Darius Banasik loses control of Qyral

![]() Darius Banasik has lost control over Qyral to the court-appointed Receiver. Or at least he has legally.

Darius Banasik has lost control over Qyral to the court-appointed Receiver. Or at least he has legally.

Following a “whirlwind of court filings” and “unworkable” relationship between Banasik and the Receiver with respect to running Qyral, the Receiver approached the court for instruction.

As part of that approach, the Receiver requested the granted Limited Receivership be converted to a general Receivership.

In response to the Receiver’s filing, the court directed Banasik (right) and Plaintiff Hanieh Sigari to respond by 9am on August 23rd.

In response to the Receiver’s filing, the court directed Banasik (right) and Plaintiff Hanieh Sigari to respond by 9am on August 23rd.

Sigari responded in support of the general Receivership motion. Banasik opposed but filed after the stated deadline.

Sigari moved to strike Banasik’s late response, which the court granted on August 26th.

From the same filing;

The Court GRANTS Sigari’s motion to strike Banasik’s response as untimely.

Given that the past few months of experience with a limited receivership have proven unworkable, the Court finds that the situation has changed such that a general receivership is now appropriate.

The Receiver shall have full and sole control over all aspects of Qyral’s operations. Neither Sigari nor Banasik (the “Parties”) shall exert any operational control over Qyral.

On September 30th, the Receiver filed a Status Report noting;

Both Sigari and Banasik have opened their own companies which compete with Qyral.

I consequently recommend that Qyral wind down operations.

BehindMLM covered Sigari’s Ellie MD launch in May 2024.

I’m unaware of Banasik’s new company (not listed on his LinkedIn and social media appears to be otherwise abandoned).

In any event a month later on October 28th, the Receiver filed an ex-parte motion seeking sanctions against Banasik.

Perhaps not surprisingly, the Receiver alleged Banasik had failed to comply with the court’s earlier “general Receivership” order.

[Banasik] still has not given the Receiver access to Qyral’s merchant accounts or turned over revenue or login information.

Only Defendant [Banasik] possesses the account information for Qyral’s website and merchant accounts and has refused to turn over that information to the Receiver despite the Receiver’s numerous requests.

In addition, Defendant continues to refuse to turn over Qyral’s revenue and access to its revenue, despite the numerous requests by the Receiver to do so.

Banasik’s apparent failure to comply with the previous court order appears tied to him still receiving income through Qyral.

Both Defendant [Banasik] and Plaintiff Hanieh Sigari have confirmed that they agree the Receiver should shut down Qyral’s operations.

Both parties are operating competing businesses with Qyral, and Qyral’s revenue has been declining since April 2024.

Currently, the only issue of contention is that the Receiver (and Plaintiff [Sigari]) wish to cease Qyral’s operations immediately by taking down the website, ceasing to accept credit card payments (cancelling Shopify, Firestorm, and other merchant accounts), and ceasing any and all credit card subscriptions that are automatically charged.

On the other hand, Defendant [Banasik] intends to continue operating Qyral for several weeks and continue to collect its revenue and receivables.

A hearing on the Receiver’s sanctions motion is scheduled for November 22nd.

On November 12th, Banasik filed his opposition to the Receiver’s sanctions motion.

Defendant [Banasik] has no intention of “continuing to operate Qyral;” he is fully cognizant that he has no authority to do so, as the Court’s aforementioned Order Re Receivership makes perfectly clear.

What Defendant has requested of the Receiver is that Qyral remain operating on a limited basis, so that Banabrands may refund customers and fully account for anything due to the receivership estate, and that its accounts may be settled.

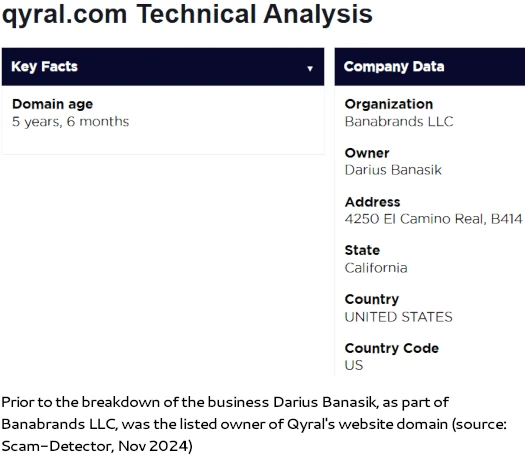

Banabrands is a company, seemingly run by Banasik’s relatives, which according to the Receiver Banasik “engaged to manage Qyral.

The Receiver has made it clear that Qyral should nonetheless be shut down immediately, and the Receiver has the absolute authority- and, more importantly, the ability- to do that.

The Receiver has made no effort to communicate with Banabrands regarding the turnover of funds, or to terminate the existing Business Services Agreement that Qyral entered into with Banabrands well before the Order Re Receivership was entered by the Court.

In responding to the Receiver’s assertion that he had refused to turn over Qyral’s website and merchant account details, and somewhat disingenuously I feel, Banasik states he

is not Banabrands, and has no interest in Banabrands.

Banabrands itself owns Qyral’s IP (and has since the formation of the company), and retains a proprietary payment processing system that the Defendant has no control over.

Accordingly, he cannot give access to something that he does not have to the Receiver.

The Business Services Agreement between Qyral and Banabrands acknowledges that Qyral does not have an existing payment processing infrastructure and Banabrands would provide that for that as part of Banabrands’ services to Qyral.

Moreover, Banabrands outlined that any and all credit card processing risk and liability, under that agreement, would be borne by Banabrands.

Therefore payment processing is part of the Banabrands service and not under the control of Defendant.

In prior communications with the Qyral Receivership, Banabrands has been represented by Paul Banasik. Paul Banasik is Darius Banasik’s brother.

In related news, GoDaddy has been dismissed as a defendant.

GoDaddy put forth it shouldn’t be a defendant because it had not “received ill-gotten funds” or had any alleged wrongdoing made against it.

The court agreed and granted GoDaddy’s dismissal motion on September 10th.

Our next update on Qyral proceedings will follow the court’s scheduled November 22nd contempt motion hearing.

Update 23rd November 2024 – The scheduled contempt motion hearing was “reset” on November 22nd;

Motion Hearings and Show Cause Hearing set for 11/22/2024 were vacated – to be Reset.

The court did however set a Qyral trial date for September 9th, 2025. I don’t see this one going to trial but I’ll keep an eye on the docket for updates.

Update 21st January 2025 – In what effectively amounts to a settlement, what’s left of Qyral has been ordered dissolved.

What a degenerate garbage. Isn’t this considered contempt? We’re all looking forward to the day he’s bending down to pick up soap in a federal prison.

It’s pretty disingenuous, as noted in the article. We’ll have to wait and see what the court thinks on Nov 22nd.

Article updated to note Qyral trial date and contempt hearing reschedule.