Joseph Cammarata bails on iGenius’ NDAU, “too volatile”

![]() One of Joseph Cammarata’s initiatives as Investview’s CEO was integrating it into iGenius’ MLM opportunity.

One of Joseph Cammarata’s initiatives as Investview’s CEO was integrating it into iGenius’ MLM opportunity.

To that end the company put out a June 2021 press-release;

Investview … is shifting its attention to ndau. The company, which has seen new highs in monthly gross revenues and net profits in Q1 2021, is betting on ndau to help fuel continued growth.

“Ndau enables individuals to participate in long-term holding of a digital currency without having to worry about such a wide range of volatility,” Investview Director of Finance Mario Romano said.

“I am confident that with our shared client-centric principles and passion for innovation and growth, Investview, LevelX and Prodigio will prove to be a winning combination for Investview and our customers,” said Investview’s Joseph Cammarata, who was named CEO in late 2019.

Following his arrest on criminal fraud charges, Cammarata pled with a court to let him liquidate his NDAU holdings.

Contrary to marketing representations Investview and iGenius made to their distributors, Cammarata told the court NDAU is too volatile to hold.

iGenius commits securities fraud through NDAU investment, offering annual returns of up to 15%.

To that end Cammarata (right), as CEO of Investview at the time, personally invested an undisclosed amount to acquire 5809 NDAU.

To that end Cammarata (right), as CEO of Investview at the time, personally invested an undisclosed amount to acquire 5809 NDAU.

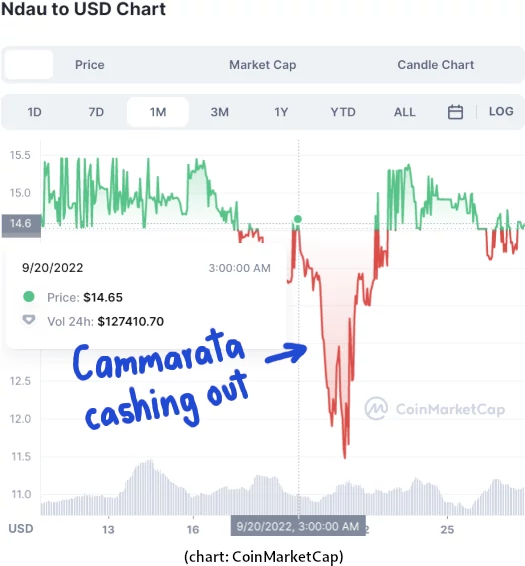

Rather than hold onto the ultimately worthless shitcoin, on September 20th Cammarata asked a court for permission to liquidate.

Defendant owns and controls a crypto asset known as NDAU in a software known as NDAU Wallet housing an account ending in -kuwq.

Defendant represents that he considers the -kuwq account (and NDAU generally) to be a volatile asset, and that the value of Defendant’s holdings has fluctuated between $40,000 and $120,000.

Defendant seeks to sell all of the approximately 5,809 NDAU in account -kuwq (currently valued at approximately $90,000, though the amount fluctuates with the market).

Plaintiff does not object to the sale of all NDAU in account -kuwq to preserve its value, with the proceeds of the sale being held as cash in a new escrow account maintained by Defendant’s counsel, where it shall remain frozen, pursuant to the terms of the Preliminary Injunction.

Cammarata’s assets have been frozen as per an injunction, granted in parallel SEC civil fraud proceedings.

Cammarata’s motion was granted later the same day.

After Cammarata was given permission to liquidate, NDAU dropped from $14.49 to $11.47 within 24 hours.

Through what is believed to be manipulated wash trading, NDAU returned to the $14.50 to $15.50 range over the next 24 hours.

In related news, on September 8th Cammarata filed a motion seeking to dissolve the injunction freezing his assets.

In the motion Cammarata claims he wasn’t “initially concerned” about the ordered asset freeze, because he figured he

knew with indisputable case law and experience with SEC regulations that the complaint brought by the SEC was nothing more than a targeted malicious prosecution brought forth to obtain an equally baseless TRO.

As reality set in, i.e. Cammarata realized the case against him was very real and his “indisputable case law” defense was, in fact, disputable, Cammarata’s position on the granted injunction changed.

Now Cammarata claims the TRO has resulted in “constitutional violation” against him.

This court has been provided sufficient proof and case law to establish that AlphaPlus statutorily did not and could not have engaged in any securities transactions and therefore, the SEC did not state any claim for relief in the Complaint.

The SEC filed its response to Cammarata’s motion on September 28th.

Cammarata’s motion fails because he already consented to the entry of the Preliminary Injunction; and, before that, he had consented to the continuation of the relief provided in the Temporary Restraining Order.

At the time the parties consented to the Preliminary Injunction, Cammarata was represented by competent counsel, Faegre Drinker Biddle & Reath LLP, and had unfettered access to his counsel because Cammarata was out on bail.

Upon release from custody, instead of paying attention to his case, Cammarata was of course plotting to escape the US with his girlfriend.

In a June 2022 text message, submitted by the DOJ as evidence in Cammarata’s criminal case,

Cammarata appeared to admit that he had the ability to evade border protection between Florida and the Bahamas.

It is this route Cammarata smuggled his girlfriend into the US undetected on multiple occasions.

Upon release on bail last year, evidently Cammarata’s plan was to escape the US to Colombia and live off ill-gotten gains.

The SEC submits Cammarata has “access to seafaring boats, private planes, and offshore assets”. Among those assets are an island in the Bahamas and an apartment in Colombia.

Unfortunately for Cammarata, his plans to escape came undone – and so here we are.

As per the SEC, Cammarata and his co-defendants

are facing massive liability, including disgorgement of the more than $40 million they stole plus prejudgment interest on the disgorgement, and civil penalties of up to $775,000 per violation for the defendant entities, and $160,000 per violation for the Individual Defendants or equal to their gross pecuniary gain.

Because Defendants’ known assets fall well short of their potential liability, the Court has appropriately frozen Defendants’ assets and assets of entities they own or control to maintain the status quo and preserve the opportunity to collect on a judgment in this case, including civil penalties.

Given Cammarata’s financial sophistication, international connections, and transgressions while on bail in the Criminal Action, there has always been and remains a substantial risk that absent the asset freeze Cammarata will seek to conceal assets or move them abroad and beyond this Court’s reach.

Cammarata’s assets are as much of a flight risk as he is; accordingly, the asset freeze is necessary to maintain the status quo pending the outcome of this case.

A decision on Cammarata’s motion remains pending.

Update 8th November 2022 – Joseph Cammarata was found guilty on eight superseding indictment count on October 27th.

I didn’t realize there was still action on the SEC’s stayed case docket.

I usually don’t follow stayed cases because there aren’t any filings. Cammarata is an “I’m so smart” defendant though, so there’s plenty of popcorn being served up.

Will be monitoring both case dockets going forward (criminal/civil).

Latest iGenius news:

iGenius reps now have the opportunity to buy and sell BK Boreyko’s Bodē PRO energy drinks.

youtu.be/jeYvBQmVmuQ?t=1048

So, financial education and energy drinks. I’m tempted to think that iGenius got themselves a product fig leaf to decorate their pyramid tree.

Hat tip to YouTuber CC Suarez for breaking this story.

I wonder if it was Boreyko’s ego that prevented this from being correctly framed as an effective acquisition.

Bode Pro never took off. Just get it over with, accept an iGenius exec position and move on.

Ever since the CFTC bust in 2018 Investview has seemed to make any of there acquisitions out to be 3rd party partners of one sort or another.

Their travel portal, their alt coin, their “cryptoElite”, all 3rd party entities. Now Bodē and Verve, 3rd party entities.

My guess is that they figure it will be easier for them to separate from any 3rd party partner if and when the regulators get around to doing their job and shutting down one or more of iGenius’ product offerings.

That makes sense. Boreyko might be weary of losing another business to regulators when the SEC finish their investigation.