Lyoness to launch eCredits cryptocurrency

The latest MLM Ponzi scheme to attach itself to a cryptocurrency appears to be Lyoness.

The latest MLM Ponzi scheme to attach itself to a cryptocurrency appears to be Lyoness.

If a recent Latvian promotional video is to be believed, Lyoness are gearing up to launch “eCredits”.

Lyoness, also known as Lyconet, Cashback World and now MyWorld, have not published technical specifications for eCredits.

Official Lyconet marketing material suggests Lyoness intends to generate eCredits and integrate them into the company’s e-commerce platform.

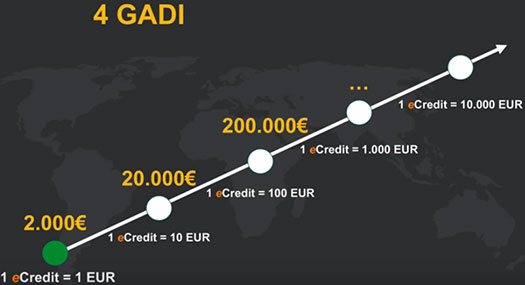

Initially Lyoness intends to sell eCredits to investors for 1 EUR each.

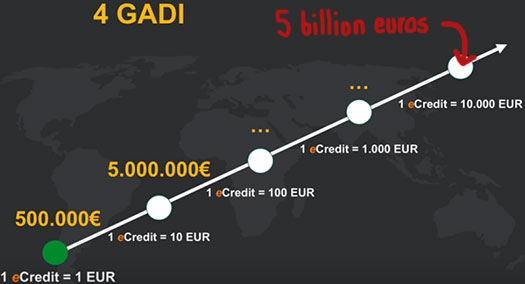

As above, the Lyoness is marketing eCredit investment on a 10,000% ROI within four years.

There doesn’t appear to be any basis for this, other than the expectation Lyoness affiliates will continue to invest in eCredits.

One could argue Lyoness’ e-commerce platform would drive the value of eCredit up, however that’s not likely considering usage of the platform is limited outside of affiliates who’ve invested.

According to the Lyconet presentation, there are three ways to acquire eCredits.

- investment into Enterprise Cloud (formerly Customer Cloud) and/or discount vouchers

- attending a Lyoness marketing event headlined by Eric Worre and/or

- qualifying for the President’s Bonus

A 2000 EUR investment into a discount voucher or Enterprise Cloud position is bundled with 2000 eCredits.

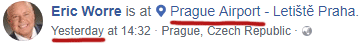

The “Worre Seminar” is an upcoming Lyoness event in Prague.

Lyoness are rewarding those who purchase ten or tickets to the event with 1990 eCredits.

An addition 199 eCredits will be given to each affiliate who attends the event (redeems a ticket).

The Presidents Bonus awards millions of eCredits to Lyoness’ top earners, typically affiliates who have convinced thousands to invest after them.

Bear in mind eCredits cost Lyoness next to nothing to generate and are worthless outside of the company itself.

At this stage Lyoness hasn’t announced whether they’ll operate an internal exchange so affiliates can cash out their eCredits.

Affiliates are also as of yet unable to actually acquire eCredits, with the company instead offering “priority”.

I believe this is Lyoness’ way of keeping track of who to allot eCredits to once they flick the switch and start generating them.

While eCredits are in the priority stage, Lyoness affiliates are able to invest in up to 49,668 eCredits per account.

Lyoness’ Erric Worre Seminar is scheduled to take place over May 24th to 26th in Prague, Czech Republic.

Worre’s social media profiles suggest he’s currently in Prague, so I’m assuming the event is taking place as scheduled.

Eric Worre describes himself as a “network marketing expert” and, through his Network Marketing Pro brand, is widely regarded across the MLM industry.

What’s he’s doing headlining an event for a confirmed Ponzi scheme is unclear.

Through Operation Cryptosweep, US authorities and several international regulators recently announced a crackdown on cryptocurrency related securities fraud.

Whether Worre, a US citizen, will personally endorse Lyoness’ eCredits at the event is also unclear.

Lyoness meanwhile have provided no indication they intend to register their eCredits cryptocurrency with securities regulators in any jurisdiction they operate in.

The official Lyconet Latvia marketing material contained no regulatory disclosures, only hype about how much of a return eCredit investment could potentially generate.

Update 29th May 2018 – Apparently we weren’t supposed to blow the lid off Lyoness’ secret eCredit scheme.

The official Latvian Lyconet source material for our report has been pulled off of YouTube sometime in the last 48 hours.

Update 25th June 2021 – After three years of illegally soliciting investment into “priority points”, Lyoness’ eCredits Ponzi scheme appears to have collapsed.

Fun to see them using one of the Pictures from Omnia Techs mining facilities…. Lyoness is BS from a to z!

Prolly ’cause multi-level Ponzi schemes and multi-level pyramid schemes wholly represent the multi-level marketing industry. It’s inherent.

Where else would a “network marketing” expert go?

I was on one of those BS “infos”. There is another way, how pepole will be able to mine eCredits. It will be through shopping, in the same way as you get Shopping Points.

And another thing that really pissed me off was that they are calling it a cryptocurrency but it has no blockchain behind. Zero, none.

And the total number of eCredits, when they will stop “mining” them is at 1000 bilions. That is 1 TRILION coins!!

How could a coin with this much supply even reach 10k€? It is not possible, even if all the money in the world is invested in it.

And they are planning to have the value fixed at round numbers. For some time at 1€, then they will somehow fix it to 10$ and so on. The price won’t be set by supply/demand, but it will be fixed from Lyoness?!

This is from what they told us at the info. It was too much BS for my brain, unbelivable what they are doing.

So basically eCredits is not a cryptocurrency, even though Lyoness are marketing it as one.

Just internally controlled points, that Lyoness create on a whim and attach an imaginary value to.

Unregistered securities ahoy!

Look at the bright side. With the North American Securities Administration Association task force going after crypocurrencies, this might be the straw that takes Lyoness down in the U.S. One can hope.

It ain’t cryptocurrency. It’s just eCoins

*eCredits (eg. IOU) 😀

IOUcoin?

what ever it takes to get the cash rushing into their account.

They can call it anything they want.

I can hear the faux compliance wank already. “eCredits can’t be a security because they don’t even exist.”

I can hear them telling one to each other: “screw all the losers, let’s invest in Enterprise Cloud 1 altogether!” 😀

Eric Is working with lyconet Since 2015. This is a Crypto and have some big names Behind.

You can’t “invest” in this crypto, only is rewarded by performence.

Yes, this crypto have a cost to the company, and it’s more real that you can imagine .

how can you say this thinks without any knowlage?

(Ozedit: Offtopic derail attempt removed)

Any doubt I can help. Just reply to my coments.

Guys like Eric Worre advertise for every scam if the money is right!

NOLINK://share-your-photo.com/0423a92e2d

As you can see here, Eric Worre has promoted the Lyoness fraud since 2013 or earlier.

@PT

If you invest in vouchers and get points, you’re investing in points.

And eCredits are not a “crypto” if they’re not publicly tradeable.

Given how frequently they rebrand themselves to avoid regulators, Lyoness presumably already has a team of developers working for it.

It takes five minutes to set up an altcoin script and maybe a few thousand if they’re running it on a dedicated server. A few hours work tops to integrate it into Lyoness’ existing platform.

The cost of setting up a Ponzi points script is negligible.

Aaaaand it’s gone. The Latvian Lyconet eCredit marketing video has been pulled from YouTube.

@OZ

– They will be publicly tradeable at the launch. Not right know.

E -credts is Crypyto.

– Lyconet/lyoness is still the same company. The networkmanketing part of the company is the same.

The rebranding have ocour in the client front what is normal and necessary in the business world to stay relevant.

Yes, you can take some minutes to set up another coin. Here the chalange is not creat a new coin. Thats easy, the question is the usability of this coin in all places. And also the sistem interation with exchanges.

Move on guys, lets talk of real Ponzi and piramid scams that are doing real bad things. Not this 15 year company. Start to be ridiculous.

Lol, straight out of the MLM Ponzi playbook. If you can acquire eCredits they’ve launched.

Not publicly tradeable with a publicly verifiable blockchain? Not a cryptocurrency.

Killing off an established brand and launching with generic unknowns is the opposite of staying relevant.

And trying to dodge regulators with name changes every 6 months isn’t normal for a legitimate business by any stretch of the imagination.

I invest funds with Lyoness. When enough new funds have been invested Lyoness pays me a ROI out of subsequently invested funds.

It doesn’t get much more of a real Ponzi pyramid scheme than that. The only thing ridiculous here is the denial.

Once again you don’t have the correct information.

You cannot buy the crypto know. You are reward by performance. And you don’t receive it know. Only at the launch.

It’your opinion is irrelevant regarding the legal side of this. Is just that. Opinion. (Ozedit: unsupported claims removed)

@PT

Nah. I invest in Lyoness, once enough subsequent investments have been made Lyoness pay me a specified ROI out of subsequently invested funds.

That’s Ponzi fraud and illegal the world over. Facts are facts.

Feel free to explain how using newly invested funds to pay Lyoness affiliates a ROI, as per Lyoness’ compensation plan, isn’t a Ponzi scheme.

Well for the ecredits there is another company. Which is all on blockchain. Lyoness platform will be used as an ecosystem because of the merchant network.

And yes…the Eric worre seminar went well…15k in the first 3 days..now the second event is happening with another 15k people.

They even lounched their own social messenger… which will be the titled sponsor of F1 and MotoGP Austrian GP.

So maybe You should put some MyWorld section in Your page where somebody who actually knows how it works can answer. Thats of course if somebody here actually cares about the facts 😀

Oh and those crazy numbers… well its not like they are impossible… dont know about the 4 year period though.

But can You imagine how high can a digital currency go if You can use it on daily basis in 400 000 places and trade with other cryptos ?

Another Lyoness shell company? Of course there is.

How what works? Lyoness is a Ponzi scheme as we’ve spelt out in our reviews. eCredits are Ponzi points and not a cryptocurrency, again as we’ve spelt out in our Lyoness related content.

The same as every other MLM altcoin that markets itself on the same “what if” hype?

Lyoness as an e-commerce platform has failed outside of the AU/voucher/coupon Ponzi investment scheme, which Lyoness is running out of countries to migrate to (where to after Italy inevitably collapses?).

Adding internal Ponzi points to that isn’t going to make the platform work.

Karlis – According to the presentation in Prague there is only 71 merchants with a total of 23 156 stores where these eCredits can be used.

And not as a currency, they are converted into voucher codes on the Lycoscam app.

The cooperation with these merchants are the same as any company that want to reward its customers/employees. When the big merchants find out that they are selling basically giftcards to a company like Myworld they will stop.

The amount of merchants will decrease and smaller merchants with close to no possesion of the market will be added. It happened in the nordic countries, Germany, Italy and will happen again.

On 31 May 2018, the Norwegian Gaming Authority made the decision in which Lyoness was notified that it must immediately cease all operations of, participation in and extent of its activity in Norway, as it is in violation of Section 16 second paragraph, cf. first paragraph, of the Lottery Act.

Decision in English:

bekm.us/lyoness-must-stop-illegal-pyramid-activty/

Well, put it this way then:

You actually doesn´t have to (Ozedit: Snip, see below.)

What you can and can’t do outside of Lyoness’ fraudulent investment scheme is irrelevant.

Lyoness affiliates have been trying to justify investment fraud with “what abouts” on here since 2012.

You wrote in the post before: Feel FREE to EXPLAIN…. and I did!

(Ozedit: Snip, see below)

What I actually wrote was:

Which you completely ignored and instead started bullshitting on about hypotheticals.

Either address Lyoness’ Ponzi investment issue (irrespective of what else is or isn’t possible) or we’re done here.

For the second time I will try to post on this thread, hopefully the moderation will accept it, as I see here there is a lot of censure when there is someone who want to explain how real things are.

1. Scheme

Tell me any MLM company with a (Ozedit: what other MLM companies do or don’t do is irrelevant to Lyoness being a Ponzi scheme)

Saying that, who’s fault is if representatives use their plan wrongly? Theirs or the company?

In my opinion if there is a solid and clear business with a service or product to consumers and you have many options to make money without recruiting, I would say it’s not an illegal scheme.

2. Crypto

Before making all that claims just based on fragmented information, please wait until midle of 2019 where all the information will be public and then share your opinion.

By the way, this you can publicly found right now:

trademarkia.com/ctm/ctm-company-cryptix-ag-864465-page-1-2

You can’t use a plan “wrongly”. Either an MLM compensation plan is fraudulent or it isn’t.

Lyoness use newly invested funds to pay off existing investors. This is Ponzi fraud by design.

That’s nice. That fact of the matter however is whatever options you attach to a Ponzi scheme are irrelevant. Fraud is fraud.

It takes 5 minutes to set up an altcoin. Stop making excuses for Lyoness trying to exit-scam through a worthless altcoin launch.

Let’s try again, tell me some (Ozedit: Offtopic derail attempt removed)

In Lyconet every upfront payment is redeemed by making purchases on merchants, so every participant can be paid by paying the upfront volume of benefits of purchases to leverage their business and than they can get it all back just by shopping by themselves or their free customers.

About “altcoin”, like I’ve said, wait to see what really is going to be launched.

I invest $x with Lyoness and, once enough subsequent investments have been made, Lyoness pays me a ROI.

This is Ponzi fraud. What can and can’t happen outside of that core mechanic is irrelevant.

An altcoin exit-scam. I just saved you a year, you’re welcome.

Your honor, I have no objection to this line of questioning. In fact, ladies and gentlemen, the prosecution rests.

Lol, that one skipped right by me.

Funny you erase what you don’t want to answer.

Any MLM compensation plan will always have the possibility of you just recruiting: If I buy 100 juices, or 100 beauty products to join a company, my upline will be paid, and every time I sponsor a new team member who buy the products everyone above will get paid. And it can goes on and on without any member sell it to customers.

So, according to you every MLM is a Ponzi scheme.

No I erase offtopic bullshit. Stop wasting my time.

False. An MLM compensation plan that permits affiliates to earn on recruitment alone is a pyramid scheme. Simple.

False. Just the “no retail” pyramid scam companies, which for some reason you’ve mistaken for the entire MLM industry.

Just another attempt at legitimate by association. “Everyone else is scamming, so why can’t Lyoness scam too?”

If you have no further flawed justifications for Lyoness’ Ponzi scheme, we’re done here.

61 Clauses in the terms and conditions of Lyoness Europe AG are ineffective or unlawful. This has been decided by several courts in Austria.

The affected contracts are ineffective and Lyoness must repay the money plus interest.

NOLINK://share-your-photo.com/bf8e1bc307

I love when people who consider themselves as experts all they do is criticize what they really do not know.

The world is full of false Gurus, but before listening to someone as the blibly says … for their works you will know them not to hear what they say, better look at what they have done and what they do.

(Ozedit: marketing spam removed)

I don’t. The never-ending parade of Lyoness investors who ignore the facts and instead spout irrelevant marketing nonsense is tiresome.

The Norwegian investigation proved, based on Lyoness’ own submitted data, that the majority of ROI revenue is sourced from funds subsequently invested by new and existing Lyoness affiliates.

That is Ponzi fraud, which Lyoness has been engaging in since the Accounting Unit days (ie. 2003).

Indeed do as the bible says; Look at what Lyoness is doing and has done, not what it and its affiliates claim to be doing.

So,I have a question……

I was given the cashback card to use as a shopper.

We have a chemist in our area who isn’t part of the cashback programme as they have their own loyalty card and we have a petrol station who is also not part of cashback world…. but every time I go to the petrol station, they ask me for my chemist card.

I am the shopper, I can then use the points I generated at the petrol station inside the chemist when buying my baby her nappies or shampoo or makeup..

From what I can understand, when it comes to Lyoness, I, the shopper gets cashback and shopping points to be used at various merchants across the globe who are participating merchants.

So, I tested it at a big food chain that is a participating merchant, and then I tested it when I bought my son his school jersey at our local school shop and each time I used it, I got cashback and shopping points.

So now, I dont understand why there is talk of a scam if shoppers can use this? We actually have a few friends who are active shoppers?

How am I being scammed as a shopper if I didn’t pay anything to join, I am actively using my card and I have lost nothing but only gained?

@Mmmmm

What you can and can’t do with the cashback card doesn’t justify the core Ponzi scheme.

What tends to happen with Lyoness merchants is they’re just affiliates trying to build Shopping Units faster so they can ROI cashout.

Lyoness’ cashback card has never been a problem, the Unit Ponzi scheme behind it is. Thus the cashback becomes a marketing tool for the Ponzi.

Which is also why the cashback has simultaneously collapsed in every country the Ponzi has too.

@Oz

So my husband wants to sign up as a shop owner, he likes the idea of having loyal customers receive his own branded card and the fact that if the customer goes shopping, they will receive cashback and that he himself will also receive a small kick back of their shopping….like the chemist and the petrol station in my previous question.

So if there is no bad news for me as a shopper, and if my husbands shop can retain his loyal customers by offering them a little extra in the form of money back, and he can also benefit out of his customers shopping, then this side of the business is legit?

You can’t “legit” a Ponzi scheme.

If you husband is genuinely interested in providing a cashback card, there are plenty of legitimate alternatives available.

The only reason a local merchant signs up with Lyoness is because they’re in the income opportunity and want to generate units faster.

Why be a front for criminals? You think thats good business?

To OZ.

I see you know what a ponzi scheme is. But also I see that you have no idea what kind of comapany Lyoness is.

So you are talking all the time for ponzi scheme. It has nothing familiar with Lyoness.

Sure it does.

I invest into Lyoness shopping units. Then once enough new investment has been made, Lyoness pay me a ROI out of subsequently invested funds.

That’s a Ponzi scheme.

@OZ

Thats what I am saying. If we talk about something, first we should understand it.

1. You never invest money. But you deposit money into the sistem, so Lyoness will be sure that you are loyal and you will shop in their partners. With every shopping made you are getting cashback, shopping points, and money back from your own deposit!

2. The system pays your extra benefits only because of shopping made from your network.

Easy as that.

You can call it whatever you want. A Lyoness affiliate invests $x in units and Lyoness pays them >$x after enough new $x unit investments have been made by other affiliates.

No shopping needs to take place for this to happen. In fact it much faster to recruit new affiliate investors then try to convince Auntie Maude to buy enough tea towels so you can get a unit ROI.

Not withstanding the shopping side of Lyoness doesn’t negate the core Ponzi business.

This shit has been going for over a decade, as Lyoness collapses and restarts in one country from another. I understand Lyoness better than you think.

They have come to the Balkans. Croatia and Bosnia are their targeted audience now.

There is no word about Lyoness but the eCredits speach is here. Hotel meetings, promotions etc.

Not sure if info in this post is outdated, but was invited to a meeting where they talked about the eCredit and what I was told is in conflict with information here.

I was told that in the best case scenario the increase in the value of the coin will reach 10€ from 1€ in the minimum of 4 years, but can take as long as 8 years or more(currency value is regulated at a fixed value to avoid bitcoin fiasco).

The 1€ to 100€ and more is more of a ‘possibilities’ but very unlikely to happen in any near future (they were quite clear on this point).

Also, after it has been mined there will be no way to ‘buy’ it, all of it will be generated by the spendings and no other way.

The problem is you “were told” by people in a Ponzi scheme. They want you to sign up so they can collect their recruitment commission.

If Lyoness are manipulating the ecredit value then it’s not a cryptocurrency, it’s straight Ponzi points.

Either way you’re being pitched a passive investment opportunity, and Lyoness isn’t registered to offer securities in any jurisdiction.

Do you not see the conflict of the words you wrote here?

It’s not war. It’s diplomacy via extraordinary means.

It’s not violence. It’s just teaching someone a lesson.

And so on and so forth.

If Lyoness can control the value of the “currency”, then it’s not true currency. It also means they can declare it’s all worthless one day. Think about it.

Thanks for what are you doing – a lot of useful infos at this website. I just have one issue:

I noticed you use a lot of fan & distributors pictures and informations, but the company itself says almost nothing about eCredits and other stuff.

The only official info about eCredits for example I found at the ecredits.com website. If you search company materials from the inside of the company, there in no info about the future value of this digital currency (not even they call it cryptocurrency and there is no sign of it will be available for mining as we are used to with other cryptos).

So we also can speculate it will be just digital tokens or so that should erase or lower the fees for trades inside the company. Etc.

Therefore, by mixing the marketers and distributors claims with official info you are in a danger of mixing up the real informations with fantasies and speculations of followers. And by my experience, it can be very far from each other.

I’ve seen and heard many “big infos and announcements” not only from people connected with Lyoness but also other MLM companies and even politics parties and their fans that were later shown as the “wish” of their authors instead of official claims, materials, and what’s worse, the reality.

I think it is just a part of human’s nature to overclaim, so please, do not fall into this trap.

By this comment, I do not rate or judge the company, just the common appearance of this trap.

Hold up, the slides were taken from an official Lyoconet marketing presentation.

This article was written in May 2018, Lyoness have had plenty of time to bury the evidence and/or abandon their ecredit altcoin by now.

The official Latvian presentation we have cited here was nuked by Lyoness within 48 hours of this article going live.

Having lost their largest investor market in Italy, Lyoness probably has bigger things to worry about.

It’s 23 May 2020 and these eCredits are they worldwide launched or they can only be bought within the company?

As far as I know, they aren’t but I want to check with you guys.

AFAIK Lyoness’ crypto plans were dumped in favor of continuing evouchers or whatever they’re called now.

Denny, the holding is waiting for official paperwork to be issued from the EU about the digital currency, so the e- credits will be completely legal and authorised from the european union.

Feel free to contact me to explain you the way you can have the e- credits. Of course you can’t buy them.

My e-mail: (removed)

Digital currency is already legal in the EU. Securities are regulated in each country separately.

Scam excuse fail.

Right, nothing suss about that. You can disclose your investment fraud scheme here publicly or not at all.

That is what I am saying. E- credits (separately than others digital currencies) is waiting for official aprovement from EU. After been aproved will be ready to use.

But we all know who is smartest here. Don’t we.

Digital currency is already legal in the EU. Which body is “approving” them one by one?

It’s not about being the smartest, it’s about calling you out for talking out of your ass to promote a Ponzi scheme.

Of course it needs to be approved one by one, otherwise you can issue your own digital currency and nobody wil know who is regulating it.

I am not working in the EU to know which body is doing what.

But what I know is that any digital currency needs to be regulated so it can be regular to be used.

Thank you for confirming you’re full of shit. Have a nice day.

Where is Lyoness supposed to get permission for a crypto-currency? Lyoness does not fulfill the requirements for a license. Article with statement of the Financial Market Authority follows.

your BECM Inc.

Todays day is 18.10.2020 and lyconet is the full regulated and powerfull company in the world and the epriority credits are the full regulated new payment currency in short future. All partners will accept it becouse is STABLE COIN and if you have epriority you are the winner.

Peoples who have fear and every day cry this is ….. will forever fall in circle of 95% peoples who will work for money and when they will see this is real they will execusing you have been on start lunch.

soon will be Ewallet aplication out so then we will see who is inteligent. Take action today and recieve some priority today becouse tomorrow is LATE.

Happy future and freedom to peoples who understand all sistem of lyconet.

Such to the extent Lyoness’ shitcoin is an investment opportunity (which it’s being marketed as), Lyoconet isn’t registered with financial regulators in any jurisdiction.

You sound like a new recruit. Sorry for your loss.

Oz, the coin will be held by Cryptix and will be connected to the Cashbackworld with a rewards program for who uses ecredits to make their payments.

Cryptix and eCredits are regulated. Cryptix.ag and eCredits.com

The investment opportunity is being marketed through Lyoness. Doesn’t matter how it’s set up.

Lyoness is not registered to offer securities in any jurisdiction.

Hey there,

i thing that Cryptix is just a developer of the eCredits. But it is interesting how they change eCredits in priority points in the backoffice.

Any Update on ecredits? They are supposed to launch oct 31st 2021.

I wrote this article in 2018. Sounds like the only update is “Lyoness is still stringing gullible investors along”.

Lyconet bought a blocktrade exchange for this purpose. From two days you can buy eCredit in pairs to BTC, EURO, USDC.

Priority Points generated for participating in Lyconet will be converted to eCredit.

Yes, you are right, you slept through 3 years, yes, you can still get them, but … 🙂