Elysium Capital securities fraud warning issued in Estonia

Elysium Capital has received a securities fraud warning from Estonia’s Financial Supervisory Authority (FSA).

Elysium Capital has received a securities fraud warning from Estonia’s Financial Supervisory Authority (FSA).

According to the FSA, Elysium Capital

does not hold an activity licence for the provision of investment services in Estonia and therefore ELYSIUM CAPITAL is not authorised to provide investment services in Estonia.

The FSA is Estonia’s top financial regulator. Its warning constitutes confirmation of securities fraud.

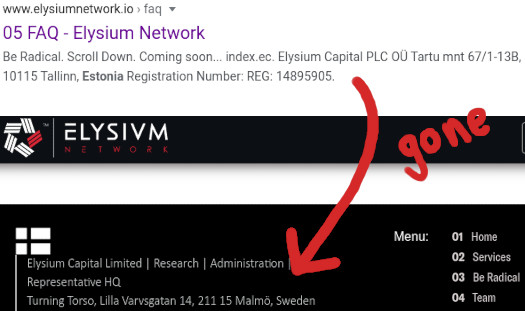

As noted by BehindMLM reader “Herr D”, since the crackdown Elysium Capital has scrubbed its Estonia address from its websites.

Elysium Capital’s website now shows an address in Sweden.

Elysium Capital is part of Elysium Network, an MLM company run by Fred Pascal Stege.

Neither Elysium Network, Elysium Capital or Stege are registered to offer securities in any jurisdiction.

The individual “Fred Pascal Stege” is an alias for “Christian Fredrik Stege”, a Swedish resident of Täby, Sweden.

Täby is a suburb to Stockholm.

If the name Fred Pascal Stege is supposedly merely an alias for someone Swedish, and therefore the identity of Fred Pascal Stege as a Dutchman, who for a number of years lived and operated businesses in Belgium, is also fake, then it’s a fake identity he has continuously and very publicly maintained for over 20 years now.

His path across a succession of dubious MLM schemes, always as Fred (Pascal) Stege, can be traced back to 1998 – and using just online sources, that’s about as far back as one can normally get.

It’s also consistent with what he says in a self-published book, where he claims he got started in MLM in October 1997.

If the name is fake, he must also have perfectly forged identity documents, since he registered at least two companies in Belgium using it (they went bankrupt in 2007), which requires a notarized document and therefore an identity check.

He must also have mastered a perfect Dutch rather than a Swedish accent when speaking English. He’s also fleshed out that fake Dutch background with the name of the secondary school in the Netherlands he went to.

That he lies about later supposed academic qualifications is highly likely (see https://behindmlm.com/mlm-reviews/elysium-network-review-elysium-capital-securities-fraud/#comment-423909) – but why bother with lying about attending a wholly unremarkable school, a detail nobody cares about?

Sorry, but I think he’s for real. Trying to take on a fake identity only makes sense if someone wants to hide an inconvenient past.

In his case, over 20 years of such an MLM past can easily be documented, all under the same name, and with pretty consistent details about his background.

This seems a bit confused. The individual in Täby is Christopher Fredrik Stege, and he has a real presence, actually legal counsel at a major Swedish foodstore chain. So not this guy.

Looking at the Elysium website, they now have a People page with more employees listed. Most of them seem to be real People, with at least two of them resident in Malmö, Shaolin Persson for example.

Sorry, that should be Shalini Persson.

He is for real; looking at the Belgian connection, a Pascal Stege was the manager of “Madison Touché BVBA” (registry number 0478.985.208, dealing with “kleinhandel in software” (software retail), declared bankrupt on April 24, 2007).

Looking at the Estonian connection, a Pascal Stege is registered with an Estonian e-ID (together with a company called Dalanta OÜ, which functions as Elysium Capital’s contact person in the Estonian registry – might just be a legal address:

that company is located at Tartu mnt 67/1-13B

10115 Tallinn, Estonia – the address which disappeared from Elysium’s websites).

Anyway, a Dutchman Pascal Stege exists (Fred doesn’t seem to be a part of his official name apparently).

Once the Estonian warning was mentioned on this site, he put the following on his facebook (July 3rd, 12:45 CET):

[…] (Somewhat more on what a security is.)

These statements may all be true.

1: Elysium Network has opened, so for the past 3 months this looks like a textbook pyramid scheme, where the only way of earning anything was recruiting people.

2 & 3: Possible, though the Estonian warning doesn’t mention securities, rather “ELYSIUM CAPITAL OÜ is not authorised to provide investment services in Estonia”.

Even if they claim to merely be a software company (the field of activity in the Estonian registry is “Other activities auxiliary to financial services, except insurance and pension funding”) where “you basically copy the tried-and-tested actions of a team of disciplined, seasoned investment veterans who have a proven track record of success” (Elysium’s site), at the moment it doesn’t look like they are allowed to offer that service.

4: Launch has been planned since at least autumn 2019. Another red flag, the network opened early April; that’s 3 months of recruiting without generating income.

Elysium Capital == Elysium Network == Elysium *

Investment services == securities.

Stege on Facebook:

Stege on the Elysium Capital website (elysiumcapital.io):

(Followed by a graph showing a supposed profit percentage for each year from 2010 to 2019.)

So he hasn’t started yet with something which has a 10-year proven track record.

From the website:

I am sure Stege has some really good explanation of how his “Elysium’s investment portfolios” aren’t securities.

On the perhaps not entirely objective elysiumallstars.com/2019/10/25/exclusive-zoom-call-with-the-elysium-founder-fred-pascal-stege/ we can find out that Stege “is the founder of the Pinnacle Fund with is an institutional fund with 700 million EUR in management.”

Which doesn’t fit with what he says on the Elysium zoomcalls (of which there are 3 every week, a couple of which I attended) for affiliates, founders and guests.

They claim to be a Fintech company, which merely offers the software to connect you, the retail client, to institutional funds which retail clients usually can’t access.

These funds or portfolios are supposedly existing funds, all Elysium supposedly does is connect you to the trades made by the professionals trading in these portfolios (unfortunately they don’t have an ISIN code “because they’re institutional”, but they really totally actually exist and are MiFID compliant, you guys.)

The explanation is that you place your money in a segregated account at a highly reputable custodian bank; you then give Elysium limited power of attorney over your money, which their software will then link to the trades made by that stellar trading desk.

“That existing desk manages your trades, not us; we just link you to them. So we are not selling securities and don’t need a securities regulation.”

In earlier communications, they talked about Swedish banks being their custodian banks; on the evening of July 3, a newsletter was sent by Elysium (reiterating what Fred said in the Zoomcall) that JP Morgan Chase will be the custodian bank

The results of these portfolios (whose mere existence hasn’t been proven yet either) can’t be checked on any independent channel.

But the newsletter has an answer of course “Once open, we’ll display the portfolios history via FundPeak asap”. Which, as far as I can see, is not an auditing or accounting firm, but can produce spreadsheets.

I suppose the alleged Pinnacle Fund explains how he can claim to have generated huge profits since 2010, while at the same time not having started with Elysium Capital yet.

But it does lead to another question: why the hell, if he has been heading a, hugely profitable, investment company since 2010, has he been involved in MLMs during that same time?

We are supposed to believe he had two parallel careers, one unremarkable and not very successful, and documented publicly (most of it can be traced right here on BehindMLM), the other one spectacularly successful, and kept carefully hidden until now.

Publicly, in 2010, he leaves Vemma to start a nutrition-based MLM of his own, interchangeably called Origin Pure and Origin Unite. On the side, he also quietly sets up Pinnacle Fund, which makes a whopping 42.34% profit in its first year.

In 2016, Pinnacle Fund makes a profit of 40.22%, rather a downturn after having made 45.14% in 2015. Origin on the other hand seems to have disappeared without a trace. What does Stege do? He joins Jeunesse Global, to peddle beauty products.

It isn’t until August 2019 that he finally comes out, so to speak, and reveals to the world that he’s been heading this spectacularly successful forex-trading institutional investment firm for almost a decade. He’s managed to keep his side job under wraps so well, that no sign of the existence of his fund is to be found anywhere on the internet.

This achievement is all the more remarkable because absolutely nothing in his life before 2010 points to him becoming the financial wizard he so clearly is.

He drifts from one dubious MLM to another, self-publishes a crapola book on MLM sales techniques, he sets up little companies in Belgium which go bankrupt – all that must have been merely a cover, while he gathered the wherewithal to start his fund.

As to some of the details mentioned above:

I love how they boast, in bold: “The Pinnacle Fund is MiFID compliant”, as if that’s something special. If you aren’t compliant, you cannot trade on any EU financial markets, it’s that simple. It’s not a set of rules you could break, or avoid.

It also doesn’t exactly inspire confidence that they repeatedly refer to MiFID. It’s been superseded by MiFID II since 2018.

But an ISIN number identifies an individual security, not a company. That Pinnacle Fund (or the company owning it, which could have a different name) must have an LEI number, per MiFID II.

Has anyone asked him for that? For that matter, has anyone asked him about the corporate details of the Pinnacle Fund?

Another possible Estonian connection is controller Kerli Lindahl who is of Estonian origin. She is now married to CRM head Scott Lindahl, both strangely residing in the Biskopsgården area of Göteborg.

Biskopsgården is one of the most crime and gang violence infested areas in Sweden.

Looking at LinkedIn I see quite a few people listing themselves as “Introducing Broker” for Elysium, in Sweden, Norway, Belgium and Netherlands. Must be a code word for Ponzi pimp.

Somebody at Elysium must be following this website quite diligently.

Where elysiumallstars.com/2019/10/25/exclusive-zoom-call-with-the-elysium-founder-fred-pascal-stege/ yesterday said that Stege

Not suspicious at all to adjust an interview from October.

Don’t think I can upload pictures on this site;

wetransfer.com/downloads/3fca3fb90435b783adf1ac25aff047af20200706120739/7e9cb9750506b28ed2d492d6f332f4fc20200706120756/afb5d8 shows the site as it was yesterday.

Less than 24 hours, somebody must have remembered he actually just talked about the portfolio.

wetransfer.com/downloads/ccec25ef21caccf81d3149800c5d098c20200706121453/818fd163bee110a1472aa9e64da414bc20200706121600/61aad7 shows what it is now.

That page shows yet another reuse of the same picture of himself he was already using in late 2011:

businessforhome.org/2012/03/origin-pure-review-2012/

He must really, really like how he looked a decade ago.

But perhaps it is a recent picture, and it’s simply that his apppearance hasn’t changed in all that time because of all those wonderful Origin and Jeunesse Global anti-aging products he was using.

After all, he had this double life going over the same period: anti-wrinkle cream salesman by day, institutional investment fund tycoon by night.

There’s something else in that article I noticed:

So someone’s money can simultaneously be safely tucked away in a bank account, where it’s available for instant withdrawal and Elysium cannot touch it; and be traded on the forex markets (and soon also the gold markets) by Elysium. It’s pure financial magic, isn’t it?

Well, they forgot to mention the biggest bank when it comes to volume, Handelsbanken.

Maybe because it is the only bank of the big 4 that has a reasonable consumer rating and hasn’t been involved in money laundering activities.

I’ve heard of day-trading, but night-trading? That puts him in the upper-echelon levels of after-hours traders. Wow, this guy is a. may. ZING!

Fred being the founder of the Pinnacle fund, information which mysteriously disappeared, is still visible on a youtube video uploaded by “Elysium Allstars” on October 28, 2019.

youtube.com/watch?v=9fYYv551C-U

Audible at 2:26 “so, uh, he also founded the Pinnacle fund”.

At around 12:30, we get a glimpse of the team members, all of whom have a digital footprint, “they are on social media; although one person had a very generic Swedish name, may be difficult to find”.

At around 17:50, we can see the disclaimer and a couple of logos. ESMA, FI, SCM (Scandinavian Capital Markets – back then their broker of choice) and the Hong Kong address have by now disappeared from elysiumnetwork.io

It didn’t take long for that video to become private…

If I were Elysium, I’d probably hope nobody made a screen recording, should anything happen to that video.

youtube.com/watch?v=-0kcH5C-35k&feature=youtu.be

In MLM there is always a strong correlation between the number of haters a company has and the business volume it generates.

On Elysium the hate barometer is off scale.

It hasn’t even started and has more haters than Crowd1. Will be fun watching that one.

It is not a matter of hate. It is a question of legality and honesty.

Whether inside or outside of MLM, a company that does not blame itself for anything respects the established rules

Three sure-fire ways to identify a scam:

1. If defenders say it’s not a pyramid scheme, it’s a scam.

2. If defenders say it’s not a Ponzi scheme, it’s a scam.

3. If defenders call negative reviewers “haters,” it’s a scam.

Might you be “Pavel Kozlov”, who reacted on the youtube video with “He is NOT the founder of the Pinnacle portfolio. This is just some false information provided by an affiliate partner. This is not an official statement.”?

The affiliate partner (whose webpage was registered on October 22, 2019) may have hugely misunderstood Fred on that alleged zoomcall.

Then again, Elysium Network didn’t open until April 2020, so were there affiliates until that point?

Elysium will offer the SoHo software to help you promote their brand; they are very careful to make sure all the information they hand out is “MiFID-compliant” (whatever that may mean), so that you as an introducing broker can’t relay any information which might get them in trouble with banks and financial inspectors (“acquiring banks and regulators ARE watching this” as per their newsletters).

If this affiliate has been posting faulty information on his webpage and youtube since October 2019, someone at Elysium surely would have noticed and stepped in before July 2020 (seeing how quickly they respond to anything on this site)?

Maybe we’re all hugely misunderstanding what they really are about, Elysium might just have found the Holy Grail of copy trading and some legal loophole which makes sure they really don’t need a securities regulation. In which case congratulations and they wholeheartedly deserve every cent they make thanks to their fully legal billion dollar idea.

Though I still feel disappearing corporate addresses, adjusted interviews, videos going private, a complete absence of LEI, KID or KIID, a multi-tiered residual income possibility by recruiting people (without any external income), smoke and mirrors around the alleged portfolios constitute a couple of red flags.

Oh yeah, Network opened but we still have some small issues to resolve before Capital opens, sorry about that but we will be huge. The word pyramid does come to mind.

He even had the time to write the international bestseller “Awaken your soul in network marketing”, which (as per his public facebook profile) was in print and should have been available within a month of February 20, 2014.

Maybe something went wrong or all readers cling to it like the Bible – no trace of it can be found anywhere.

facebook.com/photo.php?fbid=10202815956627435&set=ecnf.1456608587&type=3&theater

He must really like the Turning Torso, it also functioned as Origin Unite’s European Corporate Headquarters from June 2013

myemail.constantcontact.com/Nov-2013–Origin-Unite-Team-Majolie-Updates—Events-This-November—Dec-Bootcamps—Only-Few-Weeks-Left-To-Win–6-000-Watch—H.html?soid=1112120086806&aid=cKYKPzxHEbA

I bet that book is at least as good as his 2002 blockbuster, Fred P. Stege’s How to RECRUIT Your Way to MILLIONS (Or Less, If You Don’t Want to Earn That Much!).

(Which is definitely still available. Either he has gifted the world with it for free, out of the goodness of his heart, or someone put up the PDF illegally. Either way, you can download it without paying for it, I’m afraid I’ve forgotten where.)

That masterpiece was published by Madison Touche Publishing Inc. Which was actually an alias for Madison Touche BVBA, one of the two small companies he had in Belgium, both of which were declared bankrupt in 2007. Which is rather hard to explain for a company which was publishing books on how to easily make MILLIONS.

Its address was Patersstraat 33-35, 2300 Turnhout, Belgium. Taking a look at that building in Google Street View gives you a feeling for how dizzying his ascent has been since then: going from that in 2002, and bankruptcy in 2007, to offices in the Turning Torso by 2013, is no mean achievement.

I’ll look around for it this weekend. One wonders if there is a chapter on “what to do when the Swedish Finansinspektionen copy the Estonian investor alert on their webpage”.

Because fi.se/en/our-registers/investor-alerts/ just happened.

Turns out it was right here on behindmlm:

(getpaidforlife.biz/ebooks/RecruitYourWayToMillions.pdf on theOrigin Unite Review).

Elysium addressed their legal status in a newsletter on July 15th:

So customers get an account with a still unnamed prime brokerage (very curious which prime broker will accept clients with EUR 500).

If you then give limited power of attorney (LPOA) that would make whoever you concede that power to an investment manager.

I’m not fully aware of copy-trading law in the EU – signalmagician.com/copy-trading-regulation/ touches upon the subject with “the FCA classes Copy Trading as portfolio or investment management where no manual input is required by the client.

This agrees with the European Securities and Markets Authorities (“ESMA”) guidance on how Copy Trading applies under MiFID.

Under this definition, the view applied by the FCA and under MiFID is that Copy Trading businesses exercise investment discretion by automatically executing the trade signals of third parties, as agreed upon under a client mandate.

In any situation where there is no manual intervention from the client, the Copy Trading business model will be viewed as portfolio management and FCA authorisation will be required.

This applies in all situations i.e. neither the clients’ ability to set risk parameters nor the installation method for Copy Trading software would lead to exemptions from authorisation.

Maybe they’ll circumvent this by saying “we’re a Hong Kong company”, they still claim to want to offer access to these protfolios in just about every jurisdiction in the world (barring the US and a couple of others).

As long as they don’t open capital, they look like a ponzi/pyramid scheme; once they open, they’d have to show a regulation and audited accounts of their portfolios (a 3rd portfolio “Alpha Linea”, fully operated by Elysium themselves as opposed to the Luxembourg Pinnacle fund and the New York Aurum Digital will be on offer.)

They still might amaze us all.

Money into Elysium Capital + passive return = securities offering.

Not being registered with securities regulators = securities fraud.

It doesn’t matter what Elysium Capital claims to do with invested funds.

Well, on his zoomcalls, he claims “we are not a hedgefund” (the whole Fintech access and signal provider explanation).

Which is not what he planned in February 2019, just about the earliest reference to Elysium I could find online.

On jobs.designcrowd.com/job/3663274 (“Logo Design job. Logo brief for Fred Stege, a company in Sweden”), under “Logo for Fintech / hedgefund” we can see that he is asking “We need a logo design for a fintech hedge hund.” (sic)

BT Designs from Greece apparently won the design contest (designcrowd.com/logo-design/contest/3663274).

Perhaps designcrowd.com just misunderstood him and publish false information or he changed his plans and now uses a private fund instead of a hedge fund.

why you people talk when you not know facts?!

Elysium LEI is lei.bloomberg.com/gleifs/view/984500CB3M451FAZ0914. Bloomberg is much more important source then this site for haterz, how you explain this?

I haven’t been paying attention but when did basic Singapore shell incorporation become a substitute for registering with financial regulators?

Elysium Capital Limited’s shell company incorporation is meaningless. Securities in Singapore are regulated by MAS.

Elysium Capital is not registered with MAS, or any other securities regulator.

is Hong Kong, not Singapore; get facts correct.

you will all see, Fred tells capital open tomorrow!

Sorry, my bad. Point stands though, Securities in Hong Kong are regulated by the Securities and Futures Commission.

Elysium isn’t registered to offer securities in Hong Kong or anywhere else.

@ bypasser:

So Elysium bothered to register for an LEI. Where did anyone question that?

But what you’re responding to was in the context of talking about this “Pinnacle Fund”, which Stege claims has been in existence since 2010, and raking in huge profits, and that, somehow, Elysium will be riding piggyback on this in the future.

That same Bloomberg site you mention produces only one result when I look for “Pinnacle Fund”. Something called Pinnacle Canada Fund Services Ltd., from Vancouver, Canada. Is that the “Pinnacle Fund” Stege bases his sales pitch on?

No, pinnacle fund is institutional fund, is not found online. Fred explain this in webinars.

I become customer with Equiti, legit broker. I copy trades thru Elysium. You think worldwide firstclass prime broker work with scam?! You think you know better then all proffessionalS?!

Legitimacy via association isn’t a thing. Who Elysium Capital does or doesn’t rope into its net doesn’t change the fact it’s committing securities fraud.

The Elysium Allstars video is publicly visible again, with the false information (“he is the founder of the Pinnacle Fund” that was adapted on the affiliate site) audible again.

youtube.com/watch?v=9fYYv551C-U

Elysium Capital Info tells us the same, uploaded by someone with a different referral link: youtube.com/watch?v=n5FyhdKn6sc

It’s a shame that the alleged KIID of the Pinnacle Portfolio at elysiumcapital.io/media/ELYSIUM _ CAPITAL LIMITED – PINNACLE PORTFOLIO.pdf doesn’t tell us more; that’s how you get misunderstandings and false information. We still don’t know who funded it or who audited it so prospective customers could trust the results to be genuine or do some due diligence.

We do find out the minimum investment is € 1,500; as opposed to the Aurum Digital fund (€ 3,000) or the Alpha Linea Fund (€ 600).

Which is not the € 500 minimum investment that was claimed so far, but let’s not complain about details.

The videos do inform us that “All marketing content must be approved by the company”. Not all affiliates got that memo, apparently.

Last month we had someone calling themselves “Herr Hater” quote Herr D and call us all a bunch of haters. Now we have “bypasser” responding to PassingBy, calling us all a bunch of “haterz.”

Anyone else thinking it’s the same person?

“Herr Hater” does seem to write English better than “bypasser”, so I’m not sure?

Perhaps you should look to other sources than Stege to explain to you what “institutional” means in an investment context.

It does not mean “secret”. It does not mean “able to operate on the European financial markets without an LEI”. It also does not mean “able to consistently generate implausible high returns, higher than any fund known to exist”.

So far, unless I’ve missed something, the only sign of the existence, since 2010, of this “Pinnacle Portfolio”, is the say-so of Stege.

The material he puts out does not state which company runs it. Why on earth would that need to be secret information? In fact, that material does not contain a single verifiable piece of information.

There is also no explanation of why such a phenomenally successful and ultra-secretive institutional fund would not only suddenly decide to make its investment strategies available to the smallest of small-time retail “investors” (the minimum amounts being talked about don’t really qualify as investments), but do so through MLM, a marketing method no reputable financial institution would ever want to be associated with.

Nor is there an explanation of how someone like Stege, who, demonstrably, has never worked in the financial sector, and who, equally demonstrably, has never had a significant capital of his own to invest, would be involved with such a company at all.

Unless Stege very recently came into a very large inheritance, he doesn’t have much money. Publicly available facts about the string of obscure little companies he’s set up since starting in MLM c. 1997 (all of them failures) conclusively show that.

yes, English is not my first language, you all mean people.

Fred is very rich man and founded hedge fund, look at originuniteambassador.blogspot.com/2013/07/international-disaster-relief-and.html

He talks with Estonia regulators, warning means nothing, warning does not mean forbidden. What Elysium does is never done before. Banks and regulators are scared of Elysium and do everything to discredit and sabotage!

I will start copy, Equiti and Jp Morganchase work with Elysium, who are you guys?

That’s really entertaining, linking to some sad online remnant of one of Stege’s many failed earlier attempts at getting rich. We get to read stuff like this, from over 7 years ago:

That worked out well, didn’t it? Clearly, Pascal (why doesn’t he use his real name?) forgot to take down that free blog thingy after Origin failed, and he had to take a job with Jeunesse Global.

The only thing it demonstrates otherwise is that he’s always been telling the same kind of lies about himself he does today (and he’s still using a picture of himself that’s years older than that 2013 piece).

But I’m sure all the world’s banks and regulators are quaking in their boots because a guy who until last year made his living peddling anti-wrinkle cream, vitamin pills and magic fruit juice (and not even for a company of his own), and before that set up a string of obscure, failed MLMs, has set up yet another MLM, this time one selling securities illegally.

Because that’s what “not authorised to provide investment services” means: that he’s operating illegally. Not just in Estonia, but everywhere else as well.

He proves that himself, by loudly proclaiming he doesn’t need a license, because something something “Prop Trading” something something “Fintech access”. Which is a lie, and he must know it’s a lie.

Really? Banks and regulators are afraid of Elysium? That’s what you’re being told? And you believe it?

No one was criticizing your English skills; we were merely performing forensics on your writing style. But if you really believe everything you just wrote about Elysium and how regulatory agencies work, you are gullible beyond words.

Financial regulators do not issue warnings unless they are thoroughly convinced that an illegal activity is going on. Such warnings are regularly followed by legal action; the warning means they are gathering evidence but are already sure of what they are going to find.

But hey, if you prefer the word of scammers over those trying to help you avoid being scammed, that’s your prerogative. Just don’t say you weren’t warned, repeatedly.

(Wasn’t having a dig at your mastery of the English language, merely pointed out that your writing style is different to Herr Hater’s.)

I presume you are an adult, so I’m not going to tell you what to do with your own money.

Even if their EA’s work (and nowadays there are some pretty decent forex bots out there) for a while and they give you a nice percentage; how do you know your revenue comes from actual trading and not form people who invested after you?

Their unverifiable KIID mentions a performance fee of 50%; half of whatever profit you may make goes to Elysium. There is no disclosure of their deal with Equiti; presumably they also earn something on every trade made by and for the customers they brought to Equiti (even losing trades will earn Elysium a kickback).

From the Pinnacle KIID “We’ve designed and configured our system with optimisationback tested at a minimum of 10 years. We always use 100% correct historical tick data for all of our backtesting. For testing high performance computing [HPC] is applied “supercomputers” with a minimum 128cores, 1TB RAM are used.”

Why does a portfolio which was allegedly funded in January 2010 need backtesting “at a minimum of 10 years”? Surely analysing the actual trades would then be possible?

If the master account is Elysium’s Prop Desk, why would there need to be a minimum investment? If you merely copy the trades, it shouldn’t make a difference whether your lotsize is 0.01 or 200 (or whatever Equiti offers as maximum lotsize).

Please take a look at whatever prweb.com/releases/2004/02/prweb103719.htm is. Back in 2004, “internet multi-millionaire” Stege (and 2 others) [are] “poised to give you an opportunity to join with them and share in the wealth.”

Sound familiar?

(apart from the 400,000 strong sales force; he’s whittled that down to 220,000 last time I checked)

From the men […] who gave you “Ezine Blaze”, “Traffic Oasis”, “GetResponse”, and “NoMore Hits”.

This is guaranteed to be “THE” company of the decade. If you ever dreamed of being at the top of something really BIG…THIS IS IT!

Raise your hands if you’ve ever heard of Madison Dynamics Inc. I don’t recall it being “THE” company of the decade. In spite of the guarantee we were given.

Madison Dynamics Incorporated was one of Stege’s Belgian limited liability companies (then called a BVBA). Here is its company register information:

kbopub.economie.fgov.be/kbopub/zoeknummerform.html?nummer=0865.344.819&actionLu=Zoek

It had a nominal capital of €18,600, of which only a legal minimum of €6,300 was paid up when it was founded. Stege contributed €4,200 of that (the rest came from a partner).

Its stated area of business was extremely broadly and vaguely defined, basically as anything to do with computers somehow.

The company filed the legally required annual account statement with the National Bank of Belgium only once, after its initial, incomplete, year of existence, up to December 31st 2004. That shows a profit of €44,900 after taxes, on an undisclosed turnover, and they had €27,588 in the bank. The company didn’t have any employees.

After that, they started breaking the law by not filing annual reports. In 2007, Stege applied for bankruptcy, on the grounds that the company has zero assets left, and that bankruptcy became final in 2008.

Ah, the business dealings of multimillionaire financial geniuses. Us ordinary mortals can merely dream of dealing with such dizzying amounts of money, and achieving such success.

The gentleman with the “generic Swedish name” should be dk.linkedin.com/in/maxelia. Very little can be found about maXelia (the secondary business name of “Isonine International Investments AB”).

Though he fails to mention his job as CIO & Senior Analyst at Elysium.

Just like Shalini Persson (whose homepage is perssonkommunikation.se/ShaliniHEMsida.jpg and LinkedIn is se.linkedin.com/in/shalinipersson) does not include her job as compliance officer at Elysium.

All the others mention their jobs at Elysium; Scott Lindahl seems to have worked with Stege at Jeunesse, Maurice Van Ophoven was at Origin and helped to design the cover for Stege’s bestseller ‘Awaken your soul in network marketing’.

Looking at Shalini Persson it is interesting that she according to the company bio “has been legal adviser to numerous direct-sales companies in an ad hoc legal team with our own CEO, Fred P. Stege”.

Also that her LinkedIn profile besides not mentioning Elysium is totally devoid of anything related to her listed law degree.

metrojobb.se/artikel/5975-v%C3%A4lj-r%C3%A4tt-f%C3%A4rg-p%C3%A5-kl%C3%A4derna-vid-anst%C3%A4llningsintervj from 2010 seems to suggest that she has a law degree and is versed in business finance.

It also seems to suggest that, if you’re working at Elysium, you upload a 10 year-old black and white picture for the team presentation.

He may have fooled the Belgian notary though. In 2002 and 2004, his home address is Nijeveenstraat 78, 2545 XW Den Haag.

That address is also mentioned in ypages.nl/companies/792191/stege-fred/ (KvK-nummer 92806701, founded in 2001, sales per year “over EUR 193 million”) and at bizdb.nl/bedrijven/1174773-stege-fred/ (KvK-nummer 79007873, “educational services”, including a vehicle driving school, allegedly founded in 1985, when he was 16).

(Can’t really determine how trustworthy these pages are; can’t find anything about these numbers at the Dutch Chamber of Comnmerce.)

postcodebijadres.nl/2545 tells us that the postal code 2545 XW Den Haag doesn’t exist. It also tells us (as does google maps) that Nijeveenstraat doesn’t go beyond number 44.

Yeah, she seems to have a law degree. What I meant is that there is nothing in her CV where she practises her education in law and business finance.

Unless there was a class in how to dress for an interview.

By November 10, 2008, when UMT & C° was renamed to Oiggio BVBA, Stege was (according to the Belgian official journal) living at Bornsestraat 78/15 in 7607 KS Almelo.

Pretty close to where his secondary school was, pretty far from Mallorca though.

We possibly can credit hum with giving the name “Popeye” to a famous carp swimming in the Twentekanaal, which also runs through Almelo.

That fish, weighing 30.2 lbs., was caught by a Fred Stege in 1989 (gwittebol.nl/karpervoer/publikaties/karpers/popeye.html).

Maybe he just suffers from what we in Germany call “Anglerlatein” (fisherman’s Latin), the tendency of making up tall tales about your achievements, which become more outlandish and spectacular with every retelling of the story.

Fun fact: Oiggio BVBA’s corporate address (Gerard Le Grellelaan 10, 2020 Antwerpen) was actually that of a large hotel (the Crowne Plaza Antwerp).

Now to solve a little mystery: the address Nijeveenstraat 78, 2545 XW Den Haag (and I hope this doesn’t get too off-topic).

I don’t think that address is fake.

First: yes, the post code 2545 XW doesn’t exist, but 2545 XV does, and is the Nijeveenstraat (all house numbers). I think it’s just a typo. One that could possibly be the result of a Belgian notary taking down information from a Dutchman: people from the Netherlands tend to pronounce the “W” and “V” sounds differently to those from Belgium (and the very South of the Netherlands).

Second: Google Maps knows about the Nijeveenstraat 78, and points us to a specific house. So how come a post code reference website says that street only goes up to number 44?

After having looked at the street on Google Maps and Street View, and at a few sites of real estate agencies selling homes there in the recent past, I think I have an answer.

The way Dutch post codes work is that they delineate a very small area, with each house number occuring only once in that area. This means they usually correspond to just one street, or a section of a longer street.

For a postal address, all you really need is therefore the post code and the house number, the rest of the address can always be reconstructed from that. Which was a clever system when it was created in 1977, since it allowed for very efficient automated mail sorting before computers were capable of sophisticated text recognition.

Adding more house numbers within a post code than originally planned is not a problem, as long as no number is assigned twice.

The Nijeveenstraat is quite short, but the houses on the even-numbered side aren’t facing the street itself. Instead, there are four perpendicular cul-de-sacs along which the buildings are, each maybe half the length of the actual street. Everything was built at the same time, the whole neighbourhood is one big development.

Consequently, there are a lot more houses there than could be catered for with just the 22 numbers that would be available if numbering only went up to 44. So they simply assigned more house numbers.

The numbers up to 44 given for the post code in all likelihood are the original “bouwnummers”, building lot numbers. On the rare occasions they’re used to identify a building, they’re preceded by “BN”, or simply “bouwnummer” in full.

They are often not the same as house numbers used for postal addresses. The development around the Nijeveenstraat is much more recent than 1977 when the post code was assigned.

As that time the planned but as yet unbuilt short street probably had been divided into just 44 lots, on which years later many more homes were built, hence more house numbers were assigned. Mystery solved.

There is actually some information of relevance to Stege that can be gleaned from this.

A side effect of Dutch post codes identifying such a small area is that they identify, with a very high degree of accuracy, how wealthy someone is: all homes with the same post code tend to be very much alike in price, often even identical, and how much someone spends on their home has a very strong correlation to their income.

If you could narrow it down to the full four digits + two letters code you could tell it with almost absolute accuracy, but even with just the four digits, you can already tell a lot about someone’s income level from just their post code.

As it happens, such information is easily available. I looked at a spreadsheet of income information by post code, published by the Dutch national statistics agency (CBS).

I am glad to say the impression I’d gotten just from looking at the Street View images of the places Stege has given as his address over the years matches exactly what I found.

2545 and 7607 have near-identical income profiles, with a median annual disposable income of €27,000, well below the national median of €34,100, with 54.3% and 51.6% of households respectively having an income in the lower 40 percentiles.

What one could call a lower- to lower-middle class neighbourhood. That also fits very much with the adresses associated with him in Belgium (where I can only go on a general visual impression of the neighbourhoods).

Certainly not the kind of neighbourhood where a hugely successful businessman would live, let alone a retired multi-multi-millionaire. But perfectly consistent with what we know about Stege’s real career, and the kind of sums his succession of small failed businesses dealt with.

And if he had been providing fake addresses, surely someone pretending to be rich would have gone for more expensive post codes?

The things you learn on this site, thanks for that!

(The same XW and number 78 is also present on the memorandum of Madison Touche BVBA from 2002 though; 2 notaries making the same typo?)

Google Maps gives me a house for number 78, though street view then gives me a view of number 6.

Looking at kadastralekaart.com/kaart/adres/s-gravenhage-nijeveenstraat-12/0518200000521112 , the house google maps gives me for 78 should be around (bird’s eye view) 12 Nijeveenstraat.

That map also doesn’t go beyond nr 44, which might be some intricacy of Dutch zoning customs? Looking at real estate agencies, I couldn’t find houses with higher numbers ever sold (haven’t looked that closely either).

Updated my TomTom satnav, will lead me to house numbers 2 up to 60. (No hard proof obviously, but usually pretty reliable)

Around 2007ish he lived in Turnhout, Belgium (docplayer.nl/841346-Getuigenissen-voordelen-van-nwm.html); maybe back then he wasn’t on facebook yet, uploading pictures of a mansion on Mallorca claiming it’s his.

Could have just lived with his wife in Turnhout but kept a registered address in the Netherlands for whatever reason?

Around that time, he was expanding Vemma and hadn’t struck gold yet – perhaps couldn’t pull off the “I founded and operated several billion dollar endeavours, several investments funds and my own family office”-shtick yet.

By the time Oiggio goes bust and he leaves Belgium/Holland for Sweden, Cyprus, Mallorca or wherever; his associates have nothing to show for it but “hey, he always said 78!?”

(Possibly in tin-foil hat mode, this thought just came to me)

I can imagine a Belgian notary getting it wrong and either never noticing it or never bothering to change it and another notary just copying the error; how do these Dutch sites get Nijeveenstraat 78 in 2545 XW?

business123.nl/eng/stege-fred-703678092-1474516 lists the same address.

Even if number 78 exists (or existed around 2004), 2545 XW never existed. That many sources making the same mistake would be a massive coincidence.

I happened to pass by the Turning Torso building the other day. I was a bit surprised to see that Elysium actually are on the company list board outside the bulding.

So, they in fact have physical presence in Malmö, Sweden.

Herr D:

Just to make clear: when I said I thought that address wasn’t fake (although it did include a typo in the post code), I didn’t mean that Stege actually lived there, just that it’s probably a home that exists. But if that address turns up in other places with the same typo in it, that must of course mean he was deliberately using it in that incorrect form, it cannot be someone else’s one-time error.

What always made most sense is that during his “Belgian” period, he was actually living in Belgium, but kept up pretended residence in the Netherlands for purely financial reasons. Even his LinkedIn page still gives his whereabouts as “Antwerp Area, Belgium”.

The obvious way to do this if you don’t have enough money to keep up an actual second residence, is to be registered as living at the home of a family member (his parents, for instance), or some other associate. That way, you can still get hold of any official correspondence. But who knows, he may actually simply have been using an entirely made-up address.

This has been a very widespread practice ever since the Benelux came into being in 1948. There was no impediment to people from the three countries living, working or setting up a business anywhere they wanted, and border controls became pretty much non-existent. It was a single market with freedom of movement of people, goods and capital, long before the EU began working on that.

Yet at the same time, banking secrecy was still in full existence, so if you were legally resident in one country but kept money in a different one, there was no way for the income tax authorities in your own country to find out about it.

For instance, almost everyone in Belgium who had some investments in stocks and bonds kept them in a bank in either the Netherlands or Luxembourg, because in Belgium there’s a tax on dividends, which within the country is inescapable because it is deducted on payout.

In the days such investments still required the cutting of coupons off physical certificates, the Brussels-Luxembourg intercity was commonly known as the “coupon train”. Tiny little Dutch towns along the border with Belgium all had big branch offices of all the major Dutch banks, visibly much too large for the local population, almost all of whose clients came from Belgium.

If you lived in one country but derived all your income from a company you owned in another one, and did all your banking there, there was no way for the tax man to check on how much money you actually made.

Since c. 2000 there have been increasing attempts to stamp down on all this, but at the time Stege was setting up these businesses in Belgium while always giving a personal address in the Netherlands, it was still rampant.

There is no sensible reason why somebody would do this, several times over, except to evade taxes, or perhaps to fly under the regulatory radar in other ways.

These weren’t businesses he was setting up as an investor from afar, to then have others run them. They were tiny little outfits, with next to no capital and no full-time employees, just a legal framework for one or maybe two man self-employment.

Why would anyone set up a small company like that with a registered office address far away from where they live, unless they have financial reasons for doing so?

Niente:

Well, he must have a base of operations somewhere, mustn’t he? If you live in Malmö, renting the cheapest possible office unit in a well-known building (the only office building in Sweden anyone outside Sweden may ever have heard of) makes perfect sense if you try to pretend to be a major company.

This site is helping them finetune their own site, maybe PassingBy should apply as compliance officer?

Today that sentence reads “You can rest assured that our signals in your portfolio will be intensively managed by a stellar trading desk”. Meaning the assets customers have at Equiti are still being managed without a license being issued to Elysium.

Where elysiumcapital.io/legal/terms-of-supply.html used to tell us that “our office is located at No.5, 17/F, Bonham Trade Centre, 50 Bonham Strand, Sheung Wan, Hong Kong”, that page now gives us a 404 Not Found message.

Luckily we were told “We recommend you print out or otherwise save a copy of these terms and conditions for your future reference.” or else this would have been lost to posterity.

elysiumnetwork.io/legal/terms-of-supply still tells us

Of course, they reserve the right to vary terms and conditions. Probably just didn’t get round to doing so yet, must have been hard work to move two whole offices from Hong Kong and Estonia to Sweden.

The Estonia fca warning isn’t there anymore since they don’t sell securrities…

Unless you can provide a statement from the FCA as such, you’re making things up.

The FCA’s warning stands, regardless of what’s currently available on their website.

Unless Elysium is registered with the FCA, they are still committing securities fraud there. As well as the rest of the world.

They do offer portfolio management, which requires FCA portfolio management authorisation (“the provision of investment services”). The general term for that is a “securities regulation”, the word security may be too general a term in this instance – they don’t directly sell securities, but need a regulation for the service they do provide.

But wait, somebody at Elysium realised they’re not managing the clients’ portfolios, but “the signals in your portfolio”. All fine and dandy then!

Wondering why this has disappeared as well.

Looking at support.equiti.com/hc/en-us/articles/360014376098-How-can-I-join-the-Money-Manager-program-; Equiti explicitly states “Please note that Equiti is an execution-only broker and does not have regulatory permission to manage the investments on behalf of others.

There is a clear distinction between the service offered by us and the Money Manager you have authorized to trade on your account. Whilst your Money Manager has a Partnership Agreement with us, they are not employed by Equiti and are responsible for all trading decisions made on your account.”

Equiti is licensed as a broker, it is not licensed to do trading on behalf of customers. A service which Elysium provides (as “Money Manager”), for which it would need a securities license, which it demonstrably doesn’t have.

The Estonian warning may have come a bit too soon; in June Elysium were just setting up their scam and hadn’t started their asset management yet.

Looking at the structure, the Estonian firm Elysium Capital OÜ is taking care of the network. Which is a pyramid structure selling worthless products or no products at all.

Looking at youtube.com/watch?v=OvX8fxisckA, a comparable scammy service (“EA World FX”); we can see that EOS (Elysium Operating System) is just the rebranding of the Equiti dashboard (Elysium didn’t even bother to change the colour scheme).

Has Stege started using “Xoom” already, or is he still sticking to “Zoom” calls? Is there any trace yet of “SoHo”?

So you may actually be right in saying that Elysium Capital OÜ is not involved in the offering of securities. It is involved in pyramid selling, which is not the jurisdiction of a financial regulator.

The company doing the asset management is the Hong Kong branch Elysium Capital Limited. I was wondering why their disclaimer now reads that they don’t provide business in Hong Kong or to Hong Kong citizens; probably covering their behind should any Hong Kong regulator come snooping?

Elysium still seems to have most “introducing brokers” in these 4 countries.

One can only hope these Belgians know about Belgian law, more specifically a royal decree of July 21, 2016 (published in the Belgian Official Journal on August 8, 2016) regarding the distribution of certain financial derivatives among Belgian retail clients.

fsma.be/en/news/fsma-regulation-establishes-framework-distribution-otc-derivatives-binary-options-cfds

Which means you can’t distribute Elysium’s bots in Belgium or to Belgian retail clients.

I can’t explicitly find whether the Belgian FSMA regards pyramid distribution or mlm remuneration as appropriate; if I could hazard a guess, I’d say no.

“fictitious gifts or bonuses”…one wonders how attainable or realistic the Belgian FSMA considers generational matching bonuses, diamond pools and binary cycles to be.

Anyway, if you’re a Belgian introducing broker or you’ve recruited a Belgian national and got rewarded for that by Elysium; you may incur problems.

Ah, so that’s why the (apparently pretty recently) updated Network site now reads

in its disclaimer.

In elysiumnetwork.io/legal/terms-of-use, we can read that

So that’s how we lost becomemoneywise.com or elysiuminsights.com

Good luck with that one.

teatmik.ee/en/personlegal/14895905-ELYSIUM-CAPITAL-O%C3%9C tells us the exact same thing is happening in Estonia. Still some work to do on building the largest crypto-trading community in the world.

On ariregister.rik.ee/eng/company/14895905/ELYSIUM-CAPITAL-O%C3%9C?active_tab=fiscal_year_reports, one can pay €2 to find out Elysium Capital OÜ had no income whatsoever between 23.01.2020 and 31.12.2020.

That’s odd, participants had to pay Elysium Capital OÜ for a place in Elysium Network. It’s as if Elysium is forgetting to pay income tax.

Ponzi Estonia and their extraditable criminals:

news.postimees.ee/8031208/estonian-businessman-turogin-subject-to-extradition-to-us-refuses-to-open-door-to-policeT

Vaguely rings a bell. Think I might have looked into it when it popped up on the US channels. From memory HashFlare wasn’t MLM so I left it there.

There’s been a few sizable non-MLM crypto busts of late. That DOJ and SEC both have crypto specific taskforces, good to see them putting in work.

Rest of the world mostly continues to pretend crypto fraud isn’t a thing.

Estonian authorities are funny.

news.err.ee/1608443264/epl-tallinn-based-crypto-currency-gaming-firm-makes-pandora-papers