Be Club misleads consumers on regulatory fraud warnings

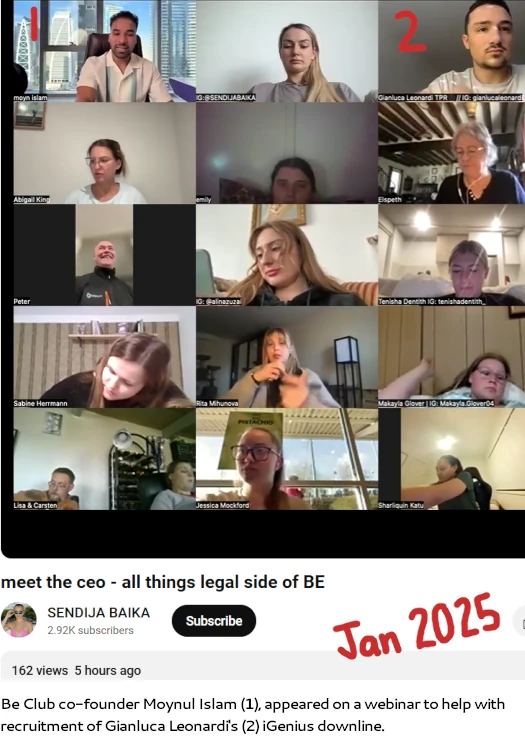

A few days ago a BehindMLM reader reached out to me regarding a Be Club webinar featuring co-founder Moynul Islam (better known as Moyn).

A few days ago a BehindMLM reader reached out to me regarding a Be Club webinar featuring co-founder Moynul Islam (better known as Moyn).

The call, hosted by former iGenius promoter Gianluca Leonardi, appears to be part of an attempt to recruit Leonardi’s iGenius downline into Be Club.

Be Club desperately needs an injection of new suckers. For December 2024 SimilarWeb tracked just ~3100 monthly visits to Be Club’s website.

88% of the traffic originated from Italy, which just happens to be where Gianluca Leonardi is from.

Now that you know the context of the webinar, we can move onto the webinar itself.

Evidently a large part of convincing Leonardi’s iGenius downline to migrate over to Be Club is to address it’s multiple regulatory fraud warnings.

Before we get into Islam’s deception on that though, it’s worth noting that said deception begins right from the beginning.

In the webinar Moyn, rather than be honest about joining OneCoin, stealing a bunch of money and then fleeing to Dubai, spins a story about joining ACN, not making much money, fast-forward to 2018 and Moyn and his brothers launch their own MLM company.

After setting himself up, Moyn gets into Be Club’s regulatory warnings. To smooth over Be Club’s regulatory warnings, which pertains to Be Club’s fraudulent business model, Moyn trots out a “everybody gets regulatory fraud warnings” ruse.

[17:32] It’s very common for most companies to get some level of warning and fines.

We have seen the companies in our space, not only they got a warning, but they got fined. Every single company that you know of in our space, when it comes to forex and trading education, they’ve received warnings from regulatory bodies.

First off “everybody is doing fraud, we’re not the only ones!”, is not a confidence-inspiring excuse.

Putting that aside for the bigger picture, the immediate disconnect between Moyn’s assertion and reality is none of Be Club’s regulatory fraud warnings pertain to “forex and trading education”.

Be Club started off as Melius. Launched in 2018, Melius saw the Islam brothers hide behind CEO Jeremy Prasetyo. Melius’ business model combined commodities fraud with pyramid recruitment.

Melius collapsed in 2020 and was rebooted as Better Experience, better known as just “Be”.

Be initially dropped Meliu’s commodities fraud but retained its pyramid scheme. In mid 2024 Be rebooted as Be Club.

Through its “SageMaster”, Be Club saw a return to commodities fraud with added securities fraud. To the best of my knowledge the SageMaster investment scheme remains the current iteration of Be Club.

On the regulatory front:

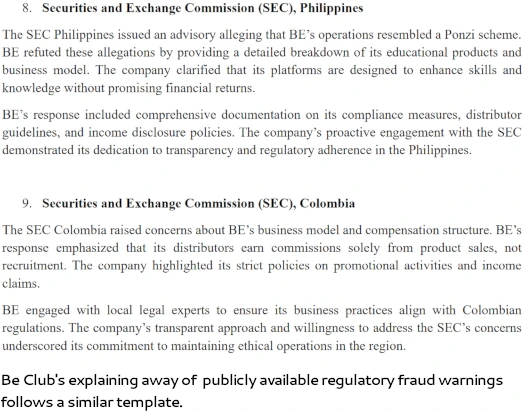

- Colombia issued a Be Rules securities fraud warning in February 2022

- Norway issued a Be investment fraud warning in March 2023

- Uruguay issued a Be pyramid fraud warning in April 2023

- the Philippines issued a Be securities and Ponzi fraud warning in November 2023

- New Zealand issued a Be Club securities fraud warning in October 2024

None of these regulatory fraud warnings were challenged and all remain in force and effective as at time of publication.

…but you wouldn’t know that to listening to Moyn.

[18:20] We are the only company in this space in the last six years with [a] clean record.

As per the very much still active and enforced regulatory fraud warnings above, Moyn’s statement is a flat out lie. You can verify this yourself by seeing the warnings on the respective regulator’s websites and contacting them if you need to.

[18:30] I want to show you guys something really important, and because last thing that I want any of you on this call to be worried about, [is] if we are compliant and legal.

Because for [the] last six years, that’s all I’ve done. I’ve focused on making sure that every country that we launched, every country that we are in, we are on the right side of the law.

Again, refer to the multiple in effect Be and Be Club regulatory fraud warnings cited above.

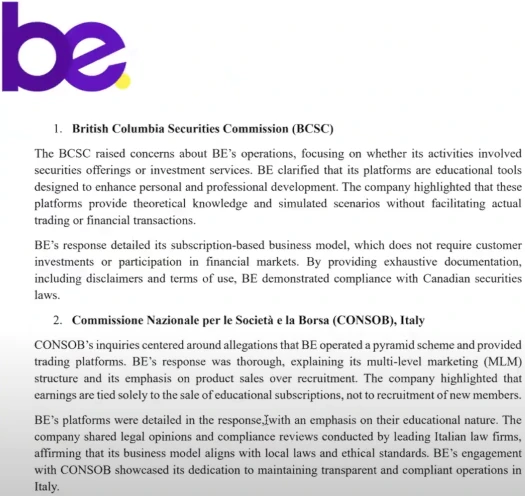

Moyn goes on to trot out a PDF documented dated January 7th, 2025.

Note that the document cites communication with the British Columbia Securities Commission, Italy’s CONSOB, Belgium’s FSMA and Quebec’s AMF. To the best of my knowledge these regulators have not issued public warnings pertaining to Melius, Be or Be Club.

That doesn’t mean pyramid, securities and commodities fraud is legal in these jurisdiction, only that I can’t speak specifically to any action taken.

Outside of these two jurisdictions, Moyn’s “regulators” document can be boiled down to:

- a regulator flagged Be or Be Club as a fraudulent scheme

- Be hired some local lawyers

- local lawyers allegedly sent a few emails to the regulator

- see, we did something

This isn’t how regulation works.

When a regulator issued a fraud warning the company cited typically has a window to officially respond and challenge the underlying investigation.

If an MLM company is successful at presenting its case at a hearing or hearings, the public fraud warning is withdrawn.

Contrary to Moyn’s claims, this has not happened in any jurisdiction in which a regulator has issued a public Be or Be Club fraud warning.

Moyn goes on to claim Be’s and Be Club’s fraud warnings come down regulators “not understanding what we do”. This is classic scammer copium.

With respect to running a pyramid scheme, you either have more retail customers than affiliate promoters by sales volume or you don’t.

With respect to securities and commodities fraud, either you are registered with financial regulators or you aren’t. Neither Melius, Be, Be Club or Moyn and his brothers have registered with financial regulators.

Moyn further rests his laurels on there being “no further action” taken after regulatory fraud warnings were issued.

This primarily comes down to Be and Be Club completely collapsing in each jurisdiction a regulatory fraud warning was issued in. To a lesser extent it also comes down to the Islam brothers fleeing the UK for Dubai as OneCoin was collapsing.

Dubai is the MLM crime capital of the world. Local regulation of MLM related pyramid, securities and commodities fraud is non-existent.

Perhaps not surprisingly, Gianluca Leonardi has also relocated to Dubai.

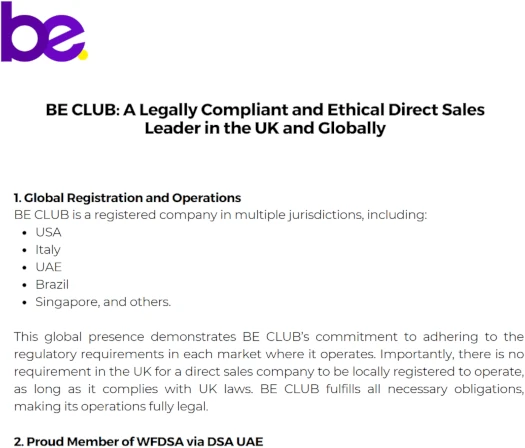

Accompanying Moyn Islam appearing on Gianluca Leonardi’s webinar are a series of documents with more falsehoods.

First we have “Be Club: A Legally Complaint and Ethical Direct Sales Leader in the UK and Globally”.

In this document Be holds up its shell company registrations as somehow translating to legal compliance. Shell companies don’t mean anything with respect to regulation and legal compliance.

Actual legal compliance would see Be registering with financial regulators, which it has not.

Be also holds up its UAE MLM association memberships. Again, Dubai is the crime capital of the world. These registrations mean nothing as far as legal compliance goes.

And finally we have this nonsense;

The company has undergone legal scrutiny in highly regulated markets such as the USA and Italy, where it was found to be legitimate and compliant with all laws.

BE CLUB has proactively subjected itself to scrutiny in jurisdictions with stringent regulatory requirements:

- USA: Known for its rigorous enforcement of consumer protection laws.

- Italy: A market with strict regulations on direct selling and multi-level marketing companies.

In both cases, BE CLUB was found to be a legitimate business, operating in full compliance with the law, and it continues to thrive without any fines or penalties.

Be Club is correct in the US being known for rigorous enforcement. It’s why Be Club has never taken off in the US.

Instead, by its own admission, Be Club targets “developing countries”.

Also regulators don’t rubber-stamp companies. Asserting legal compliance because a country’s regulators haven’t issued fraud warnings is false equivalence.

Specific to the US you can verify Be Club isn’t registered with the SEC or CFTC by respectively searching the EDGAR and NFA databases.

If it were active in the US, Be Club committing securities and commodities fraud in violation of US financial law is verifiable proof it isn’t legally compliant there.

Next we have “Be Factsheet: Addressing Rumours and Misinformation”.

This document attempts to downplay the Islam brothers role as OneCoin Ponzi promoters.

BE’s founders, Moyn and Monir Islam, have faced speculation about their involvement.

However, the facts tell a different story – one that highlights their minor role as investors and their efforts to expose the truth.

The truth is the Islam brothers were top OneCoin promoters in the UK. They primarily targeted migrant communities and, after stealing a bunch of money from these communities, the Islam brothers dipped and fled to Dubai.

That’s history, that’s what happened. That the Islam brothers can’t even acknowledge these basic truths (that anyone can independently verify, it’s not like the Islam brothers promoted OneCoin in secret), speaks to their characters.

Right now Be Club is on death’s door and has been for most of 2024. Should Gianluca Leonardi successfully plunder his iGenius downline and recruit them into Be Club – triggering a boost in local recruitment, I suspect it won’t be long before we see a CONSOB Be Club fraud warning.

Failing which pyramid recruitment, securities fraud and commodities fraud are all illegal in Italy in any case.

If you’re in Gianluca Leonardi’s iGenius downline and are thinking of signing up with Be Club, ask yourself why nobody from prior countries Be Club has had a run in are still around. Why is it outside of Leonardi’s recent focus on his Italian iGenius downline is there nothing going on in Be Club?

You can verify yourself that Be Club and the Islam brothers aren’t registered with CONSOB. As far as actual due-diligence goes, unless you’re comfortable with fraud that should be the end of it.

The infusion of new suckers was more the work of Miguel Vees Raposo than Giancarlo Leonardi. To the best of my knowledge, Giancarlo is Miguel’s downline.

Going off the linked webinar, Raposo seems to have delegated recruitment of new suckers to Giancarlo.

Probably easier to get a guy hiding out in Dubai to cross-recruit to lessen the risk of iGenius taking legal action.

True, but Vees lives in Dubai too

Oh he’s fucked off to Dubai too has he?

I’d say Be Club was keeping the Dubai MLM dream alive… but y’know, ~3000 monthly website visits and all.

Perhaps Italy is already over and these guys are hoping to pivot to Germany.

The fact that you say that Be Club “is on death’s door” shows your absolute cluelessness as to what is truly happening with the company.

The conference held just a few months ago had over 8000 in attendance and monthly corporate Zooms consistently have over 6000 attendees (including lasts month’s Zoom).

Your constant griping and harping on the fact that the Islam brothers were involved with OneCoin a decade ago actually erodes your credibility, get over it…it means nothing.

Many of the leaders who were involved with OneCoin in the embryonic stage of crypto naively believed it was legit for the time that they promoted it and left when they finally came to the realization that it in fact was a flawed model… the Islam brothers included.

Saying that Be’s membership in the UAE DSA “means nothing” because it’s the “UAE Chapter” of the DSA is discriminatory. The UAE DSA Chapter is also a member of the WFDSA (World Federation DSA) and is held to the same standards as the USA DSA Chapter. Only legit companies are accepted, no Ponzi’s…check the UAE DSA membership list, which is composed of only 18 companies.

Truth is that the BE subscription based product’s value far outweighs it’s cost… and the fact is that the vast majority of product users are clients and not network building Affiliates.

BE’s product is reasonably priced, truly works, is secure, doesn’t work by asking for deposits of capital and is light years ahead of any other Fintech products in existence.

The Be company is completely transparent. The regulatory “warnings” issued are unfortunate, baseless The fact that you say that Be Club “is on death’s door” shows your absolute cluelessness as to what is truly happening with the company.

Truth is that the BE subscription based product’s value far outweighs it’s cost… and the fact is that the vast majority of product users are clients and not network building Affiliates. BE’s product truly works, is secure, doesn’t anybody to fork and is light years ahead of anything else in Fintech.

~3000 monthly website visits is dead for an MLM company. Be Club recruitment outside of Italy has all but collapsed.

That due-diligence bothers you is telling. This is the Islam brothers reality, it’s who they are in the MLM industry.

It is also the reality of the foundation of Melius Club which was eventually rebooted into Be Club.

The DSA is not a regulator. Membership with the DSA, let alone the DSA in the MLM crime capital of the world, is in fact meaningless.

If that were the case Be Club wouldn’t have collapsed everywhere outside of Italy.

There’s nothing baseless or unfortunate about pyramid, securities and commodities fraud.

The law is the law. Either you’re following it or you’re committing fraud.

The only thing Be Club has done in response to regulatory fraud warnings is change its website domain four or five times.

To date Be Club has not registered with financial regulators in any jurisdiction. Pretending the Islam brothers aren’t aware they are and continue to violate financial laws is silly.

Stop making excuses for fraud.

For comparison, the figures from January 2024, when be.club had ~17.6K visitors.

postimg.cc/nM5hVhPm

At that time most visitors came from Denmark (74.54%), followed by Italy (19.42%) and the United Kingdom (6.04%).

postimg.cc/rRtcR5Pr

@melanie and @Oz, keep in mind that many more visits appear to be going to the so-called flagship site, which is sagemaster.io. Italy, Colombia, and Denmark still top the visit list

~34,000 monthly visits. Everywhere has collapsed except new suckers in Colombia (again) and Norway. I take it Frederick is from one of the collapsed countries hence the butthurt.

Be Club’s Colombia fraud warning stands so the company is illegally operating in and recruiting consumers in Colombia. So much for adhering to regulations and operating legally.

Interesting to note the only thing keeping Be Club afloat is SageMaster, it’s unregistered fraudulent investment scheme. Literally nobody gives a crap about the rest of Be Club’s products (and never did outside of pyramid recruitment).

@OZ, Sagemaster’s Terms and Services explicitly exclude the USA and UAE (where the company is headquartered, tee-hee). In a call with Vees, he told me that language will be changed. I’m not holding my breath.

Language of the T&S or marketing language?

If it’s the latter you can’t “language” your way out of securities and commodities fraud.

@Oz, the T&S. That didn’t stop Vees and Leonardi from buying in, and the ~3,000 visits from the US per month suggest that no one gives a shit about security fraud.

No butthurt here, just pointing out your flawed analysis. No fraud occurring♂️

1) 8000 in attendance at their last conference at the end of Sept 2024 & over 6000 in attendance on each monthly corporate call. Again, you’re clueless in terms of the company’s business model. Besides the SageMaster platform website a large swath of BE’s clients utilize Be’s Fintech education platform & mobile apps.

2) There’s a huge difference between “due diligence” and harping on and obsessing over an unwittingly unfortunate entrance into the crypto space a decade ago, when it was in its embryonic stage. You’re harping & obsessing, not providing “due diligence”.

3) The DSA may not be a government regulatory body they are recognized to hold high industry standards worldwide. Again, only 18 companies were accepted by UAE DSA. If, as you say, the UAE is the Ponzi crime capital of the world and the DSA means nothing, then why aren’t a plethora of UAE Ponzi companies members?

3) Be hasn’t collapsed, it’s actually thriving with the major of members being satisfied end-user clients. The SageMaster platform is NOT an investment scheme. It DOES NOT work by asking for any deposits of capital in any way, shape or form.

4) A “warning” is just that…a “warning”, which can occur for a number of baseless and unfounded reasons… and yes, the company persistently communicated with the regulatory bodies who issued the “warnings” head on. Operating after a warning is issued is not illegal. Only operating after a “cease & desist order” or an “injunction order” is issued is illegal.

A company rebooting after its first 2 year learning curve doesn’t necessarily indicate wrongdoing. The founders were always transparent. “Be” has been “Be” since 2020…adding “Club” to the name does in no way constitute a “reboot”.

5) Only companies selling securities need to be registered with financial regulators and based on the Howey test they aren’t (unless one twists the Be business model into a pretzel to imagine that it fits).

6) Given the upcoming U.S. Administration’s business regulation & crypto attitudes, the SageMaster terms & conditions language regarding U.S. exclusion may certainly be changed

Website traffic statistics do not support this. Neither does Be Club collapsing in countries where recruitment has inevitably died off.

Crypto has been around since 2009. OneCoin launched in 2014. From day one OneCoin was an unregistered fraudulent investment scheme, just like Be Club is today.

The Islam brothers stole a bunch of money through OneCoin and then fled to Dubai to escape their victims. This is the Islam brothers’ MLM legacy and it’s impossible to perform due-diligence into Be Club without referencing this.

Thank you for agreeing that, with respect to regulation, membership with the DSA is meaningless as stated.

Be Club is dead outside of Colombia and Norway – two countries who have already issued Be Club fraud warnings.

I don’t know why you’d keep arguing this when anyone can lookup website traffic statistics.

Stop making excuses for fraud.

Securities fraud and commodities fraud is illegal in every country with a regulated financial market. A regulator issuing a fraud warning is explicitly pointing this out to consumers regarding specific companies.

This is typically the best they can do when scammers running fraudulent countries are hiding in offshore hidey holes. In the more active jurisdictions, like the US, regulators and authorities sometimes go after local promoters.

Regardless, fraud by definition is illegal.

Stop making excuses for fraud.

MLM + passive returns = securities offering. Based on the Howey Test Be Club’s passive returns investment scheme is a securities offering.

And in addition to securities fraud, Be Club also commits commodities fraud.

Securities fraud has been illegal in the US since 1933. The US is not going to legalize securities fraud.

Notwithstanding what does or doesn’t happen doesn’t change the fact Be Club is and has been committing fraud and operating illegally.

No excuses for fraud are being made as no fraud is occurring, your analysis is deeply flawed. (Ozedit: snip, see below)

There’s no need for analysis when:

1. Multiple financial regulators have issued Be Club fraud warnings; and

2. consumers can verify Be Club isn’t roistered with financial regulators in their country to confirm securities and commodities fraud.

If you can’t acknowledge the basic reality of Be Club’s verifiable fraud, I think we’re done here. You’re not even arguing the fraud hasn’t taken place, you’re just claiming fraud isn’t fraud.

I’ll make it easy for you; Provide evidence Be Club has registered with financial regulators and filed audited financial reports, as is legally required. Especially in Colombia and Norway.

Anything else will be marked as spam. Best of luck with the scamming.

Anyone who has read this detailed article will recognize the criminal energy with which the fraudulent Islam brothers operate.

postimg.cc/v146H92f

letmeexpose.is/exposing-moyn-ehsaan-and-monir-islam/

I’m “waiting” for documentation for the US. Like I said above, I’m not holding my breath.

Weren’t the Islam brothers supposed to have a freezing order against them making it impossible to move money? They wouldn’t be promoting anything for free.

Did somebody not tell them, don’t they care and/or was that a waste of time?

I agree with Fredrick, the be products are ground-breaking, innovative, real and do provide true value. (Ozedit: snip, see below)

That’s nice but has nothing to do with Be having insignificant retail sales, securities fraud and commodities fraud.

Marketing waffle = spambin.

You unjustifiably claim that there is blatant fraud occurring, however that is simply your layman opinion on a grey area in securities and commodity law.

The facts are that in the U.S. an entity that is providing signal aggregation and API connected automated trading strategy tools does not need to register as a commodity trading advisor (CTA) with the Commodity Futures Trading Commission (CFTC).

Paying commissions on a subscription service in order to receive fintech education and access to signal aggregation and API connected automated trading strategy tools does not constitute a CTA.

Any CFTC order requiring a trade signal or an API connected automated trade strategy platform to register as a CTA stems out of the facts and circumstances of specific cases. It’s not black and white.

Further clarification is needed to identify components triggering CTA requirements; the precise facets for integrations between API connected automated trading strategy tools & trade signal providers and trade data platforms and commodity trading providers remain unclear.

Beyond that, other countries are mostly even more ambiguous on the subject.

(Ozedit: derails removed)

@Olaf The terms of service for Sagemaster state that it cannot be sold in the US or UAE. The former prohibition is almost certainly due to its being an unregulated security.

Hence reinforcing the fact that no fraud is being committed.

That said, the current unavailabity in the U.S. is certainly out of an abundance of caution due to the existing ambiguity… that may change in the future, especially given the political tide there.

Except that the product is being sold to US citizens.

Going around in circles…firstly, re-read my second comment regarding the grey area when it comes to requirements for API connected, automated trade strategy platform and trade signal providers needing to register with the CFTC as a CTA.

Secondly the SageMaster platform is fully restricted in the U.S. and as such it cannot be accessed from any U.S, state or territory, not even with a VPN.

There is no law against a U.S. citizen subscribing to fintech education. If a U.S. citizen is resident in another country they are outside the purview of the restricted accessibility from within the U.S. states and territories.

Since be’s inception the Islam brothers have acted with full integrity and generosity toward their be clients and affiliates. They have invested heavily in product research & development and continue to do so.

They are providing state of the art, ground breaking products whose value far outweighs the subscription price to consumers.

I’m not sure how many ways I can say this. Not only is Sagemaster available in the US, Miguel Vees and Shona Duffy tried to sell it to me, insisted doing so was legal, and assured me that the language of the T&S would be updated “soon”.

As of December, 2024, there were ~3000 visits per month to Sagemaster.io from the US, with an average visit duration of several minutes, suggesting successful engagement with the product.

@Olaf

Multiple regulatory fraud warnings, verifiable securities and commodities fraud. Unjustifiable my ass.

If you’re running an MLM company offering returns through forex trading (automated or otherwise), you absolutely need to register with the CFTC (NFA).

There is no exemption for setting up a forex scheme via API in either the Securities and Exchange Act or the Commodities Act.

There are also multiple disclosure violations of both Acts taking place with SageMaster.

There is no ambiguity. Be Club is committing securities and commodities fraud.

The moment you see an MLM company exclude the US for what is a legal activity you know fraud is occuring. It’s well-known in scam circles that the US will come after you if you get too big committing securities and commodities fraud.

Other jurisdictions will too (see Be Club securities fraud warnings) but they’re unlikely to prosecute unless you’re local. The underlying securities and commodities laws are the same as the US.

Stop making excuses for fraud.

If you want to continue insisting Be Club isn’t committing fraud, please provide evidence it has registered with financial regulators jurisdictions it is operating in. Anything else from you will be marked as spam.

Quite the opposite. If you are running legitimately there is no reason to cut off a potential large swathe of customers just to avoid regulatory requirements.

When my kids hide something it’s not because they didn’t do something,it’s because they know they did something

@Robert

People from the U.S. only spending an average of a few minutes on the SageMaster site … (Ozedit: snip, see below)

Olaf:

Also Olaf:

One cannot have a constructing conversation with scammers who keep moving the goalposts (i.e. making it up as they go along).

Be Club’s regulatory registration and filed audited financial reports remain 404.

@Oz

As you are the one making the allegations and accusations of fraud (Ozedit: snip, see below)

From the article:

My guy, welcome to the spam-bin.