Quility Review: Symmetry Financial Group & Asurea merger

Quility operates in the insurance MLM niche. The company doesn’t provide a corporate address on its website, but does state it’s “Made with (heart emoji) in CA, NC and NV”.

Quility operates in the insurance MLM niche. The company doesn’t provide a corporate address on its website, but does state it’s “Made with (heart emoji) in CA, NC and NV”.

Quility provides a brief history on its origin;

While the Quility name is new, we’ve been in the insurance business for a while.

Before joining forces, our agents represented two partner companies, Symmetry Financial Group and Asurea.

In 2020, we combined our nationwide family of agents to become Quility.

Heading up Quility are co-founders Casey Watkins, Brandon Ellison and Brian Pope.

Heading up Quility are co-founders Casey Watkins, Brandon Ellison and Brian Pope.

Watkins, Ellison and Pope are behind Symmetry Financial Group, founded in 2009.

I’ve also seen Pope credited as a co-founder of Asurea. On Asurea’s website (which is still up for some reason), Pope is credited as Chairman of the Board.

This prompted me to go look up Symmetry Financial Group, whose website is also still up for some reason.

For a merger that happened almost a year and a half ago, Quility brand messaging appears to be all over the place.

From what I can gather both Symmetry Financial Group and Asurea operated as MLM companies.

In a May 2020 interview, Casey Watkins stated

Symmetry Financial Group and Asurea have worked in alignment with each other since our company’s inception.

Seeing as Brian Pope was co-founder of both companies, I’m not really sure what the need for two companies in the first place was.

Since their respective launches, neither Symmetry Financial Group or Asurea appear to have run into regulatory trouble.

I can’t speak to the individual MLM opportunities as BehindMLM didn’t review either.

Today though we take a look at the current Quility MLM opportunity.

Quility’s Products

Quility markets insurance fulfilled by third-party providers. Quility claims to work with “80+ insurance companies”.

We shop more than 80 major insurance companies to help you find the best policy at the best price.

Insurance companies featured on Quility’s website include American-Amicable, Mutual of Omaha, Foresters Financial, Americo, John Hancock and Assurity.

Insurance products offered by Quility include:

- mortgage protection

- term life

- permanent life

- final expense

- debt free life

- disability and critical illness; and

- retirement solution

Quility doesn’t provide any pricing examples.

To be fair though, due to the personalized nature of insurance, they aren’t that helpful anyway.

Quility’s Compensation Plan

The compensation plan I’m working off for this review is a “Symmetry Agent Handbook”, dated October 2021.

The top of the handbook does state Symmetry is “powered by Quility”. The document however frequently links to Symmetry Financial Group’s website.

Why Quility still doesn’t have its own compensation documentation a year and a half after launching I don’t know.

Quility Affiliate Ranks

There are fifteen affiliate ranks within Quility’s compensation plan.

Along with their respective qualification criteria, they are as follows:

- New Agent – sign up as a Quility affiliate

- Seasoned New Agent – submit six policy applications within your first six weeks

- Top Producer – generate at least $20,000 in policy volume for two consecutive months

- Elite Producer – generate at least $30,000 in policy volume for two consecutive months

- Team Leader – generate at least $10,000 in personal policy volume and $15,000 in group policy volume for two consecutive months, and recruit and maintain three New Agents or higher

- Key Leader – generate at least $20,000 in personal policy volume and $30,000 in group policy volume for two consecutive months, and generate a downline of four New Agents or higher (three must be personally recruited)

- Agency Owner – generate at least $30,000 in personal policy volume and $50,000 in group policy volume for three consecutive months, be at the 95% commission rank and generate and generate a downline of six New Agents or higher (four must be personally recruited)

- Agency Director – recruit and maintain one Agency Owner or higher

- Regional Agency Director – recruit and maintain two Agency Owner or higher

- Managing Vice President – recruit and maintain one Agency Director and two Agency Owners or higher

- Senior Vice President – recruit and maintain two Agency Directors and one Agency Owner or higher

- Executive Vice President – recruit and maintain three Agency Directors or higher

- Associate Partner – recruit and maintain one Managing Vice President on a 120% commission rate, two Agency Directors and one Agency Owner or higher

- Senior Partner – recruit and maintain two Managing Vice Presidents on a 120% commission rate and one Agency Director or higher

- Managing Partner – recruit and maintain three Managing Vice Presidents on a 120% commission rate and one Agency Director or higher

Note that specified required ranks and commission rates of recruited affiliates are minimum amounts.

For commission rank qualification criteria see below.

Commission Ranks

Quility’s commission ranks are in addition to affiliate ranks.

Commission ranks determine base commissions paid on approve policies.

- 70% – sign up as a Quility affiliate

- 75% – generate $2500 in PV or GV

- 80% – generate $5000 in PV or GV

- 85% – generate $10,000 in PV or GV

- 90% – generate $15,000 in PV or GV

- 95% – generate $20,000 PV or $30,000 GV (across six recruited affiliates)

- 100% – generate $25,000 PV or $45,000 GV (across nine recruited affiliates)

- 105% – generate $27,500 PV or $65,000 GV (across thirteen recruited affiliates)

- 110% – generate $30,000 PV or $95,000 GV (across nineteen recruited affiliates)

- 115% – generate $35,000 PV or $145,000 GV (across twenty-nine recruited affiliates)

- 120% – generate $40,00 PV or $225,000 GV (across forty-five recruited affiliates)

PV stands for “Personal Volume” and is policy volume generated by an affiliate.

GV stands for “Group Volume” and is PV generated by an affiliate and their downline.

Note that required PV and GV must be maintained for two consecutive months.

Also note that no more than 50% of required GV can come from any one unilevel leg.

Although not explicitly clarified, I believe once qualified for ranks are permanent.

Policy Volume Commissions (first year)

Quility’s policy volume commissions are tied to commission ranks above.

Note that a 120% commission is paid on all written policies. This allows higher ranked Quility affiliates to earn commissions on downline volume.

These are referred to as “override” commissions, and are tracked via a unilevel compensation structure.

A unilevel compensation structure places an affiliate at the top of a unilevel team, with every personally recruited affiliate placed directly under them (level 1):

If any level 1 affiliates recruit new affiliates, they are placed on level 2 of the original affiliate’s unilevel team.

If any level 2 affiliates recruit new affiliates, they are placed on level 3 and so on and so forth down a theoretical infinite number of levels.

The way an override works is a lesser ranked affiliate sells a policy and is paid their corresponding commission rank rate.

If their upline is higher ranked, they earn the difference between their commission rank rate and that of the downline affiliate.

In this manner upline affiliates are able to collect override 5% to 50% differences, depending on their commission rank and that of downline affiliates.

Renewal Commissions

Quility don’t provide policy renewal commission specifics.

The company’s compensation plan states only that “this type of commission is not available from all carriers.”

Downline Volume Bonus

Quility affiliates can qualify to earn a bonus on downline volume (GV).

Bonus qualification is determined by whether an affiliate is commission rank qualifying on their own volume (Producer) or that of their downline (Builder).

- Producers must generate $5000 PV a month

- Builders must be at the 95% commission rank and generating $25,000 GV a month

- Builders at the 105% commission rank and higher must be generating $35,000 GV a month

The following lead-based additional qualification also applies:

- $200 to $249 in PPL over a 90-day rolling period = 50% bonus rate paid out

- $250 or more PPL over a 90-day rolling period = full bonus rate paid paid out

- $7500 in “max case credit” is required

PPL stands for “paid premium per lead” and is the average PV generated across purchased leads in a month.

“Max case credit” isn’t defined anywhere in the compensation document. I have no idea what this is.

If the above qualification criteria is met, bonus rates are then calculated based on monthly generated PV:

- generate $12,500 to $14,999 a month in PV and earn a 2% bonus rate

- generate $15,000 to $19,999 a month in PV and earn a 2.25% bonus rate

- generate $20,000 to $24,999 a month in PV and earn a 2.5% bonus rate

- generate $25,000 to $29,999 a month in PV and earn a 3% bonus rate

- generate $30,000 to $39,999 a month in PV and earn a 4% bonus rate

- generate $40,000+ a month in PV and earn a 5% bonus rate

Other Bonuses

Quility’s compensation documentation references a Capital Bonus, “120+ Equity Bonuses” and “additional incentives”.

No information on the Capital Bonus is provided.

The 120+ Equity Bonus appears to be an alternative that kicks in when a downline affiliate reaches the 120% commission rank.

“Equity” suggests shares may be offered but again no specifics are provided.

Additional incentives are described as follows:

SFG Destination is the featured trip for each year and agents are given a yearlong qualification period in which to earn an invitation on the trip.

Other contests such as Symmetry Open, November to Remember, Bonus Lead Bandito, etc. have a shorter duration and are rolled out periodically throughout the year.

The paragraph above that references “trips and contests” offered by Quility’s partnered insurance carriers.

Joining Quility

Quility affiliates are required to apply for licenses, errors and omissions insurance (optional) and pass an in house exam.

Costs for any of this are not provided by Quility.

Conclusion

My major concern with Quility is the lack of transparency.

There’s a lot to digest when it comes to insurance MLMs. Quility do a good job of explaining what they do explain (which is admittedly a lot), but crucial due-diligence points are withheld.

For starters, the cost of joining the company. I take it licenses are required and that’s on top of whatever Quility themselves are charging.

Not disclosing these costs is an immediate red flag and potential violation of the FTC Act (disclosures).

Then there’s Quility’s equity program, which I flagged as a worry in going over compensation.

While specifics aren’t provided, Quility do provide this explanation in their compensation glossary:

Equity Appreciation Rights (EARs)

EARs allow the recipient to participate in a share of the value creation of Quility above a floor value established in an award.

These are granted by the company in its sole discretion as a “gift” to the recipient and are subject to the specific terms of the grant (including conditions on forfeiture).

Recipients must remain in good standing at the time of a “trigger event” to be entitled to receive payment on the

EARs he or she holds.

Sounds like someone is trying very hard not to use the term “shares” to describe a virtual share scheme.

This is significant because neither Quility, Symmetry Financial Group or Asurea are registered with the SEC.

It is certainly odd that Quility don’t provide specifics regarding their equity program. The company’s “Agent Handbook” is presented as a summary of the “Agency Owner Handbook”.

This summarized version clocks in at thirty-six pages, so it’s not like Quility shy away from explanations.

Instead details of the equity program appears to be intentional, which is another red flag to me.

Other than that Quility’s compensation appears pretty straight forward. You qualify for a commission rate, earn on lesser ranked downline affiliates and additional bonuses are available.

One sticking point for bonuses is the requirement Quility affiliates purchase leads and maintain a $200 PPL.

Conversion of company-supplied leads is a major variable and tying it to bonus qualification seems unfair.

Not only that, Quility will even cut you off if you don’t convert their leads:

Agents should maintain a $250 monthly minimum Paid Premium Per Lead (PPL), a 65% or higher issue rate, and a close ratio

of 30% or higher to ensure profitability and continued participation in the Mortgage Lead Program.SFG reserves the right to cancel a standing A lead order if an agent’s

numbers fall below these minimums for two consecutive months.

“A Leads” are Quility’s premium leads. The company offers

- A Leads – “the freshest type of leads” that are less than 21 days old

- Overstock A Leads – unsold A Leads that are over 21 days old ($9 to $13)

- Bonus Leads – leads already sold to existing agents, $7.99 to 50 cents

- DX Leads – no explanation provided

With respect to A Lead pricing, Quility states:

The cost per lead is dependent on the agent’s contract level (see the SFG Promotion Guidelines for A lead cost).

The linked “SFT Promotion Guidelines” document contains no information about A Lead cost.

From the prices that are disclosed however, we can surmise A Leads cost over $13 each.

That can add up quickly. Oh and presumably if you don’t convert purchased A Leads, Quility will still sell you cheaper leads.

Theoretically these leads would be harder to convert, so I’m not sure what the logic is there other than cha-ching.

With respect to offered insurance, Quility claim to offer “the best policy at the best price”.

We do the shopping for you to ensure you get the best coverage at the best price. It’s our promise to you.

If you’ve got insurance, comparison seems painless enough through a Quility web app.

Get a free quote in seconds based on your insurance needs, then continue to our online application and secure the coverage you need in 10 minutes. It’s that simple.

The app does harvest your contact details but that seems unavoidable.

What I’m not clear on is whether using the app makes you a sellable lead or not. I can see that being annoying if so.

The good news is leads can give you some idea of how your potential upline’s Quility business is going.

You can either ask them for the total number of leads purchased over the past few months and how many converted.

Or just ask for their PPL (PV divided by how many A Leads they purchased that month).

Personally I’m not a fan of mandatory lead purchases (you have to buy leads to fully participate in Quility’s MLM opp), but if it’s there best to make use of it as a tool before signing up.

The other thing to watch out for is clawbacks. 120% commissions don’t materialize out of thin-air. You’re being paid on future policy payments on the assumption those policies aren’t cancelled.

If they are, you’re on the hook.

Commission Chargeback

If an agent has received advanced commission and the client fails to pay premium or cancels the policy, the carrier will issue a chargeback on the commission received by the agent for any unpaid premium.

Chargebacks can also be issued on override commissions received for a downline agent’s business.

The last thing I want to discuss is Quility’s branding. Specifically why Symmetry Financial Group and Asurea still exist if they supposedly merged into Quility?

The last thing I want to discuss is Quility’s branding. Specifically why Symmetry Financial Group and Asurea still exist if they supposedly merged into Quility?

I couldn’t find this addressed anywhere. And it’s certainly confusing.

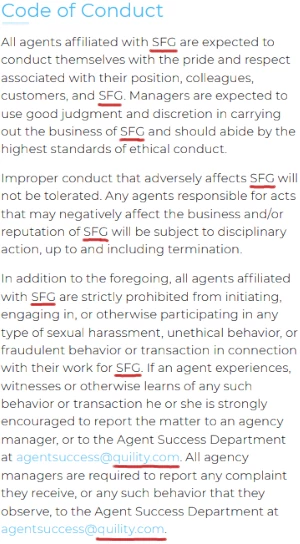

Take for example the “Code of Conduct” on the right, taken from a Symmetry Financial Group branded handbook offered on Quility’s website.

As you can see the company uses both names interchangeably.

Was there even a merger, or was Quility created as a new name to market Symmetry and Asurea through?

Surely if there was a genuine attempt at merging the companies everything would be under the Quility brand by now?

Approach with caution.

This business is a complete scam. Despite the appearance of a legit company that sells insurance online this is all a facade (or a best a tiny part of turnover).

The whole business is about recruiting new “salespeople” who unwittingly become the actual clients. ie they waste their money on buying leads (the real business is selling leads that the company knows are a waste of time) getting the adviser to buy a policy themselves and sell a few to friends.

Then once the adviser discovers the truth about the leads, they are encouraged to divert their efforts to recruit others to do the same, trigger repeat /repeat and so on.

A sad reflection of the life insurance industry in America. Don’t get me wrong a lot of effort has gone into masquerading this farce as a great business with videos about great their culture and helping others. All a bit crazy!

The thing is that I suspect the insurers who get the new business that is generated generate support this model, almost certainly knowing about the MLM undertone but choosing to turn a blind eye.

There’s a few points that are off, but mostly all accurate. The main off point is about leads, buying leads is not required and isn’t that profitable for Quility.

They’ve even started encouraging agents to partner up with other lead vendors if that’s what works best for them (less hassle for Quility).

That being said, I have personally used their leads and have closed anywhere from 20-40% of the leads consistently. Which translates to an ROI of 5 times the lead investment (on the low-end).

I.e. spend $1000 make $5000. $4000 profit. It’s pretty simple how everything works if someone has a background in sales they would get it.

Selling leads is lucrative or Quility wouldn’t do it. Can’t comment on the quality of leads.

That’s not the case with Insurance Marketing Organizations (IMO) – here’s why:

Symmetry can break even (or even lose some) selling leads and still turn a profit due to IMOs earning overrides and bonuses from the carriers in exchange for building the distribution for them.

The primary difference between the Symmetry model and other IMOs is any agent can also build their own agency but it’s optional. There are many agents earning full-time income from personal sales and no recruiting.

Most insurance carriers within the independent channel rely on IMOs to recruit, train and manage the sales force. I believe Symmetry has direct IMO contracts with most (if not all) of their carriers.

We could argue about the multiple levels of overrides and lower starting commissions at another time. The insurance industry has a 90% failure rate which is nothing to boast about. Allowing insurance agents to start part-time can be a good way to enter into the industry and not always a negative.

Disclosure: I’m not with Symmetry – never have been.

Bruh, put down the marketing handbook.

Hypotheticals doesn’t change the fact that selling leads is lucrative or Quility wouldn’t do it.

Talking out your ass = spambin.

Oz – IMOs like Symmetry can lose money on selling leads and still net out a profit. It’s not a hypothetical as I consult with IMOs that use that exact model. In fact, almost all IMOs provide free leads as perks for production in the insurance industry.

Are you suggesting otherwise?

FYI – I am not a fan of the Symmetry MLM model as my username would suggest. However, that doesn’t keep me from being open-minded about other aspects of their business.

And then we’ve got companies like Family First Life reportedly making millions off selling leads?

I can’t speak to IMOs, I’m speaking to MLM insurance companies.

FFL and Symmetry are both IMOs that use an MLM model and are not MLM insurance companies. (just to confirm – there is a difference)

Right. Well FFL is well-known to be making bank of selling leads to their distributors. So it’s definitely a cash grab for MLM insurance companies selling leads, hypothetical “what ifs” and “buts” aside.