Trevon James tells court he can’t pay BitConnect fines

After failing to respond to an SEC lawsuit filed against him, Trevon James has asked a court to set aside a recorded entry of default.

After failing to respond to an SEC lawsuit filed against him, Trevon James has asked a court to set aside a recorded entry of default.

In a six-page October 18th filed pro-ser letter, James has also informed the court he doesn’t “have the Bitcoin to liquidate in order to pay these fines.”

James, who identifies himself as Trevon Brown, married and a father of three, claims being sued by the SEC “is the worst thing that ever happened to me”.

BitConnect was a multi-billion MLM crypto Ponzi that James, as a top promoter, is accused of stealing millions through.

Even after BitConnect’s fraud was laid out in court and its executives indicted and sent to prison, James maintains his experience with BitConnect “was great”.

To that end, the SEC sued James and several other BitConnect promoters in 2021. At the request of the SEC, the court clerk recorded an Entry of Default against James on August 26th, 2024.

In September 2024, the SEC revealed default judgment penalties against James totalling $3.5 million.

States James (right) in his letter to the court;

States James (right) in his letter to the court;

Looking back, there is no question that this is the worst thing that has ever happened to me.

Not even Bitconnect itself because that experience was great. It’s what the SEC did to bitconnect is what makes it the worst thing that ever happened to me.

The SEC’s charge of Bitconnect ruined my life and my reputation in the cryptocurrency space.

To my fans I was the funny crypto enthusiast who enjoys the technology and just loves to chat and make jokes about it, all while trying to predict the direction the crypto space is going.

All of that has been torn apart and I find it hard to do what I do best with the life path I chose of being a video production personality.

Now I’m “that scammer guy” “the bitconnect scammer” “BITCONNNNEEECTTTT!!” “HEY HEY HEYYYYY” “WASSA WASSA WASSAP BITCONNECT!!!!”.

If you are unfamiliar with the last three quotes those are jokes that are said indefinitely online to the people who participated in the coin to remind them of their loses.

Whether it be financial loss or reputation. I still till this day have to deal with commenters online and in public who have to remind me that I’m now considered a scammer, even though I never took anything from anyone.

Instead of acknowledging the victims he stole from, James has a cry to the court over his YouTube career being devastated.

Now for the average person, sure it’s just a little online bullying that could be ignored. But for me, someone who is trying to have a career in reporting on cryptocurrency this has been very damaging.

And to be known as the Bitconnect scammer when you google my real first and middle name is mortifying. I’ve never scammed anyone in my life!

I did not know [BitConnect] would end like it did because I had never seen anything like the collapse of Bitconnect before in my life.

I didn’t even learn about what the SEC was until I had to learn what a subpoena was. I’m not at the corporate level so it was all new to me and I’ve learned a lot.

BitConnect collapsed in January 2018, wiping $2.4 billion of the BCC Ponzi token across ten days.

James goes on to argue the SEC’s case against him should be dismissed in its entirety, because the BitConnect Ponzi scheme is “just like bitcoin”.

I’m not defending the creators of Bitconnect because I don’t know them or their intentions, but Bitconnect is mined just like Bitcoin is mined, and Bitcoin has gotten the pass from the SEC as “not a security” so based on that alone I think this case against me should be dismissed.

Despite the SEC not filing charges against BitConnect until three years after it collapsed, James blames the SEC’s 2021 filed lawsuit for BitConnect’s 2018 collapse (note there are no editorial errors in that last sentence).

Bitconnect collapsed after the SEC charged it because the holders of the coin sold it off heavily, and never looked back.

The loses in Bitconnect were the result of the SEC scaring participants out. The rules/laws the SEC is using to charge me are ancient laws from the 1940’s.

Television was barely a thing when these laws were put in place let alone computers or internet.

For the record, the Securities and Exchange Act was ratified in 1933. What this has to do with James violating US securities law through BitConnect is unclear.

Securities are securities, regardless of the medium they are offered through.

Despite professing his innocence, James does appear capable of recognizing his fraud.

Days or weeks pass and I get a letter from the SEC. This period is very blurry for me to recall because it was all so long ago and new to me at the time.

But I eventually got a subpoena to come testify as a witness in the case against Bitconnect in New York and was asked to see all my wallets and transactions.

During the interview I answered all questions up until they started to play back to me some of my videos where I started to say things in the video that I could see could be taken out of context in order to use what I said in those videos, against me.

One particular part was were I said people had “lost money”. Being unsure of their angle for asking me about why I said that, I applied my right to remain silent.

Five pages into James’ letter, we get to the relevant legal point. Albeit with James’ continued fundamental misunderstanding of the securities fraud he’s been charged with;

I didn’t realize I had a deadline to respond or I would have because I always have.

So I’m writing to ask you to end this case because I don’t have the Bitcoin to liquidate in order to pay these fines.

As far as disgorgment [sic], they are asking me to pay them essentially the amount of Bitcoin that was hacked from me, which is outrageous and cruel because they know I don’t have it, and even have proof I don’t have it in their own documents.

It’s worth noting that since BitConnect’s collapse, James purchased a house in South Carolina and a BMW luxury SUV. In August 2019, James asked his YouTube channel viewers for advice on investing a million dollars into real-estate.

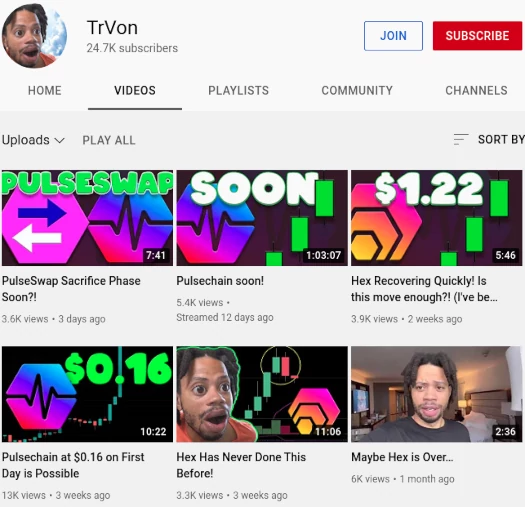

On his YouTube channel, James has also of course continued to document and promote his investment into numerous fraudulent crypto investment schemes.

How can I payback what I don’t have. And how do any of us know I need to pay anything back if there are no laws for cryptocurrencies.

Just because some early crypto enthusiasts decided to call blockchain ledgers “currency”, the SEC gets to enforce monetary laws onto what are literally spreadsheets?

Each blockchain is a spreadsheet copied to 1000s of computers in a decentralized manner so that it can’t be deleted. They didn’t know these would exist in the 1940s.

We need laws for crypto and hopefully this case, along with the others going on right now with the SEC, can help us as a country come up with new rules and regulations for this new technology.

I’ve already paid for this through my reputation and stress over the past 7 years.

If you see that dismissing this case is not justice please extend the case and have me show you the proof that you need to see to dismiss it.

I wouldn’t mind speaking with you face to face at a trial which I think is better than this anyway because I’m sure you have questions for me.

I have no problem with being barred from participating in securities because I’ve never done that anyway.

And for the disgorgement the only way I could pay this is if the FBI truly has my BTC.

I was irresponsible in not getting representation earlier and when I’ve tried to get representation everyone I asked said they aren’t qualified for this type of case or it’s too far along at this point.

I trust that you see what’s actually going on here between me and the SEC. After all, I started out as a witness in all this.

The SEC filed its response to James’ letter on October 29th. In its response, the SEC acknowledged James’ “request to move to dismiss [its] Complaint”.

The regulator also laid out why Brown’s request was “meritless”.

Brown’s contemplated motion to dismiss lacks merit. The Brown Letter consists largely of a recitation of purported facts that, even if true and relevant to the Commission’s claims (which they are not), would be inappropriate for consideration on a motion to dismiss.

The sole argument Brown raises that purports to address the sufficiency of the Complaint’s allegations and that therefore could properly be considered on a motion to dismiss is his contention that the BitConnect Lending Program did not meet the definition of “securities” under the federal securities laws. Brown Ltr. at 3, 5.

This argument, however, is meritless.

For the reasons discussed in the Commission’s papers in support of its default judgment motion against Brown, the Complaint more than adequately alleges that the BitConnect Lending Program constituted an “investment contract” under SEC v. W.J. Howey Co., 328 U.S. 293 (1946) and therefore met the definition of a security under Section 2(a)(1) of the Securities Act of 1933, 15 U.S.C. § 77b(a)(1), and Section 3(a)(10) of the Securities Exchange Act of 1934, 15 U.S.C. 78c(a)(10).

Following a November 13th telephone conference, the court granted James permission to file a motion to dismiss by December 13th. The court has also referred the matter to a Magistrate Judge to explore possible settlement.

As at time of publication, James remains a pro-se defendant without legal representation.

Update 15th December 2024 – Trevon James has not filed a Motion to Dismiss.

Instead, a telephone conference was held on December 9th, leading to what will likely be a settlement between James and the SEC.

As per two orders issued after the conference;

Pursuant to the telephonic conference held today, December 9, 2024, a follow up conference is scheduled for Tuesday, January 7, 2025.

The Clerk of Court is directed to attempt to locate pro bono counsel to represent Mr. Brown for the limited purpose of settlement.

The scheduled January 7th conference is to further discuss settlement between the parties.

Update 8th January 2025 – Trevon James has acquired pro bono legal representation. An attorney put in a appearance on behalf of James on January 2nd.

The scheduled January 7th conference took place as scheduled. A settlement conference for Trevon James has been scheduled for February 7th.

Update 8th February 2025 – Trevon James’ BitConnect settlement conference has been delayed to April 2025.

Because I know you’re going to read this Trevon, my guy… go read up on the Howey Test and see how it applies to BitConnect’s investment scheme.

You’ve been charged with securities fraud. There doesn’t need to be specific laws for cryptocurrency with respect to investment contracts and securities because the medium securities are offered through is irrelevant.

Let’s say an asteroid smashes into Earth tomorrow and scientists discover a new chemical compound on it that can kill someone on contact.

Scientists name this new chemical “BitConnect”.

Someone then breaks into the lab. Let’s call this person “Trevon James”.

So this guy, “Trevon James”, breaks into the lab, steals a sample of “BitConnect” and uses it to kill someone in a premeditated manner.

Following an investigation, authorities identify “Trevon James” and charge him with murder.

What you’re essentially arguing is existing murder laws shouldn’t apply because “wE nEeD nEw LaWs FoR bItCoNnEcT! mUrDeR lAwS aRe FrOm ThE 1700s. WtF?”

And because I have absolutely no confidence in you putting together your own motion to dismiss, the above is not a legal defense. Whatever you do don’t put this in your motion to dismiss.

“ThIs Is NoT fInAnCiAl AdViCe” also isn’t a legal defense. It’s never meant anything legally with respect to securities law.

Nobody ever beat a murder charge because they yelled “this isn’t murder!” before committing murder.

I just spat my drink out laughing.

To quote Admiral Ackbar:

IT’S A TRAP

What happened to the other Bitconnect YouTube influencers ? I remember there was a guy even younger than James.

CryptoNick disappeared. Michael Noble is fighting with the SEC over his monetary penalty and restitution.

Craig Grant dicked off to Jamaica and is ploughing his BitConnect ill-gotten gains into property development.

Article updated to note Brown and the SEC are likely headed towards settlement.

Article updated with latest on Noble and James proceedings.

Both Trevor and Craig Grant need to be locked TFU and punished. They got myself along with a bunch of other people cuz we trusted them.

It’s appalling to see Trevor is still posting meme coins and clearly other scams.