Titan Capital Markets Review: Boris CEO trading bot Ponzi

Titan Capital Markets fails to provide ownership or executive information on its website.

Titan Capital Markets fails to provide ownership or executive information on its website.

Titan Capital Market’s website domain (“titancapitalmarkets.com”), was privately registered on March 31st, 2022.

An official marketing presentation names “Howard Yan” as CEO of Titan Capital Markets.

Yan doesn’t exist outside of Titan Capital Markets’ marketing. That said, some effort has gone into creating a bogus digital profile.

The domain “yanfxeducation.com” was registered on June 8th, 2022.

The website presents a photo of Yan with fictional backstory and forex trading filler fluff.

In one Titan Capital Markets promo video we’re introduced to “Klaus Huber”.

Huber is an actor who, back in 2016, portrayed a pedophile in an awareness campaign for a Malaysian charity.

The campaign was put together by Naga DDB Tribal, a Malaysian marketing company.

I want to clarify that work is work and I’m not insinuating anything from the actor’s role. The takeaway is that “Klaus Huber” is being played by a Malaysian actor and doesn’t actually exist.

Neither does Howard Yan but, other than him possibly being from Taiwan, was unable to find anything further.

Some of Titan Capital Markets’ videos are strange, like this Fulham Football club sponsorship promo.

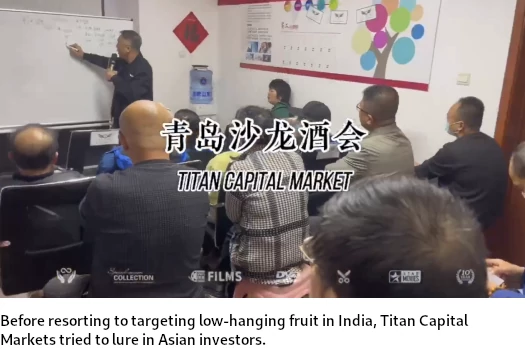

Early Titan Capital Markets videos suggest initial promotion in south-east Asia. Since then recruitment anywhere outside of India appears to have collapsed.

Today SimilarWeb tracks 100% of Titan Capital Markets’ website traffic as originating from India.

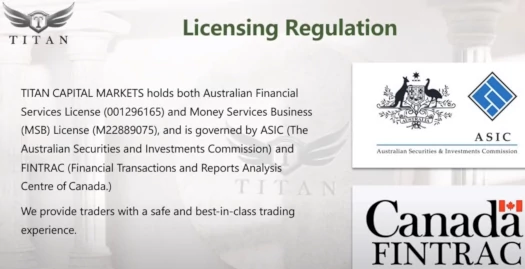

In an attempt to appear legitimate, Titan Capital Markets presents itself as an Australian shell company:

From the above research, we conclude that whoever is running Titan Capital Markets is likely based out south-east Asia.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money.

Titan Capital Markets’ Products

Titan Capital Markets has no retailable products or services.

Affiliates are only able to market Titan Capital Markets affiliate membership itself.

Titan Capital Markets affiliate membership provides access to “financial courses”.

Titan Capital Markets’ Compensation Plan

Titan Capital Markets affiliates pay a fee. How much is paid in fees determines how much is able to be invested in Titan Capital Markets’ passive investment opportunity:

- Basic Level – $30 fee allows you to invest $10 to $45

- Standard Level – $100 fee allows you to invest $10 to $200

- Advanced Level – $300 fee allows you to invest $10 to $900 (bonus 0.15% a day)

- Pro Level – $1000 fee allows you to invest $10 to $5000 (bonus 0.2% a day)

Returns for the Basic Level aren’t provided, but Standard and higher tier affiliates invest in a “Wise Wings” plan.

The Wise Wings Plan pays a 7% to 8.8% ROI over 15 days.

Note that Titan Capital Markets charges a 5% withdrawal fee.

The MLM side of Titan Capital Markets pays on recruitment of affiliate investors.

Titan Capital Markets Affiliate Ranks

There are five affiliate ranks within Titan Capital Markets’ compensation plan.

Along with their respective qualification criteria, they are as follows:

- JNR Partner – earn $500

- SNR Partner – earn $3000

- Executive Partner – earn $10,000

- JNR Executive Partner – earn $30,000

- SNR Executive Partner – earn $100,000

Recruitment Commissions

Titan Capital Markets affiliates earn a commission per affiliate they recruit.

Recruitment commission rates are determined by how much an affiliate themselves spent on membership:

- Basic tier affiliates earn a 10% recruitment commission rate

- Standard and higher tier affiliates earn a 15% recruitment commission rate

Residual Commissions

Titan Capital Markets pays residual commissions via a binary compensation structure.

A binary compensation structure places an affiliate at the top of a binary team, split into two sides (left and right):

The first level of the binary team houses two positions. The second level of the binary team is generated by splitting these first two positions into another two positions each (4 positions).

Subsequent levels of the binary team are generated as required, with each new level housing twice as many positions as the previous level.

Positions in the binary team are filled via direct and indirect recruitment of affiliates. Note there is no limit to how deep a binary team can grow.

At the end of each day Titan Capital Markets tallies up new fee volume on both sides of the binary team.

Affiliates are paid 12% of fee volume generated on their weaker binary team side.

Once paid out on, fee volume is matched against the stronger binary team side and flushed.

Any leftover volume on the stronger binary team side carries over.

Residual Commissions Match

Titan Capital Markets pays a residual commission match down three levels of recruitment (unilevel):

- level 1 (personally recruited affiliates) – 10%

- level 2 (must recruit three affiliates to qualify) – 5%

- level 3 (must recruit five affiliates to qualify) – 5%

Note that the Residual Commissions Match is daily capped at how much an affiliate has spent in fees.

Titan Partner Rewards

Titan Partner Rewards are a bonus percentage paid on fees paid by personally recruited affiliates.

- JNR Partners earn a 2% bonus

- SNR Partners earn a 4% bonus

- Executive Partners earn a 6% bonus

- JNR Executive Partners earn an 8% bonus

- SNR Executive Partners earn a 10% bonus

ROI Match

Titan Capital Markets pays a match on returns earned by downline affiliates.

The ROI Match is paid using the same unilevel team the Residual Commissions Match is paid with (see above), this time capped at eight levels:

- Basic Level tier affiliates earn a 5% ROI match on levels 1 to 3

- Standard Level tier affiliates earn a 5% match on levels 1 to 5

- Advanced and Pro Level tier affiliates earn a 5% match on levels 1 to 8

Super Leadership Dividends

Titan Capital Markets matches 20% of returns paid out company wide. This match is placed into Super Leadership Dividend pools.

- Hermes (must have one SNR Executive in your downline) – qualify a 5% Super Leadership Dividends Pool

- Athena (must have two SNR Executives in your downline) – qualify for a 10% Super Leadership Dividends Pool

- Poseidon (must have three SNR Executives in your downline) – qualify for a 15% Super Leadership Dividends Pool

- Zeus (must have four SNR Executives in your downline) – qualify for the full 20% Super Leadership Dividends Pool

Note that recruited SNR Executives must be in separate unilevel team legs.

Joining Titan Capital Markets

Titan Capital Markets affiliate membership costs between $30 and $1000:

- Basic Level – $30

- Standard Level – $100

- Advanced Level – $300

- Pro Level – $1000

The more a Titan Capital Markets affiliate spends on fees the higher their income potential.

Titan Capital Markets Conclusion

Titan Capital Markets represents it generates external ROI revenue via a “3-way arbitrage system”. This is the typical trading bot Ponzi ruse.

Titan Capital Markets fails to provide evidence it generates external ROI revenue, via a trading bot or any other means.

Being a passive investment opportunity, Titan Capital Markets is required to register with financial regulators and provide audited financial reports.

The only financial regulator Titan Capital Markets appears to have registered with is the Australian Securities and Investments Commission (ASIC).

Given Titan Capital Markets appears to be operated from south-east Asia, and 100% of its website traffic originates from India, ASIC registration is meaningless.

Notwithstanding ASIC’s atrocious history when it comes to regulating MLM related securities fraud.

As it stands, the only verifiable source of revenue entering Titan Capital Markets is new investment. Using new investment to pay returns makes Titan Capital Markets a Ponzi scheme.

This is in line with Titan Capital Markets using actors to play fictional executives.

Furthermore with nothing marketed or sold to retail customers, Titan Capital Markets’ MLM opportunity is a pyramid scheme.

As with all MLM Ponzi schemes, once affiliate recruitment dries up so too will new investment.

This will starve Titan Capital Markets of ROI revenue, eventually prompting a collapse.

Math guarantees the majority of participants in Ponzi schemes lose money.

Martin Calladine did an expose on Titan in Oct 2022 on Twitter. It appears Mr. Yan’s website was just a hackjob copied from another FX “guru” “Dato Jimmy Wong of JF Lennon Institute of Financial Science” from Singapore.

Quite a bit of verbiage was copied verbatim, with only the theme and title changed to something else.

NOLINKs://twitter.com/uglygame/status/1581023051927683073

And the Titan site appears to be geoblocked from the MAJOR English-speaking part of the world (US, UK, Australia, etc.) at least as if October 2022.

Bit weird to put out English marketing videos if you’re going to geo-block the English speaking world.

Why don’t they just be honest about targeting third-world countries then.

Good morning,

I think one I took this platform seriously but after checking there are some doubts.

What do you say about the Wikifx rating and also the multiple seminars that the ceo of titan participates for more credibility I think you have to approach the promoters.

THANKS

I think none of that has anything to do with actual due-diligence into Titan Capital Markets.

Read the review. THANKS

Don’t invest in this company… Company suddenly terminated my team members account without any notice..

Please be safe and protect your money..