Sixth Society: $200,000 membership securities fraud

![]() Sixth Society fails to provide ownership or executive information on its website.

Sixth Society fails to provide ownership or executive information on its website.

Sixth Society’s website domain (“sixthsociety.com”), was first registered in 2016. The private registration was last updated on March 4th, 2024.

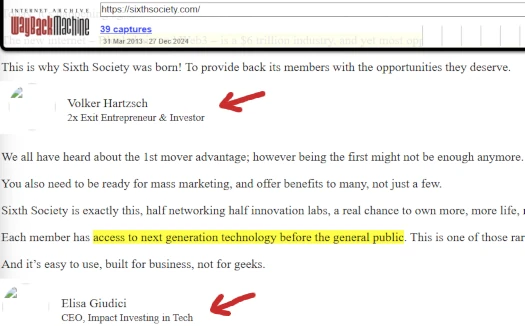

Through the Wayback Machine we can see Sixth Society’s earlier website design revealed two names of interest; Volker Hartzsch and Elisa Giudici:

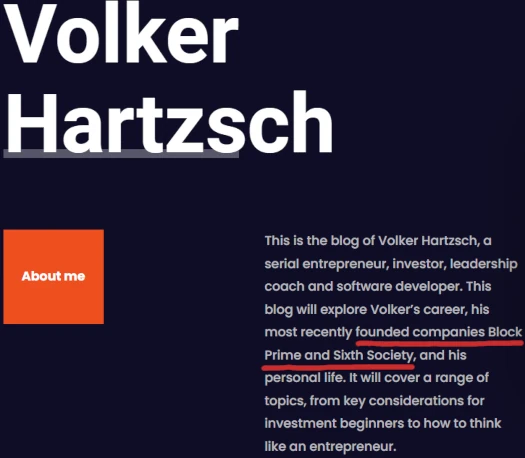

On his personal website Volker Hartzsch cites himself as a founder of Sixth Society:

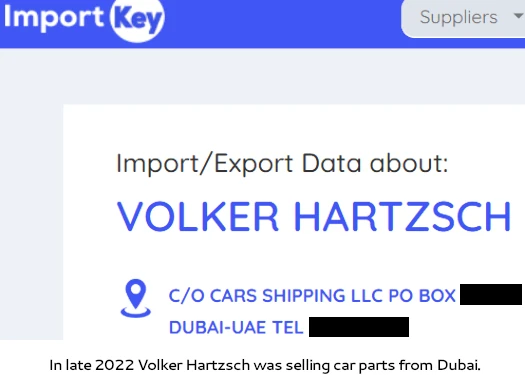

Before he reinvented himself as a crypto bro, Hartzsch was selling car parts from Dubai:

According to Hartzsch’s Twitter profile he’s still based out of the UAE:

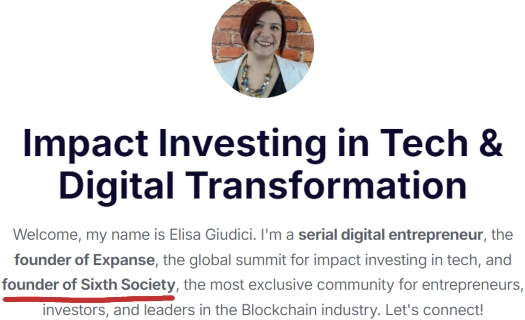

On her personal website Elisa Giudici, a purported UK resident, cites herself as “founder of Sixth Society”:

Why this information is not disclosed on Sixth Society’s website is unclear.

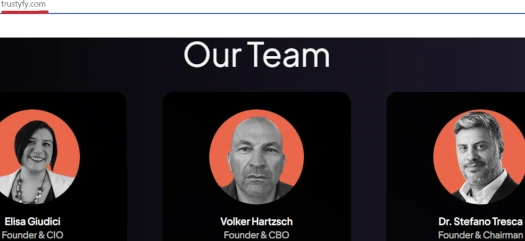

While they each appear to have their own crypto bro projects under their respective belts, Hartzsch and Giudici are also co-founders of Trustyfy:

Trustyfy appears to operate as a middleman between crypto wallet owners and “external partners … [who] can empower you with more traditional services, such as debit cards”.

As per its website Sixth Society represents it is run through Block Prime LTD;

This website and app are owned and operated by Sixth Society, a business of Block Prime Ltd, with headquarters in London, United Kingdom, company number 14031792.

Block Prime LTD was a UK company run by Hartzsch, Giudici and Stefano Tresca.

As per the screenshot above, Tresca is a co-founder of Trustyfy. He also appears to be a Sixth Society co-founder.

Block Prime LTD was voluntarily dissolved on December 17th, 2024. The footer of Sixth Society’s website now ties the company to “Sixth Society OU” and “Sixth Society US Inc.”

Sixth Society OU is an Estonian shell company under the control of Hartzsch, Giudici and Blas Daniel Pedreno Esteban.

Esteban is a resident of Spain and is listed as “Head of Backend Dev” on Trusyfy’s website.

Esteban is a resident of Spain and is listed as “Head of Backend Dev” on Trusyfy’s website.

Esteban’s name being tied to Sixth Society’s Estonian shell company suggests he’s also a co-founder but I wasn’t able to verify.

Sixth Society US Inc. is a Delaware shell company. Owing to lax registration requirements and regulation, Delaware is a favorite US jurisdiction for scammers to register shell companies in.

Pertaining to Volker Hartzsch being based out of Dubai;

Due to the proliferation of scams and failure to enforce securities fraud regulation, BehindMLM ranks Dubai as the MLM crime capital of the world.

BehindMLM’s guidelines for Dubai are:

- If someone lives in Dubai and approaches you about an MLM opportunity, they’re trying to scam you.

- If an MLM company is based out of or represents it has ties to Dubai, it’s a scam.

If you want to know specifically how this applies to Sixth Society, read on for a full review.

Sixth Society’s Products

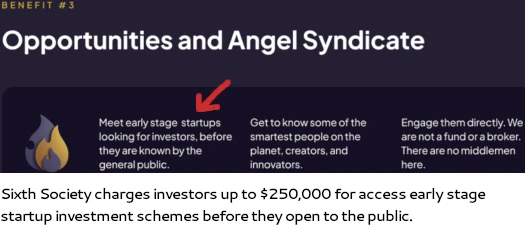

Sixth Society has no retailable products or services.

Affiliates are only able to market Sixth Society affiliate membership itself.

Sixth Society’s Compensation Plan

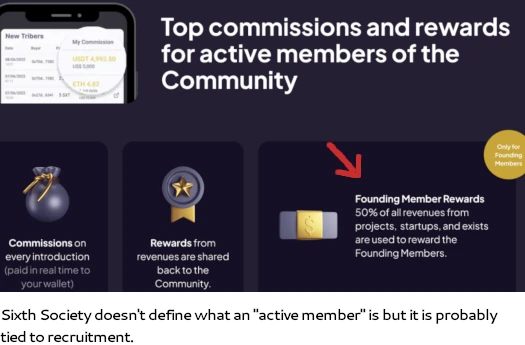

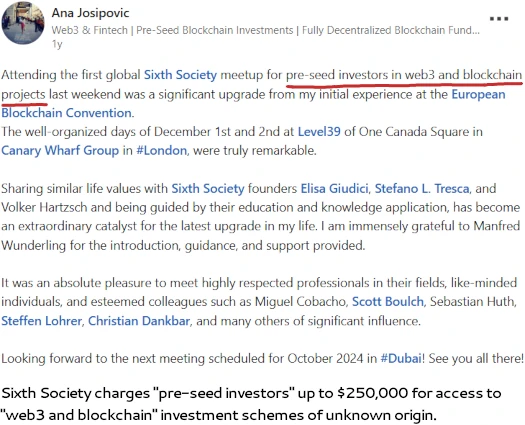

Sixth Society sells $200,000 “founder” or $2500 annual memberships.

The MLM side of the business pays on recruitment of affiliate investors and ties into company-wide investment.

Recruitment Commissions

Sixth Society pays a 10% commission on recruitment of founder or annual membership affiliates.

Downline Rewards

Sixth Society takes 10% of company-wide membership fees and “share[s them] back to the community”.

Specific details are not provided.

Founder Member Passive Returns

Sixth Society claims it takes

50% of all revenues from projects, startups, and exists [sic] are used to reward the Founding Members.

Specific details and any additional qualifying criteria is not provided.

Joining Sixth Society

Sixth Society affiliate membership is $200,000 for a founder position or $2500 annually.

Sixth Society Conclusion

As Trustyfy operates as a middleman between crypto wallet holders and “partners” who provide financial services, Sixth Society operates as a middleman between its members and investment schemes.

The pitch of returns through these undisclosed investment schemes is two-tier; again through claimed external partners but also internally to founding members.

Sixth Society’s pitch of passive returns and access to third-party returns constitutes a securities offering. Commodities law might also apply depending if there’s a trading aspect to any of the offered investment schemes.

On its website Sixth Society fails to provide evidence it has registered with financial regulators in any jurisdiction. This constitutes securities fraud, with commodities fraud also being a possibility.

What we can also verify is pyramid fraud. Sixth Society doesn’t market or sell any products or services to retail customers. All commissions are tied to affiliate recruitment.

Also worth noting is, in claiming BlockPrime is a parent company, “partners” of BlockPrime may be knowing or unknowing accomplices to money laundering.

That’s of course assuming BlockPrime itself isn’t running the claimed “external partners” side of the business.

In committing verifiable securities fraud, there’s also the possibility that the “founding members” investment scheme is running as a Ponzi scheme.

Audited financial reports filed with regulators is the only way for consumers to verify Sixth Society is doing what it claims to be. Due to the aforementioned securities fraud however, these filings are not available.

Certainly if any Sixth Society membership funds are being used to pay founding members passive returns, that would constitute a Ponzi scheme.

As with all MLM Ponzi schemes, once affiliate recruitment dries up so too will new investment.

This will starve Sixth Society of ROI revenue, eventually prompting a collapse.

The math behind Ponzi schemes guarantees that when they collapse, the majority of participants lose money.

There is an event organised by “a few of the founding members of Sixth Society” in Melbourne, Australia on Feb 8, being promoted heavily by someone going by the name of Nardea Febina.

eventbrite.com.au/e/melbourne-event-your-gateway-to-invest-in-pre-seed-level-start-ups-tickets-1127200831029

I contacted the venue a few days ago, but no response back.

Nardea is also using the name Nadia.

Reported the Melbourne event to ticket seller Eventbrite also.

What a brainless article. Sixth Society is an angel syndication. You pay a $2500/yr membership fee for education and vetted deals that you can voluntarily invest in or not.

There are no passive returns for founding members, but they do pay commissions for referring other investors to the membership. I have been involved since 2023 and have loved the experience.

Calling Volker, Stefano, and Elisa “Crypto bros” is an insult to their experience and the author of this article should be ashamed.

2023 huh? Bet the people you’ve stolen from haven’t loved their experience.

I get it, you got in early, stole a bunch of money. It’s over now though so you’ve rocked up here for damage control.

You can call a fraudulent investment scheme an “angel syndication” or whatever else you want, it’s still just a fraudulent investment scheme. Feel free to provide evidence Sixth Society is registered with financial regulators in any jurisdiction.

Re. passive returns, yeah there aren’t any now because Ponzi go boom. Plenty of examples of passive returns marketing from Sixth Society included in the review.

Ignoring presented evidence is pretty brainless but hey.

Crypto bros gonna crypto bro. Ponzi scammers works too I guess. I’ll probably go with that if there’s Sixth Society regulatory filings and/or indictments.

Still going strong, Oz. No idea where you’re getting your information from but Sixth Society and Trustyfy are growing every day.

Every person I’ve intro’d has renewed after their first year. Have a great life!

SimilarWeb: 32 monthly Sixth Society website visits across October 2025, up from 0 the prior two months.

No that’s not a typo. Sorry for your loss.