LSG Financial Review: “Automated investing” Ponzi scheme

![]() LSG Financial brands itself as a financial firm.

LSG Financial brands itself as a financial firm.

LSG is an online financial institution. We help you plan your financial goals and recommend smart investment choices, so that you save time and gain peace of mind, knowing that your money is working for you.

The company’s name incorporates “Liam, Sachwell & Galahad”. Typically surnames, no evidence is provided to confirm these are actual people.

In fact LSG Financial provides no information about company ownership or its executives.

LSG Financial’s website domain (“lsgfinancial.com”), was privately registered on June 7th, 2021.

SimilarWeb’s tracking reveals traffic to LSG Financial’s website was dead until late August 2022. Top sources of LSG Financial website traffic are Belgium (51%) and the Netherlands (49%).

This even split strongly suggests whoever is running LSG Financial is based out of Europe.

No idea if it’s official or not but a private FaceBook group named “LSG Financial” was created on August 10th, 2022. This coincides with traffic to LSG Financial’s website increasing.

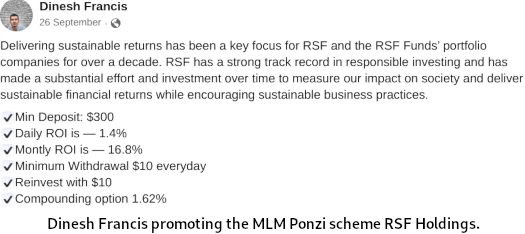

The two admins of the LSG Financial FaceBook group are Dinesh Francis and Freek Otf Andringa.

Francis appears to be promoting multiple Ponzi schemes:

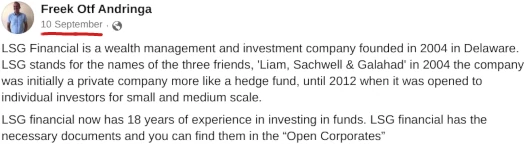

Andringa represents he is based out of the Netherlands.

Contrary to Andringa’s claims above, LSG Financial didn’t exist till 2021.

Prior to LSG Financial, Andringa promoted the EvoRich Ponzi scheme.

Following the arrest of owner Andrey Khovratov, EvoRich collapsed earlier this year.

Another possibility is LSG Financial is run by Russians. This is based on the inclusion of Yandex Translate on LSG Financial’s website.

Yandex is a Russian search engine that typically nobody outside of Russia uses.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money.

LSG Financial’s Products

LSG Financial has no retailable products or services.

Affiliates are only able to market LSG Financial affiliate membership itself.

LSG Financial’s Compensation Plan

LSG Financial affiliates invest funds on the promise of a daily return:

- Safety Net – invest $100 to $9999 and receive 0.8% to 0.85% a day

- Equity Pool – invest $10,000 to $24,999 and receive 1% to 1.05% a day

- ETF – invest $25,000 to $49,999 and receive 1.6% to 1.65% a day

- Fixed Income – invest $50,000 to $99,999 and receive 1.9% to 1.95% a day

- Balanced Fund – invest $100,000 or more and receive 1.9% to 1.95% a day

- Retirement Fund – invest $100,000 or more and receive 1.5% to 1.7% a day

As per LSG Financial’s investment plans, Retirement fund pays out less than Balance Fund. Why anyone would invest at the Retirement Fund tier is unclear.

Note that LSG Financial Investment plans are valid for 12 months, after which new investment is required to continue earning.

The MLM side of LSG Fund pays commissions on recruitment of affiliate investors.

LSG Financial pays referral commissions on invested funds down three levels of recruitment (unilevel):

- level 1 (personally recruited affiliates) – 10%

- level 2 – 5%

- level 3 – 3%

Joining LSG Financial

LSG Financial affiliate membership appears to be free.

A minimum $100 initial investment is required to participate in the attached income opportunity.

LSG Financial Conclusion

Although LSG Financial markets itself as a financial firm, in reality it’s a simple Ponzi scheme.

Despite clearly offering securities by way of running a passive investment scheme, LSG Financial is not registered to offer securities in any jursidictions.

Instead, gullible investors in Europe are fed this baloney:

LSG offers advice as a fiduciary, and we help you manage your money.

We do this work as two legal entities—LSG Financial LSC which is an Michigan LARA (Michigan Department of Licensing and Regulatory Affairs)-registered investment advisor, and LSG Financial Services, an SEC-registered broker-dealer, regulated by Michigan CSCL (Corporations, Securities and Commercial Licensing Bureau).

LSG Financial is registered SEC entity.

This is from an LSG Financial 10-K Annual Report, filed with the SEC in April 2022:

Lode-Star Mining Inc. was incorporated in the State of Nevada on December 9, 2004 for the purpose of acquiring and exploring mineral properties.

On December, 28, 2021, we entered into an agreement with Sapir Pharmaceuticals, Inc. to acquire all of the assets.

Further to a Mineral Option Agreement (the “Option Agreement”) dated October 4, 2014, on December 5, 2014, we entered into a subscription agreement (the “Subscription Agreement”) with Lode-Star Gold INC., a private Nevada corporation (“LSG”) in which we agreed to issue 35,000,000 shares of our common stock, valued at $230,180, to LSG in exchange for an initial 20% undivided beneficial interest in and to LSG’s Goldfield property, which made LSG our largest and controlling shareholder.

The SEC registered LSG Financial Services pertains to “Lode-Star Gold”. More importantly, it’s a non-profitable company.

We have no revenues, have losses since inception, and have been issued a going concern opinion by our auditor.

We are relying upon loans and/or the sale of securities to fund our operations. We have no employees and expect to use outside consultants, advisors, attorneys and accountants as necessary for the next twelve months.

So how is a company with no revenue paying out up to 1.95% a day?

They aren’t. The SEC registered LSG Financial Services has nothing to do with LSG Financial the MLM company.

The scammers behind LSG Financial the MLM company have just stolen the name and faked association.

Notwithstanding LSG Financial hasn’t caught on in the US. LSG Financial is not registered to offer securities in either Belgium or the Netherlands.

The scammers running LSG Financial do their best to hide the Ponzi scheme, with no specific investment details provided on their public-facing website.

As with all MLM Ponzi schemes, once affiliate recruitment runs dry so too will new investment.

This will starve LSG Financial of ROI revenue, eventually prompting a collapse.

The math behind MLM Ponzi schemes guarantees that when they collapse, the majority of participants lose money.

Just a note on RSF Holdings; BehindMLM hasn’t published a review but I did enough research to confirm it’s a Ponzi scheme.

Full RSF Holdings review is pending.

Emphasising the low-effort nature of the Ponzi, “Liam” isn’t a common surname, only a given name (short for William). Wikipedia lists dozens of people with Liam as a first name but none as a surname.

There is also nobody called “Galahad” other than the mythical Knight of the Round Table.

There have probably been some real people named after Galahad but none famous enough to rate a Wikipedia article. (Possibly because they didn’t survive their school years.) Anyway, it could conceivably be a first name but is definitely not a surname.

So the scammers picked three names out of thin air in an attempt to cosplay an investment partnership, and managed only one believable surname, which is spelled wrong (Satchwell). The others are a first name and a fictional character.

And while we’re at it, it is also worth nothing that company logos don’t generally include full stops at the end of the name (Deloitte uses one but on a much longer name it screams illiteracy), and the letter “G” doesn’t usually have an uncircumcised bellend.

@Malthusian:

+1 for “uncircumcised bellend.”