ProCap issued contempt cease & desist from Philippines

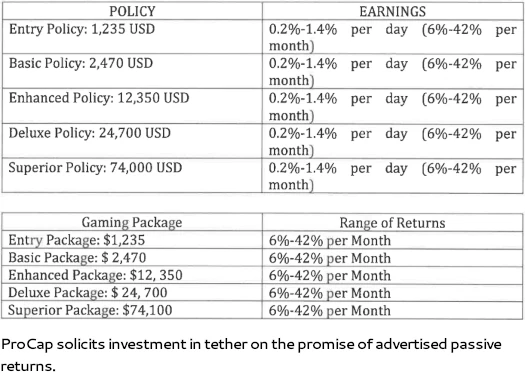

![]() Following the arrest of twenty ProCap Insurance scammers last October, the Philippine SEC noted the Ponzi scheme was still being promoted in the Philippines.

Following the arrest of twenty ProCap Insurance scammers last October, the Philippine SEC noted the Ponzi scheme was still being promoted in the Philippines.

Apparently the foregoing [arrests] did not deter ProCap from carrying out its unauthorized investment-taking activities as the EIPD showed another evidence that ProCap is continuously offering/selling its unregistered securities.

ProCap had in fact invited the public to join its business presentations via Zoom platform on 23 January 2024 for this purpose.

This promoted the Enforcement and Investors Protection Department (EIPD) to file an instant motion requesting a cease and desist order.

The motion was granted on February 8th and pertains to:

- ProCap International Inc., a shell company registered by Marilyn Presto Pedrigal and Jessica Fuentes Florendo in the Philippines;

- ProCap Insure, a shell company registered in Seychelles; and

- ProCap InsureTech, a shell company registered in Seychelles

Continued promotion of ProCap in the Philippines runs the risk of perpetrators being held in contempt. It’s assumed this will lead to more arrests.

In response to the arrests last October, ProCap rebranded from ProCap Insurance to ProCap International.

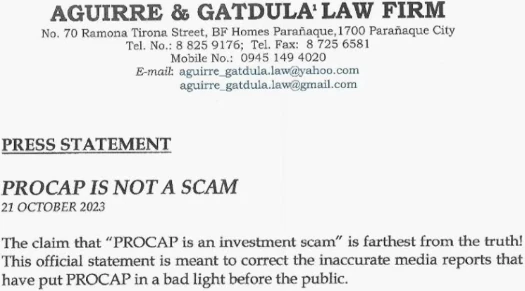

ProCap also hired the law firm Aguirre & Gatdula to put out a “we are not a scam” statement the day after the October arrests.

Aguirre & Gatdula don’t appear to have a website. The claimed law firm operates on FaceBook through Yahoo and GMail email addresses.

The statement put out by Aguirre & Gatdula denies the October arrests and claims, despite ProCap committing securities fraud, that the company “operates within the bounds of the law”.

Aguirre & Gatdula also misrepresented ProCap was registered to offer securities in the Philippines.

In its effort to comply with the Philippine laws and regulations, ProCap engaged the services of the Firm on 01 October 2023 for the necessary legal assistance to ensure that ProCap operates within the bounds of the law.

With an existing SEC registration and business permit, ProCap’s office is open and operational as there is no directive for its closure from any government office.

As confirmed by in the order granting the EIPD’s cease and desist motion;

ProCap has no license to sell/offer securities.

The EIPD presented in evidence the Certifications issued by the Company Registration and Monitoring Department (CRMD), Markets and Securities Regulation Department (MSRD), and the Corporate Governance and Finance Department (CGFD) of the Commission [SEC] which all certified that they have not issued to ProCap a secondary license to operate as a broker/dealer of securities, and that ProCap is not a registered issuer of securities pursuant to … the SRC, or of mutual funds, including exchange traded funds, membership certificates, and time shares.

ProCap appears to be a Ponzi scheme run out of Singapore by Chinese nationals.

As of March 2024, SimilarWeb tracked ~5400 monthly visits to ProCap’s website. Top sources of traffic include the Philippines 64% (up 367% month on month), Turkey (13%), Switzerland (7%), Japan (7%) and France (5%).

In addition to ongoing regulatory enforcement in the Philippines, Hong Kong issued a ProCap securities fraud warning on April 8th.

Update 15th November 2024 – The Philippine SEC revoked ProCap’s “ProCap International Inc.” registration on August 7th, 2024.

aren’t securities – stocks, loans, etc. The money put into Procap is the money you gamble with every day.

It’s impossible for Procap to use that money for anything but the player’s gambling session for the next day. Players must gamble once a day.

Procap earns with the player as all earnings are split 50-50. Procap’s 50% earnings are used in case players lose all their gambling money and covers it so players can gamble the next day.

Gambling money is not a security. Cease and desist is invalid and that’s why Procap still has an office in the Philippines.

Procap even sponsored Miss World Philippines 2024.

Another dumbass who doesn’t know what a securities offering is.

Securities fraud isn’t gambling. Ponzi schemes aren’t gambling.

You’re giving crypto to randos over the internet. ProCap scammers can do whatever they want with it.

Let me guess, gambling = “click a button”? ProCap could just as easily have you pat your head and rub your tummy once a day – it has nothing to do with the return.

Whether it is or it isn’t is irrelevant to ProCap’s passive returns MLM opportunity, which very much is a securities offering.

Yeah that’s not how regulation works. Your honor we didn’t commit fraud because we declared securities laws invalid!

Getting dumbass locals to pretend where they congregate is an official office while ProCap’s scammers hide in Hong Kong/Singapore is irrelevant to ProCap committing securities fraud because it’s a Ponzi scheme.

That and a fraud warning is confirming illegality. You’re still free to promote ProCap Insurance. The Philippine SEC has simply advised you that if you continue to scam people you run the risk of a fine and prison time.

Oh well in that case, say no more. Best of luck with the scamming.

ProCap Insurance’s website returns a 403 error. Sorry for your loss.

hahaha, Seriously? Did you actually just claim that securities offerings are in the same category as gambling on horse racing? Have you informed financial regulators of your amazing revelation?

You will be laughed at (by both them and us) but please do give it a go and let us know how you get on.

Ponzi schemes are in the same category as Internet crypto casinos.

Not legally and with respect to regulation. Gaming laws aren’t used to regulate and prosecute Ponzi fraud.

The only exception I could see argued is Norway, in which Ponzi and pyramid schemes are regulated by the Lottery Board.

Four to five key figures, including Max Tan and Zack, who recently went into hiding after fraud with (3key technology) and (Lyra lab) businesses in Korea, appearing at the procap event with James (Jubilee Ace).

They took more than $60 million from Korea & $5 billion from Japan and went into hiding, but they didn’t even apologize. Please look into it. The victims are struggling so much everywhere.

Please look into what? Ponzi scammers not apologizing for stealing your money?

BehindMLM reviewed ProCap and reported on subsequent arrests and fraud warnings. Ponzi victims struggling is beyond the scope of BehindMLM’s reporting.

(3key technology) and (Lyra Lab), (Jubile Ace), (GTR) There are common people involved in crime.

MAX TAN, JACK, and four or five other people who are currently marketing to PROCAP are avoiding victims with ridiculous excuses that they caused $60 million in damage to Korea and couldn’t contact them because they were kidnapped.

They found it at a PROCAP event and demanded an apology and compensation from LYRA victims, but rather they say they are victims and lie that they are forced to work for PROCAP to make money.

On the other hand, they are making ridiculous excuses that they will reward them if they invest again in them.

Article updated to note Philippine SEC has revoked ProCap’s shell company registration.