QZ Asset Management collapses, “SEC audit” exit-scam

The QZ Asset Management Ponzi scheme has collapsed.

The QZ Asset Management Ponzi scheme has collapsed.

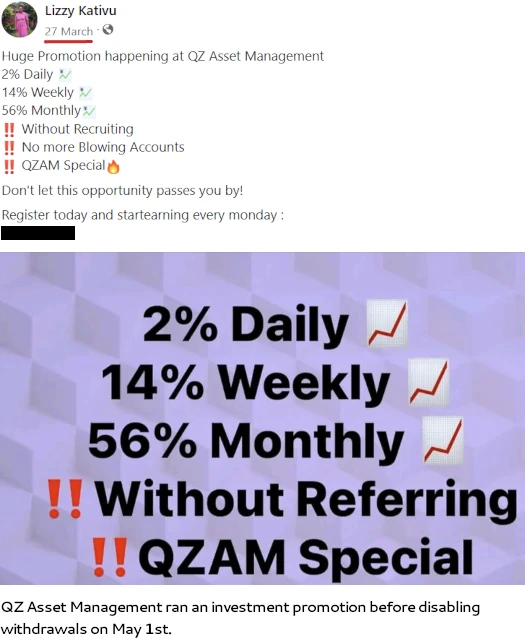

Withdrawals were disabled on or around May 1st, under the ruse of an “SEC audit” exit-scam.

CEO Blake Yeung Pu Lei informed investors withdrawals were delayed in a May 1st “weekly update”.

We are now at the last phase of financial auditing by SEC which will take between 6 to 8 weeks to complete.

And of course, QZ Asset Management withdrawals are disabled during this time.

Therefore, there will be some inconvenience and disruption to our operations.

Once this auditing is done, we can then resume back to norm and business as usual.

Yeung goes on to blabber about “adhering to strict SEC requirements”…

…which is amusing seeing as QZ Asset Management has been committing securities fraud in the US and elsewhere in the world since launch.

Launched in late 2022, QZ Asset Management is a simple 400% ROI MLM crypto Ponzi scheme.

Preparations for QZ Asset Management’s exit-scam began in February, through a misinformation riddled S-1 Registration Statement filed with the SEC.

One example is QZ Asset Management claiming to have “approximately $8.4 billion in assets”. Through it’s MLM opportunity, QZ Asset Management pitches up to 3.5% a week.

3.5% of $8.4 billion is $280 million. If that money actually existed QZ Asset Management obviously doesn’t need your money. There’s also no need for Blake Yeung to be stringing investors along with marketing update videos from his basement.

That said, filing anything with the SEC is a bit of effort to go to for an exit-scam. Much easier to just disappear.

On the flip side, if you just disable withdrawals and do a runner, you don’t get “6 to 8 weeks” to create distance between you and your victims.

Getting back to Yeung’s exit-scam video; First and foremost, the SEC doesn’t audit companies. Registered companies hire third-party auditors, who then put together periodic financial statements that are filed.

QZ Asset Management have failed to make any financial filings. In fact, QZ Asset Management hasn’t made any additional SEC filings beyond its first February filing.

QZ Asset Management doesn’t have a third-party financial auditor because obvious Ponzi is obvious.

Typically we don’t see Ponzi scammers tempt the SEC but when you’re running a scam targeting Africa from Hong Kong, with an easy backdoor to mainland China, you’re probably not too worried about US authorities coming after you.

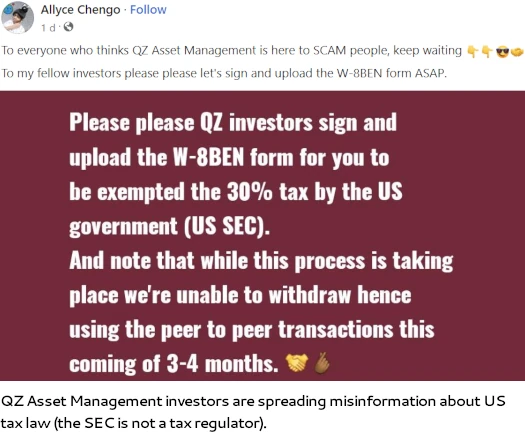

In the wake of Yeung’s “withdrawals are disabled” announcement, promoters are circulating a request to complete a W-8BEN tax form.

I don’t know if this is an official communication through QZ Asset Management or promoters trying to harvest data.

Update 4th May 2023 – QZ Asset Management is sending out W8-BEN forms through its backoffice.

Investors are being told if they don’t return the completed forms, QZ Asset Management will deduct 30% from their backoffice funds. /end update

A W8-BEN tax form is an IRS filing for non-US residents, used to declare non-US sources of income.

For the vast majority of QZ Asset Management investors, who have no ties to the US and aren’t filing US tax returns, this is smoke and mirrors.

What I suspect is happening is W8-BEN forms are being used to confirm investor details, once the forms are returned to QZ Asset Management (or promoters making the request).

Once confirmed, details of QZ Asset Management’s most gullible investors will likely be sold on.

Presently SimilarWeb tracks top sources of QZ Asset Management website traffic as South Africa (72%), the Philippines (8%), Namibia (5%) and Botswana (3%).

South African authorities can’t get on top of a $1.7 billion Ponzi scheme being run by South Africans, so don’t expect too much from them.

Back in February Indonesian authorities confirmed QZ Asset Management was operating illegally, quickly killing off recruitment there.

Pending QZ Asset Management completing its exit-scam sometime in June or July (“bad new guys, the SEC said we didn’t pass the audit. Oh well… bye!”, total QZ Asset Management victim numbers and how much they’ve lost remains unknown.

Update 25th May 2023 – QZ Asset Management’s exit-scam is complete. The Ponzi scheme pulled its website offline on May 24th.

OMG! That was short lived!

Poor Mr. Carlos Cid, at least with IX Inversors he was able to scam, ahem, to work for more than a year!

haha, have you seen the QZ Asset reward program?

ibb.co/18RrTX3

And their latest video is of QZ’s IPO

ibb.co/PmTnHLT

The IPO is BS. You can’t commit securities fraud and then legitimately launch an IPO.

Marketing for low-hanging fruit in Africa.

Interested on how it’s gonna end.

It’s already ended. Sorry for your loss.

keep piping up because the company is already in its listing stages on nasdaq.

nasdaq.com/market-activity/ipos/overview?dealId=1249269-105743

There are rich pickings in South Africa at the moment.

All the suckers (oops, INVESTORS) who are finally coming to terms with how they were duped by the MTI management are now looking for somewhere to lose (OOPS again – invest) their remaining money.

Oz, a minor technical clarification: a W-8BEN form is for non-US residents to declare their non-residency so they don’t have to pay tax on US-sourced income.

It is for residents of countries that have a dual-tax agreement with the US. Those people then pay tax on the US income in their own country.

A W-8BEN form allows a US-based entity to refrain from withholding tax on payments being made (e.g. interest or dividends) to a non-US person.

The US has dual-tax agreements with South Africa and the Philippines, but not with Namibia or Botswana.

@felix

Look at the filings, nothing since the initial Feb 2023 one with bullshit information.

Sorry for your loss.

@Ian

Also:

businessservices.wisc.edu/documents/w-8ben-certificate-of-foreign-status-of-beneficial-owner-for-united-states-tax-withholding-and-reporting-individuals

US tax law is a bit of a nightmare to wade through so thanks for fact-checking.

The takeaway is QZ Asset Management isn’t a US based entity. Nor does it pay anyone from within the US.

As we speak, a lot of their key promoters have moved to another platform just launched. So even if they push this through, recruitment will halt thereby cutting their funding.

Greed is taken many to an unknown destination.

@Ian Viney-The dual tax agreement with South Africa allows a reduced witholding tax of 15% as opposed to the insinuated 0%.

@oz the intention of the form is for users to declare their us sourced income so that they qualify for reduced tax or zero % withholding tax. Tax agreements with the country of residency will determine if it is zero % or 15%.

A company the size of QZ should have done due diligence and known before hand that withholding taxes of 30% exist.

The average second year student in Finance or Accounting knows that there are tax implications for receiving money from a US based entity.

@OZ QZ holdings which now owns qz asset management is a US registered entity.

QZ Asset doesn’t pay out of the US. It’s a crypto Ponzi scheme run out of south-east Asia.

It’s part of the exit-scam, you’re not supposed to think too much about it.

Nope. It’s a shell company owned and operated out of south-east Asia.

Drone detected

i m very much scared of QZ investment because to me i mis understand why thy hold withdrawal button but the depost button is on why?

i need more clarification on this plz.

Clarification: You invested in a Ponzi scheme and your money is gone.

Sorry for your loss.

QZ Asset Management is using some African people to scam their own people. I was part in their early meetings we had with some leaders from different countries.

The company promised the leaders free account with $5,000 each plus some commissions they are paying for leaders aside their normal mlm bonuses.

No legit company can bribe people to promote. When I heard it, I did not border myself to even join so am waiting for a day it will finally scam!

How does this work?

You give your money to Ponzi scammers and then sorry for your loss.

As a member, I am here to provide a balanced perspective. While I understand the scepticism surrounding QZ Asset Management, I would like to point out that there are several reasons why this company may not be a scam.

The said forms have been submitted, cleared and approved and withdrawals are now again going through.

(Ozedit: spam removed)

I checked social media and all I’m seeing are Africans still in denial about getting scammed (being led by the promoters who recruited them).

You clearly don’t “understand the skepticism”, because you failed to address QZ Asset Management committing securities fraud. Instead you trotted out spam copypasta from your upline.

What forms have been “cleared and approved”? The tax nonsense? Prove it.

Also regardless of whether QZ Asset Management reboots after disabling withdrawals at some point, the fact remains it’s a Ponzi scheme in which the majority of investors are mathematically guaranteed to lose money.

There is no “balance” when it comes to MLM Ponzi schemes, only widespread financial losses outside of admins, a few early investors and the recruiting ringleaders.

Please it’s good to hear from current beneficiary.

Just who is telling the truth?

They will only open withdrawal to top leaders so they can keep promoting and suck in new money.

Selfishness and greed is driving people crazy… Africa wake up. You are losing too much to scammers.

Am just shocked the compliance with the US SEC and how Nasdaq’s website still informing we the people about IPO!

I Know SEC doesn’t audit but it regulates.

I didn’t join QZ because of the monies I saw people making rather because of the US SEC website information about QZ. And NASHDAQ too.

My Facebook account is full of QZ boasting about it’s compliance with the US SEC and how it’s on going to nasdaq listing.

@felix but the system is done. Besides the US SEC has or will probably see what’s happening. The conversation btn Blake and Richard he was planning a Ponzi scheme.

I know right!

Am confused too I don’t know who’s telling the truth.

Regulation is reactionary. These latest Chinese “lulz NASDAQ listing!” scams last barely a few months. We typically see SEC cases take much longer than that to be filed – and not against Chinese scammers hiding in Dubai, Singapore and/or Hong Kong.

Totally agree with NASDAQ having to tighten up their website. If Chinese scammers are going to file bogus data with the SEC and then use NASDAQ’s website to issue press-releases to push Ponzi schemes, we can’t have regulation trailing so far behind.

QZ Asset Management’s website is gone and the socials have been deleted. That’s the last you’ll hear of them.

Qz asset management scammed ponzi. They are gone with Africans money.

@sam you mentioned that you were part in their early meetings they had with some leaders from different countries.

Do you perhaps have Blake, Mark and Richard contact details. We want to follow up on them with our monies.

What’s the different between QZ holdings and QZ asset management?

QZ Asset Management = Ponzi scheme.

QZ Holdings = shell company used to create fictional IPO narrative for Ponzi marketing.

We told them long ago, where are the defenders of the ponzi…. once you hear name leader leader, leader run away. the leaders are soulless.

Sad part with QZ so called leaders encourage peopke to deposit huge capital, in ordee that they receive commisions.

Heartless soulless, greedy, and ignorant.