Mindset 24 Global’s John McLane Jr. pleads guilty to tax fraud

Mindset 24 Global’s John Brian McLane Jr. has pled guilty to tax fraud.

Mindset 24 Global’s John Brian McLane Jr. has pled guilty to tax fraud.

Following an IRS investigation, the DOJ filed charges against McLane in June 2022.

As per a June 21st “information” filing, McLane made just over a million dollars in 2019, which he failed to pay $417,481 in taxes on.

In addition to income from Mindset 24 Global, McLane failed to declare income from Safe ID Trust and Testculin (dba Stiff Marketing).

Both defunct, Safe ID Trust was an identity protection themed MLM company. Testculin sold male enhancement products.

On top of marketing company income, McLane also generated income through gambling.

That income, likewise, should have been reported as taxable income on the Defendant’s individual income tax returns, but was not.

The IRS’ investigation revealed that, instead of paying his taxes, McLane used the money

to pay a variety of personal expenses, including travel, housing, his children’s college tuition, vehicles, retail purchases, and other living expenses.

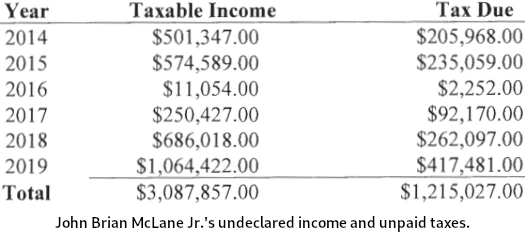

On July 22nd, McLane pled guilty to tax evasion. McLane’s plea agreement detailed additional unreported income, spanning 2014 to 2019:

On November 30th, McLane was sentenced to:

- five years probation;

- home detention for twelve months with electronic monitoring;

- $1.2 million in restitution; and

- 100 hours community service

In addition to tax fraud, McLane settled Mindset 24 Global securities fraud charges with the SEC last month.

McLane will pay $135,200 in disgorgement, $17,770 in prejudgment interest and a $60,000 civil monetary penalty ($212,970 total).

The SEC filed suit against Mindset 24 Global and McLane in 2021. The regulator alleged McLane ran a Ponzi scheme topping a million dollars.