Master Coin Plus Review: 120 day bitcoin investment ROI scheme

Master Coin Plus operate in the cryptocurrency MLM niche and name Thomas Armour as CEO of the company.

Master Coin Plus operate in the cryptocurrency MLM niche and name Thomas Armour as CEO of the company.

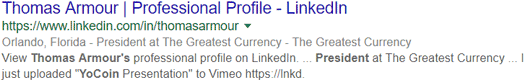

Armour is based out of Florida in the US. On his LinkedIn profile, Armour cites himself as an “internationally recognized keynote speaker, author, coach, sales trainer, and educator.”

Prior to Master Coin Plus Armour (right) was the President of YoCoin.

Prior to Master Coin Plus Armour (right) was the President of YoCoin.

YoCoin is a pump and dump MLM altcoin launched just over a year ago.

Affiliates invested up to $2000 in YoCoin. After reaching a pump high of 33.9 cents in early July, 2016, today YoCoin’s dump value is just 0.3 cents.

Update 25th July 2017 – A former YoCoin affiliate reached out and stated they’d never heard of Thomas Armour being President of YoCoin.

I went to cite my research and couldn’t find the original reference I came across when researching this review.

Dug into it a bit more and realized Tom has been deleting any and all references to YoCoin on his social media profiles and video accounts.

LinkedIn doesn’t cache but below you can see Armour refer to himself as “President at the Greatest Currency”:

Under that position heading was a description for YoCoin, which I took as Armour claiming to be President of YoCoin.

No idea if that was a stealth position or Armour was telling porky pies, but it is what it is. /end update

On the affiliate side of things Armour has promoted Game Loot Network, Saivian and Magic 10 Maketing.

Read on for a full review of the Master Coin Plus MLM opportunity.

Master Coin Plus Products

Master Coin Plus has no retailable products or services, with affiliates only able to market Master Coin Plus affiliate membership itself.

Master Coin Plus affiliates invest on the expectation they’ll receive a net ROI after 120 days.

Bundled with Master Coin Plus affiliate investment is access to “Master Coin Plus University”, which purportedly explains “golden cryptocurrency trading rules”.

The Master Coin Plus Compensation Plan

Master Coin Plus affiliates invest in 0.0625 to 32 BTC “packages” on the promise of a 120 day ROI.

Residual commissions are paid on funds invested by recruited downline affiliates.

Master Coin Plus pay residual commissions via a binary compensation structure.

A binary compensation structure places an affiliate at the top of a binary team, split into two sides (left and right):

The first level of the binary team houses two positions. The second level of the binary team is generated by splitting these first two positions into another two positions each (4 positions).

Subsequent levels of the binary team are generated as required, with each new level housing twice as many positions as the previous level.

Positions in the binary team are filled via direct and indirect recruitment of affiliates. Note that there is no limit to how deep a binary team can grow.

At the end of each day Master Coin Plus tally up new investment volume on both sides of the binary team.

Master Coin Plus affiliates are paid a percentage of matched volume on both sides of the binary team.

- invest 0.625 BTC and receive a 7% binary commission, capped at 0.15 BTC a day and/or 3 BTC a month

- invest 0.125 BTC and receive a 8% binary commission, capped at 0.25 BTC a day and/or 7 BTC a month

- invest 0.25 BTC and receive a 9% binary commission, capped at 0.5 BTC a day and/or 15 BTC a month

- invest 0.5 BTC and receive a 10% binary commission, capped at 1 BTC a day and/or 30 BTC a month

- invest 1 BTC and receive a 12% binary commission, capped at 2 BTC a day and/or 60 BTC a month

- invest 2 BTC and receive a 14% binary commission, capped at 4 BTC a day and/or 120 BTC a month

- invest 4 BTC and receive a 16% binary commission, capped at 8 BTC a day and/or 240 BTC a month

- invest 8 BTC and receive a 18% binary commission, capped at 16 BTC a day and/or 480 BTC a month

- invest 16 BTC and receive a 19% binary commission, capped at 32 BTC a day and/or 960 BTC a month

- invest 32 BTC and receive a 20% binary commission, capped at 64 BTC a day and/or 1920 BTC a month

Unmatched investment on the stronger binary side is carried over the next day.

Joining Master Coin Plus

Master Coin Plus affiliate membership is tied to an investment of between 0.0625 and 32 BTC.

The more bitcoin a Master Coin Plus invests the higher their income potential via the Master Coin Plus compensation plan.

Conclusion

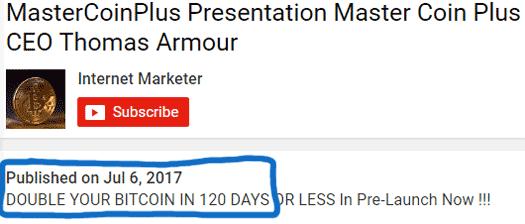

Master Coin Plus appears to be an attempt to market a bitcoin doubler, without referring to it as a bitcoin doubler.

Affiliates are only investing bitcoin on the expectation Master Coin Plus will pay them a 120 day ROI.

Officially however all I could find was mention of “growing” invested bitcoin funds. Master Coin Plus are careful not to explicitly provide an exact ROI percentage.

Those investing aren’t so heavy with the pseudo-compliance and peg Master Coin Plus’ expected return at 200%:

This aligns Master Coin Plus with other bitcoin doublers that have launched this year (GladiaCoin, JetCoin, Cointherum, Royal Dragon Traders, TwiceCoin etc.).

Master Coin Plus claim they generate affiliate ROIs through cryptocurrency trading, mining and the use of bitcoin ATMs.

Like all of the aforementioned bitcoin doubler scams however, the company provides no proof of any of these activities are taking place or tied to affiliate ROIs.

This leaves new affiliate investment the only verifiable source of revenue entering the company, the use of which to pay existing affiliates a ROI makes Master Coin Plus a Ponzi scheme.

On the regulatory front Thomas Armour is based out of the US and Master Coin Plus is being pitched to US residents.

At the time of publication Alexa estimate the US is the largest source of traffic to the Master Coin Plus website (28%).

A search of the SEC’s Edgar database however turns up nothing for Master Coin Plus or any derivatives.

This means Armour and Master Coin Plus’ MLM opportunity is an unregistered securities offering, made in violation of the Securities Exchange Act.

As with all Ponzi schemes, Master Coin Plus will collapse once newly invested funds run out. For the bitcoin doubler model, this is typically well before the initial maturity period (residual commissions further drain available ROI funds).

As has happened time and time again, when a bitcoin doubler Ponzi collapses the majority of investors lose money.

Yo! Another coin!

Another Gladiacoin copycat that will fail along with the 20 other field copycats and the scam itself, Gladiacoin.

Look at the binary payplans. All copying a failed system. Same hype about “trading cryptocurrencies” but not able to show it. Why doesn’t admins trade by themselves and reap the rewards of their trading skills? They want to give away their trading profits?

Has it occurred to potential losers in this scheme that no profitable trading exists, or for that matter any trading at all?

I do not believe your research and I do not believe my post will make it to this page as an open and fair analysis. Based on your sloppy research that you posted above Tom Armour did not make reference to himself as president of YoCoin. It clearly states that he uploaded a YoCoin presentation.

I believe you guys here at this Behind MLM unfairly attacks many MLM start-ups for your own gain. There are ways here that you profit. Hopefully the readers can see for themselves.

I know of a delegation from Washington DC that went down to visit the trading floor at MasterCoin plus. They are the real deal.

That’s a search snippet from Google search results. The now deleted entry in Armour’s LinkedIn profile had him as “President at The Greatest Cryptocurrency”, and under that title was a description of YoCoin.

I can’t show you the exact page because Google doesn’t cache LinkedIn profiles.

Thought to ask why Armour felt the need to scrub his online profiles of YoCoin after this review was published?

Seems you’re pretty selective in your beliefs. Unless it’s bullshit, you’re not buying it.

I’m OK with that. MLM due-diligence isn’t about beliefs, it’s about facts.

Best of luck with the scamming.

Tyreik is right. Mastercoin is the real deal.

The “real deal” as far as Ponzi fraud goes sure. There’s no legitimate business taking place in Master Coin though.

there is no coin.

I put some money here and when i was trying to withdraw, never heard from the Thomas any more, prior to that he would answer emails.

No response any more. I think they left the US and are now enjoying what they collected.

My thought whoever is saying is the real deal here is in on the scam or has not asked to withdraw. Just send an email to (removed) and let us know if you get a reply.

I have been waiting for weeks to hear something. Oh and by the way, they never said they were a coin, they are traders that leverage the coin market and trade 45 coins or so.

Joe

if someone has acquired Bitcoin while in MCP is there an avenue where an investor could not cash out but just move their coins from MCP to a more creditable group?

I’m not 100% sure but I believe you’d have to withdraw to a bitcoin wallet first. That bitcoin wallet is probably the same one as you initially invested from.

All of you here who so vehemently defended MasterCoin Plus… would one of you care to tell me how to collect my money?

I never recruited anyone, so I just have a stake wallet with a ton of MCP in it, but nothing in the commission wallet. I’ve had my money in there for well over 300 days.

I was doing business with a customer that claimed he would just put the money on a bitpay card. He even got to the point where he would not even go to his shop because he was making money in the mastercoin plus market.

He would vacation and travel more and more which seemed like something I should be doing.

I registered well over 400 days ago. I cant reach anyone to help with any of this problem. They changed over to some other form of coin but no one knows anything about it!

I contacted the staff at bitcoin and they tried to help recover my funds, even wrote each e-mail address to get no response. This has got to be a big scam.

The phone number for mastercoin plus is never answered and no message is returned. I would like to see a class action suite take place.

I think the law should take this criminal and put him in his place.

Class actions don’t just materialize out of thin air. You have to file one if you want to get the ball rolling.

Unfortunately you got scammed by one of your customers. ALl that travel and vacation time he or she had? That was funded by money stolen from bagholders such as yourself.

I to give a couple thousand dollars to a guy who put it in master coin. Two years ago. He’s gone dark on me.

I’m not a tech geek any idea who I could contact to find out if any money is there?

You gave money to a random stranger over the internet.

Your money is gone, sorry for your loss.