Kindred Hearts Review: $100 four-tier illegal gifting scheme

![]() Kindred Hearts provides no information on its website about who owns or runs the company.

Kindred Hearts provides no information on its website about who owns or runs the company.

Kindred Hearts website domain (“kindredheartsteam.com”), was first registered in 2009. The private registration was last updated on June 9th, 2021.

A visit to Kindred Heart’s website reveals login/join buttons, and a message stating “US RESIDENTS ONLY”.

We know this wasn’t always the case. I learnt of Kindred Hearts after publishing BehindMLM’s Gift Of Legacy review.

Long story short; a bunch of disgruntled South African Kindred Hearts affiliates launched their own clone opp, after getting the boot from Kindred Hearts.

Gift of Legacy founder Chris Hattingh, claims Kindred Hearts is being run by an anonymous eighty-three year old woman from the US.

Attempts to ascertain Kindred Hearts ownership are clouded by other businesses bearing the same name.

I’m found an Australian fashion company and Kindred Hearts gift shop in Michigan.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money.

Kindred Hearts’ Products

Kindred Hearts has no retailable products or services.

Affiliates are only able to market Kindred Hearts affiliate membership itself.

Kindred Hearts’ Compensation Plan

Kindred Hearts affiliates participate in four-tier $100 gifting cycler.

Kindred Hearts tracks gifting payments via a 2×3 matrix.

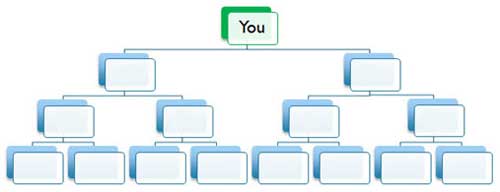

A 2×3 matrix places an affiliate at the top of a matrix, with two positions directly under them.

These two positions form the first level of the matrix:

The second level of the matrix is generated by splitting these first two positions into another two positions each (four position).

Level three is generated in the same manner and houses eight positions.

A newly recruited Kindred Hearts affiliates sign up and gifts $100 to whoever recruited them.

This places them at the top of their own first-tier $100 2×3 matrix.

Positions in the matrix are filled via subsequent $100 gifting payments, made by directly and indirectly recruited affiliates.

Note that each Kindred Hearts affiliate is required to recruit personally recruit two affiliates to qualify to receive gifting payments.

When all eight levels of the matrix are filled, a “cycle” is triggered.

This results in:

- a $300 payout

- $100 used to generate a new first tier $100 gifting position; and

- $400 used to cycle into the second gifting tier.

After this first cycle, no new second gifting tier position is created. This results in second and subsequent cycles generating $700 in kept gifting payments.

The other three Kindred Hearts gifting tiers operate in the same manner:

- $400 second tier cycle – keep $1800, $400 used to generate new second-tier gifting position and $1000 used to generate third-tier gifting position (second and subsequent cycles you keep $2800 as there’s no fourth-tier gifting position created)

- $1000 third-tier cycle – keep $5000, $1000 used to generate new third-tier gifting position and $2000 used to generate fourth-tier gifting position (second and subsequent cycles you keep $7000 as there’s no fourth-tier gifting position created)

- $2000 fourth-tier cycle – keep $14,000, $2000 used to generate new fourth-tier gifting position

Joining Kindred Hearts

Kindred Hearts affiliate membership is tied to a $100 gifting payment.

Kindred Hearts Conclusion

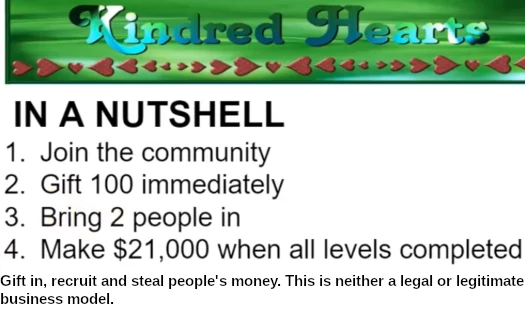

Kindred Hearts is an illegal gifting scheme, marketing using the same cliche lies we see in every gifting scheme.

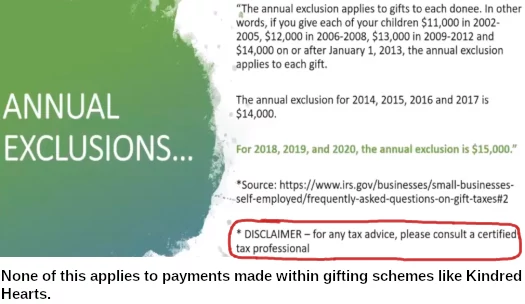

The most prominent justification is US taxation law referring to monetary gifts:

What should be obvious is that this does not apply to gifting business opportunities.

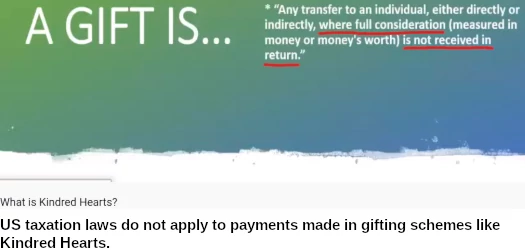

Ironically, the same Kindred Hearts presentation the above slide was taken from, goes on to define what the US taxation laws apply to:

In illegal gifting schemes like Kindred Hearts, gifting payments are made on the expectation of receipt of gifting payments from other participants.

This is key to differentiating a no-string-attached gifting payment, and an illegal gifting scheme.

Note that denying the expectation of gifting payments doesn’t change this fact. Be wary of anyone pretending they joined Kindred Hearts for any other reason then to make money.

- Kindred Hearts Tier 1 – gift $100 and receive $300/$700 from other participants

- Kindred Hearts Tier 2 – gift $400 and receive $1800/$2800 from other participants

- Kindred Hearts Tier 3 – gift $1000 and receive $5000/$7000 from other participants

- Kindred Hearts Tier 4 – gift $2000 and receive $14,000 from other participants

That’s Kindred Hearts’ business model, period.

So why is it illegal?

MLM gifting schemes operate as pyramid schemes. They require constant $100 gifting payments to keep the matrices cycling.

If recruitment tanks and new $100 gifting payments slow down or stop, the whole thing collapses.

What differentiates a gifting pyramid scheme from a regular MLM pyramid scheme is that payments are made between participants.

This is academic and has no impact on the illegitimacy of the scheme.

Like all pyramid schemes, the majority of participants in gifting schemes lose money.

This is due to early adopters cycling through to the top-tiers, through which the majority of gifted funds are distributed.

If you need further clarification on the legality of gifting schemes in the US (they are illegal in most jurisdictions), get in contact with the FTC.

Either explain Kindred Hearts’ business model to them or send them this review.

And if that’s too much effort, as suggested by Kindred Hearts promoters, contact an accountant and run this business model past them.

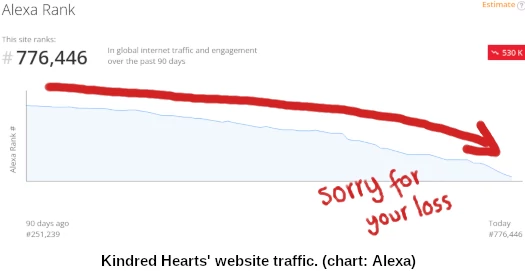

As a final point of interest, Kindred Hearts’ website traffic is in decline:

This translates into the inevitable decline in recruitment which, as we’ve explained above, spells the end of an MLM gifting scheme.

Unless gullible new recruits are found, Kindred Hearts is well on its way to collapse.

Hmm. It looks like KH finally closed the loophole that let anyone walk in and harvest the list of accounts… used to be that signing up as 0 with the password 0 would allow you to see any open board whatsoever there.

And 83 years old sounds about right for Mary Angel, who PHH pointed out in 2014 as the admin of KH at the time. realscam.com/f42/kindred-hearts-3161/

This is not a scam. This review seems to be written in 2021, four years ago. I joined Kindred Hearts in 2020 and was able to be blessed over $28k.

I loss contact due to my own personal issues but just joined again a week ago,its 2025. In less than 3 hours I will blessed to receive gifting.

Please get your facts correct. It is not a MLM. It does not payout any person for even one level because they referred someone else. There are people on the team that have not referred anyone at all and still get blessed.

There is never a way to make money without others being involved. Stocks, bonds, cryptocurrencies all are based on supply & demand which means the involvement of others affects its value & your ROI.

Kindred Hearts is an MLM gifting scheme as per its business model.

You “lost contact” because Kindred Hearts collapsed. Sounds like you’ve rejoined in an attempt to to scam some more people out of money.

As of December 2024 SimilarWeb tracked just ~1100 monthly visits to Kindred Hearts’ website. Sorry for your loss.