SEC facing sanctions for incorrect dates in iX Global case

The SEC has been ordered to explain why it shouldn’t be sanctioned in the ongoing Debt Box & iX Global case.

The SEC has been ordered to explain why it shouldn’t be sanctioned in the ongoing Debt Box & iX Global case.

As noted by the court, at the hearing to dissolve the TRO (the TRO was dissolved in October),

the court highlighted several of the Commission’s representations supporting the TRO Application the court believed were false or misleading.

The misrepresentations pertain to date ranges Debt Box began transferring investor funds outside of the US.

In support of their ex-parte motion requesting a TRO, the SEC alleged;

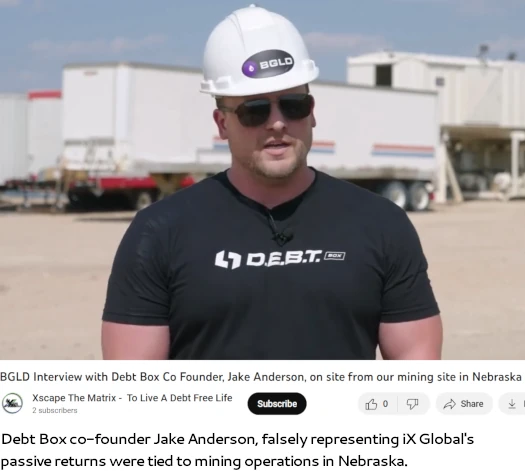

Evidence obtained by the Commission, and set forth in the Commission’s [TRO Application] indicates that Defendants are currently in the process of attempting to relocate assets and investor funds overseas, where at least Defendant Jacob Anderson has contended that those assets will be outside the reach of U.S. regulators.

Bank records obtained by the Commission . . . show that on June 26, 2023, Defendant iX Global, LLC—the multi-level-marketing entity through which the Defendants’ ‘node licenses’ are primarily promoted—began closing its bank accounts in the United States, and removed over $720,000 in putative investor funds from those accounts.

To further support their motion, the SEC also alleged iX Global had closed bank accounts.

In June, Defendants began to liquidate investor funds and move operations overseas.

On June 26, 2023, Defendant iX Global . . . closed its main accounts with Bank of America and cashed out over $720,000 in putative investor funds.

Meanwhile, DEBT Box’s principals claim DEBT Box is in the process of moving its operations to the United Arab Emirates for the express purpose of evading the federal securities laws.

For instance, in a June 14, 2023, promotional video posted on YouTube, Defendant Jacob Anderson claimed Defendants “have moved all of [DEBT Box’s] operations to Abu Dhabi,” so as to “be under the jurisdictional control of Abu Dhabi, not the SEC.

Defendants have also taken action to block SEC investigative staff from viewing their social media sites, and appear to have recently deleted a website containing training materials for the scheme’s promotors [sic].

During the ex-parte proceedings leading up to the original order granting the TRO, the SEC noted “around 33 bank accounts” had been closed within a 48 hour period.

The court understood this to mean Defendants had closed 33 bank accounts in the last 48 hours.

In their motion to dissolve the TRO, Debt Box claimed it “did not have any account closures in July 2023.”

They provided documents showing the closed accounts belonging to them or DEBT Box—thirteen accounts total—closed by January 2023

Nine of those accounts were closed by banks (not Defendants), including the accounts closed in January 2023.

As to the other four accounts, it is unclear who initiated the closures, but they occurred in August 2021 and January 2022.

Debt Box also argued that Anderson’s statements about “avoid[ing] SEC jurisdiction” were taken out of context.

Debt Box asserted it had already begun avoiding US regulation by transitioning to the UAE in May 2022, well before the SEC’s requested TRO.

As opposed to Debt Box committing securities fraud and then transferring the proceeds of said fraud offshore, it is the bank account closure dates provided by the SEC in support of their TRO that the court is hung up on.

First, the Commission tacitly acknowledged there was no evidence DEBT Box or the DEBT Council Defendants closed accounts in July 2023.

At no point in its Opposition did the Commission acknowledge (the SEC attorney’s) statement that “in the last 48 hours Defendants have closed additional bank accounts.” Nor did it provide evidence to support that statement.

The dates for the UAE move is also an issue.

Second, the Commission argued DEBT Box’s move to Abu Dhabi was ongoing and had not finished in May 2022.

With respect to the iX Global bank account closed in June 2023;

The iX Global Defendants explained the bank closed those accounts without input from iX Global.

They also cited an Exhibit from the Commission’s TRO Application showing the $720,000 from the closed accounts was deposited into a Mountain America Credit Union account (i.e., not sent overseas).

In response, the Commission acknowledged the iX Global Defendants did not close the accounts but faulted them for not providing “any evidence” the funds “were preserved.”

The Commission did not provide evidence iX Global moved the $720,000 overseas after depositing it into the Mountain America Credit Union account.

Nor did it acknowledge that when it requested the TRO, it had reason to know iX Global deposited the $720,000 into a domestic account.

This brings us to the order to show cause.

Given the extraordinary power conferred by the TRO, the court is mindful of how it was obtained.

From November 30th, the SEC has fourteen days to explain why sanctions shouldn’t be ordered against it for the above “misrepresentations”.

It should be noted that the court attached the following statement to its November 30th order;

The court cautions that although it denied the Commission’s request for extraordinary relief, it is not presently ruling on the merits of the Commission’s claims.

I’m kind of curious what sanctions the SEC would be facing if the court ordered them. Hopefully they don’t jeopardize the case (I don’t see that being likely).

If the sanctions are a financial penalty, that’s something whoever is in charge of these things internally to examine and deal with.

Meanwhile once we move past this, the case will continue. “Yeah we did the stuff, we just did it earlier than the SEC claims” isn’t a legal defense to the broader alleged fraudulent conduct.

Clearly there has been attempts to violate and continue to violate US securities law by shifting business operations and investor funds offshore. And that’s something hopefully Debt Box and iX Global will answer for.

Beyond potential SEC sanctions, a Joint Status Report is due by January 3rd, 2024. A Status Conference has been scheduled for January 17th.

Update 15th December 2023 – On December 7th the SEC filed a motion requesting additional time to respond to the show cause order.

The court granted the motion, giving the SEC until December 21st to respond.

Update 22nd December 2023 – The SEC has filed its response to the court’s show cause order.

1) where at least Defendant Jacob Anderson has contended that those assets will be outside the reach of U.S. regulators.

—> This is absolute horseshit, nothing is out of the reach of US regulators.

2) at the hearing to dissolve the TRO (the TRO was dissolved in October),

—> Just out of curiosity the SEC routinely charges the Management (personally) what difference does it make if a company that has ceased activities and ‘bankrupt’ is dissolved as the records remain up-to 5+ yrs anyway?

The company wasn’t dissolved, the TRO was dissolved. Although for all intents and purposes Debt Box doesn’t have any legitimate business operations (as alleged by the SEC).

It’d be a shame if a preliminary injunction wasn’t ordered. That’s way too much time for investor funds to be spent/hidden, pending the ultimate outcome of the case.

As ALWAYS a masterful comprehensive review. Stellar! How do u do it like u do it.

the amazing important work u do if ONLY more would investigate first & do due diligence… before falling victim! No excuse really with OZ as a guide.

Thanks for the support!

Weird how its being reported differently elsewhere.

msn.com/en-us/news/other/u-s-judge-warns-sec-over-false-and-misleading-request-in-crypto-case

The issue at play here is not what happened but how the SEc handled it.

The SEC has blanket enforcement powers that if wielded arbitrarily can cause harm when unintended

Let’s not get it wrong. 99pct of the time it’s deserved. But to have that ability to wield this means they have to be that much more clean.

The judge never said debt box was nothing that was alleged. They’ve said the reasons the TRO was granted don’t align with the initial info.

Look at Cardiff. No monetary penalties – but if what he did wasn’t wrong would he be in jail right now? Criminal conduct has a higher burden of proof than civil (50pct +1)

All this case is saying is that to wield the heavy hammer of a TRo which is essentially a shutdown, you better have your ducks in order. The SEc didnt hear and they are being taken to task on it.

You’ll see one of two things here…. This disappears because they can’t enforce overseas or you see a slow wind down and settlement.

I think the former is more likely

We all know if they’ve moved overseas in the interim, we know what the intent was.

Can you elaborate on:

As the SEC can enforce overseas, CFTC, and DOJ certainly can, arguably domestic laws do not apply to legitimately run companies (or illegitimate) where the US Federal Agencies apply, as they have and do force overseas persons, companies to comply with US laws even though for example, if a US Citizen buys stocks in the FTSE they adhere to UK regulations/laws, where Crypto is concerned (FCA) the US SEC forces said companies to abide to US laws rather than their regulator (FCA).

One thing to note, Debt Box was a US company, US persons, US Banking, US Vendors, the Nexos to the US is very clear.

Whereas with many ‘SEC cases’ we’ve seen companies with no US company position, no US persons, no US banking, No use of USD, No or minor US vendors sued by the SEC.

A example: sec.gov/news/press-release/2021-125

Just because a US citizen ‘may’ read content on it.

@Mike

Only investor money has been moved overseas. Principals are still in and operating from the US.

@Tom

That report isn’t any different to BehindMLM’s? It’s just missing broader context.

Show me a single case that the SEC has been able to enforce in Dubai. That’s essentially the issue. They have teeth here and in countries where they have reach but the scammers know where to move.

Dubai is really special in that sense, having said that they have signed LE agreements, and at times either remove visa or deport to the gate where the people are handed over.

Monetary -> can’t really comment, for everywhere else however they usually ply pressure on via the DOJ and the perp hands over the goods.

Good to be back. Much near to dubai silicon oasis now. Black Range Rover sport parked reminds me of someone who did earn much and is trying to wriggle out.

is the debt box mining box still being sold by ix global?

Nope.

Article updated to note SEC’s show case response extension.

Viraj patil arrested in India.

youtu.be/GyVVr6zfOB8?si=mw3gfAhArr13OIZi

Thanks for the heads up!

Patil’s arrest:

youtu.be/Wox2gO0yfxU?si=S6UaU-AXMC_-mFrJ