Otter Spot Review: BUSD smart-contract cycler Ponzi

Otter Spot fails to provide ownership or executive information on its website.

Otter Spot fails to provide ownership or executive information on its website.

Otter Spot’s website domain (“otterspot.io”), was privately registered on May 18th, 2023.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money.

Otter Spot’s Products

Otter Spot has no retailable products or services.

Affiliates are only able to market Otter Spot affiliate membership itself.

Otter Spot’s Compensation Plan

Otter Spot affiliates invest Binance USD (BUSD) in 3×2 matrix cycler tiers:

- 10 BUSD

- 20 BUSD

- 40 BUSD

- 80 BUSD

- 160 BUSD

- 320 BUSD

- 640 BUSD

- 1280 BUSD

- 2560 BUSD

- 5120 BUSD

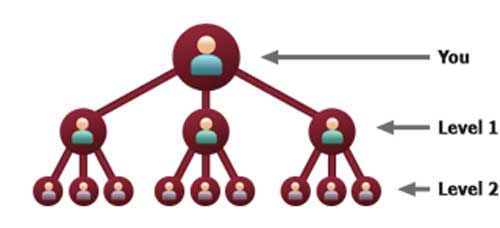

A 3×2 matrix places an affiliate at the top of a matrix, with three positions directly under them:

These three positions form the first level of the matrix. The second level of the matrix is generated by splitting each of these three positions into another three positions each (9 positions).

Otter Spot pays out 90% of invested funds in each position either upline, downline or to the affiliate at the top of the matrix.

How a payment is distributed is determined as follows:

- 1st position is passed downline

- 2nd position is passed upline

- 3rd position is paid out

Upline commissions follow whoever recruited the affiliate but it’s unclear on who in the downline receives “downline commissions”.

Also note that a full 3×2 matrix results in four of each of the above payments made. The third “kept” payment is used to fund a new position on the same cycler tier.

Referral Commissions

Otter Spot pays a 10% referral commission on invested BUSD.

Note that Otter Spot affiliates only each referral commissions up to the highest tier they themselves have invested at.

E.g. if a 320 BUSD tier affiliate recruits an affiliate who invests at the 1280 BUSD tier, they don’t earn a referral commission.

Joining Otter Spot

Otter Spot affiliate membership is tied to a minimum 10 BUSD investment.

Full participation in the attached income opportunity costs 10,230 BUSD.

Otter Spot Conclusion

Otter Spot is a simple smart-contract cycler Ponzi – and they admit as much on their website;

Otter’s major functioning is based on referral programs where the existing community members will refer the link of the system to new participants and get remuneration in return.

That’s a roundabout way of saying all Otter Spot does is recycle invested funds to pay withdrawals, making it a Ponzi scheme.

That Otter Spot is a cycler Ponzi run through a smart-contract is neither here nor there – the unsustainable math is the same.

As with all MLM Ponzi schemes, once affiliate recruitment dries up so too will new investment.

Being a cycler Ponzi, this will see Otter Spot’s matrices begin to stall.

Once enough matrices have stalled, an irreversible collapse is triggered.

Cycler Ponzis primarily benefit those running them and early investors. These participants create the first positions entered into the cycler.

Consequently they cycle the most and wind up stealing the most money. A few breadcrumbs are paid to later participants who recruit.

Of course in order for that to happen, the majority of Otter Spot affiliates have to lose money.

With no external source of revenue math guarantees that, when Otter Spot inevitably collapses, the majority of participants lose money.