Mirror Trading International’s attorneys withdraw

The South African law firm Ulrich Roux and Associates has announced it has dropped Mirror Trading International as a client.

The South African law firm Ulrich Roux and Associates has announced it has dropped Mirror Trading International as a client.

In their December 21st open letter, Ulrich Roux and Associates confirm

Ulrich Roux and Associates was formally appointed as the legal representative of Mirror Trading International on 28 April 2020.

We were appointed by Cheri Ward, head of communications and marketing for MTI, to assist MTI with the following:

- Legal compliance in terms of the SA Companies Act 71 of 2008.

- Legal assistance with the drafting of contracts and general litigation.

- Legal representation pertaining to correspondence received and interaction with the FSCA.

On their official Facebook page, Ulrich Roux and Associates define themselves as divorce and family lawyers.

Beyond money, what they were doing representing a Ponzi scheme with respect to securities litigation is unclear.

As I understand it, URA was used by MTI primarily to silence South Africa based critics. Think OneCoin’s relationship with the notorious lawfirm Schulenberg & Schenk in Germany. The same kind of antics.

Anyway, being the legal face for Mirror Trading International, which is currently imploding, URA appear to have been inundated with queries from desperate investors they were otherwise working against.

URA made it clear from the outset that we were in no position to provide potential clients with financial advice as to whether they should invest with MTI, as we are not financial advisors, nor are we specialists in Bitcoin or any other form of cryptocurrency trading.

Evidently Ulrich Roux and Associates have no problem being paid stolen investor funds to assist a Ponzi scheme. When it comes to the victims whose money they were paid though, they’re on their own.

URA is in no way affiliated to MTI and can accordingly not be held responsible or liable for any profit or loss arising from any investment made, using the MTI platform.

In addition to this, we confirm that our firm is not a member of MTI, nor are we involved in their internal business structure.

URA is an independent law firm, with the sole mandate of providing legal assistance to MTI on a contractual basis, as set out above.

The kicker is URA stating it, as a law firm, didn’t invest in MTI. Whether any of the firms individual attorneys did isn’t clarified.

Certainly, from the way MTI and its affiliate investors used Ulrich Roux and Associates’ name, it would appear so.

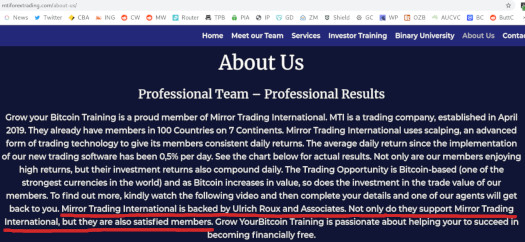

The following is a screenshot from an MTI investor page (still online at the time publication):

The highlighted copy reads as follows:

Mirror Trading International is backed by Ulrich Roux and Associates. Not only do they support Mirror Trading International, but they are also satisfied members.

This is typical of how the relationship between MTI and URA was described, both by affiliate investors and MTI itself.

It’s worth noting that since the news CEO Johan Steynberg fled South Africa a few days ago, promoters of MTI have been deleting their promotional efforts en masse.

It seems that, like Ulrich Roux and Associates, they fear their participation in MTI could lead to criminal charges.

While URA deny the law firm itself invested in MTI, it seems odd they’d let affiliates market them as the legal backbone of the Ponzi scheme and represent them as investors slide.

Remember, URA was primarily used by MTI so threaten and silence critics. Part of that would have been scouring the internet for criticism they could act on.

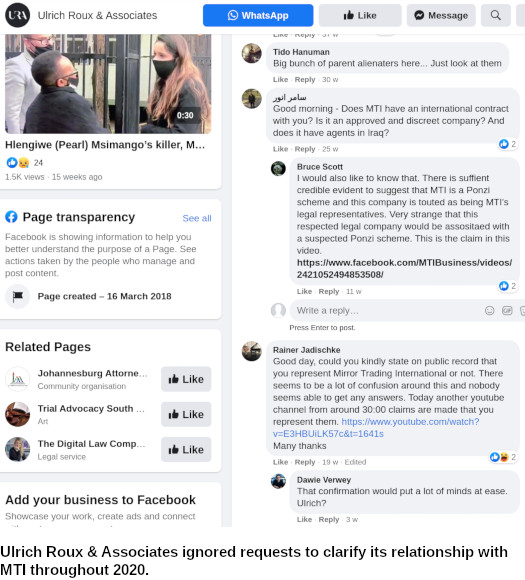

Naturally they’d have known full-well how they were being represented. Indeed there are several instances of URA being asked to clarify their relationship with MTI throughout 2020.

As you can see, all of the queries went unanswered.

Only now, with Mirror Trading withdrawals suspended and criminal charges looming, has the law firm put out a statement.

Other points clarified by URA in their statement include:

- confirming Johan Steynberg is no longer in South Africa and not contactable (we suspect this last claim is a lie pushed by Cheri Marks);

- MTI affiliates are not being paid withdrawals;

- URA itself has received “no clear instructions” from MTI regarding points one and two; and

- URA has been in contact with the FSCA regarding their investigation and will continue to cooperate.

Legal representatives only act upon instructions of their clients and accordingly we are left with but to withdraw as the attorneys of record for Mirror Trading International, as we hereby do.

URA finishes up by requesting any further enquiries be directed to MTI corporate. Which, as I understand it, are not responding to affiliate investor enquiries.

What’s that? Shit hit the fan? Thanks for the money guys, bye!

Update 23rd December 2020 – Comments by Ulrich Roux on a recent Mirror Trading International webinar, casts convincing doubt on the claims made by Ulrich Roux and Associates in their withdrawal notice.

I have so many friends that contacted me to be in their MTI downline.

It was quite easy (as with Crowd1) for me to smell a rat.

I kept on telling them that MTI lacks transparency and that taking MTI’s word without any real evidence of ROI wasn’t good enough for me.

They were all so amazed at my response since they saw their money grow (on MTI’s fake front end) and even got payouts until a while back. As if that was any evidence of it not being a Ponzi Scheme!?

I feel really sorry for all of the people that got scammed.

Serial scammer Joel Santiago has jumped ship:

He’s crushed, crushed I say to discover MTI is a scam. eye roll.

Regarding URA, there are 3 reasons that could perhaps explain for them withdrawing. I’m not a legal expert, so not sure if these are in fact valid.

1. When BTC Global (Cheri’s previous scam) collapsed, URA represented Andrew Caw (Cheri’s best friend). He is involved in MTI too, so perhaps URA is to represent him again and thus couldn’t represent MTI. But the fact remains, URA has now been involved in at least 2 Ponzi schemes.

2. The names of at least 2 of the URA associates were found in the data leak, and thus perhaps created a conflict of interest.

3. Ulrich Roux himself was on one of the recent “Zoom meetings” where he didn’t speak very favorably of the FSCA. Perhaps behind the scenes there is action being taken against him and thus his firm wouldn’t be able to represent MTI as UR would now have to defend himself.

Joel needs to get in touch with Ari Macabbi. Ari can make him feel better when he joins Ari and pimps Ari’s latest and greatest (cough, cough) legitimate program. We know it is legitimate because Ari said so. I am sure it will help Joel get over being crushed with MTI’s collapse.

Joel’s only concern is how he can get his bitcoin back that he hadn’t yet, but it sure did sound good claiming he wanted to help “all” get their bitcoin back, didn’t it.

Thier goes my $100 bucks.

Divorce and family law may well be the bread and butter of Ulrich Roux and Associates, but I think that one major aspect here is that Ulrich Roux is a publicity whore.

Just pop his name in the YouTube search box, and you’ll see he’s a prominent legal talking head on South African TV. It seems like no high-profile court case is complete without Roux appearing on some TV show or other, giving his expert opinion – primarily on criminal cases, but his area of legal expertise is near-universal.

Lawyers who actively pursue the spotlight like that usually don’t particularly care what kind of business it brings them.

That’s also why his name is featured so often and so prominently in MTI publicity material: it’s an attempt to create “as seen on TV” respectability. (Allowing his name to be used like that would get him in serious trouble with his professional association in a lot of European countries, but perhaps it’s allowed in SA.)

He’s also got a prior connection to the previous Cheri Ward/Marks scam, BTC. When one Andrew Caw and his company Bitcaw Trading were mentioned by the authorities as being behind BTC, Caw huffed and puffed, claiming he had nothing to do with it, and threatening legal action. He hired Ulrich Roux as his lawyer (and no legal action followed, AFAIK).

Caw also contacted BehindMLM about it, demanding his name be removed. Which perhaps he shouldn’t have done, because that led to some digging showing him to be a close associate of Cheri, and heavily involved in BTC:

https://behindmlm.com/companies/btc-global-team-ponzi-collapses-admin-in-denial/

https://behindmlm.com/companies/bitcaw-trading-threatens-to-sue-hawks-over-btc-global-team-assoc/

Ulrich is really no different to his old man Barry. Remember how Barry loved the limelight during the Oscar Pistorius trial? We all believed Oscar was innocent didn’t we? For about three seconds maximum

Hi All,

Is there no way to withdraw your funds from MTI anymore?

Thanks 🙁

Those interested in hearing Roux state in person just how perfectly legal MTI is, how bad, misguided and downright stupid the FSCA is, and how the FSCA is legally incapable of shutting down MTI, can listen to this video:

MTI Leaders Meeting November 2020

youtube.com/watch?v=fjG4X3oOHxw

He authoratively explains how the conservative dumbasses at the FSCA are not only suspicious because they’re incapable of understanding how the financial geniuses from MTI are able to generate such huge profits, no, behind it all, as their main driving force, is their desire to destabilize the cryptocurrency market in general.

(It’s long, but he’s on right at the beginning. Cheri sucking up to him is also entertainingly cringeworthy.)

@ PassingBy

It seems a complaint about Roux’s behaviour to the Law Society of the Northern Provinces in Pretoria is in order

Thanks for providing that video PassingBy.

Will go over it tomorrow in detail, think there’s a followup worth publishing.

There are still ample of people believing in MTI.

As it stands, there are many who are jealous and want to destroy this company. On the other hand, Many people have invested their life savings, because they believe in the company.

Their belief is based on MTI employees, their work and includes the top management. They believe that all of them are good people. That is what makes any business to prosper.

Some of them won’t even try to get their money out. They are loyal, and they will be waiting.

Every company has its ups and downs at the beginning. I wish them all the best, I also believe in them.

Let’s leave the things go it’s own way for now, and see how things revels.

Regards

Apparently we all live in one giant movie from the sounds of MTI’s official statement on things. They’re clearly getting desperate now……..

moneyweb.co.za/news/south-africa/mtis-statement-on-missing-ceo/

There is a huge followup to do, you are far behind by now unfortunately, the updates are worthy of a movie script!

@Nina

False. I viable business model makes a business prosper.

The Ponzi model used by MTI is not a viable business model. Sorry for your loss.

Y’all gonna have to be a little patient with me today. Got some unavoidable errands to run but I’ll be back in the afternoon to cover the crazy MLM news we all love.

Omg what is this.

I was expecting bullshit from Cheri but this thing is a freaking novel.

So, let’s review the BS MTI has been feeding everyone.

1. They safely earn 10% per month with automated Forex trading. An impossibility according to those educated with regards to Forex. Yet, MTI has cracked the code with their EA trading. Clever bunch.

2. MTI can’t supply you with any evidence (broker trade reports) of their profits because the expert advisor they use to trade with is a protected secret.

3. The broker (FXChoice before Trade300) also requested not to be revealed because too many people were contacting them while doing their due diligence. (Although a quick search on the Internet would reveal who the broker was)

4. Trade300 is a broker that has existed from 2014 according to Trade300’s website. Yet, if you use the way back machine you can see that the domain name was for sale last year and the year before and so forth…

5. They do not need to be registered with the FSCA although the FSCA disagrees with MTI on this statement. Johan is somehow more knowledgeable than the FSCA and all the investors believed him.

6. Just as the FSCA was closing in on MTI, all of the sudden, Russians started hacking their servers.

7. MTI is the victim of the FSCA, the Russians, The Texas Securities Board as well as the Freemasons. All because these people are jealous of MTI’s success and don’t want them to succeed so MTI’s poor CEO had to flee the country.

Look, if ever I heard a bunch of BS, then this is it.

@Nina. The company that you believe in has been banned in one state in the USA, they have been blacklisted in Montreal and they are facing an official criminal charge in South Africa, one of their biggest account holders and marketing influence (Crypto Analyzer) has brought out a video now stating that this business might be a scam, people are no longer able to withdraw and sign up new people and MTI’s lawyers have now jumped ship.

Your CEO has fled the country and the “management” that you refer to has a track record of doing this exact thing in their previous scams.

At a stage in your life, please take a few steps back and reassess how genuine greed is affecting your cognitive decision making ability. Also be aware that any profit you had made from this was stolen from others who were scammed into this by people with the same mindset as you (that mindset being: “I will step on whoever I have to, to make money).

Your words show a clear lack of knowledge on proper business practices and financial literacy.

You seem to be under the impression that the FSCA are the police and don’t know the first thing about business.

Please take into account that the FSCA are not the police. They consist of a variety of individuals, most notably forensic auditors who studied for years and specialize in what does and does not indicate proper business practices.

Please don’t make the mistake of believing that your crack a shit googling skills is equal to their skill set.

In future please stick to your skill set and stay out of the business world as you might, in future, again be responsible for the financial detriment of people who trusted your poort business savvy.

Maybe start by realizing that you are wrong, you have wronged others and how can you prevent from doing this ever again. It would be the most constructive thing that MTI could’ve done for you.

Also, if you wanna hit back with the old: “You’re just jealous cause I made money and you didn’t” jibe. Let me assure you right here and now that criminals don’t make me jealous.

I wasn’t kidding 😉

I sympathize, but you have been swept up in sensation and lied to by whoever referred you, and those that paid them to do it. MTI is and always was a long-term scam meant to steal as much money as possible

Short of it is wherever you are from go to the police and join the thousands of others reporting this financial fraud.

Im only interested in how I will get my deposit back? Some of the staff must be held responsible or Johans wife?

Ye withdraw is pending 🙁

JUST IN | Court grants provisional liquidation order against Stellenbosch Bitcoin trader MTI

news24.com/fin24/companies/financial-services/just-in-court-grants-provisional-liquidation-order-against-stellenbosch-bitcoin-trader-mti-20201229

A small victory. But a victory nonetheless…….

Liquidation = US equivalent of a civil lawsuit?

Typically these actions are stayed pending the outcome of regulatory action.

I suppose because *crickets*, they’re going to proceed and cause a mess.

“Liquidation” means the company for all intents and purposes (ito the Insolvency Act) has more debts than assets and cannot reasonably ever get out of the hole. Everything is frozen and the assets liquidated.

Think of a fire sale. Anyone who lost out makes a claim and if they are lucky receives a few cents to the Rand.

Outstanding taxes and salaries to unpaid employees come first. Typically, there’s nothing left over.

So how’s that going to work when the “assets” (stolen funds) are locked up in Cheri Ward’s crypto wallets?

You need authorities to move in and start making seizures. Any civil action is a waste of time.

How is it going to work?

Not very well. The legislation was formulated in 1936. The FSCA is doing its own thing of course but I don’t expect anything much.

As I understand it, the primary job of the provisional liquidators is to do some thorough forensic accounting, determining what assets are left, and who is in control of them.

You can’t seize stuff without first knowing it exists, and who legally owns it. (It’s pretty certain that MTI as a corporate entity will turn out to own next to nothing.)

Although just how that will interact with the ongoing police investigation isn’t clear to me.

And sorting out how the bitcoin was moved around between wallets isn’t going to be trivial. That there was deliberate obfuscation going on, and the use of tumblers or a functional equivalent, is a given: if they’d kept things simple, the Ponzi nature of the thing would have been glaringly obvious from a simple look at the blockchain.

There is one unusual interesting aspect to this process: the fact that MTI used bitcoin as their money transfer mechanism. The liquidators, and the courts, of course work in real money, in this case rands.

The price of bitcoin has risen steeply over the time MTI was active. It about quadrupled over the course of 2020. Let’s take that as a rough estimate of the overall price rise since people put in money (the correct number will of course be different for each payment).

That would mean that if only 25% of the bitcoin put in can be recovered, 100% of the rand value could be returned to investors. That would be unheard of for a Ponzi. Hell, there could even be an actual, completely accidental, profit.

That whole recovery process is going to be interesting, because of that same bitcoin volatility.

How are any clawbacks going to be calculated, in bitcoin, or in rand, and if so, using the price at what point in time? MTI may end up being the basis for new legal rules about cryptocurrency.

It’s an additional entertaining aspect that if all those people who bought bitcoin only to give it to MTI (I don’t think they had a significant number of investors who already had bitcoin lying around) had instead kept it, and sold it at the moment MTI collapsed, they’d have realized a much higher return than MTI even promised.

At about 10% a month, MTI only promised to triple your money in one year.

All I can think is I’m glad I don’t have to sort the mess out.

In the US all they do is seize everything, liquidate it and then distribute if there’s a receiver (or FTC does it).

Everything is calculated in USD (time of investment and withdrawals), based on the BTC price at the time of investment and withdrawal

If you instigate a parallel civil case the SEC/FTC will get a stay. For criminal cases the DOJ don’t seem to mind (see OneCoin class-action).

Calculating everything in real money and at the price bitcoin had at the time, and therefore treating bitcoin as nothing more than a money transfer system, the way criminals generally use it, is no doubt the simplest and generally fairest way.

But I sometimes wish the authorities could make some of these annoying crypto-believers put their money where their mouth is, and treat cryptocurrency as if it was actual money.

In this case, it would be great if they could force everyone who took more bitcoin out of MTI than they put in to return that profit as bitcoin. Which almost all of them would have to buy at today’s price, not what the price was when they put it in. (With any resulting overall profit in real money being kept by the state of course.)

It will certainly be interesting to see how any seizing of crypto assets proceeds. In particular, how much BTC did Steynberg have control of when he fled, and will they be able to get at it?

(BTW, Steynberg in past utterances apparently showed himself to be a big fan of monero, a cryptocurrency which unlike bitcoin is designed to be anonymous and untraceable. It’s quite possible he’s converted a lot of the BTC loot into that.)

It is reported in the SA media that the Steinbergs have been provisionally sequestrated.

All those nice things they bought will be taken away and sold on a fire sale. Anyone heard from SA’s answer to Ginny Sack, Cheri Mark?

Thanks for the heads up. I’ve been tied up with the vet since Wednesday so I’ve barely had time to moderate comments and reply.

Reviews published were pre-written earlier in the week. I was hoping to have things back to normal today but had to go in again.

I’ll get through what I can tonight and we should be caught up over the weekend (have to go in again on Monday).