TMX Global Review: Money laundering pyramid scheme

TMX Global fails to provide ownership or executive information on its website.

TMX Global fails to provide ownership or executive information on its website.

TMX Global’s website domain (“tmxglobal.io”), was privately registered on July 14th, 2025.

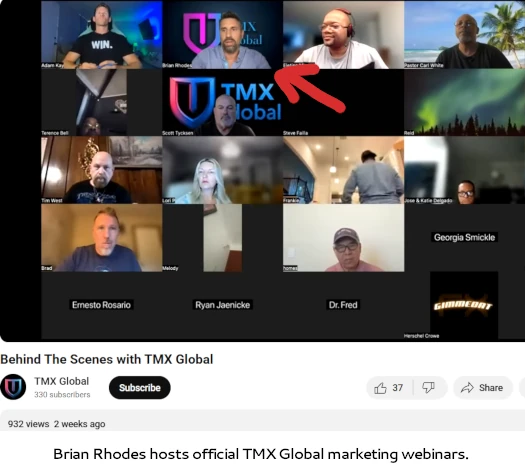

One name we can attach to TMX Global is Brian Rhodes:

As above, Rhodes hosts official TMX Global corporate webinars.

Brian Rhodes is a US national and serial promoter of MLM crypto Ponzi schemes. Originally from the Missouri, Rhodes has since relocated to the Dominican Republic.

BehindMLM first came across Rhodes in 2022 as a promoter of Biman Das’ FastBNB Ponzi scheme.

After FastBNB collapsed we ran into Rhodes again with Easymatic and QunoMine. Other collapsed MLM Ponzi schemes Rhodes has promoted include CoinMarketBull, Vortic United and InvesableAI.

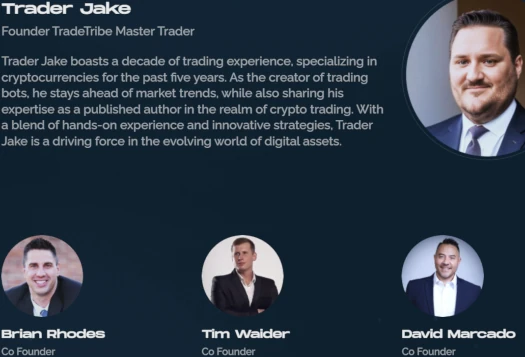

BehindMLM last came across Rhodes in August 2024, as co-founder of the TradeTribe Ponzi scheme.

TradeTribe was a reboot of the collapsed Capitalium Ponzi scheme.

While TradeTribe’s website is still up, the site has an expired security certificate. This is indicative of TradeTribe’s website having been abandoned due to collapse.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money.

TMX Global’s Products

TMX Global has no retailable products or services.

Promoters are only able to access TMX Global promoter membership itself.

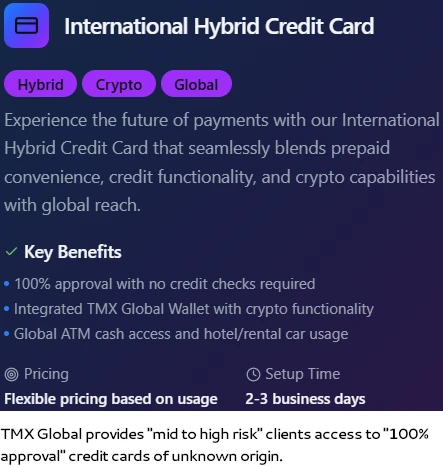

TMX Global promoter membership provides access to various money laundering debit cards:

- TMX Signature Package – 250 USDT, $25,000 daily limit

- TMX Gold Package – 500 USDT, $50,000 daily limit

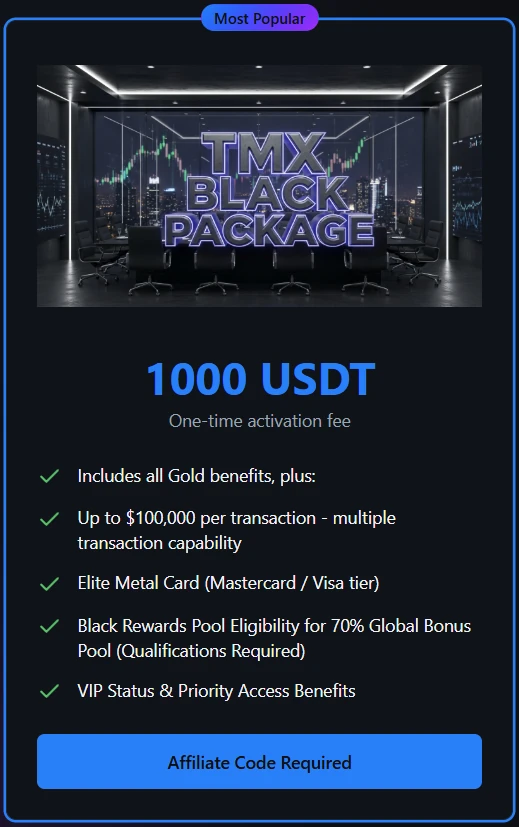

- TMX Black Package – 1000 USDT, $100,000 daily limit

TMX Global’s Compensation Plan

TMX Global’s compensation plan pays on recruitment of promoters who purchase its money laundering cards.

TMX Global pays referral commissions down three levels of recruitment (unilevel):

- level 1 (personally recruited promoters) – 30%

- level 2 – 10%

- level 3 – 5%

Joining TMX Global

TMX Global promoter membership is free.

Full participation in the attached income opportunity requires a 250 to 1000 USDT purchase of a money laundering card.

TMX Global Conclusion

While scams sometimes offer access to debit cards as a marketing feature, TMX Global has made it the whole opportunity.

The usual set up is an inconspicuously named shell company registered in a dodgy jurisdiction.

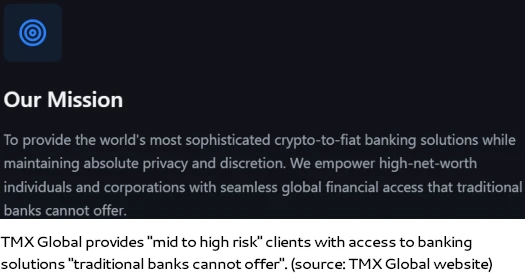

The shell company is then hooked up to a dodgy processing merchant, providing access to banking services.

The setup usually doesn’t last long. As fraud triggers are set up, banks take action. This requires new shell companies and/or processing merchants.

It’s a cat and mouse game the banks always win. To that end TMX Global doesn’t disclose its shell company/companies, or the partnered dodgy merchant.

I did note TMX Global has a boiler-plate “AML Policy” on its website. Such to the extent any personal details are handed over, this opens up an identity theft threat vector.

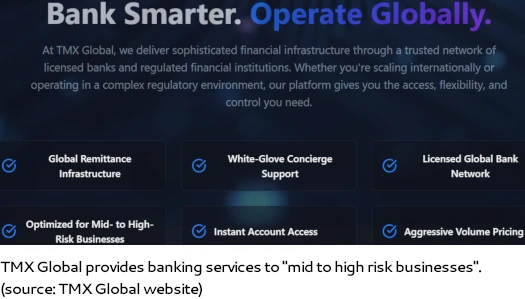

Although TMX Global doesn’t outright market its debit cards to money laundering clients, who they’re targeting makes it obvious.

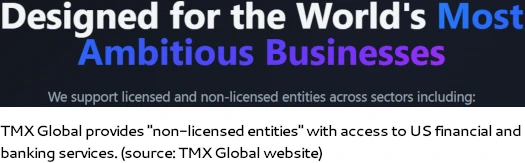

TMX Global offers premium multi-currency banking, white-glove service, and real-time financial infrastructure for high-growth, high-risk businesses.

“High-risk businesses” are typically associated with fraud. This why they’ve been deemed “high-risk” by respectable banking channels to begin with.

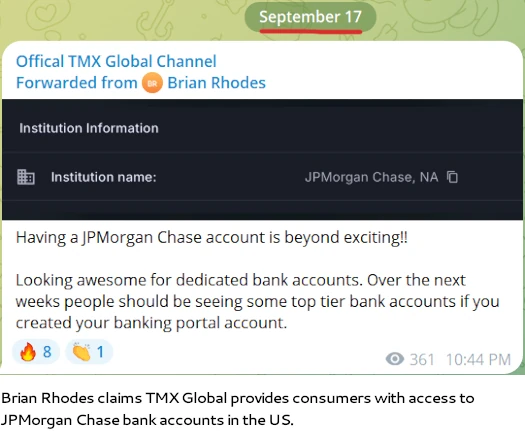

Yet here we have TMX Global pitching access to US bank accounts for their “high-risk” clients:

As far as TMX Global’s MLM operations go, it’s a pyramid scheme.

TMX Global’s customers are its promoters, with nothing marketed or sold to retail customers.

The FTC has made it clear that MLM companies with little to no retail sale revenue are pyramid schemes. Other countries have similar laws prohibiting pyramid schemes.

As with all MLM pyramid schemes, once promoter recruitment dries up so too will commissions.

TMX Global does offer some monthly subscription services but its money laundering cards are one-time fee access.

Math guarantees that at any given time, the majority of participants in an MLM pyramid scheme will not have recouped their initial spend.

This same math also guarantees that when an MLM pyramid scheme inevitably collapses, the majority of participants lose money.

Additional risk-factors include abrupt shutting of debit card services and fraudulent obtained bank accounts. Any money attached to these services and accounts will likely be frozen in the event of an internal investigation.

Financial laws typically require said investigations to be disclosed to authorities, further raising the threat risk level to consumers involved in TMX Global.

Hat tip to Danny de Hek for the heads up on this one: dehek.com/general/scam-fraud-investigations/tmx-global-exposed-pay-to-play-crypto-card-mlm-led-by-adam-key-brian-rhodes/

TMX and TRADETRIBE Same. Just changed the name.