QZ Asset Management Review: BDAI trading Ponzi scheme

QZ Asset Management operates in the financial investment MLM niche.

QZ Asset Management operates in the financial investment MLM niche.

The company also goes by QZ Invest and represents it is based out of Guangzhou, China.

Supposedly heading up QZ Asset Management is Blake Yeung Pu Lei.

Yeung doesn’t have a verifiable digital footprint. This could be due to language-barriers.

While QZ Asset Management doesn’t have an official YouTube channel, marketing videos doing the rounds reveal Yeung has a typical Hong Kong “British” English accent.

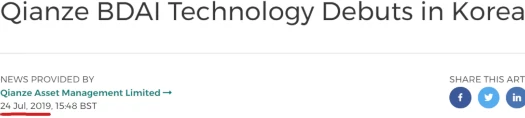

Prior to rebranding on or around 2021, QZ Asset Management went by Qianze Asset Management.

Other executives names on QZ Asset Management’s website include:

- Roger Sim – Regional Director

- Panjal Chandra – Director of Systems Development

- Julian D. Meyers – Director of Credit Risk Management

- Andrei Petrov – Director of System Security

I wasn’t able to verify whether any of these people actually exist.

Update 24th March 2023 – Through QZ Global Limited (QZ Global Ltd), a newly incorporated South Dakota shell company (created January 9th, 2023), QZ Asset Management has informed the SEC it intends to sell shares.

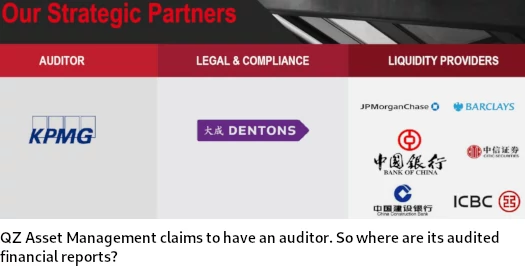

QZ Global Limited’s February 27th filing itself does not contain any disclosure of QZ Asset Management’s BDAI token MLM investment scheme. Nor does it contain audited financial reports.

What it does contain is a list of QZ Asset Management, purportedly accurate as of December 2021. In addition the executives named on QZ Asset’s website we have:

- Cui Tong Fei – Founding partner, Chairman and Director

- Voong Kuang Jie – Founding Partner, Chief HR Officer and Director

/end update

QZ Asset Management operates from the domain (“qzinvest.com”).

Private registration, cross-referenced with the Wayback Machine, suggests Qianze Asset Management acquired the domain sometime in 2021.

Despite only existing since around 2019 at the earliest, QZ Asset Management falsely claims it has been around “for more than 10 years”.

Read on for a full review of QZ Asset Management’s MLM opportunity.

QZ Asset Management’s Products

QZ Asset Management has no retailable products or services.

Affiliates are only able to market QZ Asset Management affiliate membership itself.

QZ Asset Management’s Compensation Plan

QZ Asset Management affiliates invest funds on the promise of an advertised ROI:

- QZ Basic – invest $100 to $900 and receive 1.75% a week

- QZ Elite – invest $1000 or more and receive 3.5% a week

QZ Asset Management caps returns at 400%, after which reinvestment is required to continue earning.

Note that MLM commissions count towards the 400% ROI cap.

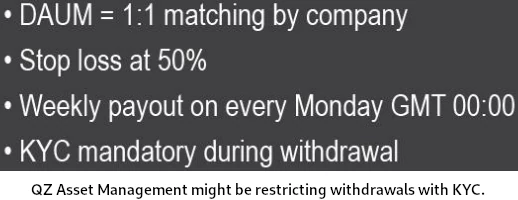

Also note that QZ Asset Management penalizes affiliates who withdraw invested funds before 91 days:

- withdrawals within the first 30 days cop a 50% fee

- withdrawals within 31 to 60 days after investing cop a 25% fee

- withdrawals within 61 to 90 days after investing cop a 10% fee

The MLM side of QZ Asset Management pays on recruitment of affiliate investors.

QZ Asset Management Affiliate Ranks

There are five affiliate ranks within QZ Asset Management’s compensation plan.

Along with their respective qualification criteria, they are as follows:

- Rank 1 – earn $3000 in accumulated residual commissions

- Vice President – earn $6000 in accumulated residual commissions

- Senior Vice President – earn $20,000 in accumulated residual commissions

- Executive Vice President – earn $50,000 in accumulated residual commissions

- Director – earn $150,000 in accumulated residual commissions

Referral Commissions

QZ Asset Management affiliates receive 10% of funds invested by personally recruited affiliates.

Residual Commissions

QZ Asset Management pays residual commissions via a binary compensation structure.

A binary compensation structure places an affiliate at the top of a binary team, split into two sides (left and right):

The first level of the binary team houses two positions. The second level of the binary team is generated by splitting these first two positions into another two positions each (4 positions).

Subsequent levels of the binary team are generated as required, with each new level housing twice as many positions as the previous level.

Positions in the binary team are filled via direct and indirect recruitment of affiliates. Note there is no limit to how deep a binary team can grow.

At the end of each day QZ Asset Management tallies up new investment volume on both sides of the binary team.

Affiliates are paid 10% of new funds invested on their weaker binary team side.

Once paid out on, funds are matched against the stronger binary team side and flushed. Any leftover investment volume on the stronger binary team side carries over.

Rank Achievement Bonus

QZ Asset Management rewards affiliates who qualify at Rank 1 and higher, with the following one-time Rank Achievement Bonuses:

- qualify at Rank 1 and receive a $500 investment position

- qualify at Vice President and receive a Samsung Galaxy S22

- qualify at Senior Vice President and receive a Rolex DateJust

- qualify at Executive Vice President and receive a Rolex Submariner

- qualify at Director and receive a Mercedes-Benz GLC

Joining QZ Asset Management

QZ Asset Management affiliate membership appears to be free.

Full participation in the attached income opportunity requires a minimum $100 initial investment.

QZ Asset Management Conclusion

Qianze Asset Management’s original 2019 launch targeted south-east Asia – namely South Korea.

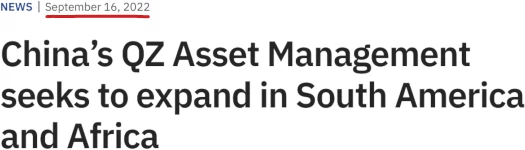

When Qianze Asset Management collapsed (circa 2021), the company rebranded as QZ Asset Management.

This took place in late 2021. For the rest of 2021 and most of 2022, QZ Asset Management went nowhere.

In October 2022, QZ Asset Management hoped to resuscitate itself by targeting low-hanging fruit in South America and Africa.

SimilarWeb currently tracks negligible QZ Asset Management website traffic, suggesting the reboot hasn’t taken off.

As to QZ Asset Management as an MLM company, the ruse behind its returns is the same old AI trading garbage every Ponzi uses:

Through our proprietary and award-winning fintech solution – the QZ Big Data and Artificial Intelligence (BDAI) analytics, we have consistently achieved strong growth momentum in all market conditions.

If we take QZ Asset Management’s “we’ve been around since 2012” claim at face value, at 3.5% a week shouldn’t they be the richest individuals on the planet by now?

In an attempt to appear legitimate, QZ Asset Management claims its registered with the Asset Management Association of China (AMAC).

According to AMAC’s Wikipedia entry;

The Asset Management Association of China (“AMAC”) is a self-regulatory association of fund management companies in China.

We learn from this that QZ Asset Management registering with AMAC is meaningless. This is true regardless of whether QZ Asset Management has in fact actually registered or not.

AMAC isn’t a financial regulator. Securities in China are regulated by the China Securities Regulatory Commission.

Considering MLM itself is illegal in China without a license, it’s not surprising QZ Asset Management doesn’t provide proof of CSRC registration. The company also fails to provide any audited financial reports.

Outside of China QZ Asset Management also fails to provide evidence of registration with financial regulators.

Why does this matter?

Because it means QZ Asset Management is committing securities fraud. MLM companies committing securities fraud lends itself to them running a Ponzi scheme.

As with all MLM Ponzi schemes, once affiliate recruitment dries up so too will new investment.

This will starve QZ Asset Management of ROI revenue, eventually prompting a collapse.

The math behind Ponzi schemes guarantees that when they collapse, the majority of participants lose money.

Update 4th May 2023 – QZ Asset Management has collapsed.

On May 1st Blake Yeung rolled out an “SEC audit” exit-scam.

Thank you for this thorough review. I posted the fraud warning about them 2 weeks ago on my Facebook.

In terms of HK and PRC requirements, calling yourself an “asset manager” requires a licence.

“Asset Manager” minus Licence equals BS.

They should rather call themselves Ass Hats.

It’s all over Africa.

In South Korea, a Ponzi scheme that has already stopped withdrawing in 2020.

Thanks for confirming. Lines up with what I surmised.

Wow… I’m scared now. Cause I invested in this, and I invited some friends. What Should I do now??

What can you do? You handed over your money to scammers.

There is a Guangzhou Qianze Investment Co. Ltd (Guangzhou Qianze Asset Management) opened in 2012, but it’s not the same owner.

tianyancha.com/company/2353831994

So the QZ Asset Management scammers pulled the ol’ misappropriate another businesses’ name play.

Already, QZ Asset Management is all over South Africa – spearheaded by some of the huge names in South African MLM spaces.

It is so sad, to see innocent people putting their hard-earned money into this thing.

Looking at the names of the Executive Directors, their Director of System Security (Andrei Petrov) – one article on CNN, going back to 2015, describes him as a “launderer working for Russian criminal organizations”.

They invited me for one on one today .so it’s risky at least I can still decide.

Was on brink of joining it,but wanted more info @ noahxna you mentioned something that caught my attention.. cloning of names..

if anyone can do further investigation about the CEO founder,my suspicion is that name they use of CEO is a very reputable name who is into Fintech.

They find a scammer who nearly looked like real person.

What you’re describing is a Boris CEO. And it’s very possible QZ Asset Management is headed up by a Boris CEO.

I believe that most here do not know how to do personal due diligence so they depend on cheap sites with completely bias negative reviews to deny them the opportunity to learn, study, research and take their risk.

Let me educate us here if only this site will allow u all to read my comment.

First, it that Guangzhou Qianze Investment Co. Ltd (Guangzhou Qianze Asset Management) opened in 2012, is the same and one with QZ Asset Management, the short form of Qianze is QZ.

The CEO of QZ is Prof Blake Yeung, all of u go to the website and read for urself, go to Yahoo finance, Bloomberg and read so that u don’t depend on all these craps here.

Thirdly, network marketing is a way to grow ur business, binance has a network marketing (Ozeidt: snip, see below)

Until u all read what an asset management company is, u will all be fooled by this baseless review.

This person failed to tell u all that QZ has been attending Fintech conference since 2019…

Don’t be foolish readers, learn to research urself

Ahh, here come the uneducated know-it-alls from third world countries.

What you’ll find on BehindMLM is actual due-diligence. As opposed to the horseshit you’ve come up with.

Prove it. Online QZ Asset Management has only existed since 2019 at the earliest.

Read what? The paid press-release spam?

1. Legitimacy via association isn’t a thing.

2. Binance isn’t MLM.

QZ Asset Management has nothing to do with asset management. It’s a Ponzi scheme.

And?

Good to see you acknowledge QZ Asset Management has only been around since 2019 though.

Learn from the South Koreans already been scammed in the first iteration of QZ Asset Management. Math is math, even for the uneducated.

Hmm. Was that Fidelis “Purity” Awusa of Nigeria just now? His Pureverse International Linkedin page only lists Bitcoin SV Academy as education.

Really needs more real world education, not yahoo-yahoo boys teaching you how to catfish, Fidelis.

Mothers of Africa (and everywhere else): don’t name your sons after the Latin for “trust me bro”. It can only end badly.

It’s like naming a daughter “Chastity”.

@ Awusa,since you a well know researcher give us footprint of your Dr Prof CEO (Blake Yeung).. where he graduated, prior work experience etc (understand he was working for reputable international funds management company..)

I almost joined it here in South Africa.

Was invited to a presentation about this so-called opportunity. Obvious ponzi scam. 3.5% – 7.0% per week returns trading the S&P500 using some BS AI? Come on!

Really sad that the economic circumstances of many people in South Africa, coupled with ignorance and greed, continue to make many fall for such nonsense.

@OZ

In order to keep sounding educated as you already are, please never be prone to committing fallacies like the one you just did in response to Fidelis.

You didn’t have to mention “third world countries”. You’ve committed a fallacy called ‘argumentum ad hominem’.

It’s called a fact. I can see IP addresses.

It’s also a fact that a lot of MLM Ponzi schemes thrive on the naivety of idiots in third world countries.

QZ Asset Management is one of those Ponzi schemes, with a particular emphasis on Africa.

We have see it before and it’s gonna happen again. some people will gain and majority will lose their fun especially the Africa countries.

this Ponzi scheme can’t last for two years.

They even an office launched in South Africa on 14th Jan.. so called CEO was also present to officialy take out of the poorest. Honourable mlm scammers graced the occasion, in fine dining and wining.

Some of the so called leaders have no soul, and yet some are intelligent enough to see they promoting a ponzi, but because they souless, thriving on other peopple miseries they grace the occasion.

Simple basic knowledge of financial market.. if a company can trade with guarantees returns of 0.50 to 1% daily, surely they dont need your lousy $100.

World is full of fund managament companies with billions of dollars, who will gladly give QZ their billions for management.

Wake up Africa, ask self why they dont target 1st world countries.

Finance 101: If you see a dollar lying on the ground, don’t bother to pick it because if it was not fake, someone else would have picked it already.

QZ is claiming that there are so many legit dollars lying on the ground, which is total BS.

Next, QZ claims in its presentation that its CEO Professor Blake Yeung is a “Chartered Financial Analyst (CFA) Level 3. This is total bulshxxt.

Standard VII(B) Reference to CFA Institute, the CFA Designation, and the CFA Program refers that and I quote “Candidates in the CFA Program may refer to their participation in the CFA Program, but such references must clearly state that an individual is a ‘CANDIDATE’ in the program and must not imply that the candidate has achieved any type of partial designation”, I close quotes.

CFA Level II or anything similar is specifically mentioned under improper references of one’s participation in the CFA Program.

Anyone who has seriously participated in the CFA Program, to the point of getting to Level 3 exams, would know that such a reference would invite the wrath of the CFA Institute. No one would want to be sanctioned after so much pain trying to earn the Charter.

I am reporting that to the Professional Conduct Program (PCP) of the CFA Institute and if that person is real, they will have to answer to the institute but I can bet my last cent that this is not a real person.

Scammers wearing stolen genuine clothing. And by the way, those who are denigrating third world countries, get yourself some brain transplant cos you suck.

Dont forget that this scheme started off within South Korea, an advanced economy. You suck big time.

Thanks for the heads up.

I have a loved one who recently invested.. im scared for their sanity should I relay this shocking revelation.

If you care about them, sure. But be prepared to learn uncomfortable things about this loved one.

Namely that they might be fine with scamming people through Ponzi schemes.

Carlos Cid, former promoter of IX Inversors (and other scams in Spain) is now going fulltime with QZ Asset Management

youtube.com/@carloscid9839/videos

It is an older channel, but videos from other scams were deleted not long ago, leaving us with only a handfull of QZ “training” material.

I am shocked by these revelations, just invested 2 days ago.

I’m shock by this revelation.

Hi, thanks for this review. A friend of mine told me about this yesterday. I found something with the SEC, searching about Blake Yeung, could you give us more informations about that, please?

The SEC document here: sec.gov/Archives/edgar/data/1966813/000196681323000002/qzs1.htm

That filing pertains to “QZ Global Limited”, which appears to be a US shell company.

Do you see anything about QZ Asset Management’s 400% ROI investment scheme in that filing? I don’t.

Something of minor interest is an unaudited financial chart on page 14.

$383,223 recorded as income for 2022, up till September. But uh yeah, 3.5% a week to 400% no problems.

In summary, the filing means nothing. They have gone to a bit more effort than your typical MLM Ponzi scheme though.

QZ Asset Management is banking on the SEC not going after scammers halfway across the world.

Coming to America,they advertised on Billboards in New York Times square for IPO in Nasdaq on August 2023

.Who exactly are this people behind QZ? If the adverts are true not photoshop.

Unfortunately this website cant upload fotos, was foin to share. Watching with intrest this QZ.

Buying advertising doesn’t change the fact QZ Asset Management is a Ponzi scheme.

At somepoint Cositorto’s Zoecash was advertised on Times Square

ne-np.facebook.com/100075621057129/videos/en-times-square-de-new-yorknuestra-criptomoneda-zoe-cash/596084598333340/

EDIT:

a screenshoot just in case the original disappears

ibb.co/FnQb9Mm

If you have the money…

It was a thing a few years ago. Costs a few thousand.

Sorta like Burj Khalifa and how that’s now a marketing joke.

Can we start a Change petition in order to rename the Burj Khalifa area as Ponzi district?

So agree, am from south Africa as well. Attended presentation recently and it didn’t make sense at all. ROI too high.

Do you guys ever review legit investment companies?! That would be helpful too.

BehindMLM’s only criteria with respect to reviews is it has to be MLM.

If you find yourself constantly looking up dodgy companies, that’s something you need to address.

Thank you so much for this heads up.

QZAM is a scam they currently closed down the website and peoples money is gone. The CEC is not reachable.

Those who were made to be board of directors continue to full peopled to register while they could see that they Compony is closing.

Instant things fall instantly…. May this open our eyes.

@ Mr Fidelis Awusa I guess you are happy to have mislead millions of Nigerians into this so called QZ Scam for your selfish interest.

You insulted the veracity of the herculean research done by admins of behindmlm.com about the fraudulent characteristics of QZ.You that did Due diligence and even flew to Thailand to be more indoctrinated into the QZ scam, How market now?

Am really pained about the monument losses of innocent people You deceived into joining the QZ Scam.

Its now official that the QZ Asset business has finally collapsed looting billions of dollars from innocent Nigerians, South Africa etc.

I was one of your downlines Mr Awusa, I attended most of your meetings in Port Harcourt. With all your bogus knowledge you claim to have in Online Business and Crypto space you still fell victim to this QZ trash that has befallen thousands of Nigerians.

I Hope you have learnt your lessons MR Awusa.

My deepest regrets is the innocent People who loaned funds and borrowed only to invest into a scam. Let us learn our lessons Africans.