EminiFX Receiver authorized to sell 3680 BTC

The EminiFX Receiver has secured court-approval to sell off 3680 BTC.

The EminiFX Receiver has secured court-approval to sell off 3680 BTC.

The vast majority of the bitcoin (3658 BTC), was recovered from CoinPayments in November.

The Receiver filed an application top sell off the bitcoin on December 9th.

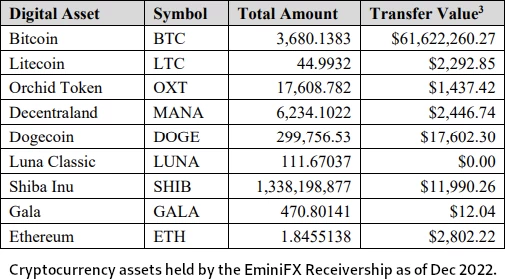

Since October, the estate has received over 3,680 Bitcoin (BTC) valued at over $60 million, as well as additional digital assets valued at around $50,000.

The Receiver believes it is in the best interest of the estate to sell the estate’s cryptocurrency in a managed process.

The proposed “managed process” would see the Receive rsell of 500 BTC every fortnight. This would take place over four months, with the aim of

minimiz(ing) the market impact on selling these assets, reduc(ing) the impact of the price volatility of Bitcoin on the estate, and lessen(ing) the potential downside risk of holding cryptocurrency for an extended period of time.

As part of the approval process, EminiFX investors were given the opportunity to provide feedback.

Between December 9th and December 21st, the EminiFX Receivership received “over a thousand emails from 930 unique email addresses”.

The majority of emails (744) were a form template or variation thereof. The form was provided to investors through a Telegram group run by EminiFX’s top net-winners.

As you’d expect, the form template was the usual refusal to acknowledge EminiFX was a Ponzi scheme and complaints about the Receivership.

The scammers running the EminiFX Telegram group have a vested interest in thwarting EminiFX regulatory proceedings. Unfortunately they continue to feed investors misinformation.

Other feedback from investors bemoaned bitcoin tanking from ~$40,000 to ~$17,000 as of December 2022.

Bitcoin price is down. Not a good time to sell.,We will loose millions. [sic]

One common proposal put forth was not selling the bitcoin, with the aim of eventually making distribution payments in bitcoin itself.

I would like to request to the Receiver and the Federal Government to allow investors or those who chooses to, to receive their investments back as bitcoin digital currency as it once was when It was received by Eminifx.

On December 22nd, the CFTC filed a reply in support of the Receiver’s application.

Tthe Commission’s investigation determined that EminiFX customers and potential customers were told, prior to the customers’ making deposits, that they would receive guaranteed returns of at least 5% “every single week” on their contributions.

Therefore, customers contributed funds to EminiFX after representations that they were making a safe investment and that their money would not be at risk.

The Commission did not uncover evidence that customers were told that their money would be held in volatile digital assets that could potentially lose much or all of their value.

Because customers contributed to EminiFX after being told that their money would be safe, the Commission supports placing estate assets into a safe investment vehicle until they can be distributed.

The CFTC also addressed common complaints and misconceptions raised by EminiFX investors.

Comments from customers asking the Receiver to retain the estate’s digital assets, though they represent the majority of the comments received by the Receiver, represent only a small fraction of the 62,000 EminiFX customers.

And in any event, those comments suggesting that the Receiver hold the digital assets and then “sell high” ask the impossible—the Receiver cannot possibly know whether the estate’s digital assets will appreciate or depreciate in the future.

The Commission also wishes to respond to criticisms and apparent misconceptions in the customer Form Letter and other customer comments.

First, the Form Letter accuses the Receiver of losing “over $50 million dollars of our crypto currency value” through his “decisions and indecision” about investments.

Respectfully, this is not accurate. It was Defendants (EminiFX), not the Receiver, who chose to accumulate bitcoin in the winter and spring of 2022 when bitcoin was at its all-time highs above $40,000, and to place that bitcoin in a foreign digital asset exchange from which it could not be quickly withdrawn by the Receiver.

By the time the Receiver was appointed on May 12, 2022, bitcoin had already fallen below $29,000—a drop of more than 38% from its all-time high.

The Receiver worked diligently to gain access to the digital assets, and ultimately succeeded on November 20, 2022.

The Receiver is not responsible for the decline in bitcoin prices before he was appointed or while he diligently sought to obtain access to the digital assets.

Second, the Form Letter and other comments imply that the Receiver is responsible for Mr. Alexandre no longer having the power to control and trade EminiFX funds.

Again, this is a misconception. It was the Commission that moved for a statutory restraining order appointing the Receiver and requiring him to “[a]ssume full control of [EminiFX] by removing Defendant Eddy Alexandre,” which the Court granted.

Thereafter, the Defendants, including Mr. Alexandre, agreed to a preliminary injunction that, among other things, prohibited Mr. Alexandre from operating any pooled investment vehicle like EminiFX or entering into trades of commodity interests.

Thus, Mr. Alexandre was removed from his position of control of EminiFX not by the Receiver’s whim, but by the Court’s orders, which were entered at the Commission’s request and (in the case of the preliminary injunction) with Mr. Alexandre’s agreement.

The Receiver filed a response to investor concerns on December 22nd, noting “at this point, the losses due to the decline in the price of Bitcoin are a sunk cost.”

In an order issued on January 4th, the court granted the EminiFX Receiver’s application.

The Court agrees with the CFTC and the Receiver that because cryptocurrencies are highly volatile and because the holdings of the Estate will eventually need to be converted to currency to be distributed to investors, the most prudent approach is to divest from Bitcoin and other cryptocurrencies.

While the Court is sympathetic to the concerns of EminiFx investors that their investments have, on net, lost value as the price of Bitcoin has fallen, this loss highlights the riskiness of Bitcoin as an investment vehicle and demonstrates the need to move these highly volatile digital assets into dollar-denominated, low-risk assets.

Neither the Court, the Receiver, nor the investors can know what the future will bring for the value of Bitcoin or the other cryptocurrencies from now until the Estate is distributed to the investors.

Thus, the Receiver’s motion to approve the proposed digital asset management protocol is GRANTED.

As reviewed here on BehindMLM in March 2022, EminiFX was a forex themed Ponzi scheme.

In parallel criminal proceedings, EminiFX founder Eddie Alexandre remains scheduled to face trial on March 27th, 2023.