Is Wealth Generators registered to offer securities through Investview?

On the footer of the Wealth Generators website you’ll find the notice:

On the footer of the Wealth Generators website you’ll find the notice:

Wealth Generators LLC is a wholly owned subsidiary of Investview (OTC:INVU)

Investview is a Nevada corporation that actually operates out of Utah, run by Ryan Smith, Annette Raynor and Chad Miller and Mario Romano.

In light of our recent report on Wealth Generators’ Crypto mining package investment offer, the assertion is that Investview being registered with the SEC makes it kosher.

Today we dig into Investview’s SEC filings, in an attempt to answer whether Wealth Generators’ investment opportunities are indeed registered securities offerings.

As per a press-release issued by Investview, Wealth Generators launched Crypto on November 13th.

Looking at Investview’s SEC filings, their last quarterly report was filed on November 14th, the day after they launched Crypto.

According to the filing, Investview has recorded $5.9 million dollars in unaudited losses throughout the 2017 financial year (6 months).

Which is kind of ironic, seeing as Wealth Generator’s whole schtick is generating wealth for its affiliates.

Explanations for Investview’s losses include $1.1 million from “spin-off operations” and $2.7 million from “debt settlement”.

As of September 30th, 2017, here’s how Investview describe their Wealth Generators opportunity:

Through our wholly owned subsidiary, Wealth Generators, we provide research, education, and investment tools designed to assist the self-directed investor in successfully navigating the financial markets.

These services include research, trade alerts, and live trading rooms that include instruction in equities, options, FOREX, ETFs, binary options, and crowdfunding sector education.

In addition to trading tools and research, we also offer full education and software applications to assist the individual in debt reduction, increased savings, budgeting, and proper tax management.

Each product subscription includes a core set of trading tools/research along with the personal finance management suite enabling an individual complete access to the information necessary to cultivate and manage his or her financial situation.

Four packages are available through a monthly subscription that can be cancelled at any time at the discretion of the customer.

A unique component of the product marketing plan is the distribution method whereby all subscriptions are sold via current participating customers who choose to distribute and sell the services by participating in the bonus plan.

The bonus plan participation is purely optional but enables individuals to create an additional income stream to further support their personal financial goals and objectives.

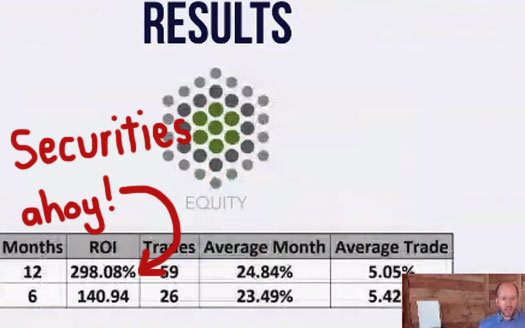

Bearing in mind Wealth Generators didn’t launch Crypto until after this filing, it’s still a far cry from Randy Schrum’s promises of passive earnings through Equity:

The obvious question: How does a company claiming to generate a 300% ROI on just one of its offered affiliate subscriptions record almost six million dollars in losses over six months?

The majority of our revenue is generated by subscription sales and payment is received at the time of purchase.

We recognize revenue for subscription sales over the subscription period and deferred revenue is recorded for the portion of the subscription period subsequent to each reporting date.

Well you see Wealth Generators, at least on paper, evidently don’t use their own offered service subscriptions. Funny that.

Not so funny is the complete lack of disclosure regarding ROI payments to affiliates processed through Wealth Generators.

As per Investview’s filing;

On October 20, 2017, we entered into a Contribution and Exchange Agreement with HODO-mania, a Texas corporation.

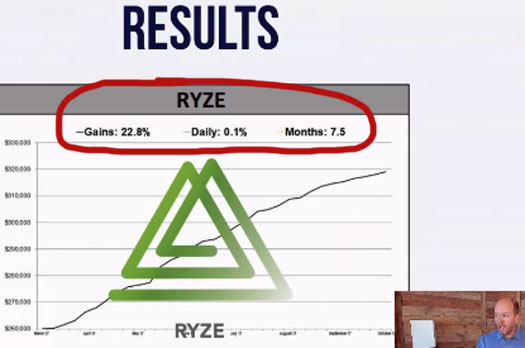

Under the terms of the agreement, we acquired the exclusive use of the RYZE.ai algorithm currently marketed by Wealth Generators as the Multiplier, the option to add certain travel services to its product lineup, and HODO-mania’s member database.

Upon the successful transfer of the assets, we will issue $50,000 of our common stock to HODO-mania, calculated using the closing sales price on that date.

The agreement also includes earn-out provisions that could result in the issuance of up to 200,000,000 shares of our common stock if certain milestones are met.

Hodo-mania doesn’t return any results on the SEC’s database, meaning neither the company or their Ryze platform are licensed to offer securities in the US.

But no problems, Wealth Generators through Investview are – right?

Well um, no. Investview don’t record Ryze ROI payments made to Wealth Generators affiliates in their SEC filings.

As far as I can tell, other than in Wealth Generators marketing (as above), Ryze’s ROI payments are made completely off the books.

In fact Investview don’t even acknowledge they’re paying affiliates ROIs through Equity and Ryze:

Through our wholly owned subsidiary Wealth Generators, we provide education and technology designed to assist individuals in navigating the financial markets.

Our services include research, newsletter alerts, and live education rooms that provide instruction on the subjects of equities, options, FOREX, ETFs, binary options, and crowdfunding.

In addition, to tools and research, we offer education and technology applications to assist individuals in debt reduction, increased savings, budgeting, and proper tax expense management.

Nope, nothing about Equity and Ryze passive returns there.

And I’m not being selective here, you can peruse Wealth Generator’s quarterly report ending September 30th and see for yourself.

But Oz, Crypto launched after September 30th!

Right. And dating back to an earlier quarterly report filed on August 14th, Investview have since filed:

- a few “current report” filings throughout October (8-K)

- the quarterly report referenced above on November 14th (10-Q)

- two “current report” filings and an amendment across November (8-K)

- a preliminary statement on December 6th (PRE 14C)

- a current report on December 13th (8-K)

- “other definitive information statements” on December 20th (DEF 14C)

- a notice of exempt offering of securities on December 21st (D)

One of the October reports deals with payment agreements among Investview’s founders.

The other two deal with “unregistered sales of equity securities” and “entry into a material definitive agreement”.

The unregistered sales of equity securities filing deals acknowledges $2.1 million raised from 17 accredited investors in exchange for shares. Another $50,000 of debt was also converted into shares, again for an accredited investor.

The definitive agreement filing details a “contribution and exchange agreement” with Hodo-mania pertaining to Ryze.

On October 20, 2017, InvestView, Inc., entered into a contribution and Exchange Agreement with HODO-mania, a Texas corporation.

Under the terms of the agreement, InvestView acquired the exclusive use of the RYZE.ai algorithm currently marketed by Wealth Generators as the Multiplier, the option to add certain travel services to its product lineup, and HODO-mania’s member database.

Upon the successful transfer of the assets to Investiew, InvestView will issue $50,000 of its common stock to HODO-mania, calculated using the closing sales price on that date.

The agreement also includes earn-out provisions that could result in the issuance of up to 200,000,000 shares of InvestView’s common stock if certain milestones are met.

There’s no mention of ROI payments to Wealth Generators affiliates by dumping money into Ryze.

The November current report filing and amendment deal with another “entry into a material definitive agreement”, “unregistered sales of equity securities” and “financial exhibits”.

The November 13th filing deals with an agreement with Priam Technologies and Binnacle Research Marketing, who appear to be shell companies that issue licenses for the use of Ryze.

On November 13, 2017, InvestView, Inc., entered into three material definitive agreements:

The first is a Product Contribution Agreement with Priam Technologies, Inc., a Seychelles international business company.

Under the terms of that agreement, Priam will arrange for InvestView to enter into a license agreement with Binnacle Research Marketing, Inc., for the rights to a software program used in the foreign currency exchange market under the name Multiplier 2.0 or “Ryze” for use in the direct sales market.

In consideration, InvestView will grant to Priam 25,000,000 shares of InvestView’s common stock upon execution of the agreement, with earn-out provisions for an additional 150,000,000 shares.

The second is the Exclusive License Agreement with Binnacle Research Marketing, Inc., under which Investview will actually license the Ryze technology.

Upon execution of the agreement, InvestView will grant to Binnacle 20,000,000 shares of its common stock, with earn-out provisions for another 20,000,000 shares.

In disclosing the third agreement, for the first time InvestView acknowledges the Wealth Generators Crypto service.

The third agreement is a Product Contribution Agreement under which InvestView will acquire from WestMyn Technology Services, Inc., a Delaware corporation, the right to lease certain hardware and firmware to be used in mining cryptocurrencies.

Under the terms of that agreement, Investview will issue 40,000,000 shares upon execution, with WestMyn to receive up to another 85,000,000 shares under certain earn-out provisions.

Although Priam, Binnacle, and WestMyn are affiliates of each other, they are not affiliates of InvestView, and these agreements were the result of arm’s-length negotiations between InvestView and each of the entities.

WestMyn Technology appears to be a shell company incorporated in Delaware back in August and run by persons unknown.

The registered agent for the incorporation is Northwest Registered Agent Service, who charge $300 to $400 to incorporate a business in Delaware.

WestMyn Technology have no public presence on the internet as far as I can see.

What’s particularly interesting is that all of the shell companies InvestView is entering into agreements with are “affiliates of each other”. Ie. they’re likely run by the same person/people.

Although Investview claims not to be directly affiliated with any of the shell companies, I’d be willing to bet if you dug deep enough you’d find a connection to Investview’s owners – even if it was through X degrees of separation.

Otherwise why the need to operate Wealth Generators’ various investment opportunities through “affiliated” compartmentalized shell companies run by persons unknown?

As per the attached Product Contribution agreement between Investview and Westmyn Technologies;

Westmyn Technologies desires to compile and provide to Investview certain valuable contract rights to products and to provide a cloud mining agreement, in exchange for issuance of stock in Investview and for the opportunity to earn-out additional Investview stock based on the performance and benefits conferred on Investview by Westmyn Technologies’ cloud mining agreement.

Casting further aspersion on the assertion that it’s a shell company unaffiliated with Investview, Westmyn Technologies signed the agreement through a lawyer in Utah – the same state Investview operates out of.

Further down the document it’s revealed the Director of Westmyn is none other than Travis Bott.

I went ahead and checked Investview’s product contribution agreement with Priam Technologies and the exclusive license with Binnacle Research.

Travis Bott is cited as the Designee of both Priam Technologies and Binnacle Research.

Aaaand here’s where things get really murky.

Wealth Generator’s acquisition of Hodo-mania came about after a failed merger between Divvee and Hodo Global.

Both the Priam and Westmyn agreements secure Bott shares in Investview.

The Binnacle Research is a license agreement and details an agreement over handling of Ryze subscription fees paid by Wealth Generators affiliates.

Basically in exchange for millions of shares in Investview, Travis Bott is providing Ryze and Crypto mining packages to Wealth Generators affiliates.

I’m not a securities lawyer and therefore can’t say for sure whether that muddies the waters over who’s offering what.

What I do know is Ryze AI and Wealth Generators’ Crypto are both marketed as investment opportunities with a definable ROI.

Investview is registered with the SEC but does not disclose revenue purportedly generated by Westmyn Technologies mining operations or ROIs paid out to affiliates in their filings.

They do however have no problem with boasting how Wealth Generators Crypto has already generated over a million dollars in investment as of December 20th.

For reference neither Westmyn Technologies, Priam Technologies, Binnacle Research or Travis Bott are registered to offer securities in the US.

So if Investview aren’t going to disclose the obvious securities offerings Wealth Generators is making available to its affiliates, who is?

Additional filings by Investview in December reveal

- a $325,000 share purchase agreement with D-Beta One EQ, a shell company incorporated in the Cayman Islands

- a $5 million standby equity distribution agreement with YAII PN, a shell company also incorporated in the Cayman Islands

Both D-Beta One EQ and YAII PN appear to be related, with Mark Angelo, Founder and President of Yorkville Advisors, signing off on both agreements on their respective behalfs.

For what it’s worth, the SEC busted Angelo and Yorkville Advisors for $280 million in pension fund fraud back in 2012.

The SEC claims that Yorkville did not adhere to its own stated valuation policies and ignored negative information about certain investments by the funds.

Yorkville also withheld adverse information about fund investments from Yorkville’s auditor, which allowed Yorkville to carry some of its largest investments at inflated values, the SEC says.

The SEC also charged Yorkville’s chief financial officer Edward Schinik with securities fraud.

According to the 35-page complaint the SEC filed in federal court in Manhattan, Angelo made Yorkville’s funds seem more attractive through fraudulent means in order to attract new investors, resulting in more than $280 million from pension funds and funds of funds that allowed Yorkville to charge the funds more than $10 million in excess fees based on the bogus asset valuations.

Strange that, through shell companies in the Cayman Islands, these guys would be so keen to drop millions into Investview.

Or maybe not.

While I’m certain there’s more research that could be done on Travis Bott’s investment opportunities and Investview’s recent financial ties to Yorkville Advisors and Mark Angelo, my interest stops at the Wealth Generators MLM opportunity.

Despite Investview owning Wealth Generators and being registered with the SEC, I can’t see any disclosure of affiliate ROI revenue generated by Ryze, Westmyn Technologies or any of Travis Bott’s other businesses.

Nor is there any disclosure of the amount paid to Wealth Generators affiliates through Bott’s various investment opportunities.

That makes Wealth Generators Crypto and pretty much everything else they offer attached to a return, unregistered securities. And as we’ve seen recently with USI-Tech, US regulators are starting to crack down on unregistered cryptocurrency securities offerings.

Needless to say this probably isn’t going to end well, least of all for Wealth Generators affiliates who have no idea of what they’re really getting into.

Update 29th June 2018 – On around March 2018 parent company Investview renamed Wealth Generators to Kuvera Global.

Randy Schrum of Occupy Wealth is bragging about bringing an attorney to his recruiting event in Las Vegas in January. So in his world, all is well.

Worked swell for USI-Tech.

…oh wait.

How many ponzis did Gerald Nehra personally said is “not Ponzi”? At least three. (Zeek, TelexFree, and Ad Surf Daily) And you’d think an ex-Amway lawyer with decades of experience would know better!

truly a shocking state of affairs, and must follow USI Tech I would have thought into disappearing into the ether.

Oh look! Wealth Generators and OccupyWealth (run by Randy Schrum) is ready to welcome USI-Tech reps to its scheme. It says so right in its post.

facebook.com/occupywealth/videos/154778641837516

Seeing that some of their investors were formerly charged with fraud is never a positive tidbit. But unless I am misunderstanding your point.. I feel like you might misunderstand their Ryze product.

I am a forex trader.. and have purchased various auto traders. If WG is selling an autotrader that you hook to your own brokerage account.. they call theirs Ryze.. I dont see an issue with that.

As far as I can tell they are up till now SEC exempt for their products because their newsletter, signals, and autotrader product are utilized in members own accounts and conducted by members.

Their advice may suck but they arent trading on others behalf and sharing profit with members. (The Ryze results look good though.. 2.7% a month).

Members pay a monthly subscription for the education and information. Or to rent the Ryze software. Not an SEC violation.

But to your point that WG if had some debt should be taking their own advice and profiting better.. lol some funny truth to that. But ironically they seem transparent in showing that their forex signals have resulted in loss.

Their own live account is showing negative. (This is not profits or loss shared with members though).

As far as their Crypto product.. seems promising. I think it’s great folks have an opportunity to purchase/lease some video cards to mine potentially profitable coins. No guarantees are given. I think it could hold up in court.

They are if it’s all automated. I understand there’s a manual option within Ryze but the automated ROI is the issue.

Automated ROI = passive return derived via the efforts of others. That’s a security and people are paying Wealth Generators to access that security, ergo they are required to register that securities offering with the SEC.

Oz Ryze is software. You purchase or rent the auto trading software that you use on your own brokerage account.

WG has no relationship with your broker. No kickback (illegal) and no sharing of profits.

It would be the same as them publishing a newsletter of stock picks (which they do I guess).. which is their advice.. but it’s up to you to purchase that stock.

You purchase the Ryze software but employ it on your own. US regulators have allowed the sale of autotrading softwares. (I’m not an expert but that’s what I feel I have credibly gleaned over the years)

Ryze isn’t the problem, the offering of a passive investment opportunity through Wealth Generators is.

You hand over money to Wealth Generators and a passive ROI is realized. How it’s set up (pseudo-compliance) is irrelevant.

If it was standalone software you downloaded and then run, even web-based then sure. As I understand it you pay a fee to access Ryze through Wealth Generators itself, and seeing as it can be entirely automated, that makes it different to buying a bot.

Edit. I added but didnt save.. US regulators have allowed newsletter distribution (Motley Fool) and the sale of autotrading softwares.

I’d be willing to bet none of those are MLM companies with compensation plans tied to access fees?

MLM regulation has a higher bar for securities.

Well you are not handing over money to WG. You pay to rent the software.. but the account balance you are using the software to grow is with your own broker and within your own complete control.

No promise of ROI or fixed return. The software does what it does and they are required to publish that past results of the bot for other folks are no guarantee of future.

Which you do by handing money over to WG. Come on mate, nobody is buying the pseudo-compliance.

And nobody is paying to access Ryze through Wealth Generators for anything but the expectation of receiving a an automated passive ROI.

You can wrap it up in all the pseudo-compliance you want, at the end of the day regulators don’t care.

So why not just register the offering with the SEC and be done with it?

Well they are registered with the SEC as you detailed. And that product is SEC exempt because it is not a security.

An attorney familiar with this type of product informed me regulators are ok with it. And he has worked with SEC agencies but again.. that’s one guy’s opinion however I find him a very experienced attorney.

Otherwise I dont know. And this is my uneducated opinion, but the difference is they are not growing your funds on your behalf. Yes you purchased a tool.. but it is property.

I might buy a house or land in hopes of appreciation. Or gold coins from a store front dealer and it’s not a security.

And back to the Motley Fool newsletter and many others. They are not licensed brokers.. yet they give stock tips.

They show past results of how their picks have done. People act on those tips in hopes for gains.

You think buying software is so different? A tool you use for trading? On your own? Software is not an unlicensed security IMO.

But to be honest.. I completely disagree with part of your beef. If they are out of compliance, that’s a problem.

And if they are scammers or ponzi etc then call them out. But as a trader.. let me tell you autotraders that average 2.7% a month for over a 4 year period is freakin great. All the ones I have used lose effectiveness in changing markets.

At this point I still dont plan on buying or using Ryze..(I like trading crypto now) but assuming they are allowed to sell it (and I think they are as I said).. that is a WONDERFUL product they are providing people.

Trust me.. there are 1000s of companies and trading “gurus” , training and signals.. and they cause most everyone to lose money. Ive used a number of them. Ryze appears to be a very fine autotrader and tool.

Passive ROI offered through an MLM company = security. And there’s nothing disclosing ROI revenue generation through Ryze in Investview’s filings (at least when I last checked prior to publication of this article).

If I buy a property I don’t suddenly lose the property because I stop paying fees to the previous owner. Further to that any non-MLM examples (such as those you’ve brought up) are irrelevant.

A passive automated return offered through an MLM opportunity is not “stock tips”.

Nobody said it was. An MLM company offering a passive automated return sure is though.

Which begs the question why Wealth Generators doesn’t register its Ryze with the SEC and be sure they’re offering it legally. And do keep in mind this is the same company the recently delved into totally unregistered mining contract securities.

There’s a pattern here.

Oz wrote.. “If it was standalone software you downloaded and then run, even web-based then sure. As I understand it you pay a fee to access Ryze through Wealth Generators itself, and seeing as it can be entirely automated, that makes it different to buying a bot.”

Ok I missed this earlier.. there might be something to this.. if you cant run the software on your own, but instead hook your brokerage account up thru their portal which runs the software.

i guess this could appear less clean. But even software you download and run on MT4 and your brokerage account has a license that connects to the seller so im not sure a regulator will find it THAT different. But im not sure how they give you the Ryze software.

Though I can say this aint “scammin” anyone.. but yeah its possible a regulatory body might not like the set up.

What you acquire and run privately is your own business.

Paying an MLM company for access to an automated passive ROI bot is a securities offering.

At this point I have no reply.. because I replied to all your points and you repeated your same assumption that they are providing passive ROI.

As I said, they cant register it with SEC because its software and they are not trading on others behalf. You turn it on, you turn it off, you adjust the settings etc. It’s in your control.

In fact they ARE registered with SEC but the SEC has exempted their products. THey are registered with FTC and the FTC has not alerted the SEC any differently. Not saying they would. Y

ou agreed- repeated my point.. the tool/ software is a property. THey are selling it. And your overall beef I feel is kinda bitchy because the big picture reality is that they have something awesome that helps people.

They need to abide by the laws.. and you feel maybe they arent.. but dont see a reason to think poorly of them in my opinion. People arent getting scammed. If the products dont benefit them they would quit.

Like anything. I just contacted a leading official with that company and apparently 70% of their profit is derived from retail customers. That’s somewhat noteworthy. (And essential for compliance as well for an MLM)

Assumption? Look no further than Wealth Generators affiliate marketing.

Woah woah woah, where did you get that from?

InvestView is registered with the SEC but there’s nothing in their filings about the passive ROIs they offer affiliates.

You don’t just register with the SEC and then do what you want, each securities offering needs to be detailed in your regulatory filings.

A security isn’t defined by turning something on or off or fiddling with settings. A security is a passive ROI, which Wealth Generators offer through Ryze.

Cool. Feelings have no place in MLM due-diligence though so lets just stick to the facts.

How can you say that without full disclosure in Investview’s regulatory filings?

Lol, sure thing. Come on mate, that’s some MLM due-diligence fail right there.

Ok.. regarding their portal and your comment. Perhaps that’s not as ideal compliance wise. Dunno.

But as a publicly traded company they cant hide as much regarding their products. They have lawyers and regulators look at their stuff often. Seems their set up has passed mustard for months.

This is another common MLM due-diligence fail.

Lack of regulatory action != regulatory endorsement.

Yes you are correct. But you also dont know that. You dont know that regulators HAVENT seen their products. I was told they have and in fact WG made some changes/ adjustments due to this.

I personally dont like MLM for many reasons.. mainly because of false hopes that result in 95% of folks not benefiting financially.. which is why i think most join. But I dont begrudge the rare MLM that has a good product that is unique. And if WG can offer mining contracts (dont require recruiting to benefit) that pay off and it’s compliant in this new unknown landscape of mining pools/ selling property.. I’m actually interested. Which is why I contacted someone.

I was new to bitcoin 3.5 years ago and heard about bitclub network and bought a share, as my experience and wisdom was a little more fledgeling.

Immediately after I suspected they were a partial ponzi. (not generating enough real profits).. however they seem to have lucked out with bitcoin value skyrocket and make plenty or possibly enough profits.. dunno.. I dont trust them. Never would promote them.. but they are still paying me on the contracts. (I would have made more just buying bitcoin and holding as I didnt promote for affiliate commissions).

If WG has legit mining operation and assigning unique video cards to members.. IF thats legit.. I can see it possibly holding up in court. And I’d love to buy some contracts.

Them being public you get a little more evidence and transparency and safeguards.. so as it stands they might be the only ones I’d go with.. but even so there is not 100% evidence. Nor can we know how regulators will deem selling mining contracts in the US in future months/years.

Using bot trading software to generate a passive ROI isn’t illegal, offering unregistered securities is.

Mining with video cards isn’t illegal, offering unregistered securities is.

As long as you continue to ignore the securities offering and insist Wealth Generators aren’t offering a passive ROI, you’re not conducting due-diligence into what they’re actually offering.

Best of luck with the business.

I just noticed Wealth Generator’s “Crypto” offering, me tooism at it’s finest.

WG went out and purchased some super skookum, mega efficient mining hardware and have a proprietary algorithm (no word if it’s 3D or not) that makes the hardware sing like Pavarotti on a hot tin roof. And the best part of all, instead of just turning those machines on and let them churn out altcoins until they’re rich beyond the dreams of avarice, they’ve decided to attach it to a MLM opportunity.

For between 500 and 5,000 USD you can purchase a “lease contract” which provides investors with “daily coin payouts” (plus referral commissions if you participate).

Hmm, let’s run the check list:

The investment of money

Into a common enterprise

With the expectation of profit

Derived primarily through the efforts of others.

Yep, Wealth Generators’ new Crypto opportunity does seem to pass each fork of that test. So, where are they registered?

RYZE is not an autotrader. If it was it would’ve been bought by a large corporation already, not Investview.

It is them taking new investors money and paying older investors 2% per month. Anybody remember Bernie Madoff or am I️ the only one? Same thing with crypto.

They take minimum $500 worth of BTC and you lease ‘mining equipment’ then they give you roughly the same return as Ryze except in Ethereum rather than USD.

No crypto mining machines, and no trading algorithm. Simply old investors being paid by new investors money.

A friend of mine is involved in this. They are called Kuvera now.

My friend was with Worldgn for a few months when one of his upline approached him and several others in his down line about this Wealth Generators opportunity.

A month later everyone signed up for Wealth Generators (Kuvera) under the upline guy and within days everyone in the downline was suspended from Worldgn.

My friend said it was because they were “looking at other income opportunities” which was apparently against Worldgn’s policy?

What doesn’t make sense is that most of these people were also involved in other businesses, corporate jobs, and even other mlm companies during the time they were with Worldgn.

Worldgn didn’t care about any of the other “income opportunities” these people were involved in until upline guy signed them all up under himself in this particular company.

The upline guy is now VP of sales for Kuvera by the way. Maybe this isn’t so unusual but it seemed a little fishy to me.

Upline guy is not VP of sales as I was led to believe. Rest of the post is accurate though.

Tyler, I have a few friends that I know who were in WorldGN too.

As far as I know from them, worldgn is sinking right now since after CES in Vegas, as nothing new coming out, nothing excited coming out at all.

Hence this leads to many leaders “suffering” in their income since no product volumes activities are driven for weeks and months.

I don’t feel shock if Many leaders decide to look for other opportunities to feed their families.

However, I also don’t feel shock for worldgn to suspend few accounts too. Nothing wrong with any distributors doing other income opportunities.

The truth is, I believe the upline’s upline must be “Afraid” that all of their downlines will move to other income opportunities. So the best way is “threatening” them by “suspending A few people first”. This is just an old trick.

But it doesnt work today. As many downlines or leaders will “compare opportunities” by themselves and make a sound decision to either stay at worldgn and sink, or move on to another platform.

That’s just my thought.