CFTC secures prelim injunction against Fundsz defendants

The CFTC has secured a preliminary injunction against the Fundsz Ponzi Defendants.

The CFTC has secured a preliminary injunction against the Fundsz Ponzi Defendants.

The preliminary injunction was ordered on August 23rd, following consent motions filed on August 21st and 22nd.

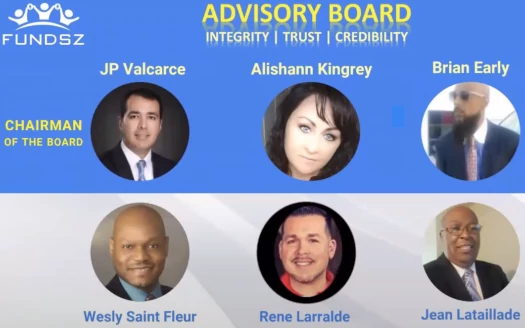

Juan Pablo Valcarce was the first to fold on August 21st. Rene Larralde, Brian Early and Alicia Ann Kingrey fell on August 22nd.

As per the court’s August 23rd order;

The CFTC has made a prima facie showing that since October 2020, Defendants Rene Larralde, Juan Pablo Valcarce, Brian Early, and Alisha Ann Kingrey have made material misrepresentations regarding the use of participant funds, expected investment returns, and historical investment returns and that these Defendants have, are, or about to engage in conduct in violation of (USC) and (CFR).

The preliminary injunction is a continuation of the previously granted SRO, which froze the Fundsz Defendants’ assets.

The SRO also saw the appointment of a Temporary Receiver, which as per the preliminary injunction is no longer temporary.

The preliminary injunction further prohibits the Defendants from committing further acts of fraud, so presumably that means what’s left of Fundsz is now over.

As asserted by the CFTC on August 15th, at the time Fundsz was still misleading investors along with fudged daily returns.

The Receiver now owns and controls everything Fundsz related on the corporate side, including its website.

At time of publication Fundsz’s original website was still online, but that’s expected to change in the coming days.

Looking forward, I can’t see this one going to trial. I expect we’ll see settlements from the Fundsz Defendants at some point.

Regarding victim recovery, it’s too early to make a call on that. At some point the Receiver will file a Status Report, in which we’ll get an idea of Fundsz’s financials.

From there we’ll have a better idea of whether a victim claims process and net-winner clawbacks are likely.

In related news the court granted Rene Larralde $8660 in legal fees, payable from frozen assets.

Update 7th October 2023 – Minor update. A tentative trial has been scheduled for October 2025. The CFTC filed an Amended Complaint on September 29th.

With respect to the Fundsz Receivership, the Receiver filed an initial report on October 2nd.

The Receiver has control of Fundsz’s website, which has now been pulled offline.

The Receiver’s report otherwise primarily details asset recovery from deceased Fundsz admin Rene Larralde.

Of particular note is 2 million USDT Larralde transferred to Galileo Capital LLC for liquidation.

Only $177,500 was liquidated, with Galileo Capital seemingly having stolen the rest.

Galileo claims that a principal, in possession of a cold wallet containing 1,882,516 USDT belonging to Rene Larralde was stolen, and the crime was reported to Costa Rican authorities, who are investigating.

Pretty confident absolutely nothing will come of that investigation. Firms stealing money from clients is just another day in the crypto industry.

I was going to do a separate write up but the Receiver has

sent a comprehensive financial affidavit and disclosure form to Defendants and requested that they complete and return the form.

Defendants are in the process of completing the form and have been generally responsive and cooperative with the Receiver and Receiver’s Counsel in connection with her efforts to gather their financial information and records.

I figure it’s probably best for the other Fundsz defendants to start coughing up assets before publishing a full article.

Those efforts should be detailed in the Receiver’s next report.

Please, let CFTC pay the investors back their money. I have an account with Fundsz alongside with my downlines

The CFTC won’t be paying back anything. The Receiver will propose a claims process if there’s enough recovery to warrant it.

How serious is the Fundsz affair with the CFTC? Since Larralde’s preliminary injunction, what has been said? Why no news to date, no more articles about this case.

The Fundsz community stole over 14 million members, why aren’t they in jail yet, why isn’t the CFTC reimbursing investors for their winnings?

For me, it’s all a show.

First Ponzi regulatory lawsuit? They take years.

Fundsz had nowhere near fourteen million members. Next you’ll be telling me they’ve been “paying out for seven years”…

Can’t answer why criminal charges haven’t been filed and the CFTC isn’t there to reimburse your Ponzi losses.

A Receiver has been appointed and is tasked with recovering as much as possible. At some point a claims process will be established.

Again, this process will take years. Welcome to the Ponzi endgame – and Fundsz victims should count themselves lucky. Most MLM Ponzi schemes collapse without regulatory repercussion.

Article updated with latest on Fundsz proceedings.

I’m not surprised to see that Rene finally got caught; I’m not really surprised he’s dead, either.

He was a scammer back when I did programming for him and his MLM Ponzi scheme “Maxous” in 2009 through early 2010.

I was new to software development then and wasn’t familiar with MLM’s. The developer before me left because he wasn’t being paid, and Rene owed me over $10k when I quit. I didn’t try for any recovery because he was broke back then.

The logo for all his “companies” are just variations on a theme. I wouldn’t be surprised if [removed] is somehow connected to this given the similarities between logos, the fact that site is also connected to crypto “investing”, and the outlandish returns they promise.

Looks like a run-of-the-mill non-MLM Ponzi. Could be a recovery scam.

Given the CFTC targeting Fundsz’ admins it is unlikely to be related.