ProCap Insurance Review: Scammers arrested in Philippines

![]() ProCap Insurance fails to provide ownership or executive information on its website.

ProCap Insurance fails to provide ownership or executive information on its website.

ProCap Insurance’s website domain (“procap.insure”), was privately registered on December 12th, 2022.

In an attempt to appear legitimate, ProCap Insurance touts a shell company in Seychelles.

Notwithstanding Seychelles being a tax-haven, for the purpose of MLM due-diligence shell incorporation anywhere is meaningless.

Of note is ProCap Insurance claiming to have offices in Manila, Philippines.

This ties into the arrest of twenty ProCap Insurance scammers on October 15th.

As per a press-release issued by the Philippine Criminal Investigation and Detection Group, twelve locals and eight foreign nationals were arrested at a marketing event held at the Dusit Thani Hotel.

During the operation, authorities recovered three (3) genuine One-Thousand-peso bills (Dusted Money), Four Hundred Fifty-One-Thousand-peso (Investment Money), and one (1) USB Flash drive containing the Powerpoint Presentation of the said unlicensed company.

The foreign nationals appear to be Chinese and/or Singapore nationals based out of Singapore.

If I had to guess, the foreign nationals were likely running or tied to running ProCap Insurance. Arrested locals were likely mostly ringleader promoters.

The arrestees have been criminally charged with securities fraud and violating the Financial Products and Services Consumer Protection Act.

At time of publication ProCap Insurance’s website is still online, so read on for a full review.

ProCap Insurance’s Products

ProCap Insurance has no retailable products or services.

Affiliates are only able to market ProCap Insurance affiliate membership itself.

ProCap Insurance’s Compensation Plan

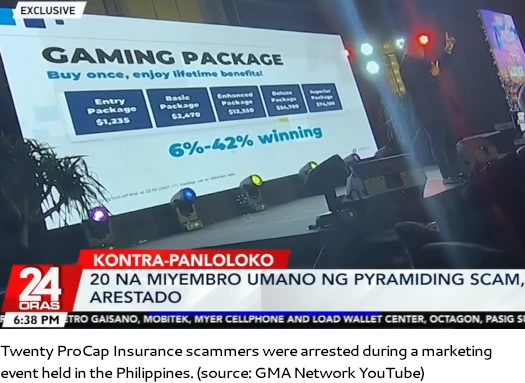

ProCap Insurance affiliates invest tether (USDT).

This is done on the promise of advertised returns:

- Policy 1 – invest 1235 USDT and receive up to 35 USDT a day

- Policy 2 – invest 2470 USDT and receive up to 70 USDT a day

- Policy 3 – invest 12,350 USDT and receive up to 350 USDT a day

- Policy 4 – invest 24,700 USDT and receive up to 700 USDT a day

- Policy 5 – invest 74,100 USDT and receive up to 2100 USDT a day

The MLM side of ProCap Insurance pays on recruitment of affiliate investors.

ProCap Insurance Affiliate Ranks

There are five affiliate ranks within ProCap Insurance’s compensation plan.

Along with their respective qualification criteria, they are as follows:

- 1 Star – generate 20,000 USDT of downline investment in three recruitment legs

- 2 Star – have three recruitment legs with a 1 Star or higher in them

- 3 Star – have three recruitment legs with a 2 Star or higher in them

- 4 Star – have three recruitment legs with a 3 Star or higher in them

- 5 Star – have three recruitment legs with a 4 Star or higher in them

Referral Commissions

ProCap Insurance pays referral commissions on invested USDT.

Referral commission rates are determined by how much an affiliate has invested:

- invest at the Policy 1 and 2 tiers and receive a 5% referral commission rate

- invest at the Policy 3 tier and receive a 6% referral commission rate

- invest at the Policy 4 tier and receive a 7% referral commission rate

- invest at the Policy 5 tier and receive an 8% referral commission rate

Note that referral commissions are coded, meaning affiliates who’ve invested more receive the difference paid to their downline.

E.g. a Policy 3 tier affiliate recruits a new affiliate and receives their 6% referral commission rate.

The remaining 2% (8% – 6% paid out), is paid upline to the first Policy 4 or Policy 5 tier affiliate found.

If a Policy 4 affiliate is found upline first, they receive 1%. The remaining 1% is paid out to the first upline Policy 5 tier affiliate found.

If a Policy 5 affiliate is found upline first, they receive the full 2% outstanding commission.

Note that nothing is ever passed up from a Policy 5 affiliate. They either receive 8% on their own recruitment, or any outstanding coded amount being passed up.

Matching Bonus

ProCap Insurance pays a Matching Bonus on returns paid to downline affiliates.

The Matching Bonus is paid out via a unilevel compensation structure.

A unilevel compensation structure places an affiliate at the top of a unilevel team, with every personally recruited affiliate placed directly under them (level 1):

If any level 1 affiliates recruit new affiliates, they are placed on level 2 of the original affiliate’s unilevel team.

If any level 2 affiliates recruit new affiliates, they are placed on level 3 and so on and so forth down a theoretical infinite number of levels.

ProCap Insurance caps the Matching Bonus at twenty unilevel team levels.

The Matching Bonus is paid out as a percentage of daily returns paid across these twenty levels based on personal investment:

- invest at Policy 1 or Policy 2 and receive an 8% match on level 1, 6% on level 2 and 4% on levels 3 to 5

- invest at Policy 3 and receive an 8% match on level 1, 6% on level 2, 4% on levels 3 to 5 and 2% on levels 6 to 10

- invest at Policy 4 and receive an 8% match on level 1, 6% on level 2, 4% on levels 3 to 5, 2% on levels 6 to 10 and 1% on levels 11 to 15

- invest at Policy 5 and receive an 8% match on level 1, 6% on level 2, 4% on levels 3 to 5, 2% on levels 6 to 10 and 1% on levels 11 to 20

Leadership Rewards

Leadership Rewards is a rank-based bonus on downline investment.

- 1 Stars receive a 1% Leadership Reward

- 2 Stars receive a 2% Leadership Reward

- 3 Stars receive a 3% Leadership Reward

- 4 Stars receive a 4% Leadership Reward

- 5 Stars receive a 5% Leadership Reward

Note that

- if an affiliate has three additional recruitment legs each with 1235 USDT or more in invested funds, Leadership Rewards are doubled

- if an affiliate has three additional recruitment legs each with 20,000 USDT or more invested funds, Leadership Rewards are tripled

Joining ProCap Insurance

ProCap Insurance affiliate membership is free.

Full participation in the attached income opportunity requires a minimum 1235 USDT investment.

ProCap Insurance Conclusion

ProCap Insurance’s ruse is “gambling insurance”.

ProCap Insurance provides insurance coverage for your capital when you engage in predictions games from authorized operators.

Policyholders can experience our coverage live at Nagaworld of Phnom Penh, Crown International Casino of Danang, Hoiana Casino of Quảng Nam, Resort World Manila, and Dream Tower of Jeju Island.

Needless to say gambling insurance isn’t a thing. None of the gaming venues cited above have anything to do with ProCap Insurance.

Dare I say it, ProCap Insurance naming these gaming venues might have led to the Philippine arrests.

Notably the Philippines is not a major source of traffic to ProCap Insurance’s website.

As of September 2023, SimilarWeb tracks top sources of ProCap Insurance website traffic as Japan (33%, down 32% month on month), the US (20%), Indonesia (16%), Switzerland (10%) and Germany (9%).

As it stands, the only verifiable source of revenue entering ProCap Insurance is new investment.

Using new investment to pay daily returns would make ProCap Insurance a Ponzi scheme. All MLM Ponzi schemes have a pyramid recruitment component, as cited by Philippine authorities.

As with all MLM Ponzi schemes, once affiliate recruitment dries up so too will new investment.

This will starve ProCap Insurance of ROI revenue, eventually prompting a collapse.

The math behind Ponzi schemes guarantees that when they collapse, the majority of participants lose money.

Update 11th April 2024 – Following non-compliance to cease illegally promoting ProCap in the Philippines, the SEC has secured a contempt cease and desist order.

ProCap also received a securities fraud cease and desist from Hong Kong on April 8th.

Four to five key figures, including Max Tan and Jack, who recently went into hiding after fraud with 3key technology and lyra lab businesses in Korea, appeared at the procap event.

They took $60 million from Korea and went into hiding, but they didn’t even apologize. Please look into it.The victims are struggling so much.