Integrity Assets Group Review: WCM777 Ponzi clone

There is no information on the Integrity Assets Group website indicating who owns or runs the business.

There is no information on the Integrity Assets Group website indicating who owns or runs the business.

The company does have an “About US” page on their website, however only the following vague marketing copy is provided:

We are a group with a vision, with major projects, and founded in the land of opportunity, “The United States of America”. We truly believe in making a difference in the world.

The company mentions South America frequently on the same page, indicating possible ownership from within:

Integrity Assets Group, Inc. was founded in 2012 in California. We now hold Multi-million contracts by supplying and distributing products and services worldwide. We are associated with well-known partners and companies from Latin America and Japan.

Our distribution to Latin America is about 350,000 tires for automobiles and large trucks. In addition, Home Appliances are also distributed to our partners in Latin America.

We also count on Strategic Divisions for the exploration and extraction of precious metals like Gold and Silver.

Our Business Warranties are completely solid and secure. We have contracts with companies who buy our products and will continue doing it for the decades to come. Such contracts are secured by a in $300 million bond.

Make of that what you will, keeping in mind that no further specifics are provided on any claims made by the company.

Meanwhile the Integrity Assets Group website domain (“integrityassetsgroup.us”) was registered on January 14th 2014. This throws into question the company’s claims they were founded in 2012, and naturally casts a shadow of doubt over the rest of the company’s claims.

The domain registration itself reveals little about company ownership, simply listing “Integrity Assets Group, Inc” as the owner with an address in California.

The mention of California matches the company’s claim they were founded there, however the specific address provided, 1901 Avenue of the Stars in Los Angeles, is owned by Regus.

The lack of a specific office number would indicate Integrity Assets Group are simply buying virtual office space (a mailing address) from Regus at $139 a month.

Two additional addresses appear on the Integrity Assets website, one in New York (14 Wall St New York, NY 10005) and one in California (100 N Barranca St #870 West Covina, CA 91791).

The New York address is yet another virtual mailbox service provided by Regus. The California address is a building owned by Wells Fargo. It might be legit but given the other two addresses are virtual, I’m not about to give Integrity Assets Group the benefit of the doubt.

As such, whether or not Integrity Assets Group has a physical presence in California or elsewhere in the US remains unclear.

I did note the mention of an “A. Al-Ajluni.” as the CEO of Intergrity Assets Group on a press-release covering a purported sponsorship deal between the company and Bryan Herta Autosport.

Indianapolis, IN – May 9, 2014 – Indianapolis 500 winning team Bryan Herta Autosport announced today that Integrity Energee Drink will be the primary sponsor of the No. 98 BHA/BBM w/ Curb Agajanian entry driven by Jack Hawksworth in the 2014 Verizon IndyCar Series.

“Integrity Assets Group was founded with a vision to supply and distribute products and services that make a real difference in the communities we serve,” said Integrity Assets Group, Inc. CEO A. Al-Ajluni.

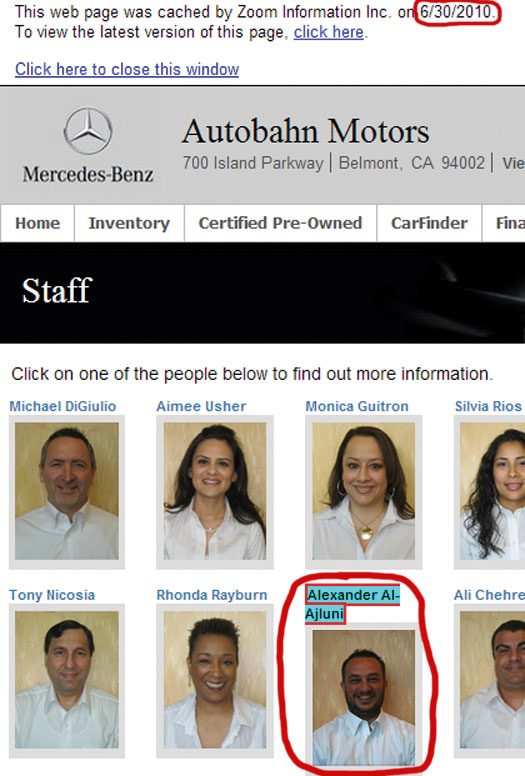

Back in 2010, Alexander Al-Ajluni worked for Autobahn Motors in Belmont, CA as an “e-commerce sales associate”:

A cached capture of the AutoBahn Motors website at the time reveals Al-Ajluni listed as one of the dealership’s sales staff:

Today Al-Ajluni’s name does not appear on the AutoBahn Motors website, indicating he’s since stopped working there.

This would go some way to explain the seemingly random sponsorship of an Indianapolis 500 racing team (auto industry contacts), however Al-Ajluni’s MLM history remains a mystery. Ditto why no information about him is publicly disclosed on the Integrity Assets Group website.

As always, if a MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money.

The Integrity Assets Group Product Line

Whether or not Integrity Assets Group has any retailable products or services is unclear.

The company lists an “Energee” energy drink on its website as a product, however no retail prices are provided. Nor is any information on how a customer would actually go about purchasing the drink.

A separate website has been set up for the drink (“energeedrink.com”), but it’s currently little more than an advertisement for Integrity Assets Group’s sponsorship of Bryan Herta Autosport.

Of note though is the last image of a slideshow that loads up on the site, which I believe shows a recent photo of Integrity Assets Group’s elusive CEO. I’ve included the 2010 photo of him from the AutoBahn Motors website cache for comparison:

Who the other gentlemen are is unclear.

The Integrity Assets Group Compensation Plan

Integrity Assets Group do not provide any information about their compensation plan on the company website.

As such, the following compensation plan analysis has been put together from various Integrity Assets Group affiliate presentations using official Integrity Assets Group marketing material.

The Integrity Assets Group compensation plan revolves around affiliates investing $2151 with the company for membership, and then recruiting others who do the same.

Passive ROI

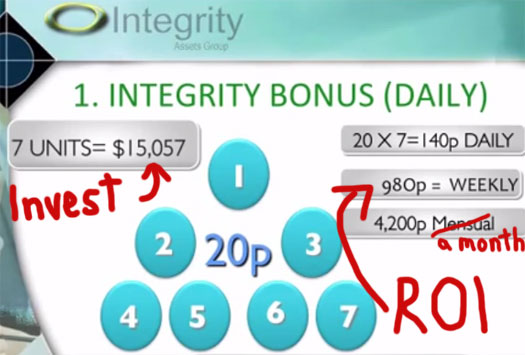

After an Integrity Assets Group affiliate has invested $2151 and joined the company, they then earn 20 QPV points a day for 200 days.

An Integrity Assets Group affiliate presentation I watched stated that

QPV is the same as dollars. We get paid in points but whenever you ask for a check, you’re paid in dollars.

This means that Integrity Assets Group are effectively paying out a $20 a day ROI for 200 days.

At the end of 200 days, this equates to a $4000 (185%) ROI.

Promoters are required to renew their agreements 200 days of the date they became Promoters. The renewal fee is to be $2,151.00.

As per the Integrity Assets Group “Policies and Procedures” manual quoted above, affiliates are then required to invest another $2151 with the company if they wish to continue.

Referral commissions are also paid out on all investments made by recruited affiliates, paid out down five levels of recruitment. Note however that this is not an open recruitment payout and is limited to five levels of a binary compensation structure.

A binary compensation structure places an affiliate at the top of a binary team, with two positions directly below them (level 1):

In turn, these two positions generate another two positions each under them (level 2), and so on and so forth down a theoretical infinite number of levels.

Integrity Assets Group cap payable referral commissions down five levels of the binary, meaning an affiliate is able to receive a commission on up to 62 affiliates (recruited directly or indirectly).

The amount of referral commission paid out depends on what level an affiliate is receiving the referral commission from:

- level 1 – 20% ($400)

- levels 2 to 5 – 5% ($100)

Residual Binary Commissions

Not to be confused with the ROI referral commission, which uses the same binary compensation structure but is a separate commission, Integrity Assets Group also pay out a daily residual commission using a binary compensation structure.

Whereas the referral commission is capped at five binary levels, the residual commission is paid out down a theoretical infinite depth.

The binary model is the same as the referral commission, but instead of a direct payment a pairing calculation is used.

The binary is split down the middle creating two sides and everytime a new affiliates signing up are matched on both sides, a “cycle commission” is paid out.

The matching ratio used is 1:1, meaning each new affiliate on one side has to be matched up with a new affiliate on the other side before a commission is paid out.

When a pair of newly recruited affiliates is matched (or existing affiliates re-invest in another position), Integrity Assets Group pay out $120.

Note that Integrity Assets Group cap binary earnings at $10,000 per day per invested position.

Residual Matrix Commissions

The second residual commission Integrity Assets Group pay out use a 2z13 matrix compensation structure.

Similar in structure to a binary, a 2×13 matrix places an affiliate at the top of the matrix with two positions directly under them (level 1).

In turn, these two positions branch out into another two positions each (level 2), again for level 3 and so on and so forth down a total of 13 levels.

Whereas positions in Integrity Assets Group’s binaries are investments, positions in the matrix represents recruited affiliates. The more filled positions an Integrity Assets Group affiliate has in their matrix (either via direct or indirect recruitment), the higher their monthly residual commission.

For every filled position in their matrix, an Integrity Assets Group affiliate is paid $2 (2 QPV).

This commission is paid monthly, with Integrity Assets Group charging a 40 QPV fee from all affiliates to fund the commissions.

I believe this fee is paid per member account, rather than per investment made under a single Integrity Assets Group affiliate account.

Joining Integrity Assets Group

Affiliate membership to Integrity Assets Group is $2151.

This membership fee is due every 200 days, coinciding with the maturity of an affiliates investment with the company.

An ongoing participation fee of $60 is also charged, with affiliates supposedly receiving some energy drink every month.

Conclusion

For a company with both “integrity” and “assets” in its name, it’s somewhat ironic that Integrity Assets Group is severely lacking in both regards.

Barring one potential actual rented office in California, outside of the hollow marketing spiel provided on their website, there’s no indication that Integrity Assets Group is an actual company.

As for integrity? The secrecy surrounding the opportunity and general lack of transparency speaks for itself.

Both are easily explained by the fact that ultimately, Integrity Assets Group is little more than a resurrection of the Ponzi points business model.

We’ve seen it attached to penny auctions, cloud-storage, GPS trackers and now an energy drink.

Integrity Assets Group affiliates invest $2151 on the promise of a $4000 ROI over 200 days. This part of the model is straight up Ponzi, with new affiliate investments used to pay out the promised 185% ROI.

Integrity Assets Group affiliate presentations encourage affiliates to invest in “7 units”, which permits them to earn recruitment commissions off of their own multiple investment positions:

The rest of the compensation plan is recruitment-based, adding a pyramid scheme layer to the scheme (common in Ponzi points business models).

The referral commissions by way of referrals obviously rely on recruitment, as does the matrix. The binary commissions rely on the Ponzi investments to pay out, but are paid out in such a way that relies on the direct recruiting efforts of an affiliate or that of their up and downlines.

In this sense Integrity Assets Group qualifies as a Ponzi-pyramid hybrid scheme, hiding behind the thinnest of facades – their energy drink.

If I had to make an educated guess, it would seem Alex Al-Ajluni has signed up with a third part to produce a dirt cheap energy drink (which seems to be all the rage these days in MLM), and has figured that if he integrates it into his Ponzi scheme, all will be well.

Unfortunately with nothing being sold to retail customers, advertised ROIs funded by new affiliate investments and no external revenue sources – Energee drink or no, Integrity Assets Group is very much a Ponzi scheme.

California, where Al-Ajluni and Integrity Assets Group appear to be based, issued a cease and desist against WCM777 back in January.

Replace Integrity Group Assets’ energy drink facade with cloud-storage, and essentially you’ve got the same business model.

WCM777 targeted latin america, charged investors up to $2000 to participate and promised affiliates pie-in-the-sky ROIs over 100 days. They too had binary and matrix commissions, with a compensation plan near-identical in nature to that of Integrity Assets Group.

Two months after the California cease and desist was issued, the SEC moved in shut down WCM777. The scheme’s owner, Phil Ming Xu, was also charged.

Should California and the SEC investigate Integrity Assets Group (if they aren’t already), one can safely assume a similar outcome here.

Unit 870 used to be the mortgage office of Wells Fargo in that building. Apparently they are renting it out now.

—

There is a corporation by that name registered April 2013, but it goes to a PO Box, and agent, Ms. Lombardo, is a lawyer

Entity Name: INTEGRITY ASSETS GROUP, INC.

Entity Number: C3549824

Date Filed: 04/05/2013

Status: ACTIVE

Jurisdiction: CALIFORNIA

Entity Address: PO BOX 8251

Entity City, State, Zip: REDLANDS CA 92375

Agent for Service of Process: CATHERINE LOMBARDO

Agent Address: 408 W FOOTHILL BLVD

Agent City, State, Zip: CLAREMONT CA 91711

The only hit I can find about that POBox is an abandoned trademark, indicating that PO Box had since been rerented.

Wysk, however, managed to find another officer: Melisa Haltom, who happens to be on LinkedIn!

NOLINK://www.linkedin.com/pub/melisa-haltom/53/581/251

However, Melisa happens to be a real real estate agent. There are records of her doing business as Integrity Asset Group before, but that’s way back in 1995.

NOLINK://webcache.googleusercontent.com/search?q=cache:aOJsw8bW8DEJ:losangeles.blockshopper.com/sales/tracts/2325_chesterfield_square/1995/Dec/11-15%3Fall%3Dtrue%26page%3D2+&cd=6&hl=en&ct=clnk&gl=us

I don’t see a link between Alex and Melisa here.

Without pulling the actual officers of the California Corp Reg, my personal feeling is the Corvina one is a fake, and the Redlands one is real.

The dates for Melisa is confusing. According to her LinkedIn list she only started investing in 2011. Before than she’s running a pizza joint.

The “Energee” trademark was issued to “The Overall Success Corporation” out of Riverside, CA.

NOLINK://www.trademarkia.com/energee-86304528.html

The address given to this corp, “6420 LITTLE BROOK TRL

RIVERSIDE, CA 92509-6150”, goes to a single family house at a dead-end turnabout. (look for house number on the curb)

I am NOT finding ANYTHING on this “Overall Success” thing. It’s NOT in California reg. However, they do seem to have a website.

NOLINK://www.theoscorporation.com/

English site’s blank. All Spanish for now. It’s a pyramid scheme: give them $500 and monthly fee of 50, refer them 10 people and get $1000. They will give “training” though.

NOLINK://theosexitototal.com/gane-dinero/ (in Spanish)

Still don’t see the link to Energee drink and Integrity Assets Group.

Something is very weird here.

(Oops, got the cost wrong. It’s $200 to start, $20 a month, get $100 per referral)

Oops, should have stated that a trademark application have been filed on June, 2014. It hadn’t been issued yet.

I noted the Energee drink cans had “integrity” printed on them. That’s the only link I could see.

I’m guessing someone in the company has a contact with an Asian white-label energy drink manufacturer.

Brad Smith AKA Brad Snosevick AKA (who knows) is involved with this firm.

It looks like they have cut off comments to their facebook page – I think the end is near.

Thank you for dropping that name concerning, it’s the piece that brings the puzzle into view. Brad Snosevick (and Melisa Haltom) are running this game with Alexander Al-Ajluni being the more or less pretty face of the company.

Brad’s name and one of their phone numbers ties us to this facebook page:

NOLINK://www.facebook.com/pages/Integrity-Assets-Group-Inc/493020837439983

So last year they weren’t a ponzi scheme, they were foreclosure attorneys. The California bar association website doesn’t have a record for him so I guess it wasn’t too hard for him to leave his legal career behind.

Oh, and there is trouble in Energee drink paradise, Bryan Herta Autosports just filed a lawsuit against Brad, Melise and I.A.G. for $1.5 million plus legal fees:

NOLINK://www.dropbox.com/s/65t1od6z7ojzh4z/IAG_Doc_1.pdf

Just one snippet:

Why, it’s almost like IAG is being accused of not being a real company but rather some form of sham corporate entity that Brad and Melise were using as their personal piggy bank.

California Office of Corporations may have something to say about that… if they are NOT accredited in California…

I think it’s called claim ducking… or “asset protection”. They talk up sponsorship, got the logo onto the cars, and the press releases, then claim the corp is the one who owe money, not them.

Sounds like deliberate fraud to me, but I’m no attorney.

Got to love Ponzi scammers heavily using an advertising deal to promote the scam, failing to pay up and then getting sued.

This is why alarm bells should go off the second someone tries to sucker you in with mention of sponsorships, fundraising, charity donations or anything that diverts from the opportunity itself.

Key phone numbers are disconnected, e:mails are getting bounced back – Smosevick unresponsive to inquiries

Here’s a Justia link in case people weren’t convinced that the lawsuit had been filed:

NOLINK://dockets.justia.com/docket/california/cacdce/2:2014cv06008/595809

Had this sent in from an Integrity affiliate:

So follow through the threat: report them to everybody. They already ran off with the money. They don’t give a ****.

the owners of this company are a scam for one “brad smith Snosevick,” I have not got my check and this man claims to be a millionaire.

he made crazy claims about dealing with 100s of millions in gold, but cant pay any of his people, he claims to be a stock expert, and a wall street retiree but cant run a company.

the staff at this company have no idea what’s going on allot of them are leaving and I don’t blame them they say Melissa does the checks but she is never there.

one of the receptionist told Melissa was the owner and that’s why she had to be there to sign my check!! but if your the owner, why did you and MR Brad have little words to say During the member gathering????? why do the owners hide??

I am tired of this and I am now talking to an attorney!

I am a member and also fell for brad snosevick’s lies. I have personally delt with him and he loves to beat around the bush when asked for financial status of the company.

He personally showed my upline multiple checks of thousands coming into the company, he claims they are profits from gold, but if this is real why hasn’t he paid anyone?

Is this a desperate attempt to grab more money after all the race car really convinced ppl this company had money but in the end they got sued !!!!

This man needs to go down, I hope brad is there in the end. I have a feeling this man has no official ties with the company and he is just the scam mastermind.

Members have also confirmed Melissa as the owner but she says very little if you ask me brad is controlling the whole show.

My upline says Snosevik showed him four 1 million dollar cashier’s checks that were proven to be false.

He has also made outrageous claims of being “veteran in stocks” but cannot sustain a company, he has not shown concrete evidence of ever multiplying money for Integrity.

Bottom line this company has no warehouse loaded with product waiting for launch, integrity is nothing but a ponzi.

Brad may not take court cases seriously by his attitude towards recent issues his company has dealt with, good thing the SEC cracks down swiftly and firmly.

I also a member of this company. I have requested a check last two months, but never received the check. I also emailed many times to them, but never get reply.

My account was subtraction, but still…. never receive the check ….even $1.

What can I do next? We can’t let him continue to scam more and more like this. We need to bring him to the court.

Thanks

Report him to…

Local police fraud unit’

US Attorney’s office

SEC

FTC

IC3 (FBI and Homeland security investigations)

Your state attorney general’s office

You better have all the evidence though. A couple posting here or even our “investigation” ain’t evidence.

on may 19/2014 I was invited to the office of Jose Chinchilla over Integrity Assets Group in west Covina to present a joint venture plan on jewelry/Colombian emeralds.

I request $ 250,000.00. He was very responsive and stated that the money was no object since they deal a Ton (1,000 kilos) of gold every month.

He insisted on a fast turnover of a working plan since Alexander Al-Aljuni (CEO ?) requested fast, fast. Then I release all the details of my business and two gems of emeralds.

After four meetings with him, he stop communicating with me, releasing responsability through another person.

After 3 months + He personally went to Colombia to use my trade secrets in his own behalf. He never return the emeralds gems to me and disappear fron Integrity.

What can I do legally?

Thank You.

Hector Basabro

Sue him, of course.

Sue the pendejo’s pants off.

How can I sue him ?

Unless you have receipts, contracts and a whole lot of proof you don’t have anything to work with and even if you have these things, hiring an attorney to obtain a judgment against a deadbeat is no way to get ahead.

The expense of having an attorney handle something like this is prohibitive. You would need to be SURE you could recover at least $100,000 to even start down this path. Ask an attorney if he will take your case on a contingency. If he says no, then you can bet your case is not worth pursuing for you either.

Instead read up on small claims court so you do not need to have a lawyer. Going that way doesn’t cost much, its informal and it might get you a judgment for the value of the gems but not the business idea. Whether you could ever collect anything from the man is doubtful but that’s for you to judge.

If you consider it a theft. Report it to the police. Provide proof, but don’t expect much. They are busy.

Suing “the pendejo” sounds good but in reality its good for the attorney….not you.

Any recent news on integrity assets group?

Nothing on my end.

I have a question. My friends told me he works at this company. He asked me to invest some money on this company.

So I was wondering if this company is legit. Thanks!

I can see why your friend approached you. You seem like an easy mark.

Step 1: Try reading the review.

um.. Actually I can’t see your review. It appears nothing on my screen. 100% sure something is wrong with my phone.

Could you kindly give me some information of this company?

It does not have to be specific. just some bad parts of it. Thanks alot!

How on Earth are you commenting then?

Get yourself to another device son…

Never mind then~! coz i could only see the first paragraph for some reason. I will figure it out. Thanks!

According to integrity assets group they are joining up with an Asian company called The Great Wild Ginseng Firm for an investment. They have photos with the CEO’s on their facebook. Is that another fake company? I can’t find any info on that asian company.

There is a agency name “Lucky LLC” which closed to Little Sai Gon and some Vietnamese’s lady works over there. They asked people give money to them and they will share their point, so that they can take our money. We have gave to them over 100K and they shared their points to us, but until now, we have not get any checks from them. Just an attention to Vietnamese people, please stay away from the Lucky LLC group. They are a scam and be careful with them. Please let us know what can we do to sue them.

Thanks

Another address is coming up associated with Integrity in Fontana. Looks like a residence. Mr. Smith (Snosevick) pulled out gold bars in a meeting and talked a big game about the multiple thousands of ounces he was moving in a month, yet he can not pay his associates, or honor contracts with Bryan Herta or a personal real estate deal.

I have filed a complaint with the West Civina DA and they were already familar with his firm. I would strongly suggest that if you have a greivance with Integrity you file a complaint with West Covina as well as the State and the Feds.

What complicates this that most of his victims are not located in the US.

There are some people telling me to be a member of Integrity assets group that im going to be making good money if I pay for the membership. Is that true or that is just a scam?

^^ Invest all of your money.

Then come back and actually try reading the review you’re commenting on.

To Lui: Don’t put your money to Integrity assets group. They are real scam.

I am their member since last 6 months and have requested the check 5 times, but never ever receive any checks or emails from them.

How much longer will integrity be in business for? How long do these type of companies last for?

From the sounds of it Integrity Assets Group has already collapsed. I guess they’ll “be in business” till they decide to pull the website down.

Integrity Ass Group… located in 100 n barrannca st in west covina, most of first floor, also in 8th floor suit #870…. it is “energy drink” company, besides having some bs samplers they do not have anything, its a SCAM.

Members complain everyday about not getting their checks. Who ever has points I suggest cash out now, for some its even too late.

Most members are not aware of the real scam going on, the things Mr. Brad Smith Snosevick (aka Anthony) is masterminding.

Who ever says he does not have money, thats a lie, he does and a lot of it, stolen from people who were sold a lie.

He has it in a trust fund and off shore accounts. He claims he was a stock expert, also that he used to be an FBI agent, joined after he graduated university, but for someone who graduated a university in the states he can not clearly speak or write in English.

He claims to live in Las Vegas and has a private jet, also lies. You will never find a picture of him anywhere without his sunglasses, he also had plastic surgery to change his face structure.

He is a masterminded scam artist, he lies to people and investors about owning gold mines, having contracts with dubai to buy tons of gold. Its all lies, it is a PONZI scheme takes money from investors pays back other investors gets their trust gets more money then screws them over.

Company is running out of money and is in trouble. His top master distributors with his sons stole a lot of dirty money from the company and disappeared, and “CEO” Melisa is part of it as well, but Brad is the one running the show, he is the sole owner of everything.

Whole company and the energy drink is a smoke screen to steal millions from people. He does not even have money to pay his employees, they are getting worried and scared and are getting ready to flee with the millions they made.

Recently they just added few security guards that look like professionals and claim its for to look more professional, but they are probably hired to protect them from angry members.

Brad does not live nor owns a house in Vegas he lives few minutes away from the company i did some research and the address is (Ozedit: address removed).

He is seen driving a red mini cooper, black mini cooper, a black suburban, and a black bmw 750. his phone number is (Ozedit: phone number removed).

If the owner of the company is full of lies what do you expect from the company itself? Integrity Assets group does not have lotta time left because all the scrutiny got the attention of the SEC and west Covina DA. and other federal agencies.

IF you are a member cash out right away and hope with some miracle that you will get your money back. As for the south koreans who just invested millions in the company good luck ever seeing that money again.

INTEGRITY IS A SCAM, BRAD AND MELISA ARE SCAMMERS, AND MEMBERS ARE THE VICTIMS. STAY AWAY AND GO REQUESTS YOUR CHECKS.

THEY CLAIM THE BANKS ARE FROZEN BECAUSE OF LARGE TRANSACTION TRUTH IS BANKS ARE CLOSING ALL THEIR ACCOUNTS BECAUS THEY ARE AWARE OF THE SUSPECIOUS ACTIVITIES, SO NOW THEY ARE MAKING COMPANY ACCOUNTS OFF SHORE.

Brad Melisa and all the other “master distributors” are going down alongside with the company. Goodluck in investing your money and expecting a return… cash out while you can and run. That’s what i did.

I am looking to serve Brad Snosevick aka Brad Smith. Would really be helpful If I had his legal name.

The above post mentioned “Anthony”. Anyone have any leads, I would appreciate. The documents that he signed for the deal gone bad I was involved was either Brad Smith or Brad Snosevick.

Brad Snosevick’s wife is Janeth Escalante. Going to serve her

They said in the conference that they are going send the check out on Oct 24th and Oct 31, and now they said the check will send out on Nov 15. What can we do if they keep lie to their members?

I have sent check request since May and now almost five months over, but still …………….. never receive any check. In the conference, he always mute members and doesn’t allow the members to talk.

On September, they said that we are going to use AllCom debit card and asked members to pay $49.95 for the fee and $19.95 for a month. We have paid it and never ever received the debit card and now he said that we are no longer using AllCom debit card. So, where is the money that AllCom charged on my credit card?

I would like to set an appointment to all the members to come to their office one or two days per week and report to local police, SEC, FBI and also report to Westminster Newsland, so that the reporters can come there and we can report everything to them.

Please let me know the day you all want to come, so that I can ask my friend who also invested to their company come there at the same time.

Please bring some billboard like “Integrity Assets Group is scam”, “Return our money”, “DON’T BE LIER”, then we can stand in their office. Please join us to get our money back.

The lawsuit betweeb Brian Herta Autosports and Integrity Assets Group continues but very slowly. The tentative trial date is for July of next year. But a prejudgment Writ of Attachment has been granted. (definition):

NOLINK://en.wikipedia.org/wiki/Prejudgment_writ_of_attachment

And a link to the writ (for $1.53 million):

NOLINK://www.dropbox.com/s/hrkfrci3vfclq36/IAG%20Writ%20of%20Attchment.pdf?dl=0

Brad haha this man has showed several leaders in the organization bank bonds in the billions!!

Just ask around, when leaders asked integrity for proof of financial backing Brad showed the bank bonds, But he hasn’t given any of the members their well deserved checks???

It is time this man pays for being a scam artist and a thief, the list of lies, and broken commitments this man has made will cover this entire page.

First let’s start with the racing car!! It was a great start, it convinced every person this man indeed has money and this company had a powerful financial backing, after all it was on TV, the indie 500!!

But why the lawsuit why didn’t integrity pay for the contract ??

The man responsible for connecting the racing team with integrity was Alex Almohana the CEO, that man vanished when the car wasn’t paid!

Brad told everyone Alex Almohana was transferred to a different office, and staff members say Brad caught him doing some fraudulent things against the company, and Alex Almohana was bad mouthing the company at the local bank.

Brad claims this is why the Wells Fargo merchant account was never approved, again two different stories.

If we talk to Mr Alex Almohana himself he would confirm he walked away he didn’t have trust in the owner anymore and left.

After the car trouble members started to request checks and company gave a number of excuses.

Number one was “they froze the chase account” due to excessive activity but MR Brad you’re a billionaire ?????

The company then asked for time to re-issue checks with a new bank and this never really happened very few checks came out!

What about the energee drink ? It never came out, why ? Well that’s because this man cannot pay for this to get done!!!

what about the members money ??? ex-employers that were concerned about checks not being paid asked Brad about these type of issues. Brads response was he collected every single member’s money and he saved it, claiming to have labeled it with the member’s name just in case things didn’t work out he would give it back, and shut down.

He told employees all expenses had come from his retirement and that the MLM was nothing to him. He said it was 10% of his business and he can close it at anytime.

Leaders have also heard the same words come from the owner Melisa Haltom.

This man has convinced everyone around him he is this billionaire and must feel very powerful but it’s time this man is exposed. Employees also say this man claims to be a stock genius and a expert this is how he retired and earned his billions.

If this is true, it’s time we go to the integrity office to claim our money !!!!

In recent months integrity announced a debit card and a new payment solution they claim to fix the check issues and pay every member what is owed.

Members had to pay for the new payment program and are still awaiting payment? Why is this ? how can you ask us to pay but u don’t provide one single payout ?

Leaders were invited to a seminar at the corporate office, where this system was put to the test and it worked!!! Something positive ‘for once.

I asked the representative from the payment company the following ” if this system works and you can give us a check today, then why can’t integrity pay all of us that signed up through this system since they claim to have bank issues and regulations with their current bank”? After all I just seen you write a check using my account?

The representatives response was integrity just needs to deposit the money u don’t even need to wait for your debit cards, you can write and print yourself a check today integrity must put money on your account.

I asked if they had a limit per check, their response was 100,000 would clear if the funds where available!!

We’ll Brad how about putting up a small piece of your billions for the hardworking people that you have scammed !!

I have talked to some of the employees that where hired to model for integrity’s clothing line everyone either quit or was fired they claim Brad promised them they would travel around the world and work with companies like Victoria Secret, Nordstrom, & Old Navy.

One of the employees claimed being in the room where mr Brad assured them they would just shut down the MLM since they secured so many contracts with these major companies.

Also in recent months public relations executive member Jose Chinchilla stepped away from the company.

This man has been there from the start, why did he walk away? He claims he left because MR Brad had lied to him for too long and is not who he says he is.

Once he concluded Brad was not who he claimed he decided to step away, the company owners lashed out and claimed he stole 3 million dollars.

I don’t believe these claims but this is my personal opinion I don’t know for a fact.

They also let go a receptionist, she was also accused of stealing by the company. How does a receptionist have access to your company funds ?? Not even your bank can write the members a certain amount of checks ??

On the way out of the office this employee claims she was assaulted and accused of stealing when she tried to resign.

When asked why she was leaving she said she could not deal with the stress of members asking for checks and her not being able to get answers from anyone.

She has filed a police report and is now seeking a attorney.

As you can see the company is loosing members and staff and the owners are getting desperate pointing fingers at everyone but them!!

Anyone who has been fired or involved is being accused of stealing by Brad and Melissa. How can anyone believe anything coming out of their mouths by now?

Their is also a circulating image that shows integrity account balance at 15 million dollars. Let’s get our money back and let’s take this liar down!

Integrity has also handed out post dated checks to members if I’m not mistaken that in itself is illegal!!!!!!

Their is no way possible this man is who he says he is. This man lives in an average home in El Monte CA, according to conversations with members and employees he claimed to drive a few Lamborghini’s and Ferraris. He claimed he lived by the beach in Malibu, in his own mansion and he had multiple luxurious homes.

With the help of friends this is the info I got: Investigations show this man did not own a mansion, he recently purchased a home for his sister, but not under his name.

Investigation also showed this man had a credit score in the low 500s and collections of 600 dollars ???? A billionaire with that low of a credit score ?? And he can’t pay a debt of 600???

Didn’t wall street teach you about the economy and how credit works??

My belief is that this is why the man isn’t on the corporation ownership or anything Else he must be planning on disappearing. With everyone’s money swift action is needed by all members lets stop this man!!!

Investigation also showed Melissa recently purchased a home in Victorville cash !!!

To all Integrity Assets Group’s members, please set a date, so that we are all come to their office to get our money back. We need to corporate. Its all our money. We need to do as soon as possible. I agreed with Rob Tang, if you can remember in each conference, he always used the free conference call. Is he a billionaire???? I am always ready for all members who want to join with us to their office. Please let me know.

Billionaire – no – he made commitments that he could not close due to lack of available funds. Complete fraud and liar.

We still do not know his real name.

Has anybody contacted the better business Bureau?

I agree with you Robert Isaly. We should all set up a date a go to their office and get our money back.

Me personally have 4 memberships and havent receive a penny. From what I been hearing is that a Cuban guy worked there and stoled over 9 billion dollares and left the state.

This company claims everyone stole money but them, they don’t know what to tell the members anymore.

First they said one of the executives stole money, mr Jose, then they blamed the banks for freezing accounts. Then they blamed staff members, any time an employee left or disappeared fingers were pointed they said they stole money! Is it really that easy to steal billions from them ???

People left because they found out the owner was full of shit and now he is saying some Cuban guy stole 9 billion ahahahahahaha. That companie never came close to having one billion mr brad was never a billionaire.

It’s time to attack the company it’self if these ppl really stole money ask integrity to show you the lawsuits against them. I mean shouldn’t they be suing or going after your money to pay you back ??

The only lawsuits that are pending are the ones with the racing car, brad never paid them he only paid a quarter of what was owed just to pretend his company had money.

It’s a scam to buy them time quit following he said she said bullshit and ask for proof, I have 8 memberships and have not received a penny myself.

They said that they will send out the check on November 15th. Did anyone received the check yet? If no, we need to set up a date and take few days off, then all coming to their office to get out money back.

Below is the list. Please add your name in

1. Robert Isaly

Below is the list. Please add your name in

1. Robert Isaly

2. John Nguyen

I watched (on Youtube) a video that described the companies situation. In short almost 90% of the original $$ were stolen and now they would like you to re-invest money. I wonder who is stupid enough to fall for this.

I would say it is what investors deserve, but I have to feel sorry for the victims becuase they are looking at this payoff as being some kind of life changing event to turn around their financial woes. Very very sad.

The vdeo was presented by Rual Juarez – can anyone tell if he is the same Raul Jaurez that was convicted in 2011 for renting homes to people that he did not own in Arizona. MO sounds the same stealing money from people that can not afford it.

I just watched the you tube video on the official integrity assets group you tube channel this is just sad !!!!! :(.

the stupid guy says the company owners are smart and have a good head on their shoulders.???? How do you figure that if they are claiming people just stole all the money from them how are they smart then ????

How can people trust them again and re-invest more money this is ridiculous if you give them more money then your just dumb and deserve to loose the money you have.

Did you see the products they have so fake looks like they made them with a printer at home, what happened to energee!!!!!! The brand on the car now u make some bullshit …..

They still have the thief Raul working for them, look him up this man is a rat. Stole from other companies before .

Whew, that’s a lot of dirty laundry to expose… Just wish you all did it like… months ago! 😀

@anonymous

It might be sad if it wasn’t one of the most commonly used excuses Ponzi schemes deploy when they run out of funds to pay out.

The money was indeed stolen, by the admin and their buddies who got in early.

I have 4 membership and too have not received anything.

First time I went to the office, I met Brad Snoevick apprently he’s the onwer and current CEO. At first he seemed familiar but I could not distinguish where I have seen him. Later after really thinking about it I remembered he was part of a Scam Investment company.

He went by the name Anthony and claimed to be greek who spoke some number of languages. Funny part is that when you speak any of the claimed languages, he gives you a blank stare and changes the subject or simply walks away.

Last thing I heard about Anthony and his company was that the Federal Authorities came into the company and arrested everyone but Anthony. I am not 100% sure, I am probably 80% sure that Brad and Anthony are the same people.

We have to do something about this Brad individual before he disappears with our money, thats if he hasn’t taken it offshore. Last thing I heard was that Integrity has offshore accounts “because” the want to have the ability to transfer large amount of funds.

Hmmmmmmmm more like take our money away where the Government has no juridiction. I am just saying.

On top of that Integrity claims to be a company of product. Their star product Energee is not even owned by Integrity. Yet they say they do. Hmmmm where are the products.

MLM with no products = Scam

Simple formula.

I am very disgusted with all the lies and empty promises. This company falls short of their name.

I agree with Robert,please let me know if you have a date to go all together to the office. Thank you.

Associated facebook page (Irvine) announces the scheme is falling apart. Bet the principles are out the door with the money already

please keep me informed, I have 7 memberships thank you…

Any news? our Polish liders keep lying as the company still trying to set up new ways to pay money to people, who is right who is wrong??

anyone can confirm thats scam, what we can do in this situation?

These guys have long since done a runner. Your Polish uplines are just trying to keep you from turning on them.

The fact that said uplines are relaying this information rather than the company itself should be all the proof you need.

100% these guys are scam. Why they don’t just write a check and send to members? that would very simply and easy.

We should all together report them to Santa Ana courthouse for this scam.

I have 7 units please let me know what I have to do to recovery my money

This is definately a scam and we need to report to the authorities for grand theft.

I will be informing the better business bureal and consumer affairs regarding this.

Finally, I got all my money back. I was at their office for almost from Monday to Friday from 8am to 6pm with the billboard “Return my money” and keep said “Return my money” every minutes.

From Monday to Thursday, they didn’t care who am I, but Friday morning, they asked to get in their office and write a check with all my money, but NOT the interest one (I don’t need that). Done and bye bye Integrity Asset Group.

Seriously? Photos??

Good to hear you got your money back and hopefully you’ve learnt something from all of this.

Hmmm… I wonder if the Herta racing guys can go ahead and serve these morons for not running.

They are just bunch of liers! And they steal peples money.

Melisa is a lieing thief so is Brad! I used to work for brad from August to Novembet, i belived Brads lies and empty promises. They still owe me over $7k.

Being inside and being part of them it is clear that they are a scam and bunch of liers. And if Brad or Melisa read this i want to tell you a big fat F YOU!

I need information about Jose Chinchilla.

i have friends that give checks to him and he cash it and he never put their units on the company he just took the money away thats why he leaft the company, but my friends need to find him.

Keep me infromed please.

Seems like Brad Snosevick, Anthony Chachahua and others have started a new venture in Las Vegas called J&B Sport Group.

We need to stop it early before more people get hurt. I have contacted the Las Vegas DA and pointed them to the trail of carnage they left with Integrity.

Confirmed: NV20141768179 is their corp ID. Who’s Mustafa Snosevick, Brian Ho, Rasha Smith, and Annie Lee?

Any news about Chinchilla? I am really appreciate some information about him.

Thanks