EminiFX Receiver recovers $173 mill out of $260 mill invested

The EminiFX Receiver has filed a report pertaining to the “financial condition” of the EminiFX Receivership.

The EminiFX Receiver has filed a report pertaining to the “financial condition” of the EminiFX Receivership.

The good news for victims of the Ponzi scheme is “the bulk of the EminiFX assets” have been recovered.

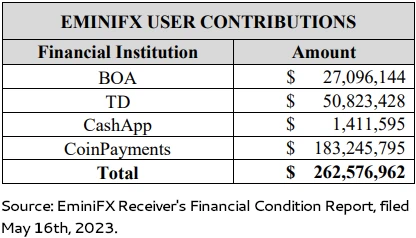

Based on ongoing analysis of records, the EminiFX Receiver believes the Ponzi scheme took “over $260 million … from at least 25,000 users”.

EminiFX launched in late 2021. By May 2022 ROI liabilities had spiralled out of control to $374 million. This is of course money that didn’t exist.

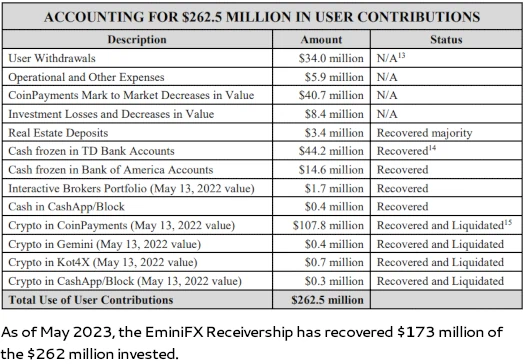

As of May 16th, 2023, the EminiFX Receiver has recovered $173 million.

As noted in the chart above, $40.7 million was lost due to cryptocurrency declining value before it could be liquidated. Another $34 million is missing due to early investors and recruiters cashing out.

As of yet the EminiFX Receiver hasn’t filed any clawback litigation. The Receiver notes however that the EminiFX Receivership

reserves all rights with respect to any amounts withdrawn by a User in excess of his or her contributions to EminiFX.

Looking forward, at some point the Receiver will initiate a claims process for EminiFX victims.

Net-winners of the Ponzi scheme are advised;

ROI and bonuses are not actual liabilities of EminiFX or the Receivership, and the Receiver does not intend to include the ROI and bonuses in the upcoming claims process.

There is as of yet no timeline for the EminiFX Receiver to implement a claims process.

I need advice,wanted to hire a lawyer to recovery my money. I 79 years old vanted my money back.

A lawyer isn’t going to do anything other than be able to advise you on current proceedings.

Any recovery will happen through the EminiFX Receivership, which you can follow along on your own.

I STIIL NOT BEING ABLE TO SEE ALL MY DEPOSITS. I DON’T WHY.

A FRIEND OF MINE WHO WAS INTRODUCED ME TO EMINIFX WAS DOING THE CRIPTO BUYING FOR ME. AFTER I WAS ABLE TO DO THE RE-BUYING EVERY TIME, ON THUERSDAY.

I SACRIFIED THA MONEY IT’S WAS A SAVING FOR MY TWO DAUGTHERS. I WAS SAVING THAT MONEY FOR THEIR COLLEGE.

YOU ARE GOING TO PAY (MR EDDY) FOR ALL YOU HAVE DONE TO THE POOR HAITIAN COMMUNITY.