Nui gambling investor funds over unregistered securities outside Texas

Following Nui’s fine for securities fraud violations in Texas it should be clear that, in order to operate legally in the US, Nui needs to register its securities offering.

Following Nui’s fine for securities fraud violations in Texas it should be clear that, in order to operate legally in the US, Nui needs to register its securities offering.

Instead of doing that though, the company is pushing ahead – on the gamble that other states and the SEC will not take any further action against it.

Securities law in Texas is immaterially different to other US states, or indeed the Securities and Exchange Act at a federal level.

That means that if one state determines a company is offering unregistered securities, there’s a 99.99% chance any other US state, or the SEC at a federal level, will too.

Rather than acknowledge this and take the necessary steps towards operating legally in the US, Nui is pressing ahead as if nothing happened in Texas.

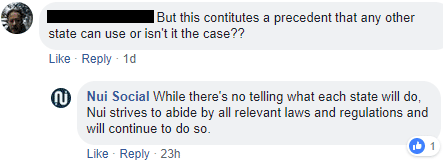

After Nui published a link to its “Nui successfully resolves Texas State Securities Board Investigation into crypto mining” press-release on Facebook, one of their investors asked;

But this constitutes a precedent that any other state can use or isn’t it the case?

To which Nui gave a misleadingly elusive answer;

While there’s no telling what each state will do, Nui strives to abide by all relevant laws and regulations and will continue to do so.

What a load of baloney.

As I’ve already stated, in order to operate legally in the US, Nui would have to register with the SEC. Or at the very least in every state the company operates in (all of them except Texas).

This, among other things, would see Nui put in writing that they are doing what they say they are doing, and leave them legally liable if they weren’t.

Compliance with securities law in the US is not optional, any more so than it wasn’t in Texas.

Nui’s Texas securities fraud fine isn’t some new law the company had no idea of, it’s the upholding of securities law at a state level that has been around since 1957.

Every single US state has similar securities laws, with the Securities and Exchange Act giving the SEC federal jurisdiction in any state.

The take away for Nui’s current and potential investors is that if Nui is illegal in Texas, it’s illegal all over the US.

Whereas the Texas Securities Board has gotten Nui to provide refunds to its Texas investors, the rest of the company’s investor-base won’t be so lucky.

We don’t have any official figures but it’s a given Darren Olayan and the rest of Nui management aren’t working for free.

It is impossible for Nui to refund all investors (where do you think the money Nui is refunding Texas investors is coming from?). Meaning that should other states and/or the SEC move to enforce securities law and take further action, there’s going to be losses.

In a sense it’s even worse than all of that.

For the record Jones Day did a great job negotiating for their client. They limited the scope of the final judgement while bowing to the inevitable fine and death sentence in the state of Texas.

By keeping Kala and the current giga and terahash offerings out of the Texas judgment it gives Nui great fodder for disinformation.

Nui could say that the Texas judgment did not find Kala to be a security (thanks Jones Day) and they’d be factually correct.

But that is not how Nui is selling this.

Nui is pretending that the Texas judgment found Kala and their giga/terahash investments NOT to be a security. Needless to say this is a far better sales pitch and likewise needless to say it’s total bull shit. Incidentally this sort of lie is and of itself a securities violation.

In fact Nui is claiming they could sell Kala/giga/terahash investments in Texas it’s just that they “made a business decision” not to.

One aspect that the TSSB deserves much credit for is the recision (refund) agreement. We are a week and a day past the judgement being released so perhaps it’s a bit too soon for any concrete terms to be made public, if in fact they ever will be made public.

Nui members in Texas, you have the upper hand here. Give Nui a fair amount of time to grant you a fair refund but don’t let them take a crap on you. If Nui refuses to make a fair and full refund report them to the TSSB, that is your leverage here.

Nui is so glad to put the Texas situation behind them but it isn’t a done deal till the affiliates in Texas are made whole. Keep Nui’s feet to the fire.

I believe some clarification needs to happen here. Agreed, the Texas SEC found the original 1 and 3 year hashrate units as well as the open ended units to be securities.

They actually didn’t say anything about the new Kala mining because it was agreed, even by Texas SEC, that owning your own mining Rig or having fractional ownership of a Rig is NOT cloud mining and therefore is NOT a security.

That is the whole point. The original products are no longer being offered anywhere. Only the new product is being offered. So they are not gambling with investor funds at all because it is no longer an “investment”.

You really have to understand that Kala mining is not cloud mining to see why they didn’t include it. Fractional ownership of a physical Rig is completely legal. Just like fractional ownership of a private jet.

If a full Rig costs $4000 and I buy 1/4th for $1000, I get exactly 1/4 of the coins produced deposited directly into my own account. It is NOT an “investment”. It is a purchase of hardware.

This is very different from what the original hashrate units were based on where they took your money, used their algorithm to mine several different coins, converted those coins into Bitcoin and then paid out.

That, admittedly, is a grey area and that is what Texas had a problem with because people could misconstrue percentages and exaggerate payouts.

But with fractional ownership mining, you get exactly your portion of what the actual physical Rig (with its own serial number attached to you) produces based on a real blockchain product.

There is no promise of returns or percentages or value or anything. The only promise is your own portion of the Kala paid out, or if you bought one and had it in your home, whatever amount it produces for you based on real blockchain hashpower and mining.

This is why Nui is secure moving forward. Just step back and be logical for a moment. Why would they spend tons of money to get Mark Rasmussen from Jones Day to represent them and settle the deal based on what I just described if they didn’t think the resolution would work everywhere?

Wouldn’t Mark, as the number one crypto attorney in the country with a reputation to defend, advise them to just stop?

He advised them to move forward because they finally found a solution that would be acceptable in every state and federally, not just because of Texas but because of conversations with several attorney generals from other states and even people in the federal SEC.

They aren’t stupid and they aren’t criminals. They are business men who sought out the best advice possible, got caught in the weeds because it was a grey area, paid dearly for their mistakes and then found a solution that would work moving forward for their people.

I personally think it is history in the making. Pretty impressive.

Proof please. There’s no mention of Kala in the TSSB’s complaint or settlement.

The Texas State Securities Board regulates securities. The issue is Nui soliciting investment from investors on the promise of a passive return.

With respect to securities regulation, how they realize that return is irrelevant.

Proof in the pie is Nui ceasing business operations in Texas. If Kala is not an unregistered security then promote it in Texas.

Go on, I dare you.

There’s nothing stopping them registering with the TSSB or SEC. Neither cloud mining or passive investment opportunities are illegal.

The only reason Nui might choose not to operate legally in the US and roll the dice, is if they aren’t doing what they say they are.

How an unregistered security is pitched falls under deceptive income claims, not the existence of an unregistered security in and of itself.

Texas securities law is essentially identical to federal securities law. Nui is as secure in any other US state as they were in Texas.

How much money Nui might or might not have spent to defend themselves is irrespective to the fact that they were caught offering unregistered securities.

Nui is literally one SEC lawsuit away from a federal shutdown.

Securities law has been around since 1933. There’s no grey area.

MLM + passive investment opportunity = security. Either register your company or operate illegally.

No need to pay a law firm to tell you that. It’s been law in the US for 86 years.

?????

Can’t count the # of times I’ve heard something similar just insert different names.

-100% of the time.. it all went wrong for the rubes.

Its called the LONG CON. Many more yokels to fleece vs what they spent to get it settled.

@Jeremy Jenkins perhaps? Don’t be shy.

Why would Nui “make a business decision” not to offer Kala giga and terahashrate investments to members in Texas even as they assure us they could (if they wanted to)?

And why wouldn’t they want to sell to people in one of the largest states in the nation? What is the marketing wisdom here?

Even from a “Post Texas” standpoint, hell especially from that standpoint selling Kala hash rates in Texas right now would engender a degree of confidence in your less than lemming like affiliates like nothing else could.

So tell me again why Nui isn’t selling anything in Texas again? I’m sure you’ll tell me it was Nui’s decision not too. Of course, of course. But tell me how that makes sense from a business perspective again?

And if you are Jeremy Jenkins then you owe the same answer to your rather impressive downline in Nui/Mintage/Kala/Compchain.

Licensed attorneys only have conversations about legal matters with people they have an attorney/client relationship with. There are no exceptions.

The S.E.C’s mandate is the regulation of the securities industry, not business consulting.

SD