Silverstar Live Review: Forex trading bot securities fraud

My first inkling that something was up with Silverstar Live was their citing of “Quicksilver” as Chief Operating Officer.

My first inkling that something was up with Silverstar Live was their citing of “Quicksilver” as Chief Operating Officer.

Quicksilver… really?

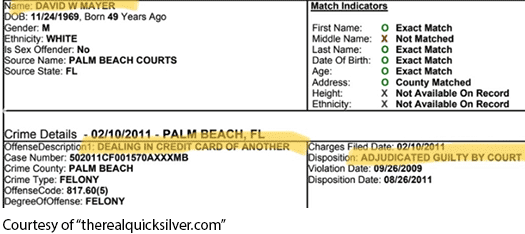

Turns out someone else has a bit of an axe to grind with “Quicksilver”, going so far as to out him as David Wayne Myer.

There’s a “The Real Quicksilver” website set up that goes into more detail. I’m not going to link it because it gets into murky territory by posting Myer’s address information and family connections.

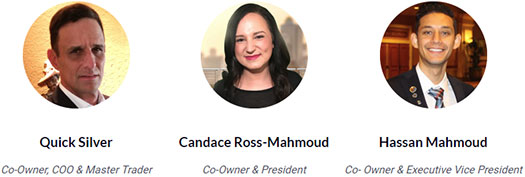

On Silverstar Builder, another website that appears to be tied to Silverstar Live, Myer is identified as a co-owner and Master Trader of the company.

The two other co-owners of Silverstar Live are identified as Candace Ross-Mahmoud (President) and Hassan Mahmoud (Executive Vice President).

In their respective Silverstar Live corporate bios, Myer is credited as

a career expert trader with 18 years experience.

For 16 consecutive years he has tripled his private trading account in the futures and Nadex market.

Candace Ross has been a top tier Marketing Strategist & Consultant in the network and affiliate marketing space for the last 6 years.

She is a self-taught internet marketer who has created multiple 7 figure sales systems and is frequently sought out to assist in the growth of corporate businesses.

Hassan Mahmoud is an international Omnipreneur & Keynote Speaker who is highly sought out by the millennial community to work with and to work on passion projects all over the world.

He has done over 250 million in sales over the past 4 years while helping multiple business owners grow their names and brands.

So uh, David Myer has supposedly generated a 300% annual ROI through trading for the past sixteen consecutive years huh?

You’d think there’d be some recognition of this outside of Silverstar Live but nope, nothing outside of Silverstar Live’s own marketing material.

So some guy nobody has ever heard of is one of the greatest and most consistent traders on the planet. Riiiiiiiiiight.

Prior to launching Silverstar Live, Candace Ross and Hassan Mahmoud were promoting Enagic.

A corporate address in Florida is provided on the Silverstar Live website. The address however appears to belong to a warehouse storage facility.

Read on for a full review of the Silverstar Live MLM opportunity.

Silverstar Live Products

Silverstar Live markets a forex autotrading bot.

We have software which specializes in automated Forex trading.

Our software does the work for you so that you can spend your time doing whatever you want.

Our software relies on algorithms with a proven track record of realizing gains based on performance to date.

Silverstar Live’s website fails to disclose any specifics of their auto trading bot, including retail pricing.

Silverstar Live’s compensation plan reveals access to the auto trading bot costs $199 and then $145 a month.

The Silverstar Live Compensation Plan

SilverStar Live’s compensation plan revolves around retail customers and affiliates paying $199 and then $145 a month to access the auto trading forex bot.

Silverstar Live Affiliate Ranks

There are twelve affiliate ranks within the Silverstar Live compensation plan.

Along with their respective qualification criteria, they are as follows:

- Icon150 – generate 435 GV a month and enroll/recruit and maintain three fee-paying retail customers and/or affiliates

- Icon600 – generate 1740 GV a month and generate and maintain a downline of twelve fee-paying retail customers and/or affiliates split 4/4/4

- Icon1500 – generate 5075 GV a month and generate and maintain a downline of thirty-five fee-paying retail customers and/or affiliates split 10/10/15

- Icon3000 – generate 13,050 GV a month and generate and maintain a downline of ninety fee-paying retail customers and/or affiliates split 30/30/30 (three of the retail customers and/or affiliates must have three retail customers and/or affiliates under them)

- Icon5000 – generate 36,250 GV a month, recruit and generate and maintain a downline of at least two Icon600 affiliates and generate and maintain a downline of two hundred and fifty fee-paying retail customers and/or affiliates split 100/100/50

- Icon10 – generate 72,500 GV a month, recruit and maintain at least two Icon1500 affiliates and generate and maintain a downline of five hundred fee-paying retail customers and/or affiliates split 200/200/100

- Mogul25 – generate 181,250 GV a month, recruit and maintain at least two Icon3000 affiliates and generate and maintain a downline of one thousand two hundred and fifty fee-paying retail customers and/or affiliates split 500/500/250

- Mogul50 – generate 362,500 GV a month, recruit and maintain at least two Icon5000 affiliates and generate and maintain a downline of two thousand five hundred fee-paying retail customers and/or affiliates split 1000/1000/500

- Mogul100 – generate 725,000 GV a month, recruit and maintain at least two Icon10 affiliates and generate and maintain a downline of five thousand fee-paying retail customers and/or affiliates split 2000/2000/1000

- Gold Star – generate 2,175,000 GV a month, recruit and maintain at least two Mogul25 affiliates and generate and maintain a downline of fifteen thousand fee-paying retail customers and/or affiliates split 6000/6000/3000

- Silver Star – generate 4,350,000 GV a month, recruit and maintain at least two Mogul50 affiliates and generate and maintain a downline of thirty thousand fee-paying retail customers and/or affiliates split 12,000/12,000/6000

- Legend – generate 8,700,000 GV a month, recruit and maintain at least two Mogul100 affiliates and generate and maintain a downline of sixty thousand fee-paying retail customers and/or affiliates split 24,000/24,000/12,000

GV stands for “Group Volume” and is sales volume generated via monthly fee payments to access Silverstar Live’s forex trading bot.

One $199/$145 a month subscription generates 145 GV a month.

Note that for rank qualification, 55% of monthly downline GV must come from retail customers.

If GV generated in a recruitment leg is less than 55%, GV is still counted from that leg but capped using a 55%/45% ratio applied to whatever retail volume is generated in that leg.

With respect to the downline split, the figures provided are the maximum amounts counted from any three recruitment legs.

A recruitment leg is a downline built under a personally recruited affiliate. It contains retail customers and recruited affiliates, down a theoretically infinite number of levels.

E.g. for Icon3000, an affiliate can either qualify via 30 fee-paying retail customers/affiliates across three recruitment legs, or lesser amounts over a greater number of recruitment legs.

Retail Commissions

For each $199 fee paid by a new retail customer or recruited affiliate, a $40 one-time commission is paid out.

Residual Commissions

Silverstar Live pays residual commissions via a 3×9 matrix.

A 3×9 matrix places a Silverstar Live affiliate at the top of a matrix, with three positions directly under them:

These three positions form the first level of the matrix. The second level of the matrix is generated by splitting each of these first three positions into another three positions each (9 positions).

Levels three to nine of the matrix are generated in the same manner, with each new level housing three times as many positions as the previous level.

Positions in the matrix are filled via enrollment of retail customers, some of which will go on to become Silverstar Live affiliates.

Silverstar Live pays a residual $3 commission per matrix position filled.

How many matrix levels a Silverstar Live affiliate can earn on is determined by how many personally enrolled retail customers and/or affiliates they have.

- enroll and/or recruit at least three retail customers and/or affiliates and earn on level 1 of the matrix

- enroll and/or recruit at least four retail customers and/or affiliates and earn on levels 1 and 2 of the matrix

- enroll and/or recruit at least five retail customers and/or affiliates and earn on levels 1 to 3 of the matrix

- enroll and/or recruit at least six retail customers and/or affiliates and earn on levels 1 to 4 of the matrix

- enroll and/or recruit at least seven retail customers and/or affiliates and earn on levels 1 to 5 of the matrix

- enroll and/or recruit at least eight retail customers and/or affiliates and earn on levels 1 to 6 of the matrix

- enroll and/or recruit at least nine retail customers and/or affiliates and earn on levels 1 to 7 of the matrix

- enroll and/or recruit at least ten retail customers and/or affiliates and earn on levels 1 to 8 of the matrix

- enroll and/or recruit at least eleven retail customers and/or affiliates and earn on levels 1 to 9 of the matrix

Generational Bonus

Silverstar Live pays a Generational Bonus via a unilevel compensation structure.

A unilevel compensation structure places an affiliate at the top of a unilevel team, with every personally recruited affiliate placed directly under them (level 1):

If any level 1 affiliates recruit new affiliates, they are placed on level 2 of the original affiliate’s unilevel team.

If any level 2 affiliates recruit new affiliates, they are placed on level 3 and so on and so forth down a theoretical infinite number of levels.

The Generational Bonus allows Gold Star and higher ranked Silverstar Live affiliates to earn on generated volume, starting from the tenth level of their unilevel team.

- Gold Star affiliates receive 2% of generated volume from the tenth level of their unilevel team, capped when another Gold Star or higher ranked affiliate is found in each unilevel team leg

- Silver Star affiliates receive 2% of generated volume from the eleventh level of their unilevel team, capped when another Silver Star or higher ranked affiliate is found in each unilevel team leg

- Legend affiliates receive 2% of generated volume from the twelfth level of their unilevel team, capped when another Legend affiliate is found in each unilevel team leg

Note that if no equal or higher ranked affiliate exists in a unilevel leg, the Generational Bonus pays out on all levels of that unilevel leg.

The Generational Bonus is calculated on each unilevel leg.

How many unilevel team levels the Generational Bonus is paid out on one unilevel team leg has no bearing on Generational Bonus payouts on other legs.

Weekly Guaranteed Commissions

Silverstar Live pays weekly guaranteed commissions based on rank:

- Icon150 = $37.50 a week

- Icon600 = $150 a week

- Icon1500 = $375 a week

- Icon3000 = $750 a week

- Icon5000 = $1250 a week

- Icon10 = $2500 a week

- Mogul25 = $6250 a week

- Mogul50 = $12,500 a week

- Mogul100 = $25,000 a week

- Gold Star = $62,500 a week

- Silver Star = $125,000 a week

- Legend = $250,000 a week

Joining Silverstar Live

SilverStar Live affiliates have to sign up as retail customers first. This costs $199 and then $145 a month.

After enrolling three retail customers of their own, a Silverstar Live retail customer can pay an annual fee to become an affiliate.

Silverstar Live affiliate fee costs are not disclosed on the company’s website.

I did try to ascertain the Silverstar Live affiliate fee amount independently but was unsuccessful.

Conclusion

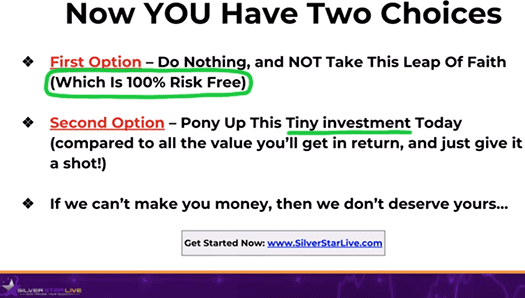

On the surface the MLM side of Silverstar Live looks legitimate.

Get retail customers before paying the affiliate fee, 55% total retail GV and yeah, provided the product isn’t total garbage you’ve laid the foundation for a solid retail-focused MLM opportunity.

The problem with Silverstar Live however is everything else.

Let’s start with Quicksilver.

One reason David Myer might not want to use his actual name are the multiple felonies he’s reportedly committed.

Of Myer’s convictions (some of which cite him as “David Wayne Mayer”), the one that caught my attention was a 2009 credit card violation.

Myer was charged in February 2011 and convicted in August the same year.

Now why would someone who’s purportedly been generating an annual 300% ROI for the past sixteen years commit credit card fraud?

And there are plenty of other seemingly bullshit marketing claims surrounding Myer…

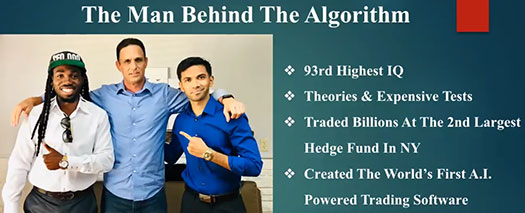

93rd highest IQ? Traded billions at the second largest hedge fund in New York? Created the world’s first AI powered software?!?

Then why, outside of his felony convictions, has nobody ever heard of David Myer?

And this is the guy that is supposedly behind Silverstar Live’s automated trading forex bot?

QS worked for the second largest hedge fund in New York and was responsible for trading accounts of hundreds of millions in the futures market over the course of 6 years.

He has applied his genius to create algorithms that mimic live trading and can be safely run almost completely hands free.

Hopefully it’s obvious by now that Myer coming up with Silverstar Live’s trading bot is extremely questionable.

But let’s leave that and instead focus on the legalities.

Quite clearly, Silverstar Live is marketing passive returns through their forex trading bot.

Ones [sic] your SLS software is activated it trades for you.

The above is taken directly from the Silverstar Live website. And if you’re still not satisfied, there are plenty more examples to draw from;

The offering of an automated (passive) return by an MLM company, regardless of the platform used, is a securities offering.

To operate legally in the US Silverstar Live would therefore need to be registered with the SEC.

At the time of publication neither Silverstar Live, David Wayne Myer or David Wayne Mayer are registered with the SEC.

Hell, I even looked up Quicksilver, no luck with that either.

This means that, forget about anything else, Silverstar Live is operating illegally across the US.

Which is a problem, because as I write this Alexa have the US pegged as the largest source of traffic to the Silverstar Live website (51.9%).

In addition to the automated forex trading bot unregistered securities offering, Silverstar Live is also committing securities fraud by failing to disclose particulars of its trading offering.

It is implied that David Myer came up with the Silverstar Live’s bot.

This isn’t good enough, with full disclosure of who created and runs the bot required to be disclosed by Silverstar Live to potential investors.

Additionally the company also needs to provide explicit historical results.

From my own research I recorded promotion of SilverStar Live dating as far back as August 2018. That’s six months of trading data that should be readily available for anyone on Silverstar Live’s website.

So why isn’t it?

All I’ve seen is grainy screen grabs of trading graphs and supposed trades, which is nowhere near what is required for compliance with US securities law.

As a prospective Silverstar Live retail customer (or affiliate), I wouldn’t be handing over any money unless the company provides historical trade data dating back to at least August 2018.

If you want to be thorough, ask for David Myer’s past eighteen year trade history results. Actual results mind, not some bullshit bar graphs or number printouts dug up from who knows where and showing who knows what.

If you do manage to get something that resembles this, be sure to ask why it isn’t filed with the SEC.

Personally I’m doubtful this information even exists.

First and foremost if Silverstar Live’s bot was all it’s cracked up to be, David Myer would be guarding it as you would any other golden goose.

Does $199 and then $145 a month sound right for a golden goose to you?

Secondly if the bot was even remotely successful, why aren’t the historical results being trumpeted anywhere?

It’s a bot that’s supposed to make money. If it’s doing that then why not let the bot speak for itself.

Why is every Silverstar Live marketing presentation full of trashcan “herp derp do u no wut forex is?” bullshit?

Raising even more questions is the emergence of AI Global Forex in the last few weeks.

AI Global Forex is essentially a 1:1 clone of Silverstar Live. Such to the extent that when you click on the AI Global Forex compensation document link, it’s literally that of Silverstar Live’s.

Then there’s this message buried in the footer of the AI Global Forex website;

AIGlobalForex.com is operated by the Market Hackers Community, a group of independent IBOs of AI Global Markets formerly known as Silver Star Live.

I don’t know exactly what scam nonsense is going on here but as far as I can tell, Silverstar Live and AI Global Forex are one and the same company.

Just to really drive a point home, at approximately three minutes into the above January 20th, 2019 video, David Myer states this about Silverstar Live’s forex bot;

I can tell you firsthand that if you have a $25,000 account, the average return on a $25,000 account is somewhere in the 8% per month range.

On $5000 accounts the average return is about 30% per month.

30% automated monthly returns… from a convicted fraudster… with no verifiable historical result data… on top of multiple securities fraud violations…

…gee gosh golly that sounds swell. Where do I sign up?

Update 5th November 2019 – On November 4th Hassan Mahmoud and Candace Ross-Mahmoud settled Silverstar Live CFTC fraud violations for $75,000 plus post-judgment interest.

Saw Candace Ross-Mahmoud mugshot on FB yesterday.. failure to appear in court for her many DUIs? Bad look for an enagic kangen water saleswoman!

Good thing she had Landon Stewart’s empower network password, she logged in and Photoshopped his $100k+ income proof there to get her and her little boyfriend flown out to LA to look at jeunesse.

Landon probably didn’t know until now. Her new sugar baby Hassan did $250+ Million but couldn’t afford to pay her kids Aaron’s rented furniture?

They’re still calling her references looking for it and her repossessed car? Her ex husband pays for her other car and alimony, no reason her kids furniture wasn’t paid for in full unless??.. 😉

Don’t get me started on cheating on her ex husband w/ Joe Stewart while still married and then cheating again with married 7 figure marketer Chuck Marshall.. she sure loves them rich marketers with money or rich parents like her current hub..

If she’d cheat on her ex husband, Joe and Hassan, I don’t think she’d have a problem cheating people out of their cash.. great review!

I smell heavy BS here aswell but I got hands on a myfxbook real account statement starting in september showing 24.75%/month:

myfxbook.com/members/Tylermackechnie/benjamin-tyler/2808985/SZZeUXKYECfgRftedjPD (delete link if you want)

Im not involved I personally think their bots will crash in their faces sooner than later.

One random trading account over one month doesn’t prove anything.

There should be dozens of accounts with trackable results dating back to at least August 2018.

They said Jesus couldn’t swim, that’s why he walked on water. I could careless about a person’s past as long as the software works.

I encourage anyone reading this to try out Benjamin for yourself. Numbers Certainly Do Not Lie.

So where are the third-party audited numbers dating back to at least August 2018?

Also whether the bot works or not doesn’t change the fact that Silverstar Live is committing securities fraud. So are you by promoting it.

This aiglobalforex.com looks like it’s just a marketing site put out by the “market hackers” team – a team in silver star.

This does sound really fishy, but I can’t deny that my buddy has had really good results with this software. I’ve seen it myself… it will be very interesting to see how this plays out. Thanks for the article.

What’s with the footer message then? AI Global Forex literally claims to be the same company with a different name.

Both Hassan Mahmoud and Candace Ross used to sell kangan water

NOLINKs://www.enagic.com/media/pdfviewer/?f=newsletter_201608.pdf

What’s kangen water? A special “pitcher” that promise to enhance your existing tap water. Guess that makes them qualified to sell nothing.

I just got pitched this from someone using a lead capture page.

Once I told them about the review here I Was blocked.

So if there is no real trading going on are the payouts generated from the monthly subscriptions?

ACTUALLY… He claims in a video to have tripled his account every month for 16 consecutive years.. Triple makes 200% ROI every month (100% is alread your money, 200% is the return)

Or.. Maybe it was every 2 months don’t quote me, But it WAS NOT 300% per year that was claimed… I’d have to check it again.

Can link it if you can’t find it. Actually the video is on the Real QuickSilver website that I wont link. Check it out.. fkin shady guy LOL.

The trading is real, I bought it to check it out as I am a trader.. I do not sell it. But it operates from your own MT4/5 trading platform on your own system on your own broker account.

Trades are recorded by the broker, it’s not an investment Ponzi.. it is still shady in other ways. This is NOT a defence.. LOL

I am not sure that it is a securities fraud because there is no money paid to a common pool with expectation of profit on the work of others. The Ponzi is aside the trading, not a part of the trading.

If they are a securities fraud then the entire MQL5 community would be shut down, but Meta Trader has never been accused of securities fraud.. it’s just software, you download the software, you run the software.

Again my 2 cents.. Not a defence, I don’t sell it, and am not renewing my subscription.

Therefore in addition, it is not possible to have a 3rd party audit since trading takes place on privately operated MT4/5 trading platforms operated by each individual on their own computers or VPS servers connected to each their own individual private broker account at the broker of their choosing.

There are no trading accounts with SSL… So you would mean to say every member should have their private trading accounts audited for the benefit of SSL??

Again not a defence, just setting the record straight, the guy is shady AF for every other reason mentioned here… LOL

Securities fraud extends beyond that. If you’re offering a passive investment opportunity through a bot you need to provide investors with detailed disclosures regarding the bot. This includes info on who made it, how it works and historical trading data (if you’re making marketing claims based on past results, which Silverstar Live are doing).

With respect to a “common pool”, the bot is controlled by Silverstar Live. By attaching the bot to multiple trading accounts one could argue a common pool is formed.

“Running software” isn’t a problem until you attach it to an MLM opportunity. An individual running an auto trading bot isn’t going to run afoul of securities law.

Sure it is. If Dave Myer wants to claim the bot is profitable (30% a month), that claim has to legally be based on past trading results.

This can be one bot run by the company but ideally would be a selection of bots, whose past trading results (dated back to at least August 2018) have been audited by a third-party.

The disclosures are made at a company-level. Then Myer and affiliates would be legally able to reference those results in their marketing.

Individual Silverstar Live affiliates making income claims regarding their own results would need to have them audited or they run the risk of violating the FTC Act (unsubstantiated income claims).

“Look at this screenshot of my mad tradez today on my phone bro!” is not a valid audit of results.

Points received. Still can’t see securities fraud from my point of view. There is no requirement to give away the algorithm when you sell a trade bot.. That is the point of proprietary software.

Perhaps a better description of how it works would be nice, but IMO the description is sufficient to not be a blatant security fraud.

The Bot is connected only to a single account, Your copy and my copy do not execute the same trades, and do not communicate with each other to plan trades (as far as my evidence suggests).

Also, we each enter our own custom settings that we decide on to make them unique to our own risk appetite, making them to some degree unique. (Or most plebs just blindly follow the advice of the fraudster for their settings.. same difference)

Again, if this is a security fraud, then the entire MQL5 community should be shut down because there are tons of bots on there, that are proprietary, poor description of how they work, that are connected to multiple accounts from many users, and are expected to generate income, just are not MLM. I don’t think MLM is a factor in tipping the scale for or against securities fraud in this case.

… Even if Myer is a fraud himself, I mean that’s pretty well documented there.. duh, directly linked to financial fraud ie credit card fraud HAHAHAH!

Good laugh: They claim to have AI.. I LOLed.. I can assure you that they are not operating any kind of self learning neural net. It is algorithmic, not AI. AI is not in the cards for their configuration.

There are blatant lies taking place for sure with no doubts. Securities fraud is off my radar on this one though, just sticking to the evidence. Still a sham regardless IMO.

Either way, security or not, people need to wake up and smell the roses!!

Cheers Mate!

You need to disclose who created the bot, their history and provide real-world examples of the bot trading with result data.

Silverstar Live surfaced on or around Aug 2018, so results going back at least that far.

You can go look up the crypto securities fraud cease and desists that were issued last year to MLM companies. They all failed to provide legally required disclosures to their investors.

But is controlled by Silverstar Live. I.e. if Silverstar Live shut down tomorrow the bot wouldn’t work.

Without legally required disclosures you can’t make any accurate representations about what the bot does or doesn’t do.

Bots aren’t illegal. Attaching them to an MLM opportunity on the promise of unverifiable past results via passive trading is without being registered to offer securities is.

This is a bit odd. Had a message from this guy recently claiming to be the guy who started Silver Star.

pinterest.co.uk/pin/845269423785385724/

outskirtspress.com/fireyourshadows

Looks like there might have been a bust up and Pete’s lost his scheme somewhere along the line.

unicourt.com/case/ca-ora-silverstar-live-software-llc-vs-peter-betiku-913712

The ponzi feeder ‘Bitcoins Wealth Club’ is shilling this scam hard.

Oh boy! Bad news travels at the speed of light these days.

I am always surprised how people fall for this BS. I must admit I fell for a few in the past too.

If these so called geniuses were so smart, they would simply allow a 3-7 day, no credit card required free trial.

I know many people would abuse that option, so allow the free trial only on the last week of the month.

They state they offer a 7 day moneybavk guarantee. Sorry but not falling for that one (again). I’m not giving my money to anyone and trust that these strangers will give it back to me if I’m not satisfied.

Or

Go live on Facebook for one full week and show “live” this system in action. On all the currency pairs.

If it’s as good as they say it is, they would sell million and millions and millions of subscription virtually overnight AND, people would pay waaaaay more than what they’re asking too. Or some rich bigwig would come and buy them out for BILLIONS of dollars.

They don’t because they fully well know this program doesn’t live up to the hype and they just want your 1 or two month subscription money and move on.

The marketing sounds good but don’t be suckered. Something stinks real bad here. One last thing, be careful on all these supposed great reviews online.

To me , it’s nothing but their affiliates pumping out many videos with their own bias, also unproven/unverified results.

If the product works, so cares what the guy has done?

He could be sitting on his prison bunk doing zoom calls from a burner phone he had smuggled inside of a bundt cake. As long as the product does what it’s supposed to do, does the other stuff really matter?

It’s called due-diligence. There’s buckley’s chance some random guy nobody in trading circles has ever heard of came up with a bot that will deliver consistent profits long-term.

You can’t assert Silverstar Live’s bot works or doesn’t, because Silverstar Live haven’t provided the SEC or potential investors with legally required disclosures to back up any of their claims.

Not withstanding securities fraud, but let’s just ignore that shall we.

This is not a scam. It’s a martingale trader that is a ticking time bomb.

It works great until you have get into downdraw that you can’t come back from. I lost all my profits and investment in a matter of 24 hours.

I used both programs. Benji placed trades 10x what I had it set at. The Hamilton settings they are suggesting are going to destroy many accounts. Killed 2 of mine at the same time.

Stay away from these guys!

Depends on your definition of “SCAM”.

It doesn’t do what SSL claims, doesn’t comply with US securities laws the purported owners’ income claims are pure fantasy and SSL doesn’t provide legal disclosures.

What more evidence do you require ?

Hi have just bought this the other week and it is a good bot and does hedge on trade but now seeing all the news on the company owns don’t know what to say but I have a live active account.

Can this BOT be used without the monthly charge.

Just bought into this because my brother-in-law said it was a good deal. Personally I think it is questionable. But if it is usable without the monthly fee it will be fine until it blows up.

Best to remove profits as they are made and try to recover the trade deposit and fees pd.

Nope. If you stop paying Silverstar Live they cut you off.

I deposited $240 in the Hamilton account and got a return of $179 in less than 12 hours. The software works. I have no problems.

And you’re trading money isn’t touched by the company. I referred 3 people and now I don’t have to pay for the software. I’m in all profit now. T

HE shit works is all I care about until it doesn’t. I’m not at a loss.

So by now you’ve presumably made your initial investment back? Why not come back in a few months and share with us your new status as one of the richest people on the planet?

With a >100% ROI in 24 hours, makes you wonder why the owners aren’t running world economies yet.

I’ve been in Silver Star for 6 weeks. I have not even come close to realizing any of the profits that are being marketed.

Current users of this software are BETA testers ….. Silver Star is all about marketing …. making sure the fat cats in the company are paid ….. users lose money while the monthly fees are charged.

This is my experience and I advise ANYONE who is thinking about this to think twice …. learn how to trade for yourself and stay away from this!!!!

Beware of the risks. This is highly speculative. The marketing does NOT reflect this. Marketers of this product are the big winners. I lost over $2,500 on these softwares so just be aware ….. Be prepared to monitor the softwares constantly and even then … if you do NOT know anything about forex ….. you’re gambling your hard earned dollars

I was promised a refund on March 1st and have not received it as I cancelled on the first day I signed up due to bad reviews, this was on Feb 5th.

I thought it had been cancelled. They charged my card 2 weeks later.

I have contacted the company via email every week and they say it’s coming. My bank said they cannot do anything since I authorized it.

Started showing up in my groups.

The banning begins.

My sponsor set me up in the trading software and within 6 weeks lost over $900 on my $1,00) account. No fail safe as they advertise, was told a system glitch upped my .10 trades to .20 and .30.

Sponsor said the trades would turn the right way (NOT) Company never answered emails or phone calls.

Sponsor cut of contact, I started a charge back of the monthly fees, I will take them to small claims on the losses.

They advertise 24/7 customer service and that is a joke, there is no customer service.

Vivian show these fraud claims to your bank, appeal their descision and don’t take no for an answer.

My banks states that after showing them proof of no response to emails, the fraud of the owners, check out Dave Myers credit card fraud, showed them the screen shot of the 24/7 customer service promise they will finalize my chargeback within the next 10 days.

Further comment, if this software is automated everyone should be getting the same trades so if all those with $500 accounts are getting different results WHY.

When I asked my sponsor why many of his clients were winning and making money yet my account was decimated he did not have an answer.

Perhaps they choose who gets winning trades and who doesn’t.

I see two different points here:

1. They did offer a software and you have to paid to use it, as you need to pay to use Adobe or any other software. The way SSL marketed it was no the right one because MLM can be missused but it’s the same as MLM used in Herbalife or the some make-up brands.

2. They didn’t solicite you money to trade, you open your own MT4/MT5 platform in any forex broker you choose and you make your deposit there, that’s completely legal and all traders do it, then you use their software to trade (automatic trading, 100% legal as well.

I have been using QuickSilver’s software and I’m satisfied with the profit I’ve made so far, you just need to have a basic Forex knowledge, if you don’t have it’s easy to learn if you put some time and effort.

1. Adobe doesn’t market a securities and is entirely different to what Silverstar Live was.

2. How you market an unregistered security doesn’t make it any less illegal.

But they did market a passive investment opportunity, which is a security.

From a regulatory standpoint how a securities offering is set up doesn’t matter.