QZ Asset Management sued by SEC for securities fraud

The SEC has filed charges against the collapsed QZ Asset Management Ponzi scheme.

The SEC has filed charges against the collapsed QZ Asset Management Ponzi scheme.

The SEC’s Complaint, filed in South Dakota on August 26th, names QZ Global Limited, QZ Asset Management Limited and Blake Yeung Pu Lei as defendants.

- QZ Global Limited is a South Dakota shell company

- QZ Asset Management Limited is a Chinese company that represented it had a head office in Shanghai

- Blake Yeung Pu Lei (below) was the face of QZ Asset Management, although it’s unclear whether he was played by an actor

The SEC characterizes QZ Asset Management as

a China-based investment adviser … [that] engaged in a concerted scheme involving multiple false statements to defraud hundreds of individuals out of millions of dollars.

This tracks with BehindMLM’s QZ Asset Management review, published in November 2022. In a nutshell, QZ Asset Management illegally solicited investment on the promise of up to 3.5% a week.

As we’ve seen recently with other scams tied to Asia, like Tragetech, part of QZ Asset Management’s Ponzi ruse was misrepresenting SEC filings made through its shell company.

Defendants deceived QZ Asset’s clients and prospective clients by falsely claiming that QZ Global had taken steps to go public, including submitting an application to have its common stock listed on the Nasdaq Global Select Market and having positive interactions with SEC staff.

Further, to provide an air of legitimacy to their fraudulent enterprise, Defendants pointed clients and prospective clients to QZ Global’s SEC filings, which were available to view on the SEC’s EDGAR system, but which were materially deficient and incomplete.

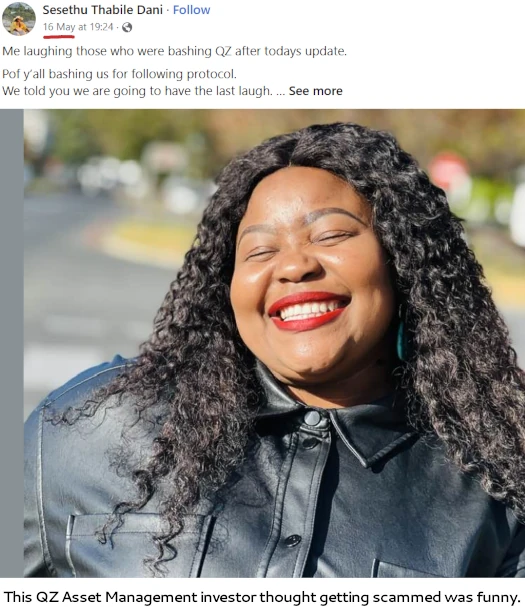

BehindMLM documented and debunked QZ Asset Managements NASDAQ shenanigans in March 2023. We also noted QZ Asset Management’s “SEC audit” exit-scam when QZ Asset Management collapsed in May 2023.

QZ Asset Management filed an S-1 Registration Statement with the SEC on February 27th, 2023.

The SEC claims it sent QZ Asset Management a letter to Yeung, who had signed the S-1 form, on March 17th, 2023.

SEC staff sent a letter addressed to Yeung, as CEO of QZ Global, notifying him that the Forms 1-A were not compliant with Regulation A as they failed to name an underwriter and failed to include the required financial statements.

Neither Yeung nor anyone from QZ Global responded to the letter or submitted additional or amended filings to the SEC.

Instead of responding to the SEC, on March 17th QZ Asset Management put out a press-release falsely claiming it had sold 100,000,000 shares.

On October 23, 2023, SEC staff sent Yeung, as CEO of QZ Global, another letter reiterating that QZ Global’s filing failed to comply with Regulation A.

Once again, neither Yeung nor anyone from QZ Global responded to the letter or submitted additional or amended filings to the SEC.

QZ Asset Management would go on complete its exit-scam by disabling its website on May 25th, 2023.

Documented QZ Asset losses by the SEC include “at least 285 clients globally” and “at least $6 million”.

The SEC’s Complaint accuses QZ Asset Management and Lei of multiple violations of the Securities and Exchange Act.

An injunction prohibiting further violations is being sought, as well as disgorgement and payment of a civil penalty.

I’ve added the SEC’s QZ Asset Management case to BehindMLM calendar. Stay tuned for updates as we continue to track the case.