RECB Review: 1000% annual ROI real-estate Ponzi

RECB stands for “Real Estate Community Bank”. No information about who owns RECB is provided on its website.

RECB stands for “Real Estate Community Bank”. No information about who owns RECB is provided on its website.

RECB’s website domain (“recbank.io”) was privately registered on April 3rd, 2020.

It’s worth noting the RECB’s official Vimeo presentation is in Spanish. At the very least this suggests whoever is running RECB is targeting a Spanish audience.

In an attempt to appear legitimate, RECB provides a corporate address in London, UK on its website.

Research reveals the street address provided is that of the fictional detective Sherlock Holmes.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money.

RECB’s Products

RECB has no retailable products or services, with affiliates only able to market RECB affiliate membership itself.

RECB’s Compensation Plan

RECB affiliates invest $50 to $1500 on the promise of a 1000% ROI paid over 365 days.

Referral commissions are paid down “7 levels of profits”, however specific details aren’t provided.

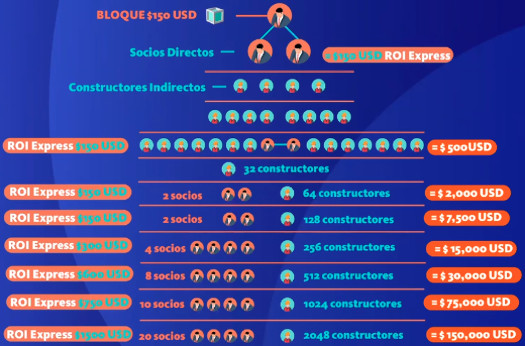

There’s also some $150 “bloque” investment scheme, which appears to pay commissions based on recruitment of affiliates who also invest in $150 “bloques”.

Joining RECB

RECB affiliate membership is free.

Full participation in the attached income opportunity however requires an initial $50 to $1500 investment.

Conclusion

RECB represents it generates external revenue through various real-estate activities:

RECB represents it generates external revenue through various real-estate activities:

No evidence of RECB engaging in any real-estate activity is provided. Nor is there evidence of RECB generating external revenue from any additional sources.

As it stands the only verifiable source of revenue entering RECB is new investment.

Using new investment to pay affiliates a 1000% ROI over 365 days makes RECB a Ponzi scheme.

As with all MLM Ponzi schemes, once affiliate recruitment dies down so too will new investment.

This will starve RECB of ROI revenue, eventually prompting a collapse.

The math behind Ponzi schemes guarantees that when they collapse, the majority of participants lose money.

There’s also the issue of RECB referring to itself as a bank. This attracts additional regulatory attention in most jurisdictions – namely because RECB isn’t a bank or providing legitimate banking operations.

If you’re going to commit fraud, why go for 221B Baker Street?

That looks similar to West African scammer’s “stupid filtering” techniques.

It keeps them from having to waste their time with people who might graduate high school.

SD

I’ve never believed this “stupid filtering” idea, which I first heard when the Nigerian 419 scams first started appearing in Europe, back in the days before the internet, when they were sent by fax rather than email. It was generally confidently stated as if it was a fact, rather than the assumption it is.

It seems to originate with people who couldn’t believe somebody could be so stupid as to come up with such preposterously obvious scam attempts, in atrocious English, and therefore assumed there must be some clever ruse behind it, an attempt by clever scammers to make sure only very stupid people take the message seriously.

The explanation that the scammers are simply just as deeply stupid and/or as badly educated as their messages suggest always seemed much simpler to me.

Nothing in what I’ve learned since then about these 419 scammers (the original Nigerian ones and the later exports/copycats in other West African countries) suggests to me there’s anything to the “stupid filtering” idea.

They’re not very educated people, following very simple playbooks (in pre-online days, often actual physical booklets), and simply targeting as many people as possible, to catch the few dumb enough to fall for it. Not educated sophisticates carefully crafting their messages to appear dumb, so only dumb people would respond.

More generally, it’s not an approach I’ve ever seen any scammer, of whatever type, claim to have used. There’s a lot of material out there by ex-scammers, describing how they operated. Deliberately making their scam attempts transparently obvious to everyone except the deeply dumb is not a part of the repertoire of any that I can recall.

Of course they try to identify and target someone’s weak spots (in the supposed “stupid filtering” scenario, stupidity), but not in ways that give them away to everyone who doesn’t have that particular weak spot.

Although of course in this case, the use of 221B Baker Street could be a joke. It has to be said, though, that for a long time that address, which didn’t exist at the time Doyle wrote the Sherlock Holmes stories, did actually belong to a very respectable, bank-like institution, the Abbey National building society.

During that time, they famously has someone on staff who was “secretary to Sherlock Holmes”, to deal with all the correspondence he received. (I don’t know what they actually did, though. Maybe they just sent some promotional material for Abbey National in reply?)

I’m still not sure about that other recent MLM scam, whose “management team” all had names of players for an English football club. Was that someone’s idea of a joke, or simply someone needing to come up with a number of plausible-sounding British names, and thinking plucking some names off the website of a sports club would do the job?

If you’re targeting a completely different part of the world, the odds of someone recognizing those names would be pretty slim.

Generally, I like to stick to Occam’s Razor. If someone does or says something really dumb, the most likely explanation is that they’re really dumb. Not someone clever deliberately pretending to be dumb as part of some sophisticated plan.

To quote Groucho Marx: “He may look like an idiot and talk like an idiot but don’t let that fool you. He really is an idiot.”

Thank you!! I never believed in it either, and it’s presented as established fact by nearly everyone.

The first time I saw it posited, it was along the lines of, “Did you ever stop to think they only say dumb things and use bad English to make sure they only appeal to dumb people? Maybe these scammers are smarter than they want us to think.” My opinion on the notion was the same then as it is now: it makes no sense.

If you want people to think you work at a bank, or are Nigerian royalty, or otherwise upper-class, you’re not going to write like a semi-illiterate naif unless you really are one.

It also isn’t borne out by facts. Read the conversations of scam-baiter bloggers like “Shiver Metimbers” and it becomes obvious the guys at the other end are not the sharpest knives in the block.

Nigerian 419 scams have low-level operatives sending out the spam and giving scripted responses, but they soon pass off the mark to a higher-up posing as a barrister or other professional.

Plenty of the bait conversations work their way up the hierarchy on the other end, and the bosses and bosses’ bosses are just as clueless that they’re being played. These are the ones who wrote the scripts and the initial spam, and their spelling is just as bad and their sophistication just as low as those below them.

These are not evil geniuses working their well-crafted trade; they’re common crooks with limited skills working the only scam they know how to do.

It boggles my mind that the “smart filter” myth persists in the face of all contrary evidence, but it’s taken on a life of its own. It went from “Hey, did you ever think maybe?” to “It’s a well-known fact that” in the past 15-20 years, and every time I try to share a dissenting opinion, I get shot down.

So again, thank you, PassingBy, for confirming my faith in humanity. I always knew you were smart.

I’ve regurgitated the “stupid filter” story a few times, so I hold my hands up – PassingBy and A&A are right. There is no evidence for it, plenty of evidence to the contrary, and it violates Occam’s Razor. I.e. it’s bollocks.

However, if the Baker Street address thing is not an intelligence filter, it must be a joke at the victims’ expense. It isn’t anything to do with pretending a connection to Abbey National, because they’re long forgotten even in the UK. They got taken over by Santander either during or before the credit crunch 12 years ago.

So it can’t be an attempt at legitimacy by association.

Hundreds of millions of people worldwide will know that 221B Baker Street is a Sherlock Holmes reference. It’s been on TV and film so many times that you don’t need to be literate to recognise it.

The only explanation that doesn’t involve it being a stupid filter or a pisstake is that the scammers plucked it out of thin air. But that seems unlikely. They might pluck “Baker Street” out of thin air, having seen a Sherlock Holmes story years before and not making the connection, but 221B?

They say the first step toward healing is recognizing you have a problem, Mal, so congrats. Of course, “they” also regurgitate the intelligence filter myth, so what to “they” know?

I, too, am baffled by RECB’s use of 221B Baker St., since it’s so universally recognized. Are they trying to be cute? Do they not know where it came from and that everyone has heard of it? I’m going to go with Dunning Kruger here and say they just think they’re way smarter than their audience, and yeah, they’re trying to be cute.

Fun fact: in the 1940s and 50s, the phonetic-alphabet word for the letter “B” was “Baker.” So anyone broadcasting that address over a WWII field radio would say “The enemy is holed up at two two one baker Baker street, Sir!” Amusing, what?

Thanks for the interesting observations on one of my favorite topics. It would certainly be astounding to me to discover that all of those mansions in the slums of Lagos were built on the earnings of scammers stupid enough to not know that western surnames are quite different than given first names.

Have you noticed how they sign up Facebook accounts with fake names that are commonly a combination of two western first names (Frank James, Robert John, Richard David, Donald Mark, etc)?

SD