Okhotnikov challenges SEC on Forsage by confirming Ponzi

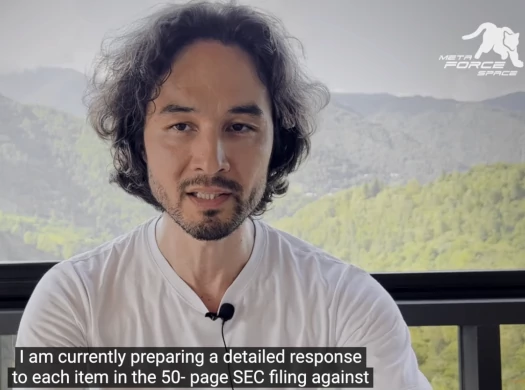

Forsage founder Vladimir “Lado” Okhotnikov has attempted to address the SEC’s Forsage fraud lawsuit against him.

Forsage founder Vladimir “Lado” Okhotnikov has attempted to address the SEC’s Forsage fraud lawsuit against him.

After confirming Forsage’s business model is a Ponzi scheme, Okhotnikov falls back on playing dumb.

Okhotnikov addressing the SEC lawsuit against him was uploaded to Meta Force’s official YouTube channel.

Titled “TV Interview: SEC Claims Are Unfounded!”, the video was uploaded on August 9th and currently has almost 4000 views.

If you were expecting a hard-hitting interview in which Okhotnikov was pressed on allegations in the SEC’s lawsuit, this is not that.

Okhotnikov opens his interview by claiming he moved to Georgia after he “figured out out that Russia is a criminal country”.

In addition to running Ponzi scams, Okhotnikov claims he owns a local car dealership.

With pleasantries out of the way, Okhotnikov addresses the SEC’s Forsage lawsuit.

Okhotnikov begins by explaining what he believes a “financial pyramid” is. Turns out it’s Forsage’s exact business model.

A financial pyramid is an investment project in which the previous person gets profit at the expense of the next person.

For example, you join the project and invest some money. This project has to give you back more money, right?

But how?

Someone else will also come into the project, invest, and at his expense, you are paid.

And how is he paid?

At the expense of someone, who will join the project next.

This is a scam because this scheme does not work. It is a lie. This kind of project will be ruined.

What I described now is a Ponzi scheme financial pyramid.

You can verify this is precisely how Forsage and its five reboots work through BehindMLM’s published reviews:

- Forsage (April 2020)

- Fortron (September 2020)

- ForsageTron (March 2021)

- Forsage XGold (March 2021)

- Forsage BUSD (May 2021) and

- MetaForce (July 2022)

Okhotnikov claims Meta Force is the “perfected” version of Forsage.

After describing Forsage’s exact business model, Okhotnikov goes on to claim it “does not have anything to do with Forsage”.

Despite collapsing five times and being rebooted six times, Okhotnikov states;

Forsage has already worked for two years and a half and its scheme can work forever.

Technically he’s not wrong. A Ponzi scheme can in fact be infinitely rebooted – but over time victim losses still mount.

Wiping victim losses and starting again isn’t the same as not having any victims.

After identifying Forsage’s business model as an investment contract, he bizarrely goes on to state the SEC’s lawsuit “does not have a foundation at all”.

Okhotnikov’s reasoning is that, again after identifying Forsage’s business model as a Ponzi scheme with investors, that Forsage in fact doesn’t have any investors.

For some reason they call our participants “the investors”, which is wrong, as this is not an investment project.

Also they think there was some money that wen up to the top people and they describe it as a Ponzi scheme. This is not true.

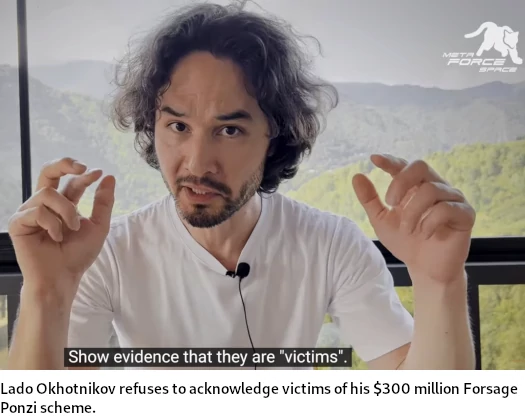

Okhotnikov doesn’t elaborate. He goes on to claim he “doesn’t know” if there are Forsage victims.

It’s a smart contract. How can it have victims? Show me them.

There are no victims because the smart contract works perfectly well.

When asked whether he expects to be arrested, Okhotnikov continued to play dumb;

I don’t understand why I should be arrested. There is no law that I have broken.

I understand that the law of the USA is complicated, as it differs across the states, bue we do not have a relation to the USA jurisdiction. So I’m not troubled because of this situation.

I believe Okhotnikov is referencing Georgia not having an extradition treaty with the US. Whether Okhotnikov and his accomplices have been indicted remains unclear.

Okhotnikov credits his 2021 disappearance to Montana’s early 2021 Forsage securities fraud cease and desist.

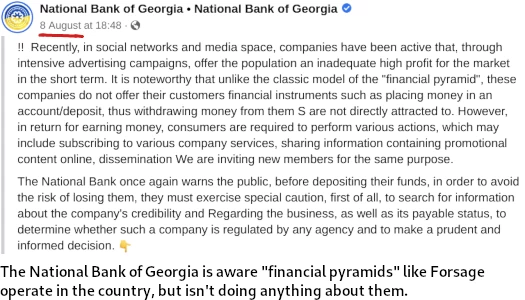

It should be noted that Ponzi schemes are just as illegal in Georgia as they are anywhere else in the world. The Central Bank of Georgia regulates securities nationally.

While the CBG are aware of fraudulent investment schemes spreading across the country…

…to date Georgian authorities have failed to publicly take action against Okhotnikov or his $300 million Forsage Ponzi scheme.

In his interview, Okhotnikov suggests the CBR might have launched an internal Forsage investigation;

They already have some questions for me in the bank [sic]. There is a check-up in the firm, etc.

As soon as it happened there came some people from tax service and even from SEC.

I am still very calm because I have nothing wrong.

Okhotnikov wraps up his interview by falling back on the classic “buy everybody else is doing!” scam excuse.

(The) SEC was no interested in other projects with the same profile (business model), but there are so many.

They existed before Forsage and exist after Forsage. Not after, since Forsage still works.

The most important is that there are a lot of fraud on the internet. There is a gigantic amount of scam.

SEC is not interested in them, because it is hard to catch them.

Top people make millions and move to other projects. SEC does not try to block them.

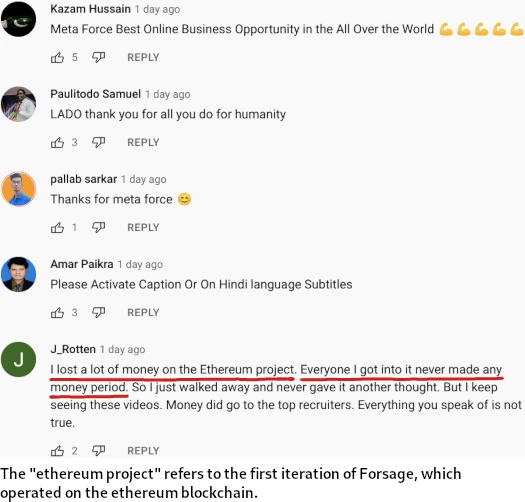

Responses to Okhotnikov’s interview are as predictable as the names of the commenters, but there were some who pushed back;

Despite not yet filing a response to the SEC’s Forsage lawsuit against him, Okhotnikov maintains he is “confident in (his) victory”.

Okhotnikov did not address two US promoters already settling Forsage fraud allegations against them.

Okhotnikov followed up his interview with a crypto bro meltdown, uploaded to Meta Force’s channel August 10th.

Securities fraud has been illegal in the US since the 1930s. Although the actual laws have been implemented at differing times, it is also illegal in any country with a regulated finance industry.

SimilarWeb ranks top sources of traffic to Meta Force’s website as Russia (26%), the UK (23%) and Georgia (6%).

The Central Bank of Russia issued a Meta Force pyramid fraud warning on August 5th.