Zeus Funding Review: Tag Markets investment fraud

Zeus Funding, aka Zeus 12X, doesn’t appear to have a website. Instead, the MLM opportunity is run through a shady Telegram group named “@zeusinstant”.

Zeus Funding, aka Zeus 12X, doesn’t appear to have a website. Instead, the MLM opportunity is run through a shady Telegram group named “@zeusinstant”.

Neither Zeus Funding’s official marketing material or its Telegram group discloses who’s behind the company.

On a September 15th Zeus Funding marketing webinar hosted by Jason Regan from Success in Living. Zeus Funding is represented by Michael Eder:

Elsewhere Eder cites himself as a co-founder and Managing Partner of Zeus Funding and something called Zyra:

As per his Instagram profile, Eder is based out of Austria:

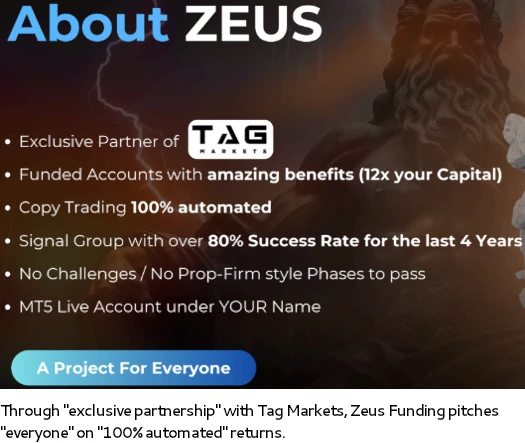

Zeus Funding claims to be a partner of Tag Markets:

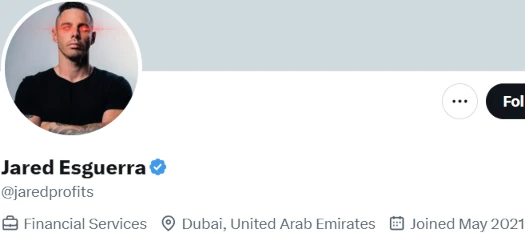

To that end, in the previously Zeus Funding webinar, Tag Markets is represented by Jared Esguerra:

Esguerra is cited as Tag Markets’ owner. On social media, Esguerra represents he works in “financial services” and is based out of Dubai;

Zeus Funding marketing material cites Kevin Marin Valez as co-founder and CEO of Tag Markets:

On social media, Valez claims to be a “digital creator” and “business administrator” based out of Colombia:

Last week BehindMLM reported on Crowd1 Ponzi victims being funneled into Tag Markets investment fraud. In the comments of that article, a BehindMLM reader claimed serial fraudster Niklas Freihofer (aka Nik Freihofer) was behind Tag Markets.

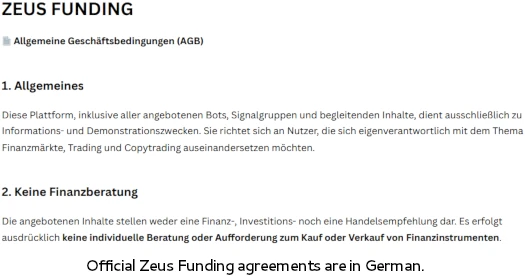

Freihofer is purportedly from Germany. This might tie into Zeus Funding’s German language focus.

Update 24th October 2025 – Niklas Freihofer (as Nik) has begun appearing on marketing webinars as owner of Tag Markets:

/end update

Another name we can attach to Tag Markets is Leonhard Wolman, author of Tag Markets’ “macro briefing” documents.

Based on Eder being based out of Austria, it follows Zeus Funding is operated from Austria.

As per the “Kevin Marin” marketing slide above, Tag Markets is represented to be operating from Columbia [sic] and Dubai.

Due to the proliferation of scams and failure to enforce securities fraud regulation, BehindMLM ranks Dubai as the MLM crime capital of the world.

BehindMLM’s guidelines for Dubai are:

- If someone lives in Dubai and approaches you about an MLM opportunity, they’re trying to scam you.

- If an MLM company is based out of or represents it has ties to Dubai, it’s a scam.

If you want to know specifically how this applies to Zeus Funding, read on for a full review.

Zeus Funding’s Products

Zeus Funding has no retailable products or services.

Promoters are only able to market Zeus Funding promoter membership itself.

Zeus Funding’s Compensation Plan

Zeus Funding promoters invest USD equivalents in cryptocurrency.

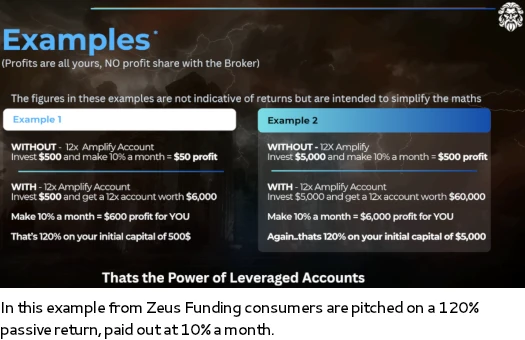

Zeus Funding markets various investment plans, each pitching passive returns:

- Zeus 12X Amplify – invest $200 or more and receive a 10x funded account capped at $1.2 million, on which “passive profits” are paid

- Strategy Dynamix – invest $250 or more and receive a $3000 funded account on which “profits from rising and falling markets” are paid

- Akropolis – invest $200 or more and receive a $2400 funded account on which “copy trading” returns are paid

Note Zeus Funding charges a 20 to 30% performance fee on ROI payments.

The MLM side of Zeus Funding pays on fees charged to recruited promoters.

Passive Pool 12X

Zeus Funding pays the Passive Pool 12X through a unilevel compensation structure.

A unilevel compensation structure places a promoter at the top of a unilevel team, with every personally recruited promoter placed directly under them (level 1):

If any level 1 promoters recruit new promoters, they are placed on level 2 of the original promoter’s unilevel team.

If any level 2 promoters recruit new promoters, they are placed on level 3 and so on and so forth down a theoretical infinite number of levels.

Zeus Funding caps the Passive Pool 12x at five unilevel team levels.

The Passive Pool 12x, purportedly generated by trading fees, is paid out across these five levels as follows:

- level 1 (personally recruited promoters) – $5

- level 2 – $1

- levels 3 to 5 – $1

Bonus Pool 12X

Zeus Funding claims the Bonus Pool 12X is paid out as “50% of the performance fee” it charges promoters.

The Bonus Pool 12X is paid out using the same unilevel team used to pay the Passive Pool 12X, capped down three levels:

- level 1 – 25%

- level 2 – 15%

- level 3 – 10%

Joining Zeus Funding

Zeus Funding promoter membership is tied to creation of a Tag Markets account.

Full participation in Zeus Funding’s MLM opportunity requires a minimum $100 investment, made through a Tag Markets account.

Zeus Funding and Tag Markets solicit investment in various cryptocurrencies; bitcoin, ethereum, tether and USD coin.

Zeus Funding Conclusion

Zeus Funding is another instance of investment fraud being committed through Tag Markets.

Zeus Funding pitches consumers on passive returns, purportedly generated via various trading investment schemes:

In offering automated passive returns to consumers, Zeus Funding and Tag Markets are required to register with financial regulators in jurisdictions they solicit investment in. Specifically, securities and commodities regulators.

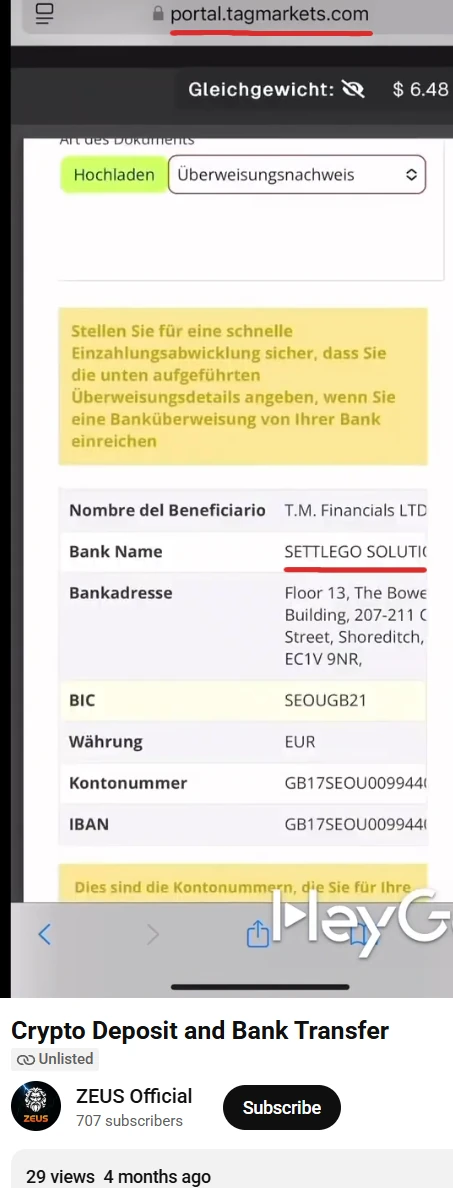

Zeus Funding fails to provide evidence it has registered with financial regulators in any jurisdiction. Tag Markets is owned by parent company T.M. Financials Ltd, a company incorporated in Mauritius.

This corresponds with two purported financial licenses, which outside of Mauritius itself are meaningless.

Tag Markets’ website also cites “Tag Markets Ltd”, a purported Saint Lucia shell company.

Tag Market only having ties to shell companies in two dodgy jurisdictions is an immediate reg flag. To that end Tag Markets has already attracted the attention of financial regulators.

Dutch authorities issued a T.M. Financials Ltd fraud warning in July 2025:

While Tag Markets solicits USD equivalent investment in cryptocurrency, the company also accepts bank transfers for euros and other currencies.

This takes place through a SettleGo Solutions bank account, registered in T.M. Financials’ name:

SettleGo Solutions is a UK financial services company dba OpenPayd. SettleGo Solutions represents it holds financial licenses in the UK, Malta and Canada.

Note that while SettleGo Solutions represents it is “authorised and regulated by the Financial Conduct Authority” (the UK’s top financial regulator), the company states on its website:

Information related to digital assets is directed only at persons outside the United Kingdom and must not be acted upon by persons in the United Kingdom.

Whether SettleGo Solutions is aware Zeus Funding and Tag Markets are using it to commit investment fraud from Dubai is unclear.

For their part, Tag Markets appears well aware it is committing fraud. A few hours after BehindMLM published its “Crowd1 victims being funneled into Tag Markets fraud” article, T.M. Financials reached out via email;

To whom it may concern,

We would appreciate some urgent information about the last article about Crowd1.

BTW the warning from the Dutch regulator was removed after we contacted them.

We look forward to hearing from you.

Best,

Tag Markets

To which I promptly replied;

Sure, what “urgent information” would that be?

The Dutch fraud warning was taken from the AMF’s FaceBook page, it is still published.

BTW BehindMLM has some urgent questions for you;

1. Does Niklas Freihofer own and/or run T.M. Financials and/or Tag Markets?

2. If Freihofer doesn’t own and/or run T.M. Financials and/or Tag Markets, who does?

3. Why is T.M. Financials and Tag Markets facilitating fraud by partnering up with multiple fraudulent MLM investment schemes? (Crowd1, CashFX. DagCoin etc.)

4. Why is T.M. Financials committing commodities fraud by failing to register with regulators in jurisdictions it accepts deposits from outside of Mauritius?

Thanks,

-Oz

That was now a week ago. I guess the information T.M. Financials wanted wasn’t so urgent.

As it stands, the only verifiable source of revenue entering Tag Markets for use in Zeus Funding’s unregistered investment scheme is new investment.

Using new investment to pay ROI withdrawals would make Zeus Funding a Ponzi scheme.

As with all MLM Ponzi schemes, once promoter recruitment dries up so too will new investment.

This will starve Zeus Funding of ROI revenue, eventually prompting a collapse. Whether this would trigger a Tag Markets collapse, or whether they intend to manage scams collapsing individually is unclear.

What is clear when a Ponzi scheme inevitably collapses, the majority of participants lose money.

Review updated to note Niklas Freihofer has begun appearing on marketing webinars as owner of Tag Markets.

Walk around Dubai, everybody know he scam. He will pull rug and throw C1 under bus. Stratify also one.

Raj push this on us, we cannot take money out. Bangkok conference they push very hard so the dada, make many promise but no keep