QZ Asset Management using NASDAQ listing to promote Ponzi

QZ Asset Management is using NASDAQ as a marketing tool.

QZ Asset Management is using NASDAQ as a marketing tool.

The Hong Kong based Ponzi scheme also claims it has raised $100 million from the private selling of shares.

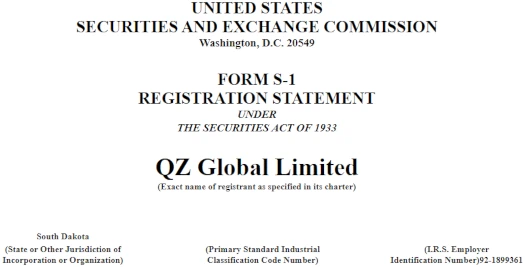

On January 9th, 2023, the shell company QZ Global Limited was incorporated in South Dakota.

Shortly after, QZ Asset Management applied for a Nasdaq listing under the symbol QZAM.

As part of the application, QZ Asset Management claimed to manage “approximately $8.4 billion in assets”.

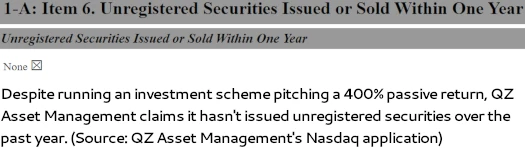

QZ Asset Management also ticked a box certifying they had not issued or sold any unregistered securities over the past year.

On February 27th, QZ Asset Management, through QZ Global Limited, filed an S-1 form with the SEC.

An S-1 Form is a requirement if a company intends to publicly offer new securities.

As per QZ Global Limited’s S-1 Form, the company intends to raise $300 million by selling 60 million shares.

The filing contains unaudited financial reports and representations. Here’s an example;

As of December 31, 2022, we had approximately $449.3 million of remaining unfunded capital commitments to our funds.

In addition, as of December 31, 2022, we had $244.9 million of indebtedness outstanding under our credit facilities and secured borrowings and $1,783.2 million of cash and cash equivalents.

Obviously not being audited these figures and claims are meaningless.

That aside, the major problem here is QZ Asset Management’s daily returns Ponzi scheme.

Naturally QZ Asset Management’s MLM investment scheme isn’t mentioned anywhere in their SEC filing or NASDAQ application.

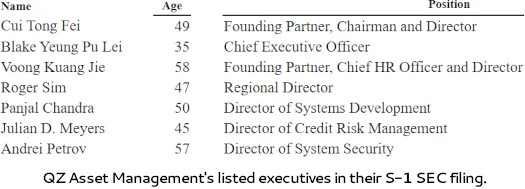

To recap, QZ Asset Management is run by founder Cui Tong Fei (who we know nothing about), and CEO Blake Yeung Pu Lei (below).

QZ Asset Management solicits investment on the promise of up to 3.5% a week. Returns are capped at 400%, after which reinvestment is required to continue earning.

QZ Asset Management represents it trades with a BDAI bot it developed.

To be honest, applying for a NASDAQ listing and filing forms with the SEC is an odd move for an MLM Ponzi scheme. I’m not 100% sure on what the end-game is here.

QZ Asset Management claims both to have been founded in China and maintain “significant Chinese operations”.

Getting a NASDAQ listing and dumping shares on investors is a pretty elaborate exit-scam if that’s what QZ Asset Management are going for. I suppose Fei and Yeung could dick off to China once that’s done – but why go to all the effort?

Obviously a collapsed Ponzi scheme that dumped shares on its investors, in the US no less, is still going to attract regulatory attention.

Perhaps Fei and Leung are counting on Chinese authorities doing nothing if everything appears above-board in the US.

Outside of that no alternative angle immediately comes to mind. Obviously QZ Asset Management’s financial representations and pretense to appear legitimate are baloney. And certainly, without protection from the Chinese government, lying to both the SEC and NASDAQ is a dangerous game.

As of February 2023, SimilarWeb tracks top sources of traffic to QZ Asset Management’s website as South Africa (56%), Philippines (23%) and the Democratic Republic of Congo (13%).

Overall QZ Asset Management website traffic is on the rise, spurred on by recruitment in South Africa (South African website visits are up 42% month on month)

From a regulatory standpoint, South Africa and the DRPC are hopeless. The Philippines has an active SEC but it seems QZ Asset Management hasn’t tripped their wire yet.

In December 2022 Indonesia’s Otoritas Jasa Keuangan declared QZ Asset Management to be an illegal investment scheme. Whatever QZ Asset Management recruitment was going on in Indonesia has since collapsed.

I don’t know if this was accidentally copy and pasted from somewhere else or not, but QZ Asset Management makes this odd disclaimer in their S-1 filing;

We regularly are subject to requests for information and informal or formal investigations by the SEC and other regulatory authorities, with which we routinely cooperate and, in the current environment, even historical practices that have been previously examined are being revisited.

If that’s true (and I doubt it is), I don’t see this nonsense holding up much longer.

Pending potential action by US regulators, which QZ Asset Management admits is a possibility…

If the SEC or any other governmental authority, regulatory agency or similar body takes issue with our past practices, including, for example, past investment and co-investment activities, internal operating procedures or arrangements with our people, including our senior advisors, we will be at risk for regulatory sanction.

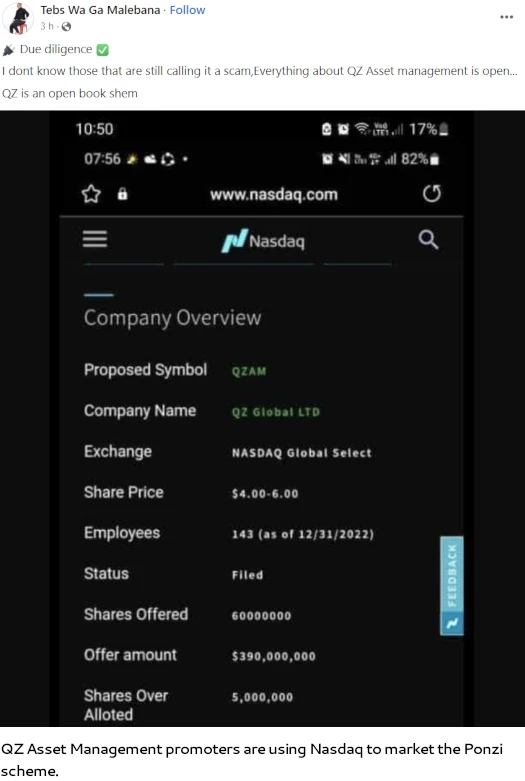

…its NASDAQ application is being used to recruit new investors.

The above screenshot is from a March 17th “news update” on QZ Asset Management’s website.

QZ Asset Management (“QZ “) today announced that it has concluded a private placement round on 31 January 2023 to sell 100,000,000 shares of the company’s common stock at a price of US$1.00 per share, for aggregate proceeds of US$100,000,000 to financial institutions.

The net proceeds from the Private Placement are intended to be used for research and development of QZ’s big data and artificial intelligence (BDAI) technology, upgrading of existing infrastructure and for global expansion purposes.

In a recent QZ Asset Management marketing video, Blake Yeung went as far as claiming the Ponzi scheme was engaged in “positive discussions” with the SEC.

Positive discussions with SEC officials have taken place following our Bangkok trip and we are on track to list in August.

Approval is expected to come some time in June and we will announce further news in due time.

And of course there’s examples from QZ Asset Management affiliates:

With QZ Asset Management shaping up to be one of the more interesting MLM Ponzi collapses to watch, we’ll keep you posted on any updates.

Update 4th May 2023 – QZ Asset Management has collapsed.

On May 1st Blake Yeung rolled out an “SEC audit” exit-scam.

I need updates as I’m the investor and wish to know the truth about this company and

Update: QZ Asset Management is a Ponzi scheme. Sorry for your loss.

Spreading like a wild fire in the Philippines since Feb this year. People are going crazy with the ROI. Unbelievable!

Well, This is interesting. If indeed QZAM is a Ponzi scheme then NASDAQ is a bigger one. imagine such an institution featuring these guys on their official website.

I will leave links below for your judgment:

-nasdaq.com/press-release/qz-asset-management-invited-to-showcase-bdai-technology-at-major-fintech-events

-nasdaq.com/market-activity/ipos/overview?dealId=1249269-105743

NASDAQ didn’t feature anything.

First link is a press-release published through a third party (i.e. it’s spam).

Second link is automatically generated as part of the one SEC filing (filled with bogus information) of a registered US shell company back in Feb.

This is all meaningless theater to convince idiots of legitimacy. The only reason anything has been filed with the SEC is because the scammers hiding in Hong Kong are counting on the SEC/DOJ not pursuing them into China.

Thanks for the info. Yeap we’re done in Africa, QZ has robbed us big time.

Some of us solely relied on the ROIs as our monthly income since we’re not employed.

Qz has scammed us in RSA using Nasdaq, KPMG, Bank of China, Barclay’s etc.

I have been scammed, R46k in this platform, I want my money back since the money is with Binance.

The only thing QZ Asset Management scammed was Africans.

If you still believe all the Nasdaq, KPMG, Bank of China, Barclay’s etc. crap, then you haven’t learnt anything.

Also the money you invested isn’t sitting in Binance waiting for you to recover it, it’s long gone.