UniLive Review: Livestreaming ruse OpenSee token Ponzi

UniLive fails to provide ownership or executive information on either of its websites.

UniLive fails to provide ownership or executive information on either of its websites.

UniLive operates from two known website domains:

- unilive.io (marketing website) – privately registered on August 11th, 2024

- h.lulin.top (affiliate login/signup) – registered in September 2023, private registration last updated on November 11th, 2024

Instead of being honest about its founders and management, in its marketing material UniLive presents fictional executives represented by cartoons:

Over on social media UniLive ditches the cartoons…

…but we’re still only left with CEOs “Steve” and “Hunter” represented by photos of unknown origin.

A UniLive rented office marketing video doing the rounds looks like someone hired out an AirBNB and put up temporary UniLive signage.

UniLive’s marketing represents the company is based out of Singapore:

Chinese also features on UniLive’s websites:

And UniLive’s website domain uses Alibaba name-servers.

Putting all of this together, we can likely ascertain UniLive is being run by:

- Singaporean admins;

- Chinese admins operating out of Singapore; or

- Singaporean and Chinese admins working together out of Singapore.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money.

UniLive’s Products

UniLive has no retailable products or services.

Affiliates are only able to market UniLive affiliate membership itself.

UniLive’s Compensation Plan

UniLive affiliates invest 100 to 10,000 tether (USDT) into “units”. These units purportedly correspond with OpenSee token (SEE) mining.

A simpler way to look at it is UniLive affiliates invest USDT on the promise of a daily return, paid in SEE tokens:

- invest 100 to 4999 USDT and receive a 1x daily ROI multiplier

- invest 5000 to 9999 USDT and receive a 1.15x daily ROI multiplier

- invest 10,000 USDT (or more) and receive a 1.3x daily ROI multiplier

Note:

- UniLive sets the daily SEE token base ROI amount each day

- ROI is capped at 300% of invested USDT, which includes MLM commissions

- once the 300% ROI cap is reached new investment is required to continue earning

- UniLive charges a 5% to 8% withdrawal fee

The MLM side of UniLive pays on recruitment of affiliate investors.

Referral Commissions

UniLive pays a 10% commission on 35% of the daily SEE token returns paid to personally recruited affiliates.

Spark Reward

UniLive pays a 10% commission on new investment volume generated by an affiliate’s recruitment efforts, divided by 35% of the total company-wide new investment volume for that day.

Residual Commissions

UniLive tracks residual commissions via a unilevel compensation structure.

A unilevel compensation structure places an affiliate at the top of a unilevel team, with every personally recruited affiliate placed directly under them (level 1):

If any level 1 affiliates recruit new affiliates, they are placed on level 2 of the original affiliate’s unilevel team.

If any level 2 affiliates recruit new affiliates, they are placed on level 3 and so on and so forth down a theoretical infinite number of levels.

Each unilevel team leg corresponds to a personally recruited UniLive affiliate.

Residual commissions are calculated as the total amount of new investment across the unilevel team, excluding the strongest unilevel team leg.

That is to say the unilevel team leg with the most investment isn’t counted.

Residual commissions are thus paid as whatever the sum total of daily new investment in the lesser unilevel team legs is, multiplied by 35% of 80% of whatever UniLive has set the daily SEE token ROI rate for that day at.

Joining UniLive

UniLive affiliate membership is free.

Full participation in the attached income opportunity requires a minimum 100 USDT investment.

Note the more a UniLive affiliate invests, the higher their income potential.

UniLive Conclusion

UniLive is a simple MLM crypto Ponzi hidden behind a livestreaming platform ruse.

Although it doesn’t have a functioning website, UniLive is presented as the livestream platform front-end:

UniLive as a streaming platform has nothing to do with its MLM opportunity and can be ignored.

This leaves with UniLive’s OpenSee “SEE” token investment scheme, which is all anyone is signing up with UniLive for.

OpenSee is presented with the usual “ChatGPT, write me a generic jargon-riddled spiel for blockchain” crypto bro script:

OpenSee is a comprehensive computing service engine tailored for the web3 ecosystem, emphasizing cutting-edge, technology-driven solutions to deliver efficient and open computing capabilities.

By harnessing the power of advanced proof of power (POP) consensus and intelligent computing.

The platform is purpose-built to accelerate business growth within the web3 space.

OpenSee introduces a transformative experience, driven by data-centric operations, agile development cycles, and robust support for intelligent processes, heralding a new era in smart business and innovation.

On the backend of UniLive we have affiliate investors investing tether into its SEE token scheme.

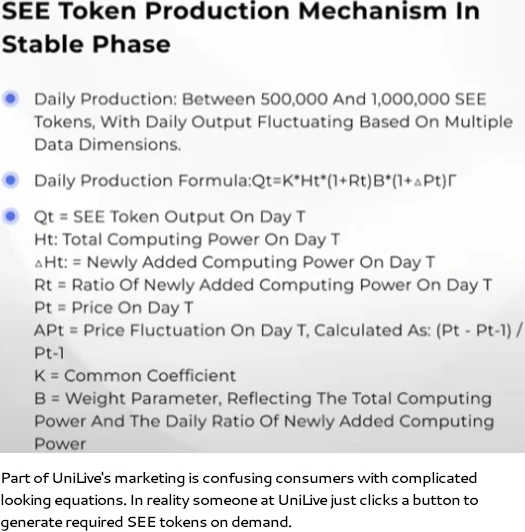

UniLive owns and generates SEE on demand out of thin air.

The investment scheme is effectively a staking model, wherein USDT is staked for SEE tokens but investors don’t get their USDT back at the end of the staking term.

Staking is capped at 300% of the invested USDT value, which includes MLM commissions (a pyramid scheme in its own right).

UniLive is pitched as the revenue generator but, with no audited financial reports filed with regulators, is not a confirmed source of revenue.

This leaves new investment as the only source of verifiable revenue entering UniLive. Recycling invested USDT to allow UniLive affiliates to cash out SEE tokens would be a Ponzi scheme.

As to who’s getting scammed; as at February 2025 SimilarWeb was tracking 100% of UniLive’s website traffic from Ukraine.

As with all MLM Ponzi schemes, once affiliate recruitment dries up so too will new investment.

This will starve UniLive of ROI revenue, eventually prompting a collapse.

The math behind Ponzi schemes guarantees that when UniLive collapses, the majority of participants lose money.

Being a shit token Ponzi, UniLive’s collapse will translate into the majority of investors bagholding yet another worthless Ponzi token.