Daisy Global’s 5th reboot is another EndoTech AI grift

03![]() Following BioLimitless and Blockchain Sports failures, Jeremy Roma has launched a fifth Daisy Global reboot.

Following BioLimitless and Blockchain Sports failures, Jeremy Roma has launched a fifth Daisy Global reboot.

Daisy Global’s fifth reboot sees Roma once again partner up with EndoTech co-founders Anna Becker and Dmitry Gooshchin.

Roma first announced a new Daisy Global EndoTech AI grift back in June. What was originally pitched as an AI agents chatbot offering is now a typical AI-assisted trading bot ruse.

An aside worth mentioning is the fiction that Daisy Global investors hold equity in Endo Tech.

As shareholders in EndoTech, the next big thing for all of us is to share in the dividends.

That fiction hasn’t changed but back in June Roma was touting the sale of EndoTech for two billion. On a December 1st Daisy Global marketing call with Becker, Eduard Khemchan and Ilya Martin, Roma has now bumped the fantasy to ten billion.

[3:34] What you’re going to hear about today is actually a plan. We’re not gonna talk in depth on the numbers today, but it’s a plan to bring the EndoTech valuation to a ten billion dollar company valuation.

Daisy Global’s fifth reboot is a variation of the AI grift EndoTech rolled out in 2023, this time using the “lulz can’t steal our money!” model.

[0:57] Guys we have some incredible, incredible news, that over the last four years the EndoTech team has been working literally nonstop with a team of some of the greatest minds, mathematicians, quant scientists, led by Dr. Anna, in the world, who set out to create something that does not exist anywhere else on the planet. They have achieved this goal.

And this is uh so exciting because guys, we have a plan and a strategy for 2026 that is so much bigger than anything we have ever experienced in the last four years together uh with Daisy.

Under the lulz can’t steal our money!” model, investors are pitched on passive returns by placing invested funds under the control of a centrally controlled trading bot.

Funds are held on a third-party brokerage or crypto exchange account, creating the illusion that a company can’t extract the funds without direct access.

[4:20] The funds remain in your wallet. You can connect directly through API.

Typically “lulz can’t touch our money!” schemes exit-scam through blowing the bot up or rigged trades.

And of course undermining every “lulz can’t touch our money!” scheme is the fact that, if the purported trading was profitable in the long-term, scammers would just deploy the bot for themselves.

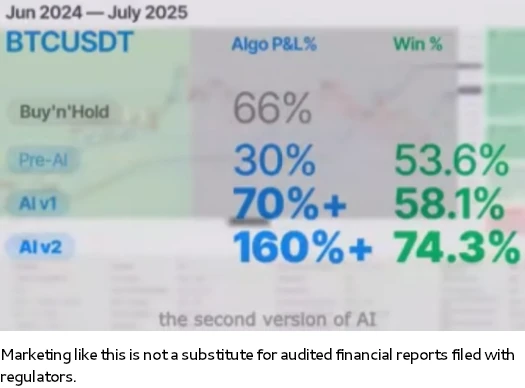

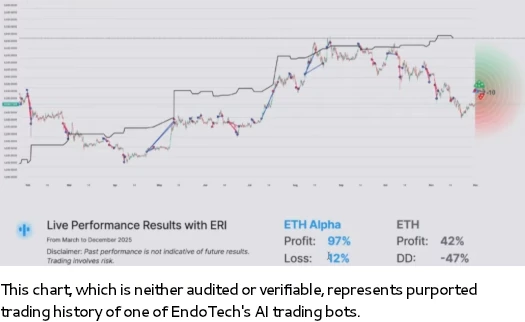

To that end Anna Becker provides potential Daisy Global investors with purported data, none of which is verifiable through audited financial reports filed with regulators.

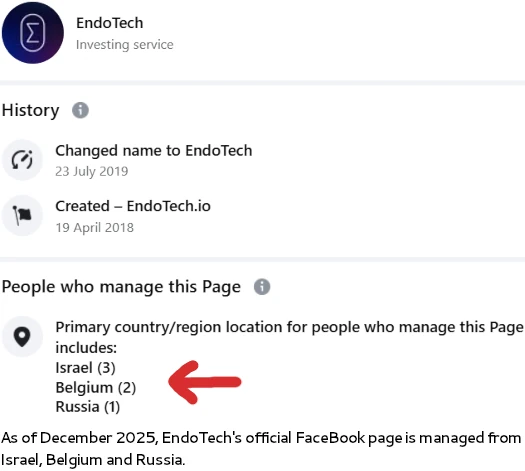

This isn’t surprising, neither EndoTech, which is based out of Israel, or Daisy Global are registered with financial or commodities regulators in any jurisdiction.

Existing Daisy Global investors are able to access EndoTech’s new AI trading investment scheme with a minimum 1000 USDT investment plus 5% annual license fee (5% of the USDT investment amount).

EndoTech and Daisy Global then charge a 20% fee on trading returns.

The plan appears to be to get some existing Daisy Global investors on board, ensure these investors receive initial passive returns, and then have these investors rope in new victims next year.

In March 2025 Roma pegged Daisy victim losses at at least $1.1 billion. Roma is a US national and, based on promotional efforts, a large percentage of Daisy Global victims are believed to be US residents.

EndoTech has been at the center of multiple MLM investment frauds. Including Daisy Forex circa late 2022, EndoTech is also tied to iGenius.

iGenius is owned by Investview, a US company who settled fraud charges with the SEC earlier this year. Jeremy Roma is a former Investview executive.

Belgium issued an EndoTech fraud warning May 2021. iGenius recently attracted regulatory attention from Canada and Poland.

Since the original launch in late 2020, Daisy Global fraud warnings have been issued by British Columbia and Alberta,