Acua Wellington is a Karatbars International recovery scam

![]() Back in April Karatbars International affiliates reported receipt of an email from AcuaWellington.

Back in April Karatbars International affiliates reported receipt of an email from AcuaWellington.

AcuaWellington represented they’d “taken over all receivables and liabilities of the Karatbars group of companies”.

Further research reveals Acua Wellington is in all likelihood a recovery scam. But not your typical recovery scam.

As supplied by BehindMLM reader Noel, here’s the email AcuaWellington sent out to Karatbars affiliates onl April 28th;

Dear Sir or Madam,

as you may have learned by now, we have taken over all receivables and liabilities of the Karatbars group of companies.

From our records, it appears that you may have receivables from various services.

Due to the special nature of the business and the legal requirements, we kindly ask you to enter your claim via our website.

Please fill in all the fields so that any claims can be settled according to the Know Your Client principle. Your information should be received by May 15, 2022. Late submissions may be rejected. All information is subject to data protection.

We will get back to you after May 15, 2022 without being asked. Your details will be checked in accordance with banking practice. By sending us your data, you expressly agree to this check.

Please understand that communication can only take place in English.

With kind regards

Acua Wellington Risk Management

One of the immediate red flags is Acua Wellington demanding personal information from affiliates.

This is an excerpt of a more recent follow up email received by another affiliate;

Currently, we are working on the basic collection of claims and demands of any kind.

Please keep in mind that we can and will only process data according to the Know Your Client principle.

Those who do not wish to participate in this system will irrevocably lose their claims.

Karatbars International’s office FaceBook page was abandoned in late 2020.

Harald Seiz, owner of Karatbars International, has made no public statements regarding Acua Wellington.

So who are Acua Wellington?

Acua Wellington operates from the domain “acuawellington.com”. This domain was first registered in 2019. The current incomplete registration was updated on January 23rd, 2022.

I believe this is when the current owners took possession of the domain, with the current website going live sometime thereafter.

Despite only existing for a few months, Acua Wellington its “funds are among the most successful in the world.”

Naturally no company ownership information is provided.

What Acua Wellington does provide on its website is a corporate address in New York City. This ties into Acua Wellington’s representations regarding the SEC, which we’ll get into in a bit.

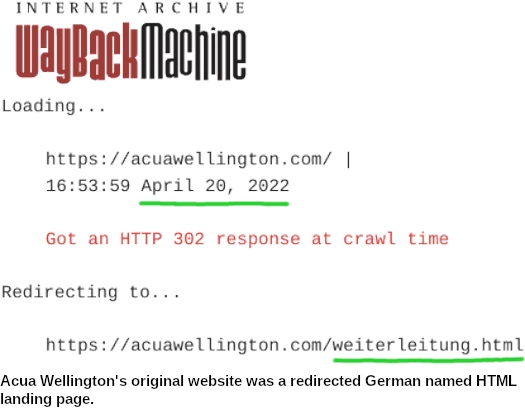

Through the Wayback Machine, we learn Acua Wellington was set up by Germans;

This is significant because Harald Seiz is German and Karatbars International is/was a German company.

Next we have the SEC representations on Acua Wellington’s website:

AcuaWellington is investor-owned. As an investor-owner, you own the funds that own AcuaWellington.

For the 10-year period ended December 31, 2020, the money market funds, bond funds, balanced funds, and stock funds outperformed their peer group averages. Results will vary for other time periods. Only mutual funds and ETFs (exchange-traded funds) with a minimum 10-year history were included in the comparison.

AcuaWellingtons can acquire companies of all types and take them public at any time without going through the traditional IPO process. For this purpose, AcuaWellington can also form a special purpose acquisition company (SPAC), which is subject to the U.S. Securities and Exchange Commission (SEC). Such a SPAC is used to pool funds to finance a merger or acquisition within a specified time frame.

Because a SPAC is registered with the SEC and it is a publicly traded company, the general public can buy its stock before the merger or acquisition occurs.

This is a load of finance bro waffle that has nothing to do with Acua Wellington or Karatbars International.

Our responsibility is reflected in our unique ownership structure, our customer-focused culture and our commitment to ethical principles.

AcuaWellington is owned by its private funds, which in turn are owned by fund shareholders.

Acua Wellington itself is not registered with the SEC. This is a red-flag for a company representing it is US-based and going on about shareholders.

As opposed to having anything to do with “private funds” or shareholders, Acua Wellington is in fact just a shitcoin reload Ponzi scheme.

From the sounds of it AcuaCoin is an ERC-20 shitcoin. These take a few minutes to set up at little to no cost.

AcuaCoin is pegged to ethereum, with Acua Wellington claiming it’s also “hedged via purely corporate assets.”

For obvious reasons, I am skeptical of a company barely a few months old run by persons unknown having significant corporate assets – if any at all.

As of yet there’s no investment opportunity associated with Acua Wellington. That’s probably coming once they figure they’ve got as much ID documents as they’re going to get through KYC.

As above, Acua Wellington has set a July 15th cutoff date for affiliates to provide ID documents to them.

Personally I’m not convinced Karatbars International was sold off. Acua Wellington has German roots and Seiz has been trying to get a new Karatbars shitcoin off the ground since KBC collapsed in 2019.

Acua Wellington is a Karatbars Ponzi reload scheme run by persons unknown. It isn’t based in the US and anyone handing over ID documents is doing so to a third-party of unknown origins.

That Harald Seiz has gone into hiding and not publicly addressed Acua Wellington says it all really. This is not how legitimate businesses operate.

This bit at least is stolen from Vanguard. It doesn’t appear to be a straight copy and paste, but the description of the ownership structure is distinctive.

“hybrid stablecoin” I just eyerolled myself into another dimension…

That worked so well for Terra… *cough*

Golden Independence claimed he received a notification about Acur Wellington from his Karatbars back office.

Having promoted at least three failed Ponzi shitcoin scams, he is probably dumb enough to fool for this latest one.

@Malthusian

Yeah the copy on Acua Wellington’s website felt very copy+paste waffle. Ran a search on a few paragraphs but nothing came up.

Good to know even if it’s not 1:1 copied it’s still ripped off from somewhere.

If they’re promoting Acua Wellington in the Karatbars backoffice then either

1. Harald Seiz is running Acua Wellington; or

2. Seiz sold off Karatbars to one of his German buddies.

The fact nobody is fronting Acua Wellington leans towards 1.

Yeah, well, if at first you don’t succeed, scam, scam again. (I had the exact same thought as you, Fernando.)

Where to begin with all this…Acua W is not at that address. They have a business with no phone number. There is no record of a stable coin. There are no reports on Acua W and their funds returns.

KaratBars was put thru a liquidation process so no assets can be sold. And who in their right minds would but a bunch of liabilities?

Karatbars has no assets and a horrible reputation.

This smells like another attempt from the fraudster Harald Seiz to get his scam company up and running again. It cant be futher from the truth.

I guess I am going to lose my Karat Bars and will not be able to cash out.

I tried reaching out by emailing Acuawellington because I could not upload my ID, I received no response.

There’s no phone number, I admit am very disappointed.

Sorry, TK, but there never were any bars of gold with your name on them. Only numbers on a screen.

Those who received any gold from Karat Bars just got little slivers of gold on paper cards, procured not out of a vault, but purchased at the last minute to add a show of legitimacy. Sorry for your loss.

Do not be fooled by offers to retrieve your funds if you send more money. It’s just another scam.

I feel like I have been scammed no activity on v999 site gold still stuck in karatbars sheesh I need to get some league help.

I’m afraid you have been. I recommend you read all the articles on Karatbars on this site; you’ll get valuable information which may save you from being fooled again.

Scroll to the top of this page. Right under the title is a link: “Karatbars International”, which will take you to a page of the 10 most recent articles.

Scroll to the bottom and click on “Older Entries.” The first article is at the bottom of that page. Start there and work your way forward in time.

Sample at least some of the comments to see how people were taken in, defending the scam because they thought Oz was wrong. He wasn’t. I don’t think Oz has ever been wrong in calling a scam.

Sorry for your loss, David.

has anyone sold the g999 coins on the gstrader platform ? Has anyone been able to transfer any crypto from the gstrader exchange to another platform ?

I forgive you Karatbars. You scammed me well.

How do you get in touch with Acuawellington.com? their KYC form does not accept photos.

No Phone number, no email? Or is this just another scam?

Read the article.

I’d love to know the answer to that also – has anyone been able to trade or cash in the g999coins?

Cash out to who? G999 is worthless outside of the Ponzi scheme and there are no more suckers buying.

GSPartners has essentially migrated to Lydian World. It gives Heit more control over the Ponzi scheme because LYS tokens are essentially Ponzi points.

Is there a class action suit going on with Karatbars?

Not that I’m aware of.

I was going to NYC To get my Gold Now that a waste of time.

What About the gold they shiped to me It’s Real that i recieve.

What gold would that be? Those marketing slivers?

Anything else that might have been shipped to you would be an alternative to paying you money. In that whatever you earnt was used to purchase gold whenever you requested it.

Karatbars’ marketing schtick of vaults of gold waiting for you to collect has always been a lie.

Can I still recover my 28 grams of Gold from AcuraWellington.

The 28 grams of gold you think you got through Karatbars never existed. Sorry for your loss.

Question #13

The answer is yes . You can currently trade G999 coin for BTC,ETH,USDT,LINK,GRT,LYS,XLM on the GStrade exchange platform.

I did a test run 2 months ago trading for USDT. It went through . I then sent USDT to a platform based in US. It worked.

Currently a G999 coin is worth .002104 USDT. This value does change.

What is missing from this article is who is behind Acua Wellington. If you check the connections between Karatbars, E-Karat and the new MBase by Harald Seiz, then one name immediately stands out, which is also behind the finchain scam: Joachim Hackbarth from Dortmund Germany.

If you now research the way Seiz and Hackbarth worked together, you will find evidence of a much larger scam: Altmann Capital Partners, Evergreen VCapital Partners and Finchain. Just follow the money.

So, Klawin. I assume that the private information I provided to Acua wellington went straight to their benefit and eventhough my accounts say I still have the gold and money, it is not there?

Any sense in pursing this with the SEC?

The gold never existed.

Both Karatbars and GSPartners had/have a sizeable US investor base. Reporting to the SEC is better than doing nothing.

So while I see that I supposedly have 43.5grams of gold in Karatbars, thats a pile of crap?

Of course not. A pile of crap would be worth more than non-existent gold.

Thank you for all the information. So sad, the way so many we inticed.

Is there any information lately where the fraudster Harald Seiz is hiding?

Dubai.

A bunch of former nutritional mlm’ers have jumped on his bandwagon and flew to dubai for their events.

He’s not going to leave from there. They’re all protected.

I tried to reach Acua W. by snail mail, using the published address on their web-site….

after weeks, it came back RTS (return to sender) ,,,,,, “was never at this address”

no other way to get a hold of anyone within Acua W. ,,,,,

last I’ve heard was the July 15. 2022 promise to be informed about news (and never heard from Auca W. since).

I also tried to contact Harald Seiz on FB ,,,,, seem to have a grand time with GF + then new Baby ? ,,,,,, somebody actually replied with some ‘mambo-jambo’ msg.

anyhow, nothing with ‘substance’.

Joachim Hackbarth is a fraudster known to the police. According to Finma, he is not allowed to work in the financial sector.

His company network also includes altmann-capital.ch, which he and his partners (Günter Wirsching) use to defraud people.

The company grsltd.org is supposed to help people get their lost money back. This is another one of his scams.