Rodney Burton claims “crime is legal”, demands release

In a bid to secure pre-trial release, Rodney Burton has told a court his “financial status has diminished significantly”.

In a bid to secure pre-trial release, Rodney Burton has told a court his “financial status has diminished significantly”.

Burton has also trotted out the “crime is legal” defense.

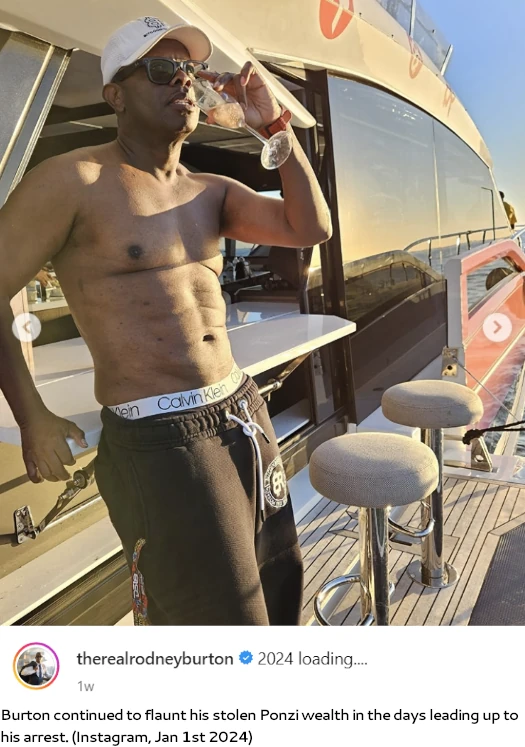

Rodney Burton, a top HyperFund Ponzi promoter who stole over $7.5 million, was arrested en route to to Dubai in January 2024.

Finding there was a “preponderance of the evidence” deeming him a flight risk, Burton was detained pending trial.

In support of the representation Burton can’t financially afford to flee, his lawyer wrote in a December 1st motion seeking release;

The yacht, which the Government viewed as a mode of transportation that could easily be used to “abscond from the country” has been sold—months ago—at a loss, eliminating any concern that Mr. Burton could “jump on a yacht and escape.”

Likewise, any luxury cars referenced at the January and July detention hearings have either been seized or are so heavily encumbered that they provide no liquidity.

Contrary to the Government’s speculation about “millions of dollars in cryptocurrency” … the Government has had full access to Mr. Burton’s devices and financial records—via multiple subpoenas and search warrants—for nearly two years; it has produced no evidence of hidden crypto wealth to which Mr. Burton has had access.

If such assets existed, they would have surfaced long ago.

“The DOJ hasn’t found it so it doesn’t exist” doesn’t exactly strike me as a strong argument. Especially factoring in Burton went so far as to become a sovereign citizen nutjob in an attempt to preserve ill-gotten gains.

The Government believes it has identified unlicensed money transmitting transactions in excess of $3,500,000 but less than $9,500,000.

In addition to the up to $9.5 million Burton stole through HyperFund, until that and the rest stolen through various other MLM crypto Ponzi schemes over the years is accounted for, pretending Burton doesn’t have access to assets enabling him to flee rings hollow.

Burton’s “crime is legal” defense tied into a recent DOJ memorandum.

On April 7, 2025, Deputy Attorney General Todd Blanche issued a memorandum titled Ending Regulation by Prosecution.

The Blanche Memo. directs prosecutors to no longer “pursue litigation or enforcement actions that have the effect of superimposing regulatory frameworks on digital assets.”

The Blanche Memo.’s core directives are two-fold:

(1) preventing financial harm to digital asset investors or consumers and (2) preventing the use of digital assets to facilitate serious crimes such as “terrorism, narcotics and human trafficking, organized crime, hacking, and cartel and gang financing.”

Neither directive applies to Mr. Burton.

I was going to point out the Blanche Memo has nothing to do with MLM crypto Ponzi schemes, which remain illegal under the Trump Administration, but then I saw Burton’s attorney concede the same.

So what are we doing here?

The Blanche Memo. further instructs “prosecutors should not charge regulatory violations in cases involving digital assets—including but not limited to unlicensed money transmitting under 18 U.S.C. § 1960(b)(1)(A) and (B) — unless there is evidence that the defendant knew of the licensing or registration requirement and willfully violated it.”

Ah, so Burton is relying on his “I didn’t know money laundering was illegal” defense (which has already been rejected by the court when it ordered Burton detained).

Burton’s “I knew nothing!” relies on him claiming HyperFund co-founder Sam Lee lied to him.

Mr. Burton did not know of the licensing and registrations requirements … for, at least, two reasons.

First, Mr. Burton reasonably relied on HyperFund as having all the licensing and registration requirements because of its corporate structure, personnel, and experience.

Sam Lee, Jayden Wei, Ryan Xu, Alfred Hew, and others—not Rodney Burton—created HyperFund and constituted HyperFund’s corporate structure.

Burton’s attorney offers up quotes from HyperFund marketing videos, in which its executives make false representations about “regulatory participation to help blockchain and especially cryptocurrencies become a legal part of the new economy”.

Crucially, nothing specific about HyperFund itself. Furthermore, Burton was free at any time to personally verify HyperFund was not registered with the SEC.

Instead of doing that, Burton claims he “conducted extraordinary due diligence” into HyperFund by visiting Dubai, the MLM crime capital of the world.

Mr. Burton conducted his due diligence about HyperFund and his role in HyperFund by visiting the HyperFund corporate offices in Dubai, United Arab Emirates and in Hong Kong, China.

During these trips, Mr. Burton interviewed HyperFund’s corporate management. He met with HyperFund’s employees. He toured the HyperFund offices in both international cities.

He interrogated how HyperFund works. He asked about his approach to his own investment in HyperFund. He inquired about his approach to helping other people invest in HyperFund.

At no time, did anyone from HyperFund mention 18 U.S.C. § 1960 and thus, Mr. Burton never knew about licensing or registering his entities for his work with HyperFund.

“The Ponzi scammers didn’t tell me they were laundering money, how was I supposed to know?!”

In response to the DOJ pointing out Burton explicitly instructed his victims on how to evade US financial laws, Burton’s attorney writes;

The Government offers a counterfactual to support its argument that Mr. Burton must have known about the statute.

According to the Government, Mr. Burton instructed investors to place “Consulting” in the memo line for checks sent to Mr. Burton’s entities to hide that Mr. Burton took fiat currency (the checks) and transferred it into cryptocurrency; the Government contends there were no consulting services offered by Mr. Burton.

There were consulting services offered by Mr. Burton. Mr. Burton goes by the moniker “Bitcoin Rodney” because he is a “lifestyle brand.”

Part of that brand includes consulting or advising people on how to by cryptocurrency like Bitcoin.

Evidently part of Burton’s “consulting” was instructing his victims on how to evade US financial law, in violation of 18 U.S.C. § 1960.

So um again, what are we doing here?

Well, Burton’s attorney argues that because Burton instructed his clients to violate 18 U.S.C. § 1960 through other companies, Burton wasn’t engaged in fraud.

Whether that holds up with the Judge remains to be seen.

In furtherance of his “I knew nothing!” claims, Burton throws Sam Lee under the bus with respect to “lies” used to promote HyperFund.

Mr. Lee knew of these lies. He “was aware or recklessly disregarded that HyperFund’s marketing materials used to recruit investors contained material misstatements.”

Mr. Burton did not know of these lies.

Mr. Burton acted as an independent advisor who believed in good faith that he was supporting a legitimate cryptocurrency platform backed by substantial corporate infrastructure.

That’s obviously a crock of shit, if for no other reason that Burton was caught trying to flee to Dubai. The DOJ of course will have to put it in legal terms.

Burton also throws Brenda Chunga under the bus, claiming she, not he, was the face of HyperFund promotion in the US.

Brenda Indah Chunga (right) was arrested in January 2024. Chunga pled guilty to conspiracy to commit securities and wire fraud, with sentencing pending.

Brenda Indah Chunga (right) was arrested in January 2024. Chunga pled guilty to conspiracy to commit securities and wire fraud, with sentencing pending.

In a December 4th report from the Guardian covering Burton’s latest motion, Sarah Martin got in touch with Sam Lee.

Lee, perhaps not surprisingly, asserted that Ponzi schemes like HyperFund are legal in the US under the Trump Administration.

Lee said he was “deeply sympathetic” to Burton, saying he was among those “caught up in Biden Era anti-crypto witch-hunt”, but called his claims “baseless”.

Lee suggested a similar program to HyperVerse – which was called a “pyramid and Ponzi scheme” in US court documents – would not face regulatory hurdles if pursued now under the Trump administration.

Lee, as co-founder of HyperFund, has been charged with conspiracy to commit securities fraud and wire fraud. Securities fraud has been illegal in the US since 1933. Wire fraud has been illegal since 1952.

Lee, an Australian national, remains a wanted fugitive hiding in Dubai. At the request of the DOJ, the SEC’s case against Lee was stayed on December 4th.

The DOJ has until December 15th to file a response to Burton’s latest release motion.

Contributing to his time in detention, Burton’s HyperFund trial has been delayed twice at request of defense counsel.

Burton is currently scheduled to face trial on March 2nd, 2026.

Update 25th December 2025 – Rodney Burton’s third bid for pre-trial release has been denied.

This time will be one of the wildest in History books,using the “Trump defense” will be infamous one day

There’s a reason ignorance of the law is not a legal defense.

Well… was a reason.

Interesting I thought they had him under lock and key for drug trafficking. I was told personality by IRS they didn’t need evidence about him promoting HyperVerse two keep him in prison.

Rodney lived fat and sassy from one scam to another for far too long.

It’s good to see him have a few bad days but if he has enough crypto left to buy a pardon the current administration would be all too happy to sell him one.

@Danny

The drug trafficking conviction came up in the filing, Burton was sentenced to five years in prison and released in 2012. Unless there’s new charges I’m unaware of?