How are Payza continuing to provide payment processor services?

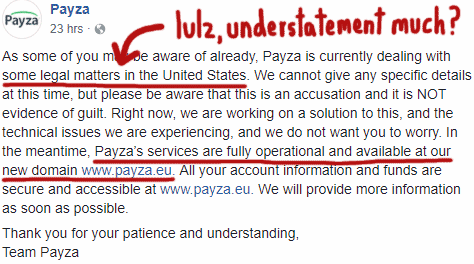

Within 24 hours of the Department of Justice and Homeland Security seizing Payza’s .com domain, the payment processor reemerged on a .eu domain.

Within 24 hours of the Department of Justice and Homeland Security seizing Payza’s .com domain, the payment processor reemerged on a .eu domain.

The “payza.eu” domain was registered back in 2012. Payza only activated in response to the domain seizure however on March 21st.

Payza’s parent shell company PH Millars is listed as the owner of the domain. The domain itself is registered through the US registrar GoDaddy.

Whereas Payza’s clients, many of whom the DOJ and HSI allege are criminals and peddlers of child pornography, were unable to access their wallet balances, after the .eu switch they were again able to transfer funds.

Considering Payza co-founder Firoz Patel is an indicted fugitive facing a $250 million money laundering case, this seemed a strange development.

Today we dig a little deeper and examine how, despite US authorities’ efforts, Payza and Patel are still servicing their clients.

The footer of the new Payza EU website states

Griffin Management is a Licensee of MH Pillars Ltd., operating as payza.eu

No information about Griffin Management is provided.

The corporate address provided on the Payza EU office belongs to Finchley House, a virtual office services provider in London, UK.

From this we learn Griffin Management is pretty much a shell company set up in haste to circumvent US regulation.

With US authorities bearing down on Firoz Patel (his co-founder brother Ferhan was also indicted and has since been arrested), the big question is how is Payza providing payment processing services?

According to Payza EU’s User Agreement, payment processing services are provided through their ‘financial software provider, Synapse‘.

According to their website, Synapse Financial

enable(s) companies to provide the best in class finance products to their customers for a fraction of the cost of traditional banks.

Advertised services on the Synapse Financial website include “process(ing) payments between bank accounts” and the “open(ing of) FDIC insured bank accounts”.

Featured “bank partners” on the Synapse Financial website include Evolve, Triumph and I-Bank. All three banks appear to be US owned and operated.

Synapse Financial itself is a US company, operated out of California by founder and CEO, Sankaet Pathak.

I wasn’t able to find any definitive links between Pathak and Payza or Firoz Patel… which just raises even more questions.

How is it an indicted fugitive wanted by US authorities is

- able to create a shell company operating out of a virtual address in the UK within 24 hours of losing control of his company’s website domain

- use said shell company to register a new domain and enter into a partnership with a US financial services provider

- potentially use the services of the financial provider to create bank accounts across three US bank and

- continue to provide payment processor services like he’s not facing imminent arrest and $250 million dollar money laundering criminal charges?

Just to be perfectly clear, this is what the DOJ and HSI allege Payza and Firoz Patel have been up to since 2005;

- providing money transmission services to Ponzi and pyramid schemes and criminals engaged in the distribution of child pornography and controlled substances

- attempts to conceal fraudulent conduct by creating customer lists that intentionally excluded Payza clients known be engaged in criminal activities

- attempts to conceal fraudulent conduct by creating customer lists that intentionally excluded Payza clients who were operating in jurisdictions Payza was not licensed to operate in

- transferring known criminal clients from AlertPay to Payza and from Payza to EgoPay

- intentionally hiding Payza’s corporate connection to EgoPay

- approving a co-conspirator’s request to transfer $1.5 million dollars in stolen funds from “Ponzi scheme 1’s” Payza account to an EgoPay account

And apparently this is now still going on, with Payza’s cryptocurrency exchange also mixed in… and nobody at Synapse Financial, Evolve, Triump or I-Bank has raised an eyebrow?

No worries chaps. I’m sure this’ll play out swell…

Update 24th March 2018 – Within 24 hours of this article going live any mention of Synapse Financial has been removed from the Payza EU website.

The Payza EU User Agreement now references “Mazarine Commerce Inc.”

This User Agreement (“Agreement”) is a contract between you and Mazarine Commerce Inc., dba Payza, dba payza.eu, a wholly owned subsidiary of MH Pillars Ltd.

Mazarine Commerce Inc. appears to be a Canadian company. Whether it is a financial service provider is not known.

If not, how and through what jurisdiction Payza are currently providing financial services to their clients is unclear.

Oh, it’s pretty obvious what’s next:

DOJ files an amended injunction and seize the EU domain, AND freeze any assets and order all theses companies to return any “deposit” received.

If it’s a financial processor, they probably have gotten a ‘reserve’ deposit from Payza.

I can’t find the Payza/Patel case on Pacer 🙁

Interesting question would be if Payza did not enter itself into the Crypto space and work toward being a Crypto exchange would the US have still shut it down so rapidly?

Very curious to see the US Government acting on Crypto programs much quicker than on any fiat scams you have reported in the past Oz.

but, but, but, Synapse Financial, Evolve, Triump and I-Bank just signed up with ‘griffin management’ and they had no idea it was a newly created licensee of the indicted payza! plus, their internet spazzed so they aren’t aware of anything at all!

so, how brilliant is feroz patel to use a USA based financial service provider and USA based banks to continue his scammy business??

does he have lawyers? does he know his brother is in a US jail?

i have contacted synapse financial [now called synapse FI], who’s founder and CEO sankaet pathak seems to be a youngish guy with a degree in computer engineering.

just made him aware of what he’s getting himself into! maybe, hopefully, his neurons will jump start or something.

The indictment was filed under seal in November 2016 and includes documented transactions which occurred as far back as 2011, so the shutdown could hardly be described as being done “quickly”.

pathak just replied saying:

now what firoz patel?

payza.eu/legal

Yes. Remember Liberty Reserve of Costa Rica? Same thing. That’s before cryptocurrency went mainstream.

hmm, i’ve requested sankaet pathak to comment here and clarify his relation to payza.

if pathak is clean he should clarify when he contracted with payza and when he ended it.

well, it seems synapse FI has indeed terminated it’s contract with payza as the ‘legal’ page on payza.eu now reads:

no mention of synapse FI^^^

Crescent Payments PVT Ltd is registered in mumbai, india since 2010 and lists firoz patel as one of it’s directors.

so, firoz patel got the boot from synapse FI and activated an old company of his as a payment processor ?

crescent payments seems to be a shell company and doesn’t appear to even have a website. does it really have any payment processing capabilities?

I doubt Crescent Payments itself is providing payment processing.

My guess is they’ll have likely applied to one and this time aren’t going to reveal who, lest they too give Firoz Patel’s never-ending parade of dodgy shell companies the boot too.

PS. I’m still getting the Synapse Financial agreement on the Payza website.

i guess the legal page reads different for different countries.

in india they work through crescent payments.

synapse must be doing the processing at the backend, though pathak claims he has terminated the contract with payza.

so, i contacted pathak again about why synapse is still mentioned on payza.eu as their payment processor and here’s his reply:

so i guess firoz patel will have to hook up with some other payment processor now, and who knows how long that relationship will last.

end.of.days.

Just seen Ferhan Patel also operating paymentrails.com and until yesterday he was still founder there also….

Don’t think Firoz cares his brother or anyone of his staff might be or end up in jail!

Crescent has another Patel on the board? Hmm.

Lemme see what researching rocasrajanco [AT] gmail.com + the Patel surname brings up… a bunch of companies. Not that useful.

The other co-founder of Payment Rails appears to be Tim Nixon, who was Payza’s Director of Operations from 2010 through 2015, putting him squarely in line with the same matters that the Patels are being charged with.

Paymentrails.com? What’s their slogan, “the leading lights of the payment processing industry”?

Now they are Mazarine Commerce Inc…

Payza is a wholly owned subsidiary of UK-based MH Pillars Ltd. and operated by Mazarine Commerce Inc. in Canada.

Yep, seeing the Mazarine Commerce message here too now.

Updated the article to reflect the change.

these are the incorporation details of mazarine:

their license expires next month, though they seem to be licensed to transfer money.

but are they a payment processor themselves or using some third party service?

mazarine has been in trouble and was ordered by the canadian courts to return money they held for banners brokers:

spergelcorporate.ca/wp-content/resources/activefiles/Order%20of%20Justice%20Newbould%20-%2001%2014%2015.pdf

how long will payza last in canada via mazarine? how long before canada acts?

Lol, the great thing about Payza unraveling is that every shell company Patel digs up can be traced to assisting fraudulent businesses.

Not sure how continuing to let Payza clients clean out their wallets will play out legally, but it certainly seems like Patel is just digging himself into a deeper and deeper hole.

Ferhan Patel has been ordered transferred to D.C. to face charges. Firoz not a care in the world…

payza has now formally announced it’s running away from the US and dumping it’s US clients:

so, what happens to US client funds held by payza?

I was going to ask the same question myself. Had my ass kicked by Sunday chores so I’m a bit behind 🙁

The indictment makes mention of confiscating amounts seized and held from as far back as 2014, but makes no mention of currently held funds

Mazzarine is also Patels outfit, since AlerPay . at one point they even called Alertpay a product of Mazarine Commerce.

Are Payza Clients cleaning out their wallets?? I put in a withdrawl request on Mar 22 to withdraw my Cash Balance to MyEtherWallet was supposed to be completed on the 24th March Still waiting!!!

More likely That The Patels are taking the clients money and trying to hide it.

Some clients seem able to put withdrawals through. Not sure what the criteria is though.

sounds like they only take money and dont payout… people can request withdrawals but get a big fat ZERO.