’t new. If it’s collapsed and being rebooted though that explains the braindead comments we’ve had recently on the Lion’s Share review.

https://behindmlm.com/mlm-reviews/lions-share-review-james-ward-enters-smart-contract-ponzis/